There are some good markers for following the events on the financial markets. Currently, the US dollar, the oil price, and the 10Y US government bond yield are rising. This conflux of factors often suggests a negative trend for share prices. This is also the case this time.

Strong US dollar

The strength of the US dollar is easily explained. Real GDP growth is significantly higher in the USA than in other regions. The Federal Reserve Bank of Atlanta’s model-based growth estimate for Q3 is 4.9% (quarter-on-quarter, annualised). That of the New York Fed is 2.1% and that of the St. Louis Fed 1.6%. The arithmetic mean of the three estimates is 2.9%, which is significantly higher than the estimates for the other regions. For example, growth in the Eurozone is likely to stagnate in Q3. In addition, the US dollar is inherently anti-cyclical: negative developments at the global level (growth slowdown, share price declines, geopolitical uncertainty) support the US dollar on average.

Note: Past performance is not a reliable indicator for future performance.

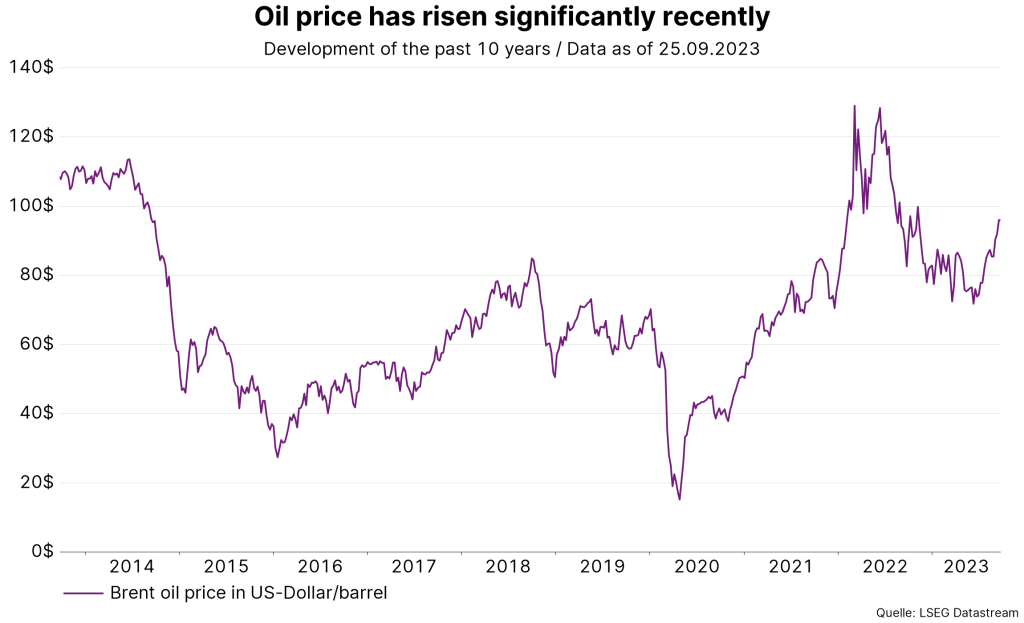

Increased oil price

The Brent oil price has risen by around 30% since Q2. This can be attributed to a large extent to the OPEC+ production restrictions. However, the higher-than-expected US growth has only had a limited part in this. The negative supply-side shock reduces economic growth and increases inflation. However, so far there is little evidence of an impact.

Note: Past performance is not a reliable indicator for future performance.

Nonetheless, three questions are inevitable. First, will there be a spillover from higher energy prices to other components of inflation? In theory, there should only be few, because the price increase was triggered by the supply side and not by strong demand. But in the current environment of high inflation, there is a risk that inflation expectations will rise. In this context, the question is whether central banks will take an even bolder course of fighting inflation. These two questions will likely be significantly influenced by the third one: to what degree could the oil price rise further and how long will the oil price shock last?

