Articles about “bonds”

Central banks are becoming more cautious: these are the implications for the bond market

The investment package in Germany and the associated ‘abandonment of the debt brake’ has caused a lot of movement in the eurozone bond market. Meanwhile, central banks have to manage the balancing act between slowing economic growth and rising inflation. Dániel Bebesy, Fixed Income Portfolio Manager at Erste Asset Management Hungary, talks in an interview about the recent central bank meetings and their impact on the bond market.

Investment View | February 2025

What’s happening on the markets? In our Investment View, the experts of our Investment Division regularly provide insights of current market events and their opinion on the various asset classes.

Shift in risks

Both the markets and central banks are pointing to a shift in economic risks from inflation towards growth. The focus is currently on the US labor market.

How do climate leaders find their way into our fixed-income portfolios?

Sustainability factors are actively integrated into the investment process in our bond portfolios. This ensures that climate risks are minimized and climate opportunities are actively seized in our corporate bond funds. Fund manager Matthias Hauser explains exactly how this works.

Market commentary: What will the second half of 2024 bring?

The second half of 2024 has already kicked off on the financial markets – but what can investors expect from it? After expectations of interest rate cuts in the US were pushed back further and further in the first half of the year, the scope for the US Federal Reserve could increase again in the remainder of the year. The main focus is likely to be on upcoming political decisions – which could also lead to greater fluctuations.

ERSTE OPPORTUNITIES MIX: the most important questions and answers

Taking advantage of short- and medium-term opportunities on the markets while at the same time focusing on long-term future trends – the new mixed fund ERSTE OPPORTUNITIES MIX makes this possible. We have summarized the most important questions and answers on the launch of the new fund.

Corporate bonds – Why emerging markets are worth a look

Fund manager Thomas Oposich explains in an interview what makes investments in emerging market bonds interesting and which sectors and companies he considers promising.

Inflation, interest rates, markets: 10 topics for 2024

After the price rally at the end of last year, the markets started 2024 with price losses. The ongoing positive correlation between bonds and equities is striking. Both asset classes have fallen equally recently, which makes diversification in a portfolio more difficult. But the year has only just begun. We therefore take a look at 10 key topics for 2024 that could be helpful when putting together a portfolio.

Market outlook: What investors can expect in 2024

2023 brought many surprises – including positive ones, such as the unexpectedly good performance across all asset classes. What can investors expect in the new year and which topics could come into focus? Gerald Stadlbauer, Head of Discretionary Portfolio Management, provides an outlook.

Stock markets review: Hopes for interest rate cuts fuelled significant gains in 2023

The international stock markets closed out 2023 with significant gains. Hopes of abating inflationary pressure and declining interest rates were the main market drivers in Q4, resulting in a strong year for stock exchanges.

Best of Charts: What’s coming, what’s going, what’s staying?

After a weak market year in 2022, 2023 is shaping up to be a pleasing conclusion for investors. Senior Fund Manager Christian Süttinger explains what remains of this year and what could be of particular interest on the markets in 2024 with the help of a few currently important charts.

Capital markets outlook 2024: good opportunities in the US election year

After a difficult market year in 2022, many asset classes performed much better this year. The outlook for the coming year 2024 is also positive – the central banks’ turnaround in interest rates has brought about a return to normality on the bond market and, with the rise in yields, is also opening up new opportunities for investors. At the same time, the ongoing geopolitical tensions in particular pose a challenge. With the improved yield opportunities for bonds, mixed funds are also coming back into focus.

How restrictive are the current interest rate policy and financial environment really?

In line with the surprisingly strong economic indicators in the US, government bond yields have risen significantly in recent months. This is putting pressure on the prices of many classes of securities and intensifying discussions about how restrictive interest rate policy really is. Could the higher level of yields make the central bank’s job easier in the form of further interest rate hikes?

Investing in the bond market – the charm of short maturities

When should one invest one’s capital in the bond market and which maturity would currently be favourable? These questions are not so easy to answer and depend, among other things, on the preferences of the respective investor. In our recent blog, expert Johann Griener gives an insight into the current market environment and clarifies the most important questions about bonds and maturity.

