“Higher for longer” has become the mantra of powerful central bankers in recent months. For example, the British central banker Andrew Baily recently said “we will need to keep interest rates high enough for long enough to ensure that we get the job done”. Jay Powell and Christine Lagarde also adopted a similar tone in their most recent interest rate decisions at the end of September. While the ECB raised rates again to 4.5%, both the Fed and the Bank of England paused. Regardless of whether the major central banks will follow up with a final rate hike in autumn, one can confidently claim that the interest rate peak has essentially been reached and that “the worst” should be behind us.

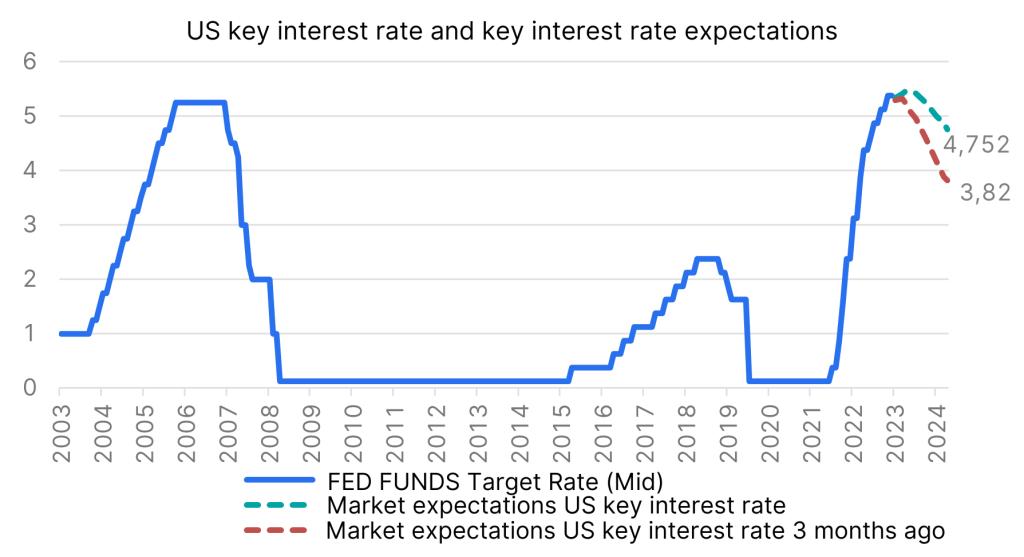

After all, we have seen the most aggressive rate hike cycle in recent history with an unprecedented 10 (ECB) or 11 (Fed) rate hikes within a few months and whether the key interest rate peaks at 5.5% or 5.75% in the case of the US is ultimately irrelevant. Much more important than the level is the duration of this restrictive environment and here the assessment among market participants has recently changed noticeably. As the chart below shows, key interest rate expectations in particular have shifted significantly upwards in the coming year, which has had a noticeable impact on the bond markets in particular, but also on the equity markets.

Source: Bloomberg; Note: Past performance is not an indicator of future developments. Prognoses are not a reliable indicator for future performance.

In this environment, the price of oil is literally adding fuel to the fire, and its recent rise has come at an inopportune time for the fight against inflation. The black gold climbed almost 30% in the last quarter, primarily due to OPEC production cuts and lower US crude oil inventories. However, given that the oil price increase is supply-side induced, the pass-through effects to other inflation components should be limited.

However, with the USD 100 per barrel mark approaching in the meantime, the pressure on inflation and its expectation is increasing, which in turn confirms the central banks in their course. In addition, the labour market in the USA remains extremely robust and the economy is not showing any signs of weakening despite the high interest rates. For example, the model-based estimate of the Federal Reserve Bank of Atlanta signals growth of 4.9% in the fourth quarter.

Even if this is probably overstating the case, it can nevertheless be said that the US economy is currently far from the feared recession. Even the battered industrial sector seems to be recovering, as the latest publication of the ISM Purchasing Managers’ Index for the manufacturing sector shows – with 49 instead of the expected 47.9, not only was the surprise particularly positive, but the index is also approaching the expansionary range again. The “soft landing” mentioned in the preface thus remains a thoroughly valid scenario in the view of many market participants. The situation in Europe is different, where above all the former growth engine Germany is weakening and the entire Eurozone is heading for economically difficult times.

O’zapft is!

Regardless of any growth worries in Germany, thousands and thousands flocked to Munich’s Oktoberfest (which, interestingly enough, takes place primarily in September) in recent weeks and indulged in the fun. Even the price of €13.75 for a “Maß” beer is unlikely to have deterred any guests, because after all, the demand after Corona is still catching up. Moreover, this year’s Wiesen visitors (following the colleagues from Berenberg Research) could actually afford more beer in real terms than in previous years. While the price of the “Maß” has risen almost twice as much as the general basket of goods since 1990, this year’s beer price increase of 4.2% was even below the current overall inflation of 4.5%. In addition, German wages climbed by 6.6% year-on-year, so there was nothing to stop the celebration.

