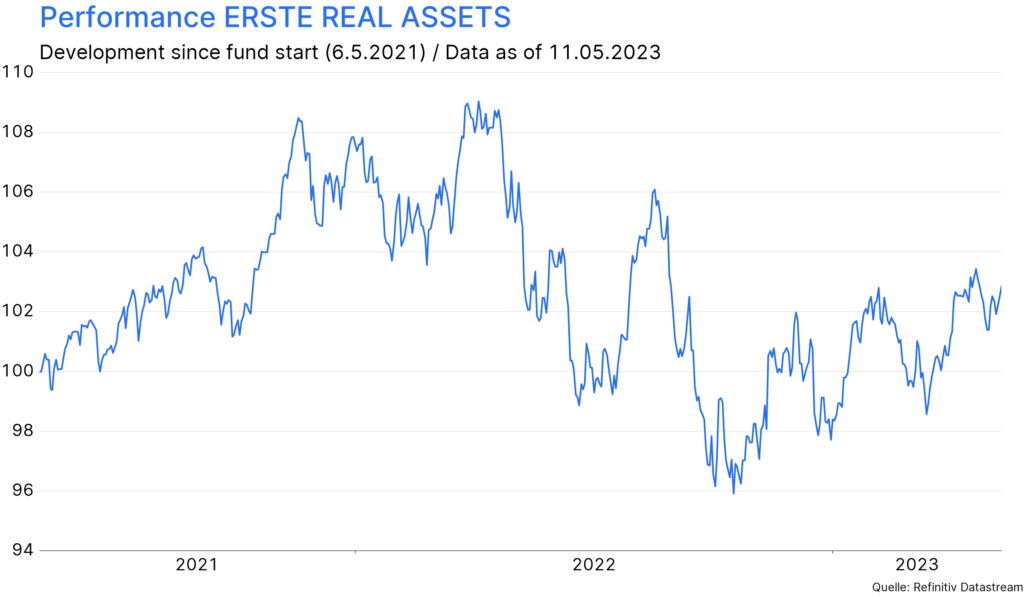

With the ERSTE REAL ASSETS mixed fund, investors can invest in real assets – and have indeed been doing so for two years now. As early as May 2021, when the fund was launched, many people were concerned about rising inflation. Since then, inflation has gained further momentum, and the interest rate environment has also changed completely.

On the occasion of the fund’s two-year anniversary, Philip Schifferegger, fund manager of ERSTE REAL ASSETS, is taking a look at the current market situation in an interview. He also explains why the fund is well equipped for both positive and negative market phases.

Please note that investments in investment funds involve risks as well as opportunities.

The pandemic-related supply chain disruptions and the outbreak of war in Ukraine have caused inflation to rise sharply over the past two years. Do you think that inflation has peaked yet?

High inflation usually occurs in waves, the peaks of which may be several years apart. The supply bottleneck for goods caused by the pandemic initially fuelled inflation, supported by expansionary monetary and fiscal policies that in combination kept demand high. Economists and central banks initially classified this development as temporary, but energy prices then gave it a whole new dynamic.

In a condensed definition, the economy is nothing other than the transformation of energy. Without energy, we could not even record and publish this interview. If energy prices multiply within a very short period of time, this naturally has a massive impact on the price structure of all goods and services offered.

But such a dynamic price development is usually not long-lasting, or to use a metaphor: as soon as you see the left side of the Eiffel Tower, the right side is not far away. The energy price peaked in June 2022; now, energy is trading much lower. That means, to answer your question, yes, we have now passed the energy price-induced peak of inflation.

We do not know whether the next wave of inflation will again be energy-induced or perhaps wage-induced. We will only know in retrospect. In any case, the central banks have reacted and raised key-lending rates significantly over the past twelve months. In the USA from 0.25% (upper limit) to 5.25% most recently. The question is whether this is enough. Normally, sustained positive real interest rates (N.B. key-lending rates minus inflation) have an inflation-inhibiting effect. In the USA, with an inflation rate of currently 5%, we have de facto exceeded the neutral threshold, while in the Eurozone we are still a long way from it.

Why does it pay off for investors to invest in real assets, especially in times of high inflation?

I would not call the ERSTE REAL ASSETS an anti-inflation investment. That would be a bit presumptuous. ERSTE REAL ASSETS is a broadly diversified portfolio that is well equipped for both positive and negative market phases due to its structuring. As a client, I don’t need to constantly worry about whether I am currently invested in the right asset class or not. The fund does not engage in short-term market timing, but sticks to its strategic allocation weights.

We have equities for the good times, and gold for the times of crisis. In addition, we hold real estate and commodities in the portfolio, which have historically proven to be a good investment in an inflationary environment. All four asset classes together allow for balanced risk diversification and this also in times of higher inflation.

“We have equities for the good times, and gold for the times of crisis. In addition, we hold real estate and commodities in the portfolio.”

Philip Schifferegger,

Fund manager ERSTE REAL ASSETS

How are you currently positioned in the fund, and what has changed in terms of positioning in the past two years since the launch?

The core of the investment has remained unchanged. We constantly hold around 50% equities and around 30% gold; but we have made adjustments to the real estate allocation. We have reduced the proportion of open-ended real estate funds and reallocated the freed-up assets to global real estate shares and infrastructure shares. At the same time, we have added around 10% commodities to the portfolio. In this way, an even broader diversification of the fund was achieved.

In the commodities segment, we focus on those industrial metals that are needed for the energy transition, such as copper and nickel. We expect strong demand potential there. An investment or speculation with food is of course excluded.

What do you think could be in store for us with regard to the economy and the markets this year? In your opinion, how should investors position themselves at this point?

It usually takes 12-18 months for interest rate hikes to take full effect. The USA started raising interest rates last year in March. This means that we are now in the thick of it, and the first effects are visible (Keyword US banking crisis). The economic momentum is expected to weaken as the year progresses. Whether it will be a mild or severe recession, we do not know.

In our view, a mild economic downturn is already priced into the market. But in the event of a profit recession, we should definitely expect unpleasant price markdowns.

On the interest rate front, we have reached the forecast level of the key interest rate of 5.25% in the USA. The market already envisages lower key-lending rates for the end of 2023. And lower interest rates are positive in themselves, both for equities and for gold.

Philip Schifferegger is fund manager at Erste Asset Management. He has worked in asset management since 1997, holds a master’s degree from the Vienna University of Economic and Business Administration and is a chartered financial analyst (CFA).

At one glance

ERSTE REAL ASSETS invests mainly in the asset classes of equities (including a focus on infrastructure), commodities and precious metals, real estate, and inflation-linked bonds, all of which form the “real values” focus. All important information about the fund can be found here.

Risk notes according to 2011 Austrian Investment Fund Act

ERSTE REAL ASSETS may make significant investments in investment funds (UCITS, UCI) pursuant to section 71 of the 2011 Austrian Investment Fund Act.

Advantages for the investor

- Investment focus on real assets

- Opportunity to achieve long term capital appreciation

- The broad investment in a vast array of assets allows for a significant degree of risk diversification in the fund, which may reduce the risk of capital losses.

- Investment funds are separate assets

Risks to be considered

- The assets in the fund may be subject to considerable price fluctuations.

- Due to investments denominated in foreign currencies, the net asset value of the fund can be negatively impacted by currency fluctuations.

- Alternative investments involve a higher level of risk

- Capital loss is possible

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.