Five pieces of advice for saving with a fund savings plan

Putting money aside is important. But it is equally important for said money to potentially earn a return. This is where the fund savings plan comes in.

Best of Charts II

Inflation, coupled with restrictive central bank measures and recession worries, continue to keep the markets busy. This is also shown by a look at some important financial charts.

Silicon Valley Bank – Impact on the Stock Markets

The turbulences surrounding the US Silicon Valley Bank (SVB) are currently keeping the markets busy. After the bank was closed last Friday, a comprehensive package of measures followed over the weekend to avoid possible consequences. In this blog post, the experts of our Investment Division explain what exactly happened and how they assess the situation.

An extraordinary year for alternative investments

The year 2022 was a challenging one on the stock markets. However, compared to the asset classes equities and bonds, alternative investments clearly outperformed. Read more in the blog post by senior fund manager Christian Süttinger.

Attractive yields: Why corporate bonds are worth a look

Corporate bond yields are now back at attractive levels. In his article, senior fund manager Hannes Kusstatscher explains what this means and how the situation on the bond market could develop.

How to invest in corporate bond funds

Yields on corporate bonds in both the investment grade and high-yield segments have risen significantly in recent months. This means that there are currently interesting entry levels again.

Our expert Johann Griener explains in his blogpost how to take advantage of this opportunity with a corporate bond fund.

Upbeat markets at the beginning of the year

Despite uncertainties, the stock and bond markets got off to a friendly start in the new year. In the USA, economic data recently surprised on the upside. Is the situation better than the mood?

How a bond fund “works”

Interest rates are back, which means that investing in bonds and bond funds again offers opportunities for attractive returns. Our expert Johann Griener explains how a bond fund works and what you should bear in mind when investing.

Ten topics for 2023

The previous year was marked by unexpectedly high inflation and rapid key interest rate hikes – but what will the new year bring?

In his article, Chief Economist Gerhard Winzer presents ten topics that could be particularly relevant for the financial markets in 2023.

Market commentary: What will the new year 2023 bring?

In the past year, numerous trouble spots preoccupied the markets. In his market commentary, Gerald Stadlbauer, Head of Discretionary Portfolio Management, gives an outlook on what 2023 might bring.

Interest rates are back

After many years of low interest rates, the tide has turned in recent months. This is also creating some opportunities on the bond market again, as our expert Johann Griener explains in his article.

The forthcoming steepening of the term structure of interest rates: An investment case

How the yield curve of a bond looks depends on several factors. In his article, fund manager Tolgahan Memişoğlu explains what this means and why yield curves could become steeper again in the future.

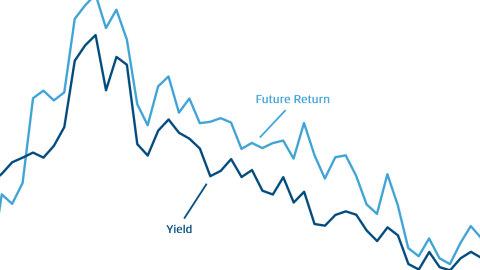

Yield and Return on Bonds

How are interest rates and future bond returns related? Why can the yield be higher than current interest rates? Our blog looks at the correlations in fixed-income investments.

Outlook: Development of the neutral real interest rate

This year brought a turning point in the monetary policy of the major central banks. The crucial question is whether this turning point is cyclical or structural. It is therefore worth taking a look at the neutral interest rate, as this captures structural macroeconomic changes.

Good nerves and stamina required

The mood on the capital markets has deteriorated further over the last months. In a comprehensive market update, Gerald Stadlbauer, Head of Discretionary Portfolio Management at Erste Asset Management, explains why stamina is needed in the current situation.

Mixed outlook for the second half of the year

Ahead of the upcoming reporting season, several negative factors dominate the markets. Tamás Menyhárt, Senior Fund Manager at Erste Asset Management, sums up the stock market year so far and shares his views on the further development.

Alternative investments defy market losses

The losses of equities, bonds and gold since the beginning of April have put the limelight on the asset class of alternative investments. What are the characteristics of such an asset? Can this slow the downturn? And how can you invest?

Investing – a long term story

We have seen some extraordinary years speaking about equity and multi asset performance. Interest rates were low, volatility – representing the average daily price changes – was comparably low. What is the situation today?

