The US central bank has embarked on a cycle of interest rate hikes. The question is: by how much will the interest rates increase still, and at what point will it reach a level detrimental to the economy, where equities should be regrouped into asset classes less sensitive to the economic cycle?

Recessions are poison for the markets. Just to illustrate this statement with numbers: the average return on US equities, as measured by the S&P 500 index, has been -8.6% p.a. during recessions since 1950. In periods of economic expansion, on the other hand, investors would make an average of 13.9% p.a. Driven by population growth and progress in productivity, expansion has been the natural state of the economy in the past decades. Yet again, we are using the USA as example, since this is where the most abundant set of data are available. The economy has expanded in 698 out of 809 months there. This means that it was in recession only 14% of the time. Statistically speaking, expansion is therefore the natural state of the economy, but it can fall into recession for three reasons:

- Economic imbalances that trigger a crisis like in 2008

- External shocks such as the two oil crises in the 1970s

- Interest hikes by the US central bank that continue until they pretty much “throttle” the economy

The question is whether we have reached that point or will at least reach it any time soon?

The Taylor rule

The so-called Taylor rule is an at least superficially simple tool for the analysis of this question. It was named after the well-known US economist John B. Taylor. Taylor is rumoured to be in with a chance of becoming the next chairman of the Fed (https://www.bloomberg.com/graphics/2017-who-will-be-the-next-fed-chair/). Prior to taking you through the analysis, we will quickly discuss the way the Taylor rule works. The concept was first created in the 1990s and is nowadays used in various forms.

The attraction of the Taylor rule hinges on the fact that it is very intuitive, even to those among us who have problems with formulas:

The US central bank is supposed to set the interest rate in such a way that in the long term it is equivalent to the value that ensures compliance with the inflation target pursued by the US central bank and full employment. However, if the actual rate of inflation is above or below the level targeted by the Fed, the US central bank can react by raising or cutting the Fed funds rate (i.e. the key-lending rate). The same is true for deviations from the GDP that can be expected for the long term, the so-called output potential. If the economy is in recession, the central bank should cut interest rates below the long-term neutral rate. If it overheats, the key-lending rates have to be above that level.

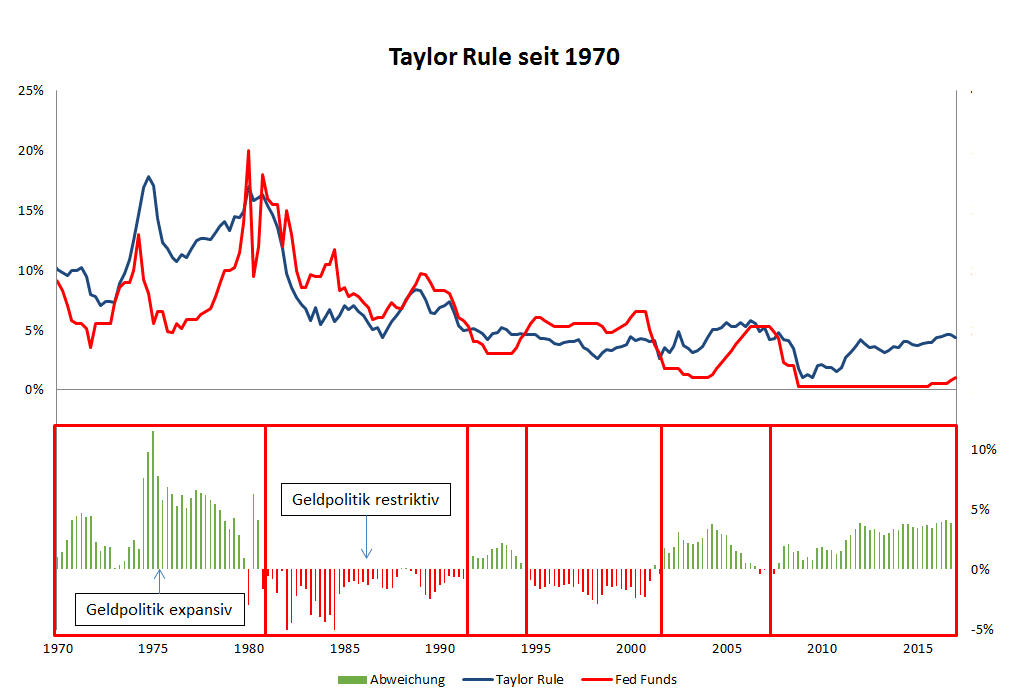

The following chart shows how the Taylor rule would have worked over the past 50 years.

Taylor rule in practice since 1970

Source: Erste Asset Management

When the Taylor rule became popular in the 1990s, it was largely charts like the one above that contributed to its popularity. The Taylor rule was very good at illustrating the monetary policy in the years before in simple terms.

- In the 1970s, the key-lending rates in the USA were significantly too low. The expansive monetary policy resulted in high inflation and, above all, rising inflation expectations.

- At the beginning of the 1980s, the US central bank changed its course under the then chairman Paul Volcker, who followed a substantially more stringent strategy. Interest rates were raised beyond the level suggested by the Taylor rule, as a result of which inflation declined and inflation expectations were reined in as well.

- From about 1985 onwards, the Fed was able to engage in fine-tuning the monetary policy in line with the economic cycle. The threat of inflation had been dealt with. Accordingly, the monetary policy was restrictive prior to the recession of 1990, then became more expansive, until 1994 when the policy was tightened again at the end of the 1990s.

- In response to the burst dotcom bubble and 9/11, and in tandem with the recession of 2001, a phase of an extremely loose monetary policy was set off. Many economists think that the low interest rates during that phase were one of the reasons of the excesses on the property market, which resulted in the financial crisis in 2008.

- From the perspective of the Taylor rule, the period after 2008 was extremely expansive. Assuming that the monetary policy was overly loose even before 2008, which had led to overheating property prices, this would not bode well for the future.

Does this mean that a crisis is imminent, or is this development driven by something else? Stay tuned for the answer in part II of the Quo Vadis trilogy!

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.