High-yield corporate bonds are currently in keen demand again, driven by the energetic steps taken by the central banks in their fight against the coronavirus crisis.

What exactly happened? Central banks are supporting the market

- In Europe, banks can deposit high-yield bonds as collateral directly with the European Central Bank if the issuer commanded an investment grade rating as of 6 April

- In the USA, the central bank directly buys such bonds if the issuer commanded an investment grade rating as of 23 March

The abrupt standstill of the entire economy created enormous losses for many companies. Even companies that had been in relatively good shape prior to the corona crisis were affected by the virus. This had an immediate impact on the credit quality and the rating. In April, May, and June, the US rating agency Moody’s downgraded more than 600 companies, among them well-renowned names such as Ford, Renault, Lufthansa, and Kraft Heinz (Ketchup).

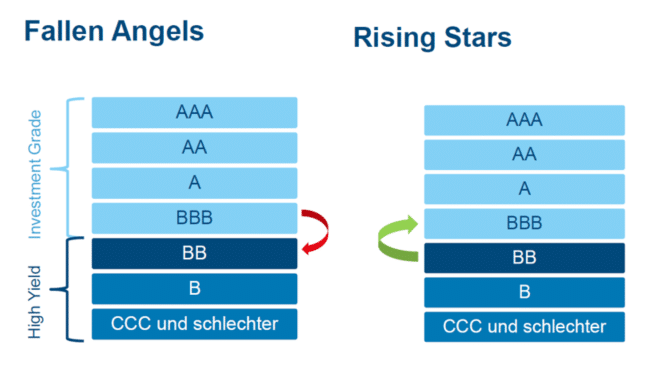

From “fallen angel” to “rising star”

The bonds issued by these so-called fallen angels are now traded at a risk premium, because investors require compensation for the downgraded rating in the form of higher yields. How could an investment in high-yield bonds pay off? The economic stimulus programmes and the recovering economy might lead to an improving outlook for some of the affected companies. The risk premiums (spreads) could fall again, which means bond prices would be rising. This way, the erstwhile fallen angels would become rising stars.

Companies want to cut costs for raising capital

Expert Kaudela: “Companies want to get rid of bad ratings quickly”

Mario Kaudela, investment expert with Erste Asset Management, comments on the development: “Generally speaking, the most recent fallen angels are mostly solid companies whose quality has suffered a bit in the wake of corona. While the downgrade is real, it is not set in stone. Companies that have been downgraded to high-yield usually aim at returning to the investment grade segment as quickly as possible – both for reasons of reputation and finance. After all, they want to reduce their cost of capital at the earliest occasion possible. Once a company has recovered, spreads tend to fall, and the rating upgrade is usually just a matter of time.”