Italy is electing a new president

Italy is about to elect a new president of state. The election that will be held from 24 January 2022 in several ballots is going to determine the successor of the current, 80-year old President Sergio Mattarella, whose mandate expires in February 2022. This was announced by the president of the chamber of deputies of […]

Pandemic year three: what are the challenges ahead?

We are now into the third year of the pandemic. Since the spring 2020 collapse, economic activity and markets have shown exceptional resilience. This is not to be taken for granted. After all, the list of potential negative influences (“challenges”) is long.

Green, green shades of bonds

In recent years, we have seen dynamic growth emerging. It started with green bonds, which were then complemented by social bonds, sustainability bonds (a combination of environmental and social projects), and sustainability-linked bonds.

Yield opportunity in the bond market: Q4 2021

Most economic indicators for August and September point to a slowdown in economic growth. However, growth rates still remain relatively strong

Where are equities headed into year-end?

Global stock markets have fallen back from their all-time highs in recent weeks. What were the causes? What potential do the equity experts at Erste Asset Management see until the end of the year?

Global economy running into headwind

The global economy is in the recovery phase of the cycle. Economic growth is well above the long-term trend, but headwinds have increased recently. What needs to happen to ensure that growth does not slow down? Chief Economist Gerhard Winzer analyses the prospects for the future.

Yield curve management

In recent days, equities and other risky asset classes have come under pressure despite the fact that in the year to date the optimism about an economic recovery has been on the rise. Is that a case of “buy the rumour, sell the fact”? Had the good news already been priced into the market? Or is there another mechanism that could be driving the future development?

Erste Asset Management regards economic recovery as driver of the capital markets in 2021

We are looking back on a turbulent investment year. After the slump in February and March, we saw a strong recovery on the markets almost across all asset classes. CEO Heinz Bednar and CIO Gerold Permoser give an outlook for the capital markets in 2021.

“High octane” for the portfolio

High-yield corporate bonds are currently in keen demand again, driven by the energetic steps taken by the central banks in their fight against the coronavirus crisis.

ECB to buy bonds despite ruling of the German Constitutional Court

The European Central Bank (ECB) wants to stick to its bond purchases despite the recent ruling by the German constitutional court. “We will continue to do whatever is necessary to fulfill this mandate,” said ECB chief Christine Lagarde.

2019 stock market review

Our 2019 stock market review: for investors around the world, 2019 was by and large a continuation of the previous year: the trade dispute between the US and China and the back and forth over Brexit remained the dominant topics.

USA: Inverse yield curve fuels fear of recession

In the US bond market, the yield on two-year government bonds had risen above the yield on ten-year bonds, creating the rare situation of an inverse yield curve. This was last the case in 2007.

Capital market outlook – expansive central banks fuelling risk appetite among investors

At the beginning of July, important stock market indices reached new all time highs. How will economic growth continue & in which asset classes does Erste Asset Management see the best investment opportunities?

Emerging markets corporate bond outlook 2019 + Video

What were the biggest challenges last year, and what are the opportunities in 2019? Emerging markets fund manager Péter Varga answers the most important questions.

Low Return on Assets – where can savers still find decent interest rates?

Many savers are fed up with investing their saved-up capital at low interest rates. The question everyone is asking themselves now is how to earn a good yield on one’s hard-earned capital in times of low interest rates like nowadays?

YIELD RADAR: September 2018

Annualised real global GDP growth amounts to slightly above 3%. The composition of growth is not homogenuous. While the US economy grows strongly, the weakening loan growths puts weight on the economic activity in China. Find out more in the current yield radar.

30 years of falling interest rates – what is ahead of us?

Let’s start with a trip down memory lane: Do you remember the scenery 30 years ago – on the financial markets, and in our personal lives? The 1980s – many of the older generation are still thinking back to the “good old times”. There were no smartphones and no data kraken. Instead, we had shoulder […]

Financial Markets Monitor May: positive opportunities outnumber negative ones

Positive opportunities still outnumber the negative ones on the capital markets – that was the conclusion of our Investment Committee. Our willingness to take risks is still optimistic and also moderately higher than in April.