Every year the independent investment research provider BCA organizes an outstanding event for investment professionals from all over the world to come together and have a vibrant discussion about recent challenges in financial markets. This year’s conference was held in Toronto, dedicated to the core topic on how to navigate client’s wealth to prosperity in a late stage of the business cycle. One of the key questions was whether the central bank will cause a recession via substantial hikes in the key interest rate as has happened in previous episodes.

Elevated uncertainty

Exactly 10 years after the financial crisis hit the markets, the impact it had on society and people’s lives seems to be like a haunting ghost which is hard to get rid of. Even though we observe economies beyond full employment, wage growth is limited leaving economists questioning their confidence in familiar models like the Phillips Curve, which suggests an increase in wage growth when the unemployment rate is low. It should be obvious that something new needs to be factored in. A suggestion might be uncertainty and anxiety about future economic and political developments.

Diminished employee’s bargaining power

Furthermore, companies are gaining more power due to greater concentration within industries, as well as technological improvements and developments like Artificial Intelligence and Robotics. As a result employee’s bargaining power is diminished. The link between wage growth and employment has been partially broken and is still waiting to be fully restored.

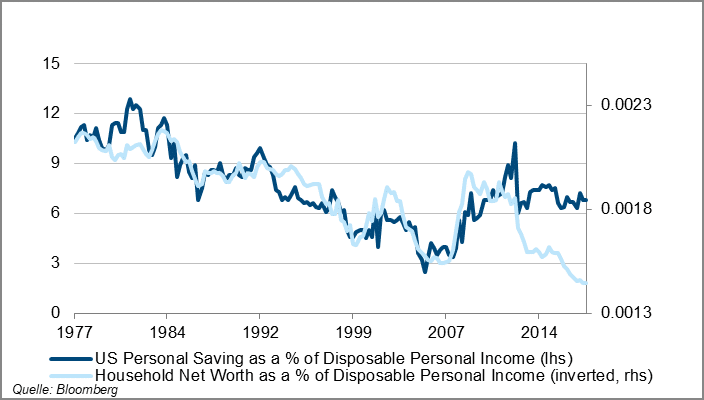

Wealthy US households

In order to underpin the argument of inflated uncertainty the following chart is provided. What we can see here is clearly a structural break in the US consumer behavior. Even though household net worth (inverted) is increasing significantly, personal savings and subsequently real personal consumption are not following the same path anymore. This means, consumption is not as strong as the increase in wealth would suggest. It is actually keeping inflation on the low end which might give the central bank (Fed) enough room for its policy to be mildly restrictive. As long as price stability is given, the Fed can keep focus on its path to normalization.

Central Bank faces dilemma

The US Federal Reserve Bank was the real driver of economic activity over the last decade, fueling markets with cheap money to tackle the aftermath of the financial crisis. Lately the policy shifted from quantitative easing to tightening and in many aspects it is a Hercules task. Debt levels are much higher than we’ve seen in the past, resulting in markets being more sensible than ever to interest rate changes. Moreover, the global feedback in asset prices and FX channels gained drastically in importance for central banks. The Fed is finding itself in the dilemma of keeping balance between preventing US markets from going into recession and pacing its tightening process to the economic environment, preferably keeping it constant. And so far, the US central bank has been quite successful unwinding its balance sheet moderately. Janet Yellen made this point clear by telling the audience, for her it is like watching paint dry and only a significant deterioration of economic activity in the US would see a change in the Fed forward guidance and consequently in its interest rate policy.

Consumption and wage growth are the key factors

In conclusion, consumption and wage growth might be the key to prevent or cause the American economy from overshooting. I recommend keeping an eye on those figures. Once the uncertainty fades and the consumption gap will close in addition to wage growth acceleration, it might result in a deadly cocktail of inflation giving the central bank no other choice than being severely more restrictive. In the end, this scenario wouldn’t be so different at all!

Disclaimer:

Forecasts are not a reliable indicator for future developments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.