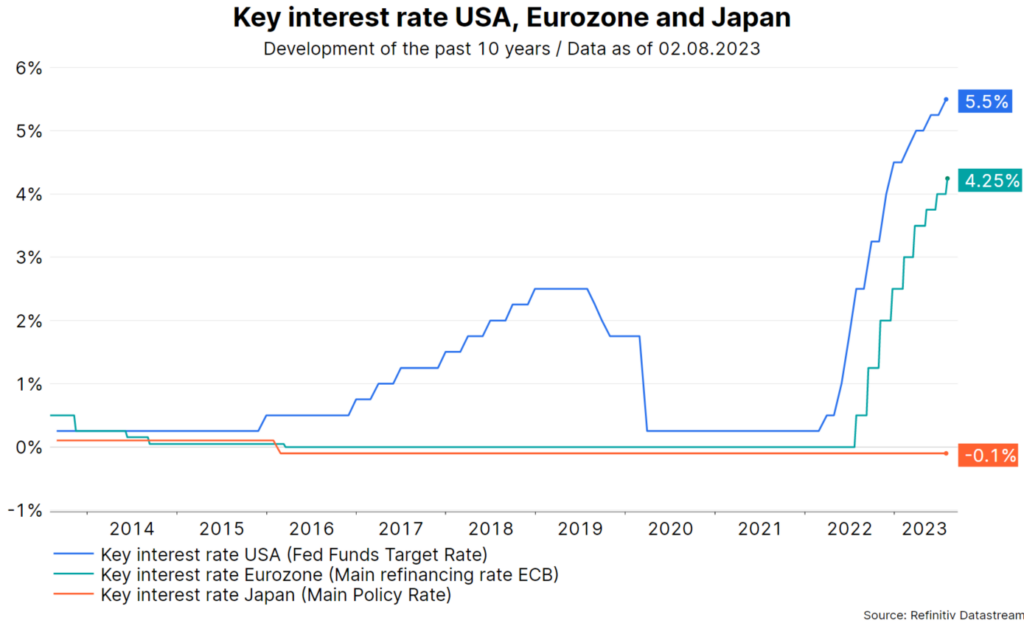

Last week was an important week for central banks with announcements from the Federal Reserve (Fed), the European Central Bank (ECB) and the Bank of Japan (BoJ). While Japan is only beginning to move away from ultra-loose monetary policy by loosening its grip on government bond yields, both the Fed and the ECB signalled that the end of the cycle is near – or may even have already arrived after last week’s rate hikes.

ECB hints at possible pause in rate hikes

The European Central Bank raised its key deposit rate for the ninth straight week by 25 basis points (100 basis points = 1%) to 3.75%, the main refinancing rate rises to 4.25%. This matched an all-time high last reached in 2000. However, the ECB omitted the previous statement that interest rates would have to rise further and instead said that further tightening would depend on whether economic data showed it to be necessary.

This leaves the door open for another hike at the ECB’s next meeting in September or a pause, with hikes perhaps resuming at a later date if inflation proves more stubborn than expected.

Fed holds out prospect of end to rate hikes

Meanwhile, the Federal Reserve has indicated that the end of its rate hike cycle is likely in sight after raising rates by 25 basis points at its meeting.

Note: Past performance is not a reliable indicator for future performance.

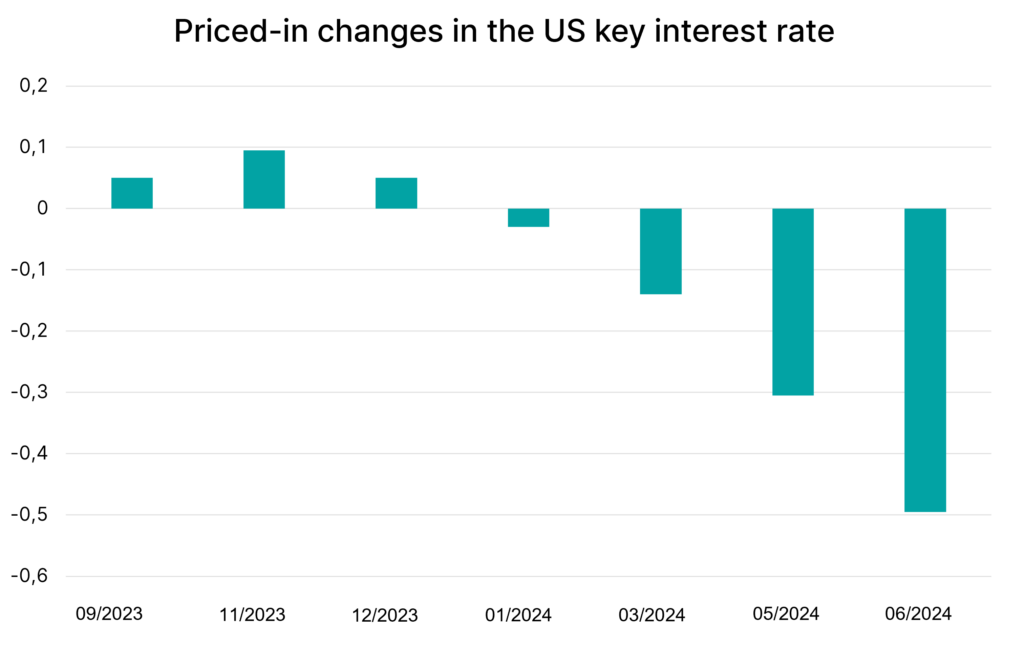

From today’s perspective, we think it is more likely that the ECB will have to raise interest rates again, while the Fed has probably completed its rate hike cycle. The markets are also not currently pricing in any further rate hikes in the US:

Note: Prognoses are not a reliable indicator for future performance.

China’s Politburo sends pro-growth message

In addition, the focus last week was on the conclusion of the July meeting of China’s Politburo. China’s leadership sent out a pro-growth message at this meeting. Although only few concrete details were announced and the wording did not amount to stimulus measures on a grand scale, the tenor is positive, where Chinese equities gained.

Around economic policy, the focus was on counter-cyclical measures such as an extension of tax and duty cuts, faster issuance of special local government bonds and the use of monetary policy tools. Officials acknowledged the need for further easing and will proactively address a comprehensive range of issues, from such as real estate to domestic consumption.

The policy bureau’s constructive tone could brighten overall market sentiment, in our view, but a sustained upswing in Chinese investments will require more than just supportive messages from the government. Rather, it will depend on how quickly the various authorities and local governments can take concrete follow-up action.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.