Before we turn our attention to the year ahead, it’s worth taking a look in the rearview mirror to briefly review 2022 as well. Basically, one might think that both society and the economy have been crisis-tested in recent years. However, the number of shocks last year is unparalleled. Expectations of a positive capital market year were abruptly dashed on February 24 with the Russian attack on Ukraine. In addition to the humanitarian tragedy, the war also acted as an accelerant for already smoldering trouble spots and, analogous to a chain reaction, this shock caused or intensified numerous others.

A year of crises

Here, for example, the strained supply chains – keyword Ukrainian cable harnesses – or the general shortage of raw materials should be mentioned. Even before the war, demand exceeded supply due to corona. The confrontation and sanctions triggered an energy crisis that will continue to affect Europe in particular for a long time to come. The high commodity prices, in turn, fueled inflation around the globe, which had already been stoked and in Europe, for example, recently reached 11.5%, the highest level since World War II. In view of this development, even the major central banks had to admit that they had underestimated inflationary dynamics for too long and that inflation was anything but “temporary”. First and foremost, the US Federal Reserve made a radical turnaround in monetary policy. On March 16, Jerome Powell raised the US key interest rate for the first time, marking the fastest tightening in decades with six more aggressive steps. With the exception of the Bank of Japan, all major central banks acted in a highly restrictive manner, accepting the negative economic effects or, to a certain extent, systemic risks – as the near collapse of the British pension system in September showed.

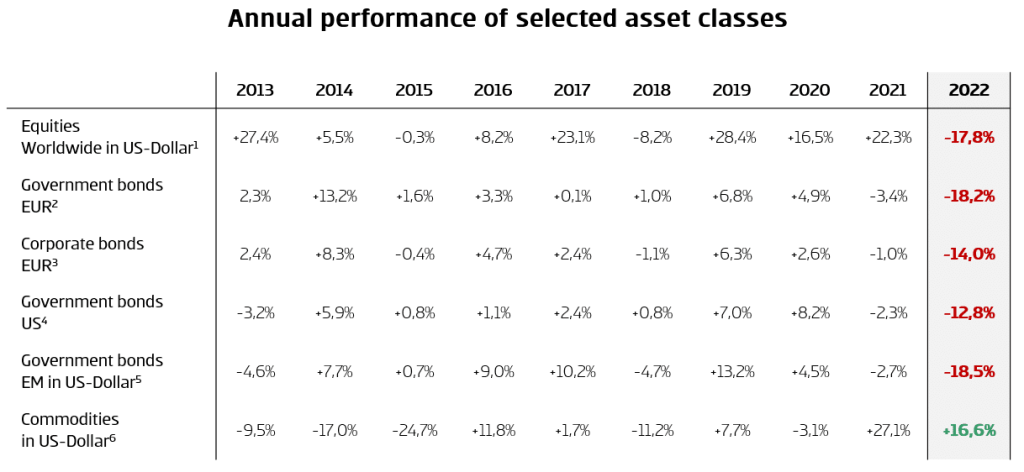

The dimension of the measures is most evident in the development of the capital markets. As the chart below shows, almost all major asset classes end 2022 with double-digit price losses. For global equities, this means the worst year since the great financial crisis of 2008 and, in the case of 10-year US government bonds (according to a study by Deutsche Bank), even the highest annual loss in 233 years.

Resilience or recession?

Last year, the financial markets focused primarily on inflation and the monetary policy that depends on it. In our view, the actual development of the economy is likely to play a more important role again in the coming year. The key question is therefore whether the global economy will continue to show enormous resilience or whether we will drift into a global recession. In view of the numerous trouble spots and, consequently, numerous leading indicators, the latter would not be surprising in principle. However, a look at the actual growth figures shows that the current economic situation is difficult, but nevertheless much better than the general mood would suggest. In our view, there is therefore a legitimate chance that the predicted recession in 2023 will not materialize or will be very mild.

