In the past ten years, media reports have been full of terms such as “zero interest” or “negative interest”. Due to the very low interest rates, an investment in the bond market, for example through a bond fund, was correspondingly uninteresting. It would therefore come as no surprise if the background knowledge of how to invest in the fixed-income market with a sensible strategy had been lost.

But interest rates are back and investing in bonds or bond funds seems to make sense again, and it offers a chance for attractive returns. And so, the question arises: “How does a bond fund work ,and what should investors bear in mind when engaging in such an investment?

In this article, we are going to look at the following questions:

- What is a bond fund?

- What sorts of bond funds exist?

- Why are bond funds interesting again?

- What should investors bear in mind when investing in bond funds?

What is a bond fund?

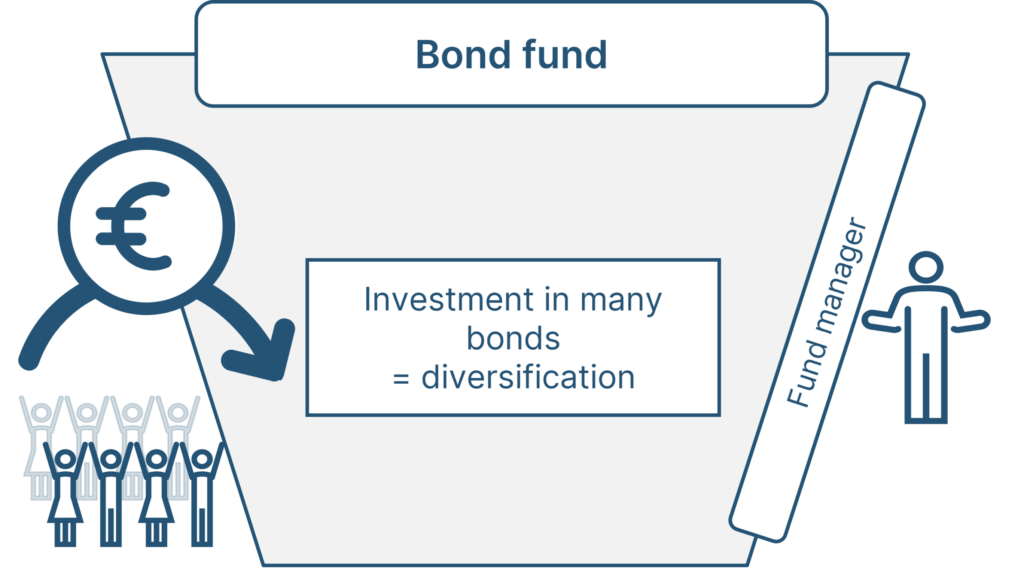

If you want to invest in bonds, but don’t want to search for individual bonds yourself and would like to spread your risk broadly, then a bond fund is a good way to go.

What could be more obvious than for many investors to

- pool their capital (already possible with smaller amounts)

- and delegate the selection of bonds to experts?

Within a bond fund, investments are made across a variety of bonds from different issuers, countries and sectors, thus achieving broad risk diversification. When a bond matures in the fund, the fund managers reinvest the capital released.

Investors can invest small amounts in a bond fund and do not have to worry about selecting securities or reinvesting coupons and expired bonds.

By purchasing fund shares, investors acquire co-ownership of the fund’s assets. As confirmation, the purchased fund units are booked into the securities account of the respective investors.

What sorts of bond funds exist?

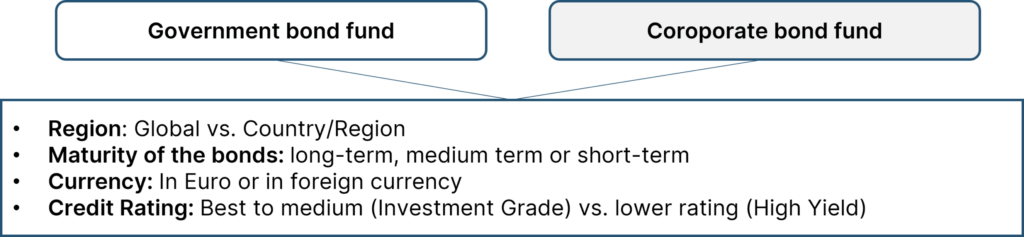

A bond fund consists of bonds. The type of fund is determined by the specific bonds that are acquired for the fund. In principle, the issuers of bonds can be governments (on various levels) or companies. These, then, are government bond or corporate bond funds.

