Author's Contributions

Middle East conflict: Is the markets’ restrained reaction appropriate?

So far, the markets have reacted little to the hostilities between Israel and Iran. Is the market development appropriate or is the risk of further escalation being underestimated? Chief economist Gerhard Winzer explores this question in today’s blog post.

The Triple B Plan

Donald Trump’s “Big Beautiful Tax Bill” package is intended to bring comprehensive tax cuts in the US. The already high budget deficit would increase further. This would also have an impact on US government bond yields, which have been rising for months anyway. There is a threat of a downward spiral with unforeseeable consequences.

Trade conflict between the USA and China eases

The US and China have agreed to suspend high tariffs for 90 days. While the markets are reacting with relief, some uncertainties remain.

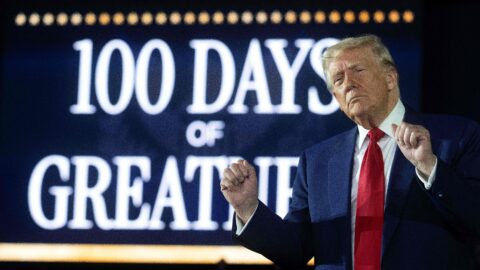

The first 100 days

The first 100 days of Donald Trump’s second presidency are behind us. What has happened since then? Will the structural changes continue at this pace?

Winzer of the week: It’s getting more extreme

The new tariffs imposed by the US government and the reactions from Mexico, Canada and China make a trade war more likely. At the same time, the US economy is showing the first signs of weakening. All of this could mean a headwind for the financial markets.

After the election, Germany is facing a change of direction

After the election in Germany, a two-party coalition could quickly be formed under the leadership of the CDU politician Merz. After five years of economic stagnation, the potential for a change of course is there. The trend-setting German stock index (DAX) is rising.

Trade conflict & Ukraine war: How structural change could affect the markets

In the global world order, much seems to be in a state of upheaval. The changes brought about by the new US administration are a structural change that is also affecting the financial markets. In our view, this scenario is currently the most likely 👉

Rising inflation expectations and yields: a risk for market sentiment?

Two developments on the stock markets have stood out since the beginning of the year: rising inflation expectations and significant increases in government bond yields. Could market sentiment soon turn frosty in view of this?

Strong US labor market report: just an outlier?

In September, the US labor market performed surprisingly well, with significantly more new jobs created than expected. This has pushed back concerns about an impending recession, which is positive for the financial markets. Was the strong labor market report just an outlier, or is the US Federal Reserve perhaps on the right track to achieving the hoped-for “soft landing”?

Interest rate cuts at the door

After the rapid and sharp interest rate increases in 2022 and 2023, the pendulum is now swinging in the opposite direction. After the European Central Bank (ECB), the US Federal Reserve will cut key interest rates for the first time this Wednesday, thus initiating a new cycle of interest rate cuts. What does all this mean for the economy and what conclusions can be drawn from it for investments?

Shift in risks

Both the markets and central banks are pointing to a shift in economic risks from inflation towards growth. The focus is currently on the US labor market.

The new age of protectionism

The path towards a clearly fragmented global economy is continuing. Recently, the increase in tariffs on Chinese electric cars in the USA and the European Union has been particularly noticeable. What impact is the rise of protectionism having on the global economy?

Soft landing beats political uncertainty

With the surprising fall in inflation in the US, the scenario of a “soft landing” has become more likely. Meanwhile, the shocking attempted assassination of US presidential candidate Donald Trump at the weekend will likely have an impact on the current election campaign.

Signs of a slowdown: more scope for central banks?

Economic and political uncertainty is increasing. Nevertheless, inflation is falling in the USA and the eurozone. This increases the scope for central banks to react to a slowdown in economic growth by lowering key interest rates.

Nationalist forces strengthened in the EU: what could be the consequences?

In the EU parliamentary elections, right-wing parties made significant gains in some major countries. In France, early elections are now on the cards following President Macron’s defeat. What possible effects could a shift to the right have in the EU?

ECB interest rate policy: First rate cut, and then?

The European Central Bank is likely to cut its key interest rate tomorrow for the first time since the interest rate turnaround in 2022. But what comes next? Will the first cut herald a series of interest rate cuts or will the monetary guardians remain cautious? Chief economist Gerhard Winzer takes a look at the ECB’s possible future interest rate policy.