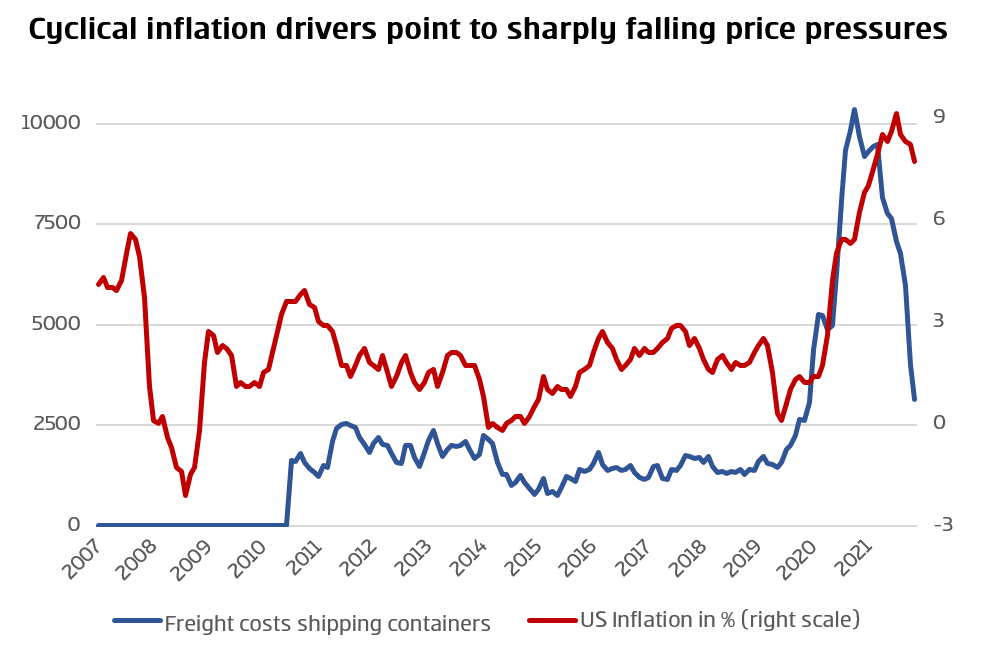

For example, the 3rd quarter growth rate for US gross domestic product published shortly before Christmas came as a surprise. At 3.2% annualized, it was well above expectations. Despite increased fears of recession, the 4th quarter in the USA is also expected to be clearly positive, primarily due to the recent improvement in consumer sentiment. Even in Europe, where many economists believe we are currently in a recession, consumer confidence has recently improved noticeably. Fears of a difficult winter are still present among consumers and businesses, but they are no longer nearly as pronounced as they were in the fall, when forced gas rationing dominated the headlines. One reason for the recent slight improvement in sentiment is certainly the break in inflationary dynamics. In the USA, we have already passed the peak of price pressure and in Europe, too, this is likely to be exceeded soon. In the meantime, the question is not so much whether inflation will fall in the coming months, but how quickly. Numerous cyclical price drivers, such as freight costs (see below) and commodity prices, suggest that price pressure will be significantly lower in the coming year.

In this context, however, it must also be mentioned that the solid labor market certainly speaks for a certain persistence of inflation, and inflation is likely to remain above the central bank’s target for the time being. However, we cannot identify the feared wage-price spiral. As a result, the central banks’ monetary policy pressure should ease noticeably in the coming year. Even if the rhetoric of most central bankers remains “forced” to remain very restrictive in view of current inflation levels, we expect key interest rates to be only marginally higher in the middle of next year at 5% in the USA and 3% in Europe.

The monetary policy environment thus remains extremely challenging, but there is justified hope that it will become at least somewhat more predictable in 2023.

The course of the global economy in the coming year will also depend to a large extent on China’s performance. While the global growth engine stuttered last year due to the zero-covid policy and the problems on the domestic real estate market, the People’s Republic could well surprise on the upside in the coming year. Above all, the unexpected turnaround in the Corona policy at the beginning of December and the accompanying opening measures could contribute to a renewed acceleration of economic growth. While the recently (unofficially) reported 37 million contagions per day certainly look scary in the short term, similar to Europe and the US, the “re-opening” should have a clearly positive growth effect.

The global economy could therefore get off lightly, even though all forecasts are currently subject to a very high degree of uncertainty in view of the numerous crises.

Signs of better investment year

After a year like 2022, it would be presumptuous or naïve to claim that everything will change for the better in 2023. After all, we are experiencing a war in the middle of Europe, suffering from the highest inflation in decades and considering a mild recession as a possible positive scenario. On the other hand, it must also be noted that there has been a significant improvement on several levels in recent weeks. For example, the inflation peak seems to have been overcome, an end to the cycle of interest rate hikes is near, the energy crisis in Europe has been averted for the time being, or the zero-covid policy in China has come to an end. In addition, the financial markets always try to map future developments. As a rule, they react positively when the real economy is still weakening. The current negative prices therefore also reflect some negative expectations. Regardless of this, opportunities have certainly built up. We are therefore cautiously positive about the future in light of recent developments.

A look at bond yields in particular shows that fixed-income investments have more value potential than they have for a long time – after all, good-quality corporate bonds now yield around 4%. The risk premiums on high-yield and emerging market bonds have also widened considerably over the past year, so that the medium- and long-term attractiveness of the asset class has increased significantly.

In view of this year’s correction on the equity markets, they are considerably more favorable in terms of valuation at the start of the year than they were a year ago. However, it must also be noted that there were definitely “unhealthy” exaggerations on the market after the Corona crash. We currently consider equities to be neither cheap nor expensive. The earnings situation of companies and the extent to which they can cope with the economic headwinds are likely to be decisive for the further course of events.

Conclusion

As mentioned at the outset, the market’s focus is likely to shift from inflation to economic growth again. This should also be accompanied by a noticeable decline in the synchronization of asset classes experienced in 2022.

In summary, given the existing multiple crises, 2023 is unlikely to be an easy year either. Volatility is likely to remain a constant companion in the coming months, so that proactive selection and allocation will gain in importance. Nevertheless, we are cautiously positive about the resilience of companies and the economy. In addition, most of the crises seem to have passed their peak, so that the dark hours of late should be followed by some sunshine over the year as a whole.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.