Stock prices have risen since the banking problems in the USA emerged. During the same period, expectations for future key interest rates have fallen significantly. In the meantime, the key interest rate in the USA is only expected to rise by 0.25 percentage points to 5.25% by June. By the end of the year, market prices already reflect key rate cuts.

According to the minutes of the Fed’s last meeting, members of the Federal Open Market Committee are showing concern about financial market stability. Fed analysts expect a mild recession at the end of the year and a decline in inflation to 2% next year. The greater focus by the Fed and other central banks on financial stability has supported markets, although risks to economic growth have increased. At the core, the question remains whether inflation will fall fast enough to allow policy rate cuts. This would alleviate the risks to growth, i.e. the risks for a major recession.

Declining inflation

Inflation rates remain too high. In the OECD area, consumer price inflation was 8.8% year-on-year in February. This is due to a combination of very loose monetary and fiscal policies, supply bottlenecks and the effects of the war in Ukraine (high energy and food prices). Because corporations had and still have high pricing power, broad-based pass-through effects took place.

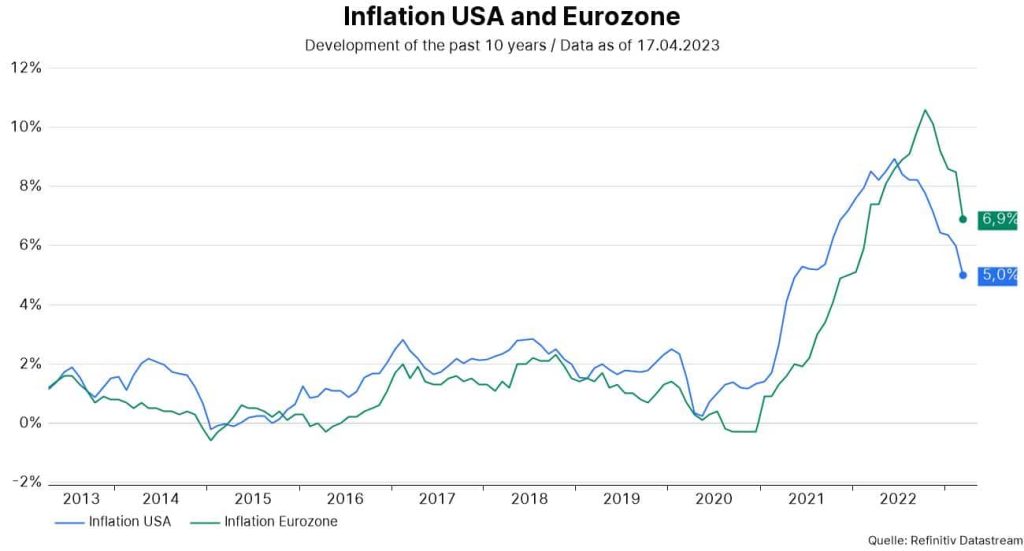

At least a falling inflation trend is discernible. In October 2022, inflation in the OECD area was still 10.7%. In the Eurozone the inflation rate were at 6.9% in March, whereas it was significantly higher in October 2022 with 10.6%. Consumer price inflation in the US for the month of March also showed a downward inflation trend, at 0.1% on a monthly basis and 5.0% on an annual basis. However, the core rate (total excluding energy and food) remained uncomfortably high at 0.4% month-on-month and 5.6% year-on-year.

Note: Past performance is not a reliable indicator of future performance.

Falling inflation impulse

Developments at the upstream production levels were encouraging. US producer prices fell 0.5% on a monthly basis to 2.7% on an annual basis. In fact, the producer price index has been trending sideways since July 2022. Import prices have also fallen (-0.6% month-to-month and -4.6% year-to-year. In other words, the original inflation impulse is diminishing.