Attack on Israel

The smouldering conflagration in the Middle East reached a new level of escalation last weekend. Iran attacked Israel directly with drones and missiles for the first time in history. There is a risk of further escalation between Iran and Israel. How is the market reacting to this?

Favorable indicators: Soft landing on approach?

More and more indicators are pointing to good global growth. Even regions and sectors that had recently weakened are likely to return to growth. The soft landing after the sharp rise in inflation and the turnaround in interest rates could succeed. The decline in inflation is pausing at the same time, as yesterday’s US inflation data shows.

Interest rate cuts and economic growth – a favourable environment for the markets

Even though the ECB recently left its key interest rate unchanged, central banks are increasingly signaling an inclination to cut interest rates for the first time. At the same time, the indicators point to good economic growth at a global level. These are positive signals for the stock markets.

US interest rates: What are we to expect in the coming months?

As the latest data shows, the US economy continues to grow strongly – despite the significant interest rate hikes in the past two years. What impact will this have on the Federal Reserve’s future interest rate policy and when could the first rate cuts follow?

Inflation, interest rates, markets: 10 topics for 2024

After the price rally at the end of last year, the markets started 2024 with price losses. The ongoing positive correlation between bonds and equities is striking. Both asset classes have fallen equally recently, which makes diversification in a portfolio more difficult. But the year has only just begun. We therefore take a look at 10 key topics for 2024 that could be helpful when putting together a portfolio.

Increasing optimism for a “soft” economic landing

While equities have recently risen, yields on the bond market have weakened. The markets are being supported by increasing hopes of a “soft” landing for the economy. What are the chances of this scenario?

Encouraging fall in inflation

Since the beginning of November the prices of both risky security classes such as equities and credit-safe government bonds have been on the rise. The market appears to be increasingly pricing in a so-called “soft” landing for the economy. The probability of this actually increased over the course of the year. However, the economic data published in recent weeks and months does not contradict the “hard” landing scenario.

Soft-landing optimism might be in for some disappointment

The financial environment has become slightly more relaxed since the beginning of November. This fact is manifesting itself on the market in the form of falling yields and rising share prices. This week, two indicators relating to the US economy in particular could provide clues as to the sustainability of this trend since the beginning of the month: retail sales and consumer prices.

How restrictive are the current interest rate policy and financial environment really?

In line with the surprisingly strong economic indicators in the US, government bond yields have risen significantly in recent months. This is putting pressure on the prices of many classes of securities and intensifying discussions about how restrictive interest rate policy really is. Could the higher level of yields make the central bank’s job easier in the form of further interest rate hikes?

Attack on Israel: Reaction of the markets

The terrorist attack on Israel by Hamas last weekend dominates the international headlines. The markets are reacting to this with price declines, but the extent of the movements has so far been limited.

Dollar exchange rate, oil price, and interest rates burdening the markets

The stock markets have recently come under pressure due to several factors. Both the higher dollar exchange rate and the higher oil prices and yields on the bond market are weighing on prices. Chief economist Gerhard Winzer assesses the current situation in his blog article.

Conditional pause on interest rate hikes

The European Central Bank has raised the key interest rates probably for the last time in this interest rate cycle. But the rising oil price poses a risk that the ECB has only taken a pause.

Pause on interest rate hikes?

Once again it’s all about interest rates this week. Will the ECB take a break this time and leave key interest rates unchanged? There is a lot to be said for it.

Hopes for a soft landing

In the past, sharp hikes in key interest rates often triggered a recession. After the latest economic and labour market data, hopes are growing for a soft landing of the economy.

What are the lasting results of the central bank meeting in Jackson Hole?

At the annual meeting of central bankers in Jackson Hole Federal Reserve Chair, Jerome Powell, summed up the uncertain environment as “navigating by the stars in a cloudy sky”. This relates, among other things, to the uncertainty about the level of the neutral interest rate, the lagged effect of key-lending rate hikes on economic growth and inflation, and the drivers of inflation.

Soft landing with risks

Currently, the most important indicators point to average global economic growth and falling inflation. The probability of an immediate recession has decreased significantly. But the risks in the medium term remain. Chief economist Gerhard Winzer explains which three scenarios are currently emerging in the blog post.

Immaculate disinflation: Is that possible?