Here is a brief overview of the essential characteristics of bond funds:

For investors, the first question should always be:

- “Who is getting my money?“

As with any investment, investing in a bond fund is about trust and personal comfort, because it is a medium to longer-term investment. Do I want to put my capital at the disposal of states or companies? Depending on the bonds in which such a fund invests, different risks may emerge for the investor.

Why are bond funds interesting again?

As with any investment, the crucial thing with bond funds is to “buy low (and sell high”). If you take into account the current coupon and the price of a bond, you can calculate the so-called yield, a key figure in bond investments.

The higher the yield, the higher the possible return on an investment in a bond or a bond fund. It is important to know the following relationship

- When the price falls, the calculated yield rises automatically.

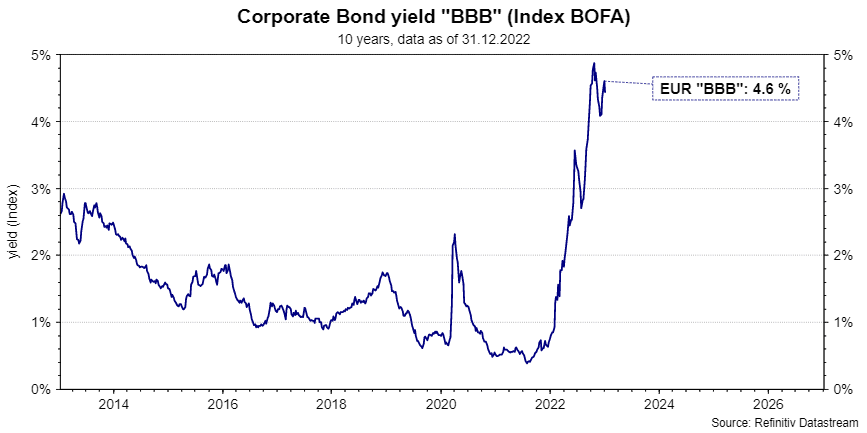

This sounds complicated, but a simple example will illustrate this mechanism. The following graph shows the development of the yield of euro corporate bonds from a selected credit rating sub-segment (in the investment grade segment) over the past ten years:

Source: Refinitiv Datastream, Development 10 years, Data as of 30.12.2022

Note: Past performance is not a reliable indicator for future performance.

In 2022, prices for corporate bonds fell sharply and yields increased accordingly. The key figure for yields on new investments is currently around 4.6%, which is the most attractive it has been in the past ten years.

It is not possible to draw direct conclusions about future performance from the current yield. However, one thing is sure:

- If you buy when the yield is high, your chance to achieve a higher return is better than if you buy at lower yields.

Yield alone should not be the only criterion for buying a bond fund, because usually a higher yield is also associated with a higher risk (e.g. default risk). Also, it is crucial for investors not to compare bond segments that have completely different risk profiles, such as a euro government bond fund versus a fund that invests in high-yield corporate bonds.

What should investors bear in mind when investing in bond funds?

There is a variety of bond funds with different investment strategies available. Past performance is not reliable indicator of future development.

- It is much more important to assess the current political and economic environment

- This should then lead to an evaluation of whether the respective bond category and the yield level appear attractive for a new investment or not

Prior to investing, the investors should thoroughly analyse their individual investment needs. After all, every bond fund comes with risks, which the investors should know.

In addition to price fluctuations, issuers may also default. There is no guarantee on the paid-in capital, and loss of capital is also possible with a longer investment period.

Bond funds usually offer two alternatives:

- distributing shares (with regular, usually annual distribution) and

- accumulating shares (without distribution, for long-term capital accumulation through automatic reinvestment of income).

This means that when selecting a fund, you can decide whether you want regular income in the form of dividends or not.

Conclusion

Yields across all bond segments have risen significantly in recent months, resulting in numerous opportunities for investors on the interest rate markets. Bond funds are one investment alternative in this context. They offer a broad degree of diversification and allow for small amounts being invested, often in the form of a monthly fund savings plan.

There are many bond funds with different investment strategies and corresponding risks. Before investing, interested investors should therefore find out exactly whether the respective fund is suitable for their investment needs.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Please note that an investment in securities also entails risks in addition to the opportunities described.