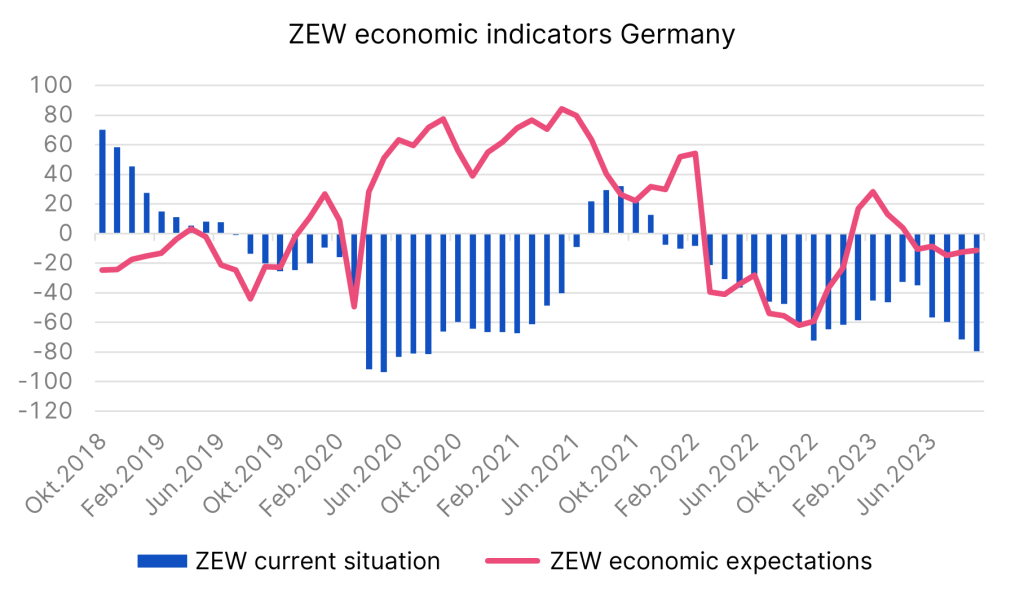

When looking at the chart below, however, at least politicians and many CEOs should lose their celebratory mood. The much-observed ZEW indicators paint a gloomy picture of the German economy – although forward-looking expectations have stabilised at a low level, the current economic situation is seen as being as bad as in the initial phase of the Corona pandemic. The German economy is weakening and even the “sick man of Europe” has been increasingly mentioned recently.

Source: Bloomberg; Note: Past performance is not an indicator of future developments. Prognoses are not a reliable indicator for future performance.

However, a comparison with the late 1990s, when Germany was struggling with high unemployment and low productivity, is probably not appropriate. Our big neighbour is currently suffering particularly badly from external shocks such as China’s economic weakness and the energy crisis. In addition, the German export economy has focused strongly on cyclical goods such as cars or chemicals. It is therefore hardly surprising that Germany suffers more than service-oriented economies such as France or Spain in a phase of economic weakness in the global economy.

Even though Germany is likely to be the only developed economy to experience a contraction in 2023, all is not lost. Similar to the US, the labour market is close to full employment and due to the shortage of skilled workers, the number of job vacancies is extraordinarily high, which implies a certain resilience. In terms of resilience, the solid SME sector, which is responsible for almost 60% of employment and thus represents the backbone of the German economy, should also help, as it does here.

In addition, Germany’s public coffers are well-filled – with a debt ratio of 65.9% (compared to Austria: 80.6%), the German government would have plenty of financial leeway for fiscal stimulus, increased investment in infrastructure, some of which is getting on in years, or the overdue climate and energy turnaround. The problems are known, the funds are available and the political will for change also seems to be there – so it remains to be hoped that the traffic light coalition will also find the necessary unity for reforms.

“Golden” or “stormy” autumn?

From a meteorological point of view, autumn is definitely “golden” in view of the current late summer temperatures. In terms of the capital markets, however, a turnaround would be needed soon to be able to issue the same predicate here. The situation as mentioned remains extremely complex – while numerous leading indicators point to difficult economic times, the US economy surprises with strong growth month after month. The accompanying central bank policy thus remains restrictive for longer in any case and inflation is falling, albeit more slowly than hoped. As the Hamas attack on Israel at the weekend showed, the geopolitical tensions are becoming more rather than less, unfortunately. The effect on the capital markets seems to be limited – but another conflict means another source of uncertainty, and uncertainty often leads to increased volatility.

Even though the current environment is characterised by a high degree of uncertainty, it is important to note that this uncertainty has so far not had a noticeable negative impact on the global consumer and therefore not on the economy. Corporate profits remain resilient and the medium-term profit outlook is also quite positive.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.