Articles about “interest rates”

Autumn on the stock markets will be anything but boring

Election campaign, interest rate turnaround, sluggish growth in Europe – there should be no sign of autumn fatigue on the stock markets. What will the coming (and certainly exciting) weeks bring for the markets and how can investors prepare for them?

Strong US labor market report: just an outlier?

In September, the US labor market performed surprisingly well, with significantly more new jobs created than expected. This has pushed back concerns about an impending recession, which is positive for the financial markets. Was the strong labor market report just an outlier, or is the US Federal Reserve perhaps on the right track to achieving the hoped-for “soft landing”?

Shift in risks

Both the markets and central banks are pointing to a shift in economic risks from inflation towards growth. The focus is currently on the US labor market.

Economic outlook: soft landing with risks attached

On the stock markets, the focus is shifting back to the downside risks. Nevertheless, there are still hopes that inflation will gradually fall and that there will be no recession. But how realistic are the hopes for this “soft landing” of the economy and how can investors position themselves in the current environment?

ECB interest rate policy: First rate cut, and then?

The European Central Bank is likely to cut its key interest rate tomorrow for the first time since the interest rate turnaround in 2022. But what comes next? Will the first cut herald a series of interest rate cuts or will the monetary guardians remain cautious? Chief economist Gerhard Winzer takes a look at the ECB’s possible future interest rate policy.

Favorable indicators: Soft landing on approach?

More and more indicators are pointing to good global growth. Even regions and sectors that had recently weakened are likely to return to growth. The soft landing after the sharp rise in inflation and the turnaround in interest rates could succeed. The decline in inflation is pausing at the same time, as yesterday’s US inflation data shows.

US interest rates: What are we to expect in the coming months?

As the latest data shows, the US economy continues to grow strongly – despite the significant interest rate hikes in the past two years. What impact will this have on the Federal Reserve’s future interest rate policy and when could the first rate cuts follow?

Market outlook: What investors can expect in 2024

2023 brought many surprises – including positive ones, such as the unexpectedly good performance across all asset classes. What can investors expect in the new year and which topics could come into focus? Gerald Stadlbauer, Head of Discretionary Portfolio Management, provides an outlook.

Phillips curve: Is there a risk of structurally higher inflation?

Inflation rose sharply in 2021 due to several supply shocks. Although there is a clear downward trend. However, the supply shocks could also have a structural effect on inflation. A look at the Phillips curve model can shed light on this.

Market commentary: Is the interest rate peak reached?

“Higher for longer” has become the mantra of the powerful central bankers in recent months. Monetary policy is likely to remain restrictive longer than originally expected. Regardless of whether the major central banks will follow up with a final interest rate step in autumn, the interest rate peak has probably been reached and “the worst” is behind us.

How restrictive are the current interest rate policy and financial environment really?

In line with the surprisingly strong economic indicators in the US, government bond yields have risen significantly in recent months. This is putting pressure on the prices of many classes of securities and intensifying discussions about how restrictive interest rate policy really is. Could the higher level of yields make the central bank’s job easier in the form of further interest rate hikes?

Inflation continues to fall: Do interest rate hikes now come to an end?

Inflation in the Eurozone is expected to fall further. According to initial estimates, the inflation rate fell more sharply than expected in August. With a view to the next ECB interest rate decision at the end of October, the question now arises: Do interest rate hikes now come to an end?

Dollar exchange rate, oil price, and interest rates burdening the markets

The stock markets have recently come under pressure due to several factors. Both the higher dollar exchange rate and the higher oil prices and yields on the bond market are weighing on prices. Chief economist Gerhard Winzer assesses the current situation in his blog article.

Where is the German housing market heading?

Despite higher inflation and interest rates, demand for housing in Germany is expected to remain robust.

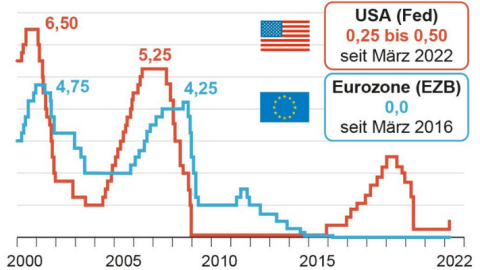

How high do key interest rates still climb?

