The stock markets have suffered significant losses so far in 2022. Both the US and European markets have corrected by around 20%, with technology-heavy indices losing even more. Inflation and rising interest rates are often cited as the reason. But why is this so?

Interest rates influence the valuation of equities

First, the theory: traditional stock valuation models discount future earnings with a risk premium and an interest rate. A simple model is the Gordon Growth model. The formula is:

D / (r-g) = Fair Value

Whereas:

D: expected dividend / year

r: discounting rate

g: terminal growth rate

The discount rate is often referred to as the cost of equity. This, in turn, is composed of a risk-free interest rate, a risk premium, and relative risk (beta factor).

Let’s look at an example of how fair value changes when the interest rate increases from 1% to 3%. We leave all other input factors unchanged.

In the first case, we assume a discount rate of 6% (1% interest, 5% cost of equity); in the second example, the discount rate increases to 8%.

In both cases, we assume a dividend of €10 and a growth rate of 3%.

Fair Value Example 1: 10 / (6%-3%) = €333

Fair Value Example 2: 10 / (8%-3%) = €200

Using this example, we have illustrated that a 2% increase in interest rates can reduce the fair value of a stock by 40%.

But why should a stock suddenly be worth less if, for example, earnings remain the same? Quite simply, when inflation rises, investors demand higher earnings to compensate for the depreciation of money. Thus, a stock must initially fall in order for future earnings to rise. In practice, however, it is more difficult because investors also have to take into account that rising prices mean that expenses for raw materials, merchandise and wages increase. The question is to what extent companies can pass these costs on to customers? Put simply, how will profits develop in the short term? In any case, uncertainties are increasing, which is reflected in increased volatility.

How does this play out in practice?

So much for the theory on inflation, interest rates and valuation. Now, what specifically happened to the inflation and interest rate landscape this year?

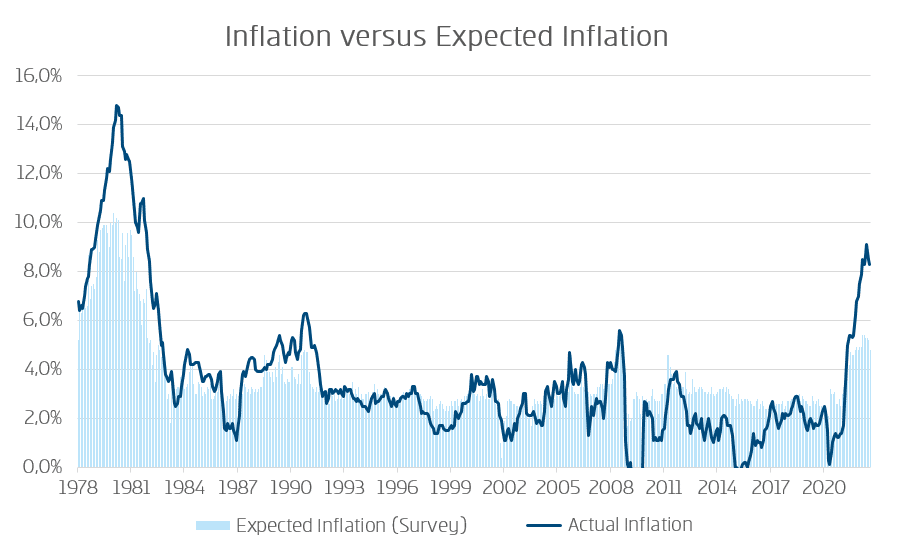

Figure (1) shows actual and expected inflation in the US over the past 45 years. At just under 9%, inflation has reached levels not seen in 30 years. Crucially, expected inflation has also risen, meaning market participants expect inflation to come back but remain at a higher level than before the Corona pandemic.

Note: Past performance is not a reliable indicator of future performance of an investment.