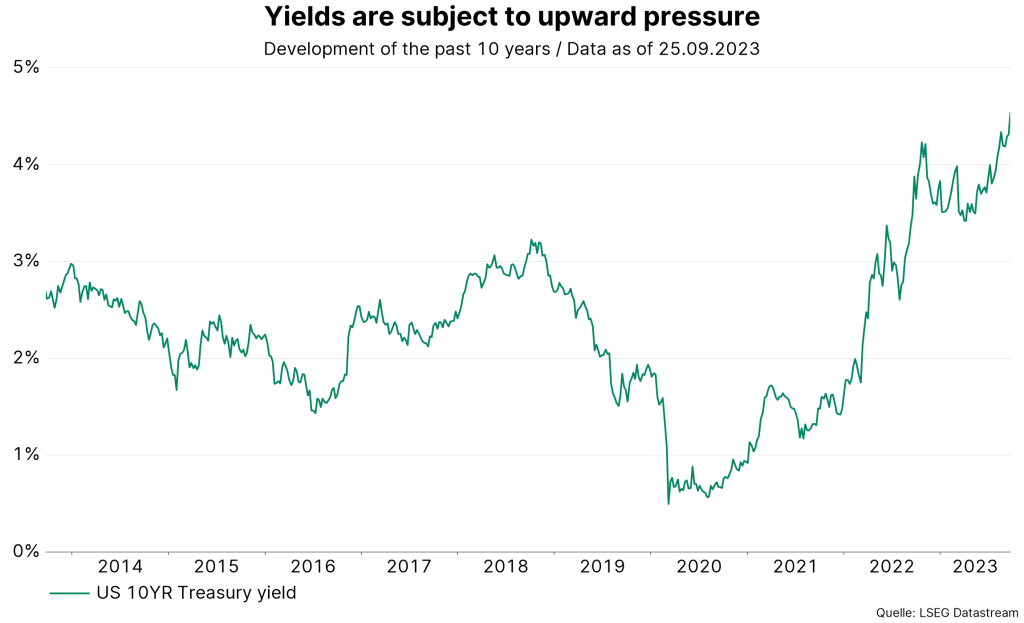

Higher yields

Government bond yields continue to face upward pressure. US yields in particular are an important benchmark for many asset classes. Generally, a higher yield means that the value (present value) of future income from existing assets (dividends, coupon payments) is lower. Thus, falling prices among numerous classes are hardly surprising.

Note: Past performance is not a reliable indicator for future performance.

Slower key-lending rate cuts

At 4.4%, the previous cyclical highs of October 2022 (4.2%) were exceeded. Those investors who are or were positioned for yield declines are thus under pressure to close their long positions. From a technical perspective, this reinforces the upward movement of yields. However, the most likely reason for the rise in yields are the signals sent by the central banks with regard to their battle against inflation in the developed economies. Last week, the most important central bank, the US Fed, left the range for the Fed funds rate unchanged at 5.25% to 5.5%, as had been widely expected.

Most interestingly, the published projections (Summary of Economic Projections or SEP) showed that the average of the Federal Open Market Committee’s (FOMC) participants’ estimates of Fed funds rates (i.e. US Fed key-lending rates) had risen since the last release in June. Another rate hike by the end of the year was already indicated last time. But the projection for the end of 2024 rose from 4.6% to 5.1%, and that for the end of 2025% from 3.4% to 3.9%.

Higher neutral interest rate

The projections for the other indicators substantiate the now slower path of interest rate cuts. The estimate for the unemployment rate was revised downwards (from 4.5% to 4.1% for 2024), while the estimate for real economic growth was revised upwards (from 1.1% to 1.5% for 2024). At the same time, inflation expectations for the end of 2024 remained unchanged at 2.5%; the implication being that the higher economic growth requires higher key-lending rates to allow for the same inflation, which means that from the central bank’s perspective the neutral key-lending rate is higher than originally thought.

If, from a cyclical perspective, the neutral interest rate, i.e. the interest rate that neither dampens nor supports the economy, has actually risen, then the current key-lending rate is not as restrictive as thought. The central bank will therefore be cautious with interest rate cuts as long as inflation is too high.

Conclusion

Stronger than expected economic growth in the US has supported the US dollar on the one hand and raised the neutral interest rate on the other. The Fed fund rates remain at a higher level than previously thought for longer. In addition to strong US growth, geopolitics, and currently the price of oil, are weighing on both economic growth and the markets, and are reinforcing inflation.

In the most likely scenario, growth in the US will weaken significantly. Even the likelihood of a recession remains uncomfortably high as the monetary policy remains restrictive for a sustainable period. For the oil price, most estimates point to stabilisation. The driving factors for the markets could thus change soon and growth fears could come to the fore. The weak preliminary purchasing managers’ index for the developed economies for the month of September also points in this direction.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.