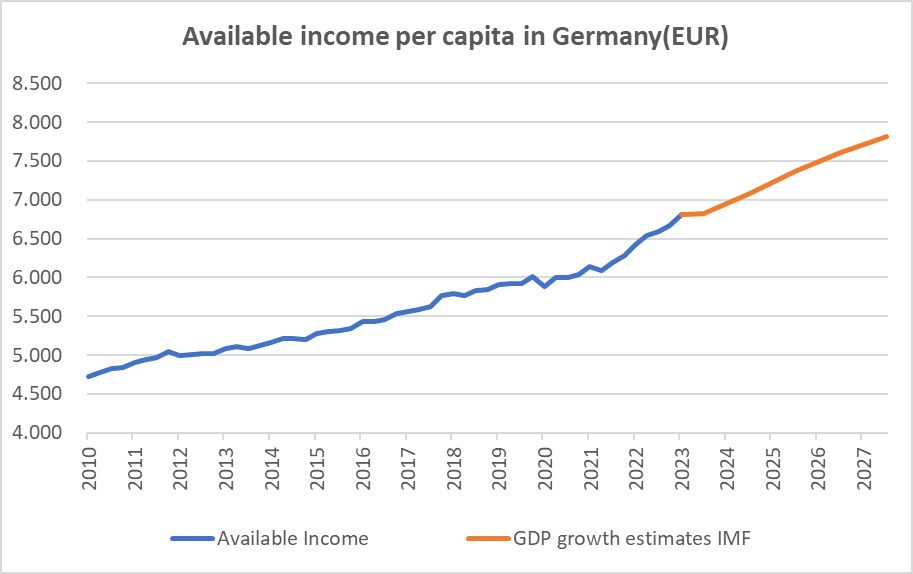

The rapid rise in inflation and interest rates has had a profound impact on real estate markets around the world. Market participants are still searching for the new equilibrium prices that will clear the market under this significantly changed economic environment.

Macroeconomic variables such as growth, inflation and interest rates, demographic factors, ownership structure, and the legal and regulatory framework all affect real estate prices and can vary significantly from country to country. In this paper, we examine how some of these factors affect the housing market in Germany.

Demographic development: urbanization and smaller households likely to drive up demand for housing

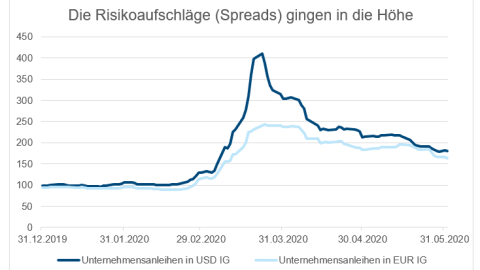

The number of households is a key factor in housing demand, as each household generally requires housing, regardless of whether it is rented or owned. While the United Nations population forecast projects that Germany’s population will peak in 2022 and decline by 1.5% by 2035, the population is also expected to continue shifting to urban areas, with the urban population expected to increase by 2.1% between 2022 and 2035.

The Federal Statistical Office of Germany (destatis) forecasts a decline in the average household size from 1.98 persons per household in 2022 to 1.94 in 2035, which would lead to a 1.3% increase in the number of households. Overall, according to these forecasts, the population decline will be more than offset by smaller household sizes and increasing urbanization, so that the number of urban households and demand for urban housing is likely to continue to rise.

Source: UN Population Division, Federal Statistical Office of Germany

Construction: Higher interest rates and construction costs will likely reduce the supply of newly built homes