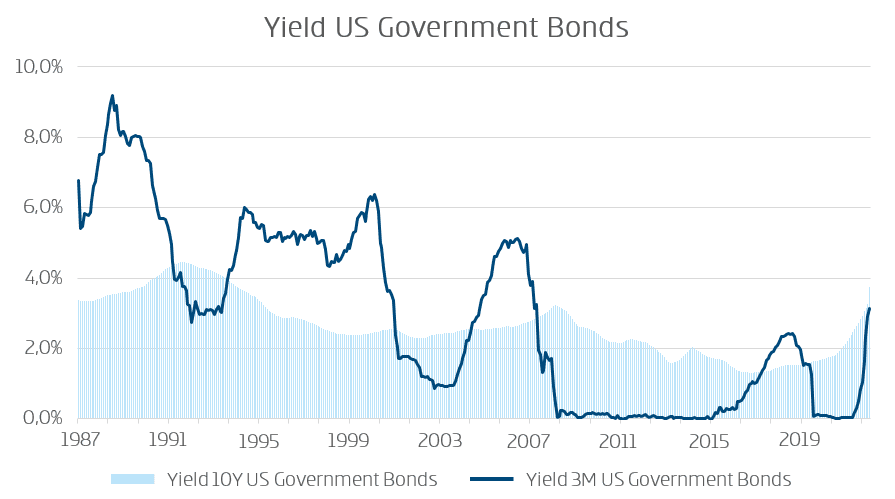

Rising inflation inevitably leads to higher interest rates. As can be seen from figure (2), the yield on 10-year US bonds has already been rising since mid-2020 and, at 3.8% most recently, has reached a multi-year high. The 3-month yield has only recently started to rise, but at a breathtaking pace. As explained earlier in the text, this rise is leading to a striking revaluation of the market. Higher interest rates mean a higher discount rate when valuing equities. If all other parameters remain the same, the fair value of a share is reduced.

Note: Past performance is not a reliable indicator of future performance of an investment.

The relationship between inflation and earnings yield

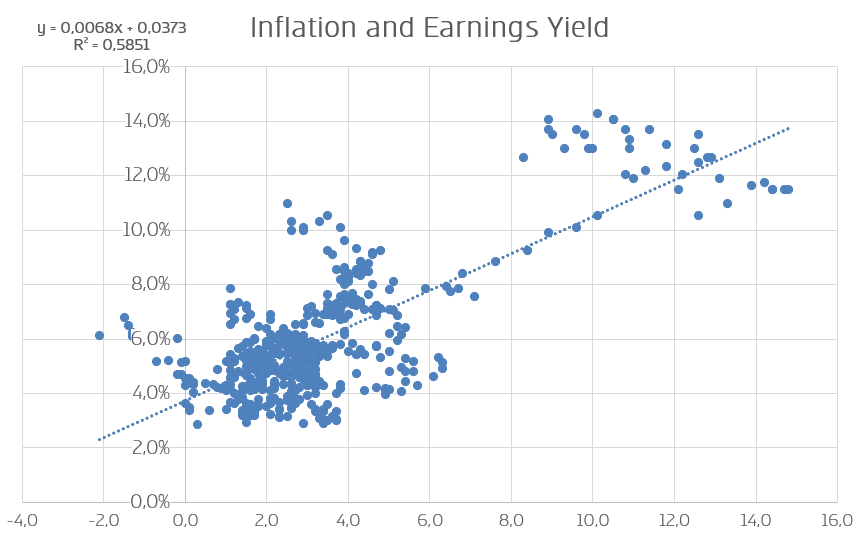

Figure (3) shows the dependence of the earnings yield (reciprocal of the price-earnings ratio) of US companies on the respective inflation. Here we assume an earnings return lagged by one year, since the market needs some time to react to a change (trials have shown that 1 year is a good assumption). A regression calculation shows that inflation explains 58% of the level of earnings yield. Other factors that (may) have an impact include profitability, dividend yield, or expected inflation in the future.

The regression shows that with expected inflation of 4.6%, the earnings yield in 12 months should be 6.6%. This equates to a price-to-earnings (P/E) ratio of 15.1. Based on a current P/E ratio of 18.8, there is a further potential correction of 19% minus the expected increase in corporate earnings over the next year.

