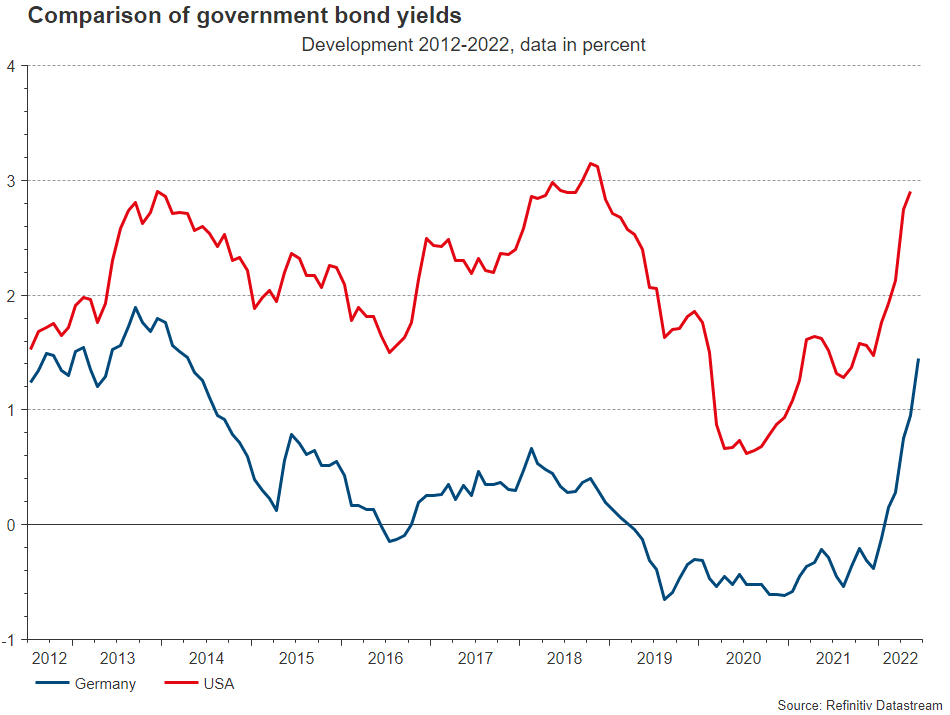

The bond markets have been in a bear market since the beginning of the year. The Bloomberg Global Treasury Index has fallen by approximately 16%. Meanwhile, bond yields have risen to levels that haven’t been seen in 14 years. As of mid-June, the yield on the Bloomberg Global Treasury Index is 2.5%, that on ten-year U.S. government bonds is 3.4% and that on ten-year German federal bonds is 1.7% (Data from Bloomberg as of June 15, 2022). This raises the question of whether bond prices are favorable enough for purchase. In other words, can the interest rate sensitivity (duration) in a bond portfolio be extended? Similar as with equities, where the most favorable entry point is at the peak of recession, that for bonds is at the peak of inflation and interest rate hike fears. However, similar as with equities, in advance the question can only be answered based on assumptions.

Are bonds cheap enough yet?

In the square of inflation, economic growth, monetary policy and financial markets, inflation has been the underlying driving factor for some time. Price pressures affect central bank policies (restrictive) and economic growth (lower), and in turn, central bank policies affect both growth (lower) and inflation (lower) in the next round. This environment can be described as stagflationary. As such, it is negative for the prices of numerous classes of securities. Meanwhile, the feedback from falling security prices (and higher bond yields) to growth (lower), inflation (lower) and central banks (less restrictive) is also gaining relevance. For bond yields themselves, the most important channel of impact has been the sharp increase in expectations for policy rate hikes in advanced economies in response to higher-than-expected inflation rates.

Falling ratings

By now, a key interest rate of over 3.5% is priced in for the Fed by year-end 2022. For the Eurozone, an increase from -0.5% (discount rate) to 1.25% is priced in. The direct effect is a reduction in the ratings of security classes (including bonds) because higher interest rates imply a lower present value of future profits and coupons. The result is a deterioration in the financial environment (falling prices).

Higher interest charge

The indirect effect of interest increases is a dampening of demand, especially in the interest-sensitive segments of the economy. In the USA, the real estate market is already showing signs of weakness. In April, the NAHB sentiment index for the real estate sector fell sharply and home sales are showing a downward trend.