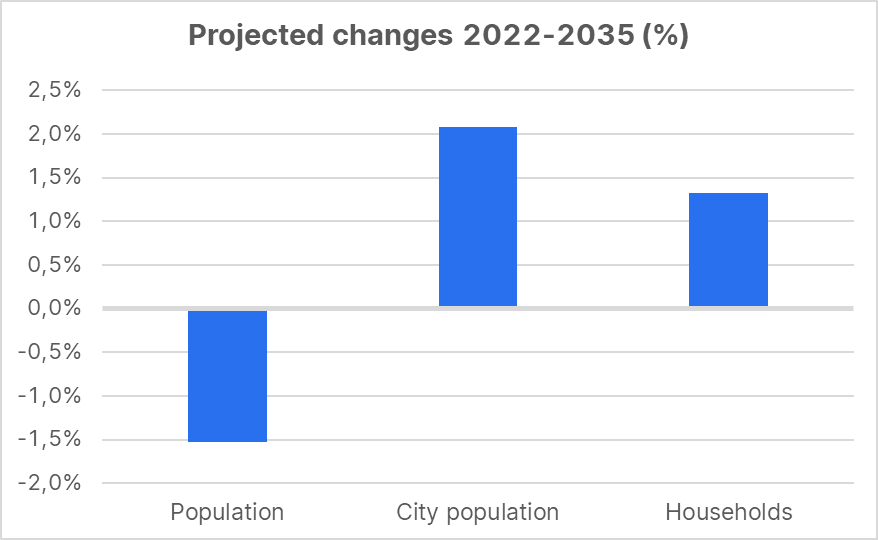

The supply of housing, especially affordable housing, has become scarce in many German cities. The current government has set itself a target of 400,000 newly built apartments per year, which has not yet been achieved. In 2021 and 2022, for example, around 300,000 new apartments were added per year. Higher construction and financing costs, restrictive regulations and social pressure (e.g. “NIMBY”, “not in my backyard”, synonymous with the rejection of housing and infrastructure projects by the population in the immediate vicinity) contribute to even lower new construction activity, which is reflected in declining building permits.

Source: Federal Statistical Office of Germany

Affordability: purchasing power eroded by higher interest rates, but should be supported by higher incomes