Both the European Central Bank and the Federal Reserve in the USA raised the key interest rate by 25 basis points last week. However, both central banks signalled that the end of the cycle is near – or may even have already been reached after the recent rate hikes.

Immaculate disinflation: Is that possible?

Can price stability, i.e. inflation of 2%, be achieved without a recession? The further decline in inflation in the US in June has raised expectations for this favourable scenario. However, a look in the rear-view mirror calls for caution. In the past, a central bank-induced decline in inflation has often been accompanied by a recession.

Recession, inflation, key interest rates: Economic outlook for the second half of the year

The feared recession has so far failed to materialise and inflation is also falling. Nevertheless, the risks remain on the downside. What could be in store for the markets in the second half of the year?

“A mild economic downturn has already been priced in by the market”

With the ERSTE REAL ASSETS mixed fund, investors can invest in real assets – and have indeed been doing so for two years now. On the occasion of the fund’s two-year anniversary, Philip Schifferegger, fund manager of ERSTE REAL ASSETS, is taking a look at the current market situation. He also explains why the fund is well equipped for both positive and negative market phases.

Central banks weigh risks

Most recently, central banks have signaled a somewhat less sharpish stance, as an effect of the rapid key rate hikes on the monetary environment has already become visible. However, recent economic data are dampening hopes for a rapid decline in inflation, as Chief Economist Gerhard Winzer explains in his market commentary.

International Monetary Fund/World Bank Group Spring Meetings 2023

The annual Spring Meetings of the International Monetary Fund and the World Bank bring together high-ranking representatives from business, the financial sector and politics. Fund manager

Tolgahan Memişoğlu reports on his impressions.

Banking problems support share prices

Since the banking problems in the US emerged in March, share prices have risen and expectations for future key interest rates have fallen significantly. However, inflation dynamics remain the most important factor for the markets, but unfortunately also one that is difficult to assess.

Risk inflation persistence

Inflation, which remains too high, continues to be the dominant macroeconomic issue. Hopes that inflation will fall as quickly as it has risen have been dampened, as Chief Economist Gerhard Winzer explains in his market commentary.

Positive January on the markets

On the stock markets, the first month of the year was positive. The recent softer tones of the central banks give rise to hopes that interest rate hikes are slowly coming to an end. Read more about the current market assessment in our Investment Update.

Market commentary: What will the new year 2023 bring?

In the past year, numerous trouble spots preoccupied the markets. In his market commentary, Gerald Stadlbauer, Head of Discretionary Portfolio Management, gives an outlook on what 2023 might bring.

Hawkish holidays from the Bank of Japan

Last week, the Japanese central bank made the last major monetary policy decision of 2022, bringing an eventful year to an end – also from a central bank perspective.

Thrilling decisions before Christmas

This week, the financial markets are once again in for an exciting ride: The European Central Bank and the US Federal Reserve will decide to what extent interest rates will be raised again.

What happens to equities when interest rates rise?

So far, the year 2022 has brought significant price losses on the stock markets. Inflation and rising interest rates are often cited as the reason. But why is that the case?

Mega interest rate hikes indirectly increase purchasing power

Gerhard Winzer, Chief Economist at Erste Asset Management, provides an overview of recent economic developments and explains, among other things, what structural problems the euro is facing.

Central Banks Attempt to Prevent Inflationary Spiral

Since the beginning of the year, the bond markets have been in a bear market. What are the implications for the economy? Erste Asset Management Chief Economist Gerhard Winzer analyzes three models in relation to the development of inflation and their implications.

How far will the interest rates be rising, Mr. Zemanek?

With the first interest rate hike in five years, the US Federal Reserve has ushered in a new era. Is the period of cheap money now over? When will the European Central Bank follow suit?

Sustainable income with “double dividends”

Comfortably making return on the money market via interest? A thing of the past. Investors wanting to outsmart inflation should think about dividends and dividend shares. The combination of dividend shares with a selection process that takes into account ESG criteria constitutes an interesting investment alternative. So there is a kind of “two dividends”.

Coronavirus: The economic effects of epidemics and pandemics

What are the economic effects of an epidemic or pandemic? Our Experts went through relevant studies in order to be able to give a well-founded assessment. The results are surprising.

Constructive central banks

Risky asset classes such as equities have recorded price increases at the beginning of the year. The core question for the investor is: Is this recovery after the sharp decline in Q4 sustainable or not?