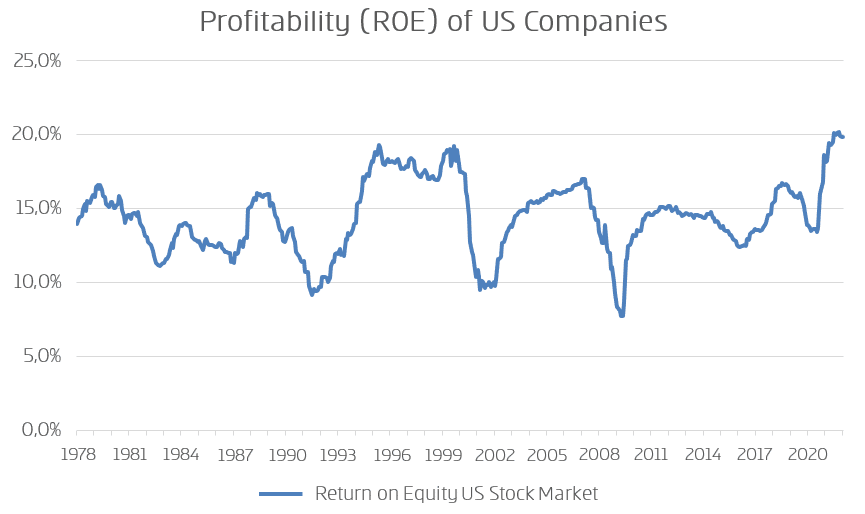

But as the regression calculation shows, inflation is only “half the story.” For example, high profitability can also justify a lower earnings yield. This is because the more profitable a company is, the more dividends can be paid out, shares bought back or money put into profitable investments. Figure (4) shows that despite higher inflation, the profitability (return on equity) of US companies remains very high. As long as this is the case, a below-average earnings yield may be assumed. Profitability is difficult to forecast. However, rising wages and higher interest rates may lower the level.

Note: Past performance is not a reliable indicator of future performance of an investment.

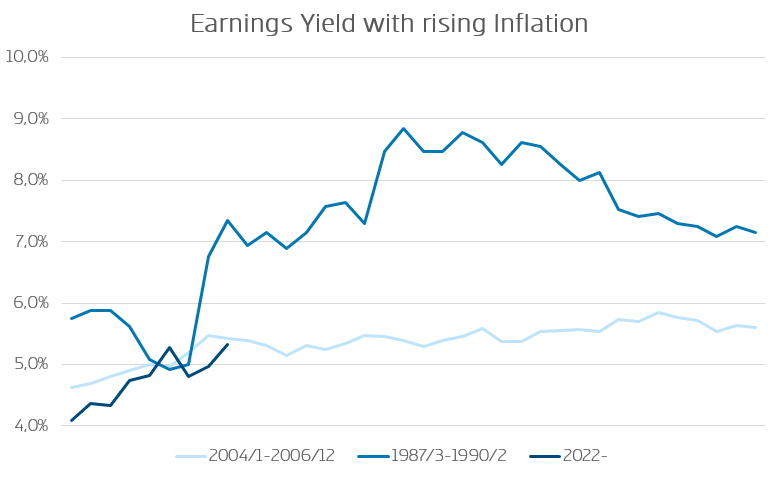

Figure (5) shows the development of profit yields in the US during periods of rising inflation expectations, similar to what we see today. Earnings yield from 1987-1990 were comparatively much higher than during 2004-2006, and today’s profitability is more comparable to 2004-2006 than during the ’87-’90 period. From this, one could infer a “fair” profit return of 5.3% (average of 2004-2006). Of course, this assumes that current inflation in the US of 8.3% approaches 4.6%. If inflation remains at 8%, we would have to assume an earnings yield of 8-9%. This would mean that the stock market is about 30-40% too expensive even at today’s level. These figures make it clear why investors are looking and reacting very nervously to the development of inflation.

Note: Past performance is not a reliable indicator of future performance of an investment.

Conclusion: Higher interest rates depress prices of equities

With inflation soaring, central banks are forced to turn the interest rate screw. Higher interest rates translate into a higher discount rate when valuing stocks, which means that even relatively small changes in interest rates can significantly reduce the fair value of a stock.

In conclusion, we can state that the US market is approximately fairly valued after the correction if the expectation that inflation will decline to 4.6% is realized. If this is not the case, we could see further falling prices next year as well. For this reason alone, it is right and important for the FED to keep its focus on fighting inflation.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.