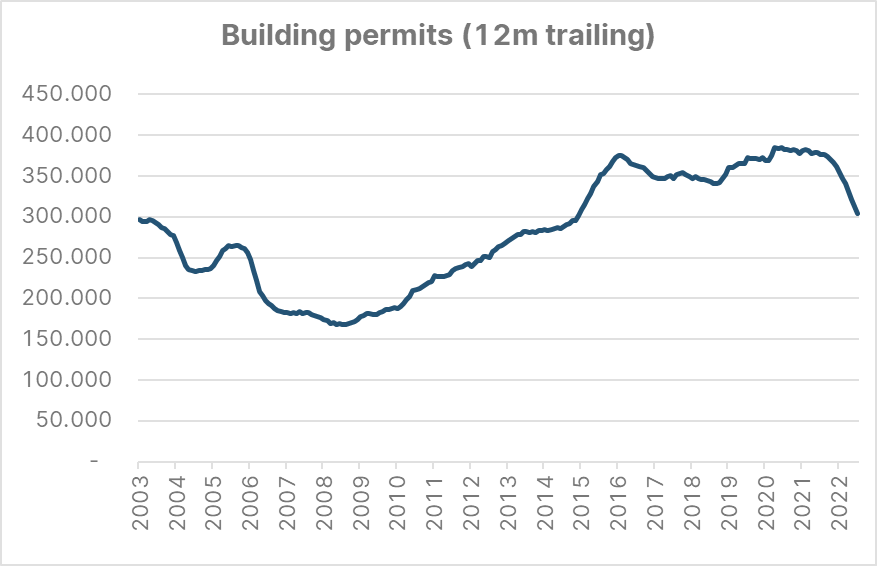

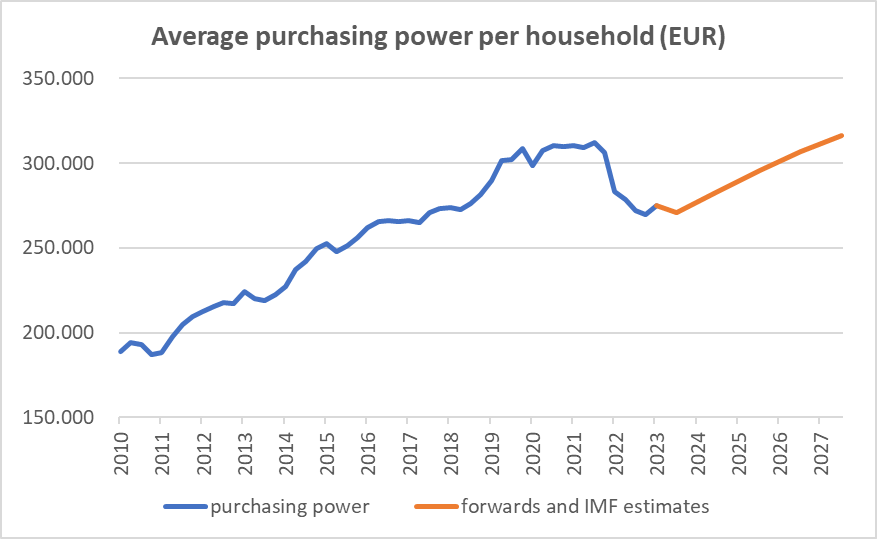

Households that rent their homes usually pay the rent with their current income. As their disposable income increases, households can also afford higher rents. While per capita disposable income increased by 10% between Q4 2021 and Q2 2023, IMF (International Monetary Fund) GDP forecasts project disposable income growth of about 3.5% per year over the next 5 years.

Source:Federal Statistical Office of Germany, IWF

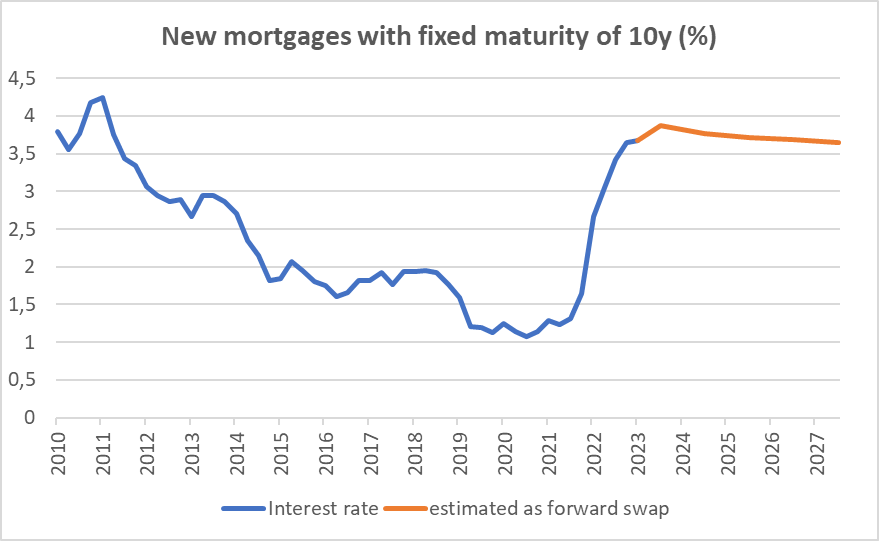

Households that own residential property usually finance the purchase with a mortgage. Higher interest rates reduce households’ purchasing power as the monthly mortgage payment increases. Average interest rates on new mortgages with fixed terms of 10 years or more have increased from 1.07% in December 2020 to 3.67% in June 2023. Interest rate markets are currently pricing in a stabilization of interest rates.

Source: Bundesbank, Bloomberg

These two variables can be used to calculate the purchasing power of a hypothetical average two-person household with a 25-year mortgage equal to 25% of disposable income and a down payment of 12 months’ income.

Between 2010 and 2019, rising household incomes and falling interest rates led to higher household purchasing power. Since 2022, however, higher interest rates have weakened purchasing power, only partially offset by higher nominal incomes. If mortgage rates stabilize, as the swap market is currently pricing, and nominal income continues to grow in line with IMF projections, household purchasing power should recover in the near future.