Stock markets in 2018 – market activity dominated by politics and volatility

2018 was a year of politics in the stock markets. Find out which three major topics dominated the international market activities in the current year.

US Congressional election results

The outcome of the US Congressional election on Tuesday has caused some relief in the international financial markets. Read more about it in our blog.

Financial markets 2018: reasons to be cautiously optimistic

The financial markets have been on the rocks in 2018. Read here why you should still keep a cautiously optimistic stance.

BCA Investment Conference in Toronto: How to navigate wealth to prosperity in a late stage of the business cycle

Every year the independent investment research provider BCA organizes an outstanding event for investment professionals from all over the world to come together and have a vibrant discussion about recent challenges in financial markets.

Rising interest rates in the USA

The sentiment of the financial market participants has deteriorated in the past months, with the losses across numerous asset classes in the year to date seemingly the driving factor. Now we have to ask ourselves: are we at the outset of a new trend, or is this just a case of increased volatility? The general decline in prices has gone in conspicuous tandem with the increase in three important financial market ratios:

Quo Vadis Italia? – The 2018 general election in Italy and its importance to the economy

The economic environment for Italy remains challenging. The fundamental problem is the low economic growth. Although the composition of the future government is still unclear, the party programs imply a persistent reform deadlock.

Investment stories in Latin America

The BBVA Latin American Local Markets Conference in London gave Christian Gaier, senior fund manager of government bonds of emerging markets, the chance to talk to local Latin American representatives. In our blog he shares some of the insights he gained and the narratives that may affect 2018.

How does inflation work? – Part 2: Inflation drivers

There are many factors that may affect inflation. Also, the weights of certain factors may vary across countries. Take the development of the exchange rate, for example.

Inflation worries burdening stock exchanges – part 2: the macro perspective

Equity indices have undergone a global correction in the past days. The Dow Jones index has shed more than 10% from its January high. What is the macro-economic reason for the correction?

Ten economic hypotheses for 2018

The current environment is very positive for the capital markets: strong growth, low inflation, supportive monetary policies, good earnings growth, and low volatilities, i.e. fluctuations. Also, the numerous risks have not had a significantly negative impact on prices. However, the phase of rising prices started as early as March 2009.

An impressive stunt

The Council of the European Central Bank pulled an impressive stunt at the monetary policy meeting on 26 October. ECB President Mario Draghi announced to reduce the extremely supportive monetary policy in the near future while …

Growth picking up in the emerging economies

Economic growth has increased significantly on a global scale and is broadly supported. According to our preliminary estimate, global GDP recorded a growth rate of 3.7% from Q1 to Q2 (annualised). While the developed economies have presumably grown by 2.7%, the emerging economies posted a growth rate of 5.2%. In this article, we would like to take a closer look at the emerging markets on the basis of classic economic indicators.

Solid Growth

Some ten years after the outbreak of the Great Recession, global economic growth is positive and broadly based, inflation is low in the developed economies and falling in important emerging economies, and monetary policies are very supportive, cautious, and predictable. At the same time, company earnings growth has increased significantly, and the volatilities of many asset prices are low. This environment is generally positive for risky asset classes.

Quo Vadis, Federal Reserve? – Part 3

I will be upfront about it: to me, the Taylor rule is still a helpful tool to assess the future monetary policy of the US central bank. However, it should not be used as blueprint without thinking it through. Instead, it should be seen as heuristic tool that helps structure one’s analysis.

Quo Vadis, Federal Reserve? – Part 2

Since 2008, the key-lending rates in the USA seem to have been significantly too low as measured by the Taylor rule. With some economists blaming Alan Greenspan’s loose monetary policy as partially responsible for the financial crisis of 2008, the question is whether we are in for a déjà-vu.

Quo Vadis, Federal Reserve? – Part 1

The US central bank has embarked on a cycle of interest rate hikes. The question is: by how much will the interest rates increase still, and at what point will it reach a level detrimental to the economy, where equities should be regrouped into asset classes less sensitive to the economic cycle?

After the interest rate hike is before the interest rate hike?

Imagine a fairy that grants you three wishes. What would you wish for? The answer would be very easy for me. I would just like to know if the economy is caught up in a recession of has embarked on an expansionary phase a year from now…