The feared recession has so far failed to materialise and inflation is also falling. For risky securities, above all equities, this brings support. But the risks remain on the downside. What could be in store for the markets in the second half of the year?

Growth

On the positive side, most indicators still point to weak real economic growth in the developed economies (around 1% quarter-on-quarter and annualised).

The flash estimates of purchasing managers’ indices for some major economies also paint a similar picture. Overall, however, the reports were disappointing for two reasons:

- the manufacturing sector remains weak – indicators point to continued stagnation.

- the service sector shows signs of cooling – in the past months it had still supported growth.

Particularly in the eurozone, purchasing managers’ data were weak. The region has already been stagnating in this respect since the fourth quarter of 2022.

Even though the probability of an immediate recession is low, the indicators point to continued low growth. The weakening momentum in the service sector poses a further risk in this regard.

“Technical” vs. “Real” Recession

The Leading Economic Index, an important indicator of growth in the US economy, recently provided indications of a contraction in gross domestic product (GDP). However, stagnation or even a slight GDP contraction for a few quarters would not be a “real” recession. Some people refer to this as a “technical” recession.

By contrast, a “real” recession would be a sharp and prolonged broad-based deterioration. Declines in corporate profits lead to lower investment and lower employment. This reduces income, which in turn reduces consumption. A downward spiral is set in motion. Experience shows that this environment is the main enemy of equities.

Monetary policy

Recessions can have many causes. Currently, however, the central banks’ restrictive monetary policy is at the centre of attention. Past and future interest rate hikes have a dampening effect on growth only after a time lag. The duration and strength of this effect are uncertain.

The effect on inflation is even more uncertain. However, past experience shows that a restrictive monetary policy to curb inflation has often triggered a recession.

Inflation

The slow decline in inflation in recent weeks has led central banks to raise their inflation expectations. In line with this, the guidance for future key interest rates, the so-called forward guidance, has been raised again.

Next week, the flash estimate of consumer price inflation for June will be published in the Eurozone. The estimate for the core inflation rate, i.e. excluding the traditionally volatile components food and energy, is 5.5% yoy, up from 5.3% in May.

Key interest rates

Also due to higher inflation expectations, further key rate hikes in the euro zone are likely. Currently, the market expects another 50 basis points this year. The ECB’s main refinancing rate would then be 4.5%.

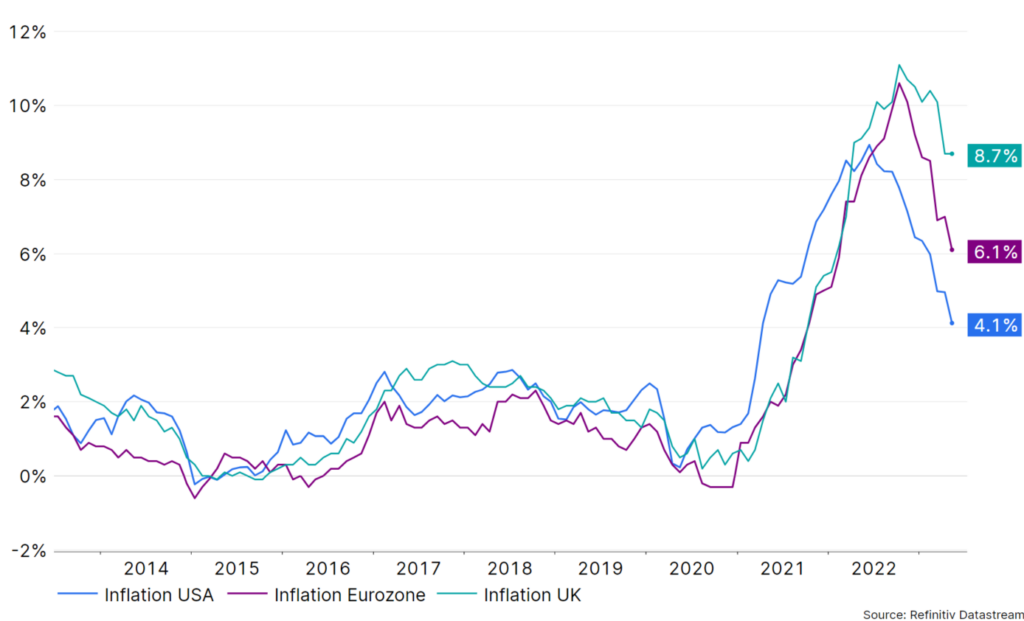

The Bank of England in the United Kingdom recently surprised with a strong rate hike of 0.5 percentage points to 5%. Previously, inflation had been surprisingly high at 8.7% year-on-year in May. Meanwhile, market prices reflect further hikes of more than one percentage point by the end of the year.

The world’s main central bank, the Fed, remains equally hawkish in its fight against inflation. The US central bank did leave key interest rates unchanged in June for the first time in this interest rate cycle. The upper band for the key interest rate is currently 5.25%. However, this is merely intended to stretch the path of interest rate hikes. In his semi-annual speeches to congressional committees, Fed Chairman Jerome Powell has put further rate hikes on the table.

Inflation rates are falling, but remain well above the central banks’ target.

Development over the past 10 years / data as of 28.06.2023

Source: Refinitiv Datastream; Note: Past performance is not a reliable indicator of future performance.

Should inflation stabilise above the central bank target of 2%, for example at 3%, the reasons could be structural. Demographic change means a tight labour market and climate change and geostrategic tensions imply higher investment activity. The possible productivity-boosting effect of new technologies, above all artificial intelligence, is still open.

It is possible that central banks will either implicitly or explicitly accept higher inflation. The consequence would be that they do not continuously pursue a restrictive policy. As long as inflation then fluctuates little around the new value, this would be a favourable scenario for the financial market.

Conclusion

True, the probability of an immediate recession is low. However, it would be bold to assume that inflation will continue to fall towards the central bank’s target of 2% without “pain”.

But even stagnation or a technical recession would probably not have particularly negative consequences for the financial markets.

The most important threat scenario for the markets continues to be the restrictive monetary policy of the central banks. This could dampen demand until a recession is triggered. The probability of this is uncomfortably high.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.