Can price stability, i.e. inflation of 2%, be achieved without a recession? The further decline in inflation in the US in June has raised expectations for this favourable scenario. However, a look in the rear-view mirror calls for caution. In the past, a central bank-induced decline in inflation has often been accompanied by a recession.

Interest rate policy based on the motto “higher and longer”

The global economy is proving to be increasingly robust against a number of headwinds. Due to the uncomfortably high level of inflation, the central banks are likely to stick to their tight interest rate policy for longer than expected.

Recession, inflation, key interest rates: Economic outlook for the second half of the year

The feared recession has so far failed to materialise and inflation is also falling. Nevertheless, the risks remain on the downside. What could be in store for the markets in the second half of the year?

Fight against inflation: Monetary policy remains restrictive

Central banks remain on a restrictive course and hold out the prospect of further key interest rate hikes. Although there are some signs of a further decline in inflation, it is falling more slowly than expected. You can read where the journey could lead in the blog post.

Interest rate decisions in focus: what will the central banks do?

This week, the markets are eagerly awaiting the upcoming interest rate decisions. The Fed in the USA will make the first move today, Wednesday. For the first time in the current cycle, no increase in the key interest rate is expected. For tomorrow’s interest rate decision by the ECB, on the other hand, the market expects a further rate hike of 25 basis points.

US labour market: strong employment growth

Surprisingly good figures came from the US labor market in the previous week. Despite the strong growth in employment, however, economic growth has recently been rather meager. Recession risks also remain at an uncomfortably high level.

“Brinkmanship” – Agreement on Debt Ceiling

The representatives of the Democrats and the Republicans have reached an agreement in the dispute over the debt ceiling in the USA. The cap of $31,400 billion is to be suspended until 2025. Subject to approval in the House of Representatives and Congress, the agreement is positive for the financial markets. However, another effect could weigh on the markets further down the line.

Meager Growth

Global growth is likely to cool significantly in the second quarter. At the same time, recession risks remain uncomfortably high, as Chief Economist Gerhard Winzer writes in his market commentary. The further course of negotiations on the US debt ceiling is also likely to cause tension on the market.

Markets in a wait-and-see mode

How much longer will the sideways trend on the stock markets last? Negative and positive factors balance each other out. One unresolved issue among many is the U.S. debt ceiling.

Central banks weigh risks

Most recently, central banks have signaled a somewhat less sharpish stance, as an effect of the rapid key rate hikes on the monetary environment has already become visible. However, recent economic data are dampening hopes for a rapid decline in inflation, as Chief Economist Gerhard Winzer explains in his market commentary.

Where is the recession?

The global economy grew strongly in the first quarter of 2023. At the same time, inflation remains too high, which is why central banks will continue to pursue a restrictive monetary policy. Although growth indicators are good to strong, there are therefore increased risks of recession.

Banking problems support share prices

Since the banking problems in the US emerged in March, share prices have risen and expectations for future key interest rates have fallen significantly. However, inflation dynamics remain the most important factor for the markets, but unfortunately also one that is difficult to assess.

Game Changer

The current crisis of confidence continues to dominate market activity and has significantly increased uncertainty about the future development of economic indicators. Read more in the current market commentary by Chief Economist Gerhard Winzer.

The Good, the Bad and the Hawk

Last week brought good, bad and inflation-fighting news, all from the US. At the start of the new trading week, the focus is on the turbulence surrounding Silicon Valley Bank.

Conditionally positive economic news

Last week, positive economic data brought back some confidence. The global purchasing managers’ index, one of the most important survey-based economic reports, rose for the third time in a row. On the other hand, the latest inflation reports dampen hopes of a rapid decline in inflation without additional key rate hikes.

Risk inflation persistence

Inflation, which remains too high, continues to be the dominant macroeconomic issue. Hopes that inflation will fall as quickly as it has risen have been dampened, as Chief Economist Gerhard Winzer explains in his market commentary.

Calibration

Central banks and markets are in a calibration phase. The question is how many key rate hikes are needed to be able to confidently expect inflation to fall in the direction of 2%. Particular attention is therefore once again being paid to the US inflation data, which will be published today, Tuesday.

Party Crashers

Improved growth prospects for China and Europe and hopes of a sustained decline in inflation have supported the markets since the beginning of the year. However, sharp central bank rhetoric and weak growth indicators in the USA could prove to be spoilers.