Reduction in purchasing power

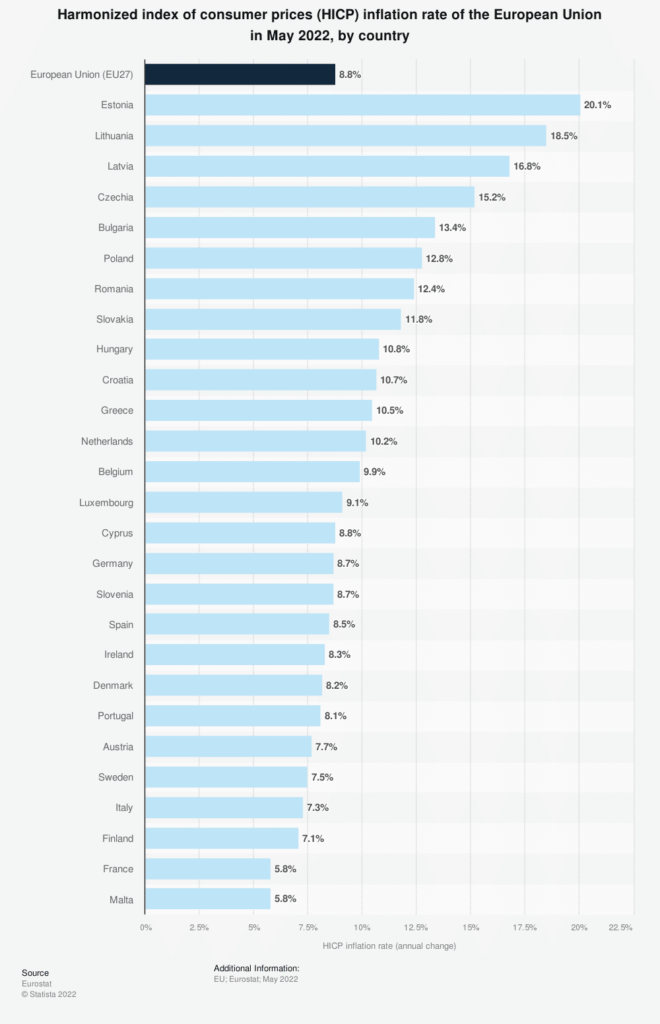

High inflation (OECD area in April: 9.2% p.a.) is reducing the purchasing power of companies and consumers. In line with this, consumer sentiment indicators have fallen. In April, consumer sentiment in the entire OECD area fell below the May 2020 level. Sentiment was only worse during the Great Recession of 2008 / 2009.

Uncertainty about inflation drivers

The reasons for the high inflation rates can be attributed to several factors. The triggers are the pandemic on the one hand and the war in Ukraine on the other. The past two years have seen strong and rapid downward and upward movements in demand, which supply has not been able to keep up with. In addition, supply itself has also been affected, for example by the closure of ports. Due to the war in Ukraine, food and energy prices have risen again. The price shocks are external in nature. The key question now is whether the higher price level lowers demand (economic growth) or sets off an inflationary spiral. The increased fears of growth argue for the former.

Change of perspective: Monetary policy was expansionary for too long

In hindsight, it is apparent that monetary policies have remained expansionary for too long. Last year, it became increasingly apparent that the pre-pandemic trend in GDP would soon be reached. Unemployment rates had also already reached low levels last year. This can largely be attributed to the strongly expansionary fiscal policies. In the USA, in particular, there have been several major fiscal packages.

For central banks, the change in perspective from “too low inflation” to “too high inflation” took place too late. For many years, the monetary policy strategy was focused on fighting deflation risks. The prevailing mindset can be summarized as, “Because inflation is too low, the recovery phase can be supported for a long time.” Expansionary monetary policies have encouraged a pass-through to other price components.

Uncertainty about future developments is very high for three reasons:

- There is considerable uncertainty about the size of the output gap.

- The (apparent) understanding of inflation dynamics is low. This applies to both market participants and central banks. As a result, it is also unclear how much economic growth will have to cool down in order to achieve the central bank’s inflation target in the medium term.

- There is considerable uncertainty in estimating the relationship between monetary policy and economic growth. How many policy rate hikes are needed to cool economic momentum to a certain extent? Complicating matters is the fact that monetary policy affects the economy only with a time lag of six to eighteen months, and inflation again lags the economy. This also creates uncertainty as to whether the central banks will manage a soft landing for the economy or ultimately trigger a recession.

Uncertainty Output Gap

If the economy is already producing very much more than it’s potential, a restrictive interest rate policy is necessary (which triggers a recession). If the production level is only slightly above potential, a soft landing is possible. The risk here is that the central bank fails to fine-tune the policy and that overly vigorous rate hikes trigger a mild recession.

Uncertainty Inflation Dynamics

In principle, the issue here is whether economic agents are thinking rationally about inflation or merely reacting to past inflation.

Rational Inflation Expectations

In the first model, there is no inflation spiral. When current inflation is above trend inflation, there is a rational expectation that inflation will fall. For the assumption of an only temporarily elevated inflation to remain credible, central banks need to take only moderate action. Policy rates are raised to a neutral interest rate level. In this case, the real interest rate level remains low (at zero percent). A soft landing of the economy is possible. Until recently, the European Central Bank was this situation, having only signaled key rate hikes at a moderate pace. Here, the risk lies in an overly restrictive policy (too rapid hikes on a too high interest rate level).

Adaptive inflation expectations

In the second model, an inflation spiral can be set in motion. This is because there are adaptive expectations that inflation will be high (or even higher) next year because it has been high (or rising) this year. In this case, central banks are under pressure to cool economic activity enough to break the inflation trend. This scenario implies a recession because real interest rates must be raised significantly into positive territory. No central bank is currently in this situation, but it represents the greatest risk for the markets.

Mixed model

A mixed model number three is also conceivable. As long as underlying inflation is at a low level, economic agents do not think much about inflation. The inflation trend fits (perhaps coincidentally) with the rational expectations model. But when inflation rises and remains above a critical level for a long time (the inflation trend rises), a regime change occurs. Economic agents become concerned about future inflation. Currently, the hope of central banks is to just avoid a regime change. Given that inflation rates have risen significantly, central banks are raising interest rates to a neutral level as quickly as possible, in order to prevent a tipping point into the inflationary spiral regime. More and more central banks in the developed economies are adapting this approach.

Conclusion

If the output gap is only slightly positive and inflation dynamics can be described as either purely rational or rational up to a tipping point, yields have now reached levels that argue for an increase in bond allocation or an increase in duration (respectively, from underweight to neutral). The two core arguments for this are: 1) High inflation rates are dampening purchasing power. 2) Central banks are trying to prevent an inflationary spiral. In the baseline scenario, real economic growth in advanced economies will remain below potential for these two reasons. It is possible that GDP will even contract slightly (recession). Thus, the gap to the pre-pandemic trend will not (be able to) be closed further for the time being. Postscript: However, uncertainties remain about 1) the actual size of the output gap and 2) the inflation dynamics.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.