Source: Bundesbank, Bloomberg, IWF, Federal Statistical Office of Germany

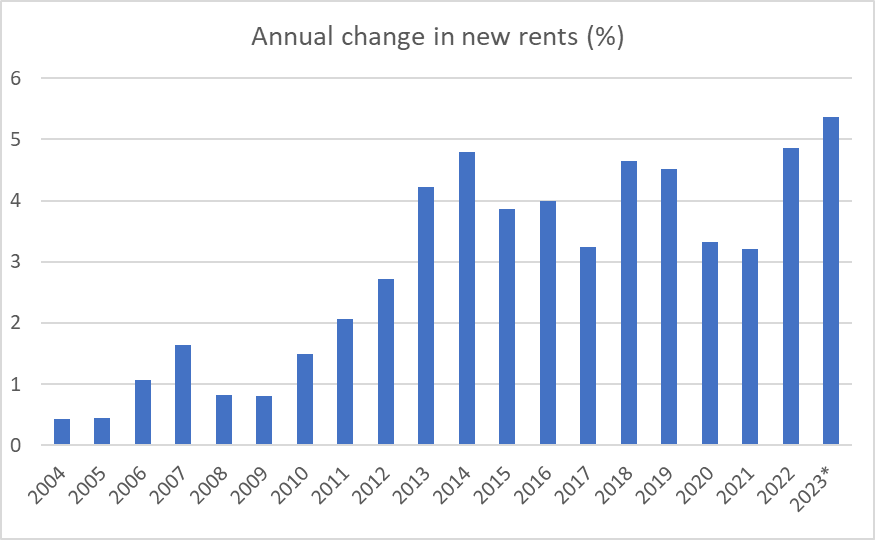

Market rents are up, but regulations limit increases for existing contracts

The supply of rental apartments was already tight in many major cities, driving up rents. With recent increases in inflation and interest rates, this trend has accelerated, with new contract rents (excluding energy costs) in Q2 2023 5.4% higher than the average in 2022. On average, new contract rents in Q2 2023 were 16% higher than in Q4 2019.

Source: vdpResearch, changes Q2 2023 to average 2022

The rent cap in Germany limits the extent to which landlords can pass on rent increases to existing tenants. The rent index measures the average new contract rent over the last 6 years and is used to adjust rents in existing contracts, subject to various limits and exceptions.

Therefore, increases in new market rents affect existing tenants only with a time lag. To the extent that higher rents are passed on to existing tenants (or tenants move out and are confronted with higher market rents), homeownership becomes comparatively more attractive, both for investors who earn higher rental income and for households that consider buying an apartment to avoid higher rents.

Environmental regulations increase the cost of owning residential property, especially older buildings, due to required upgrades and taxes on buildings with low energy efficiency. This will make such properties less attractive to investors, who will demand lower prices.

Debt and ownership structure

Around half of German households own their own home. Mortgage loans generally have fixed interest rates of around 10-15 years. Interest rate increases will therefore only affect existing borrowers with a delay, while their current income will rise on average.

Of the rental properties, 65% are owned by individual investors, 14% are owned by professional investors, and 21% are owned by non-profit landlords (public housing, housing associations, and religious organizations). Some of these investors, especially the professional ones, financed the properties with debt, usually through bonds and bank loans. Unlike mortgages to households, these debts typically have initial maturities of 5-10 years and are not grace periods.

As a result, a significant portion of this debt will come due in the next few years and will need to be refinanced at much higher interest rates, increasing the investor’s interest costs. If interest costs rise faster than rents, some owners may be forced to contribute additional equity to cover the shortfall or sell the property.

Landlords may also face pressure if the appraised value of their properties declines significantly. Some loan agreements require that the value of the debt be less than 60% of the appraised value of the properties. If values drop significantly, some landlords could exceed this limit and may then have to issue new equity, sell some properties to repay the debt, or reach an agreement with lenders.

Landlords facing high debt and interest costs might be forced to sell at reduced prices and lower prices further. The mere expectation that landlords will be forced to sell at reduced prices could discourage potential buyers from entering the market and cause them to wait for better prices. This could lead to a significant drop in prices in the near future.

What has happened so far and what could follow?

So far, price declines since the peak in mid-2022 have been moderate on average, ranging between 5% and 15% depending on the index. The number of transactions has been very low compared with previous years, suggesting that both sellers and buyers are holding back on transactions before a clearer picture emerges. The adjustment process triggered by higher interest rates may present problems for some leveraged landlords, but those that successfully navigate the next few years should benefit from robust medium-term supply and demand fundamentals.

In this uncertain environment, it is critical for active managers to continuously assess macroeconomic, sector and market trends to identify attractive investment opportunities and avoid unattractive risks in equities, bonds and hybrid instruments of real estate companies.

Key points:

– Demand for housing in Germany, especially in the larger cities, is expected to remain robust in the coming years.

– Supply is likely to continue to lag behind, at least in the short term.

– As a result, rents are likely to continue to rise strongly, partly dampened by regulation.

– Housing affordability has been affected by higher interest rates but is expected to recover gradually without further interest rate shocks, supported by growth in disposable income.

– The market has not yet found its new equilibrium. During the adjustment period, highly leveraged landlords may come under pressure and be forced to sell at sharply reduced prices. – Those landlords who successfully navigate the next few years should benefit from robust medium-term fundamentals.

Legal note:

Prognoses are no reliable indicator for future performance.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.