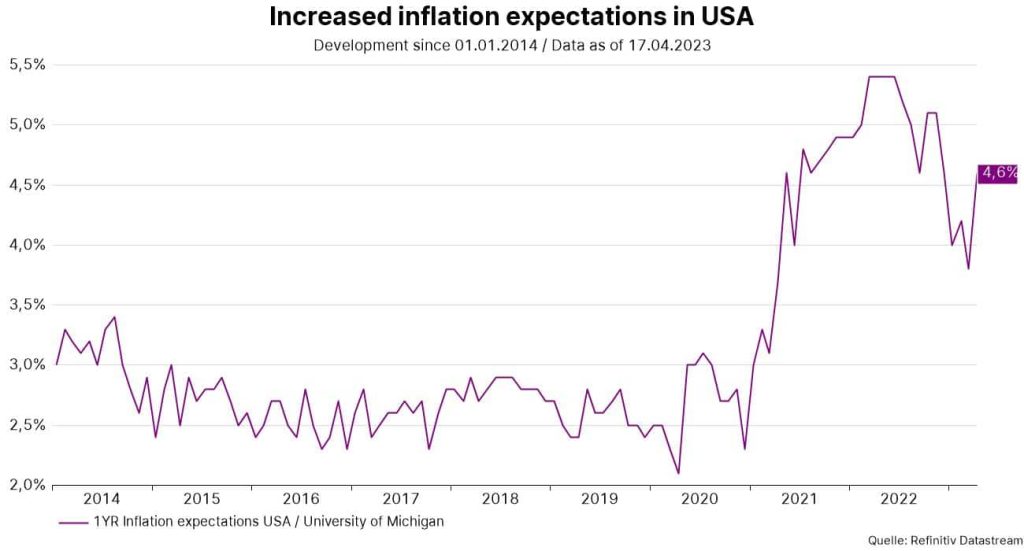

Increased inflation expectations

The key question is whether there will be secondary round effects. Above all, the firm labor market, i.e. the low unemployment rates, point to upside risks for inflation. In the OECD area, the unemployment rate was only 4.9% in February. In the USA, the unemployment rate was 3.5% in March. But inflation expectations also play a role here. There was an unpleasant development here last week. Consumer inflation expectations for the coming 12 months rose surprisingly sharply in April (from 3.6% in March to 4.6%: Source University of Michigan, preliminary estimate). Thus, they did not continue the declining trend from the last high (5.4% in April 2022).

Note: Past performance is not a reliable indicator of future performance.

Surprisingly strong growth

The aggregate of economic indicators points to strong growth in real global GDP in Q1 2023 (around 4% quarter-on-quarter, annualized). Last week, industrial production in the Eurozone for the month of February showed a significant increase of 1.5% month-on-month to 2.0% year-on-year. In the US, both retail sales (-1.0% month-on-month) and manufacturing (-0.5% month-on-month) fell in the month of March. However, the start of the new year showed particularly strong gains.

Overall, US GDP will have grown strongly in the first quarter (around 3%). In China, exports grew strongly in the month of March (14.8% y/y) and the total social financing (credit growth) figure was above expectations. The V-shaped recovery after the opening measures is striking. The estimate for GDP growth in the first quarter is around 10% (quarter-on-quarter, annualized; to be released next Tuesday).

More restrictive lending

Stress indicators for the financial system have fallen after rising in March, triggered by the problems at medium-sized banks in the USA. However, the risk of a renewed period of instability in the financial system remains, at least as long as central banks are under pressure to pursue a restrictive monetary policy due to excessively high inflation. In addition, an important impact channel is being closely monitored. Many experts expect a further tightening of banks’ lending guidelines. Because this development will put additional pressure on growth and inflation, this is seen as a (partial) substitute for further key rate hikes, also by central banks. However, there is considerable uncertainty about the extent.

A clue was provided last week in the US by a report from the Federation of Small Businesses (NFIB). In March, a net 9 percent of businesses said they were having trouble getting credit. That doesn’t sound like much, but the indicator has been trending downward since March 2021 (-1) and accelerated in March 2023 (from -5 to -9).

Conclusion: Two scenarios

Thus, inflation dynamics remain the most important factor, but unfortunately difficult to assess. In the “inflation” scenario, inflation persists at too high a level (inflation persistence). In this environment, the probability of a recession as well as a more unstable financial environment is increased because monetary policies remain restrictive or (have to) become even more restrictive.

Two sub-scenarios emerge in this context. In the first variant, the recession causes falling inflation with a time lag. In the second, unfavorable variant, monetary policy does not become restrictive enough because otherwise stability in the financial system would decline. This would also imply persistently too high inflation in the longer term.

In the positive “disinflation” scenario, a recession can be avoided and the financial system remains stable because inflation is falling fast enough. Markets have increasingly priced in the second scenario since March. But the jury is still out.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.