Risk comes with a price

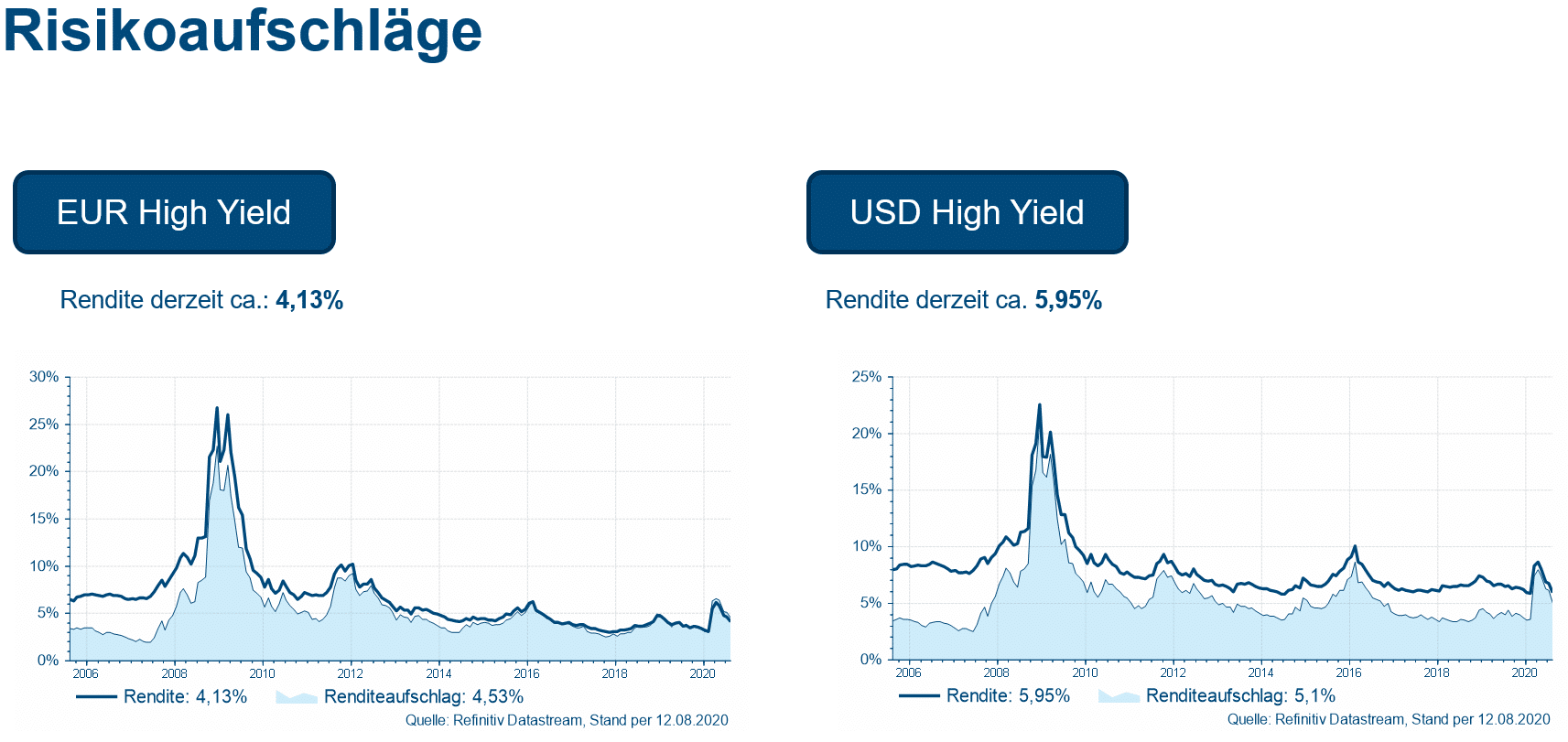

While the risk premiums on high-yield corporate bonds are far away from their historical peaks during the financial crisis of 2008, the rise in March during the corona shutdown was significant. The situation has calmed in recent months: the default rate (i.e. the percentage of companies becoming insolvent) is currently in the low single digits. However, investors have to keep an eye on them in connection with the infection rates. Now that we have entered calmer waters, yields are falling again, thus offering upward potential for high-yield bond prices.

Another reason why these bonds are attractive is the still difficult search for attractive yields in the current state of low interest rates. At the moment, high-yield benchmark bonds in Europe pay an average of 4.13% in Europe (source: Refinitiv Datastream) and of 5.95% in the USA (source: Refinitiv Datastream), respectively. In view of the continued zero interest-rate policy of the central banks and the in some cases already negative yields of credit-safe government bonds, high-yield corporate bonds offer the chance of positive rates of return.

Positive outlook for high-yield bonds

This is one of the reasons why Erste Asset Management has stepped up the allocation in high-yield bonds in mixed funds; please refer to our blog entry “Outlook on the financial markets”.

What do investors have to bear in mind when investing in high-yield bonds?

Basically, it is important to check one’s risk preference and to operate on the basis of a medium- to long-term horizon when investing in high-yield bonds. Instead of buying an individual bond, the principle of diversification suggests investing in a fund. If some bonds fail to perform, it is less painful when this affects only a small part of the portfolio. In order to avoid such failures altogether as much as possible, the title selection should involve the services of a professional management team as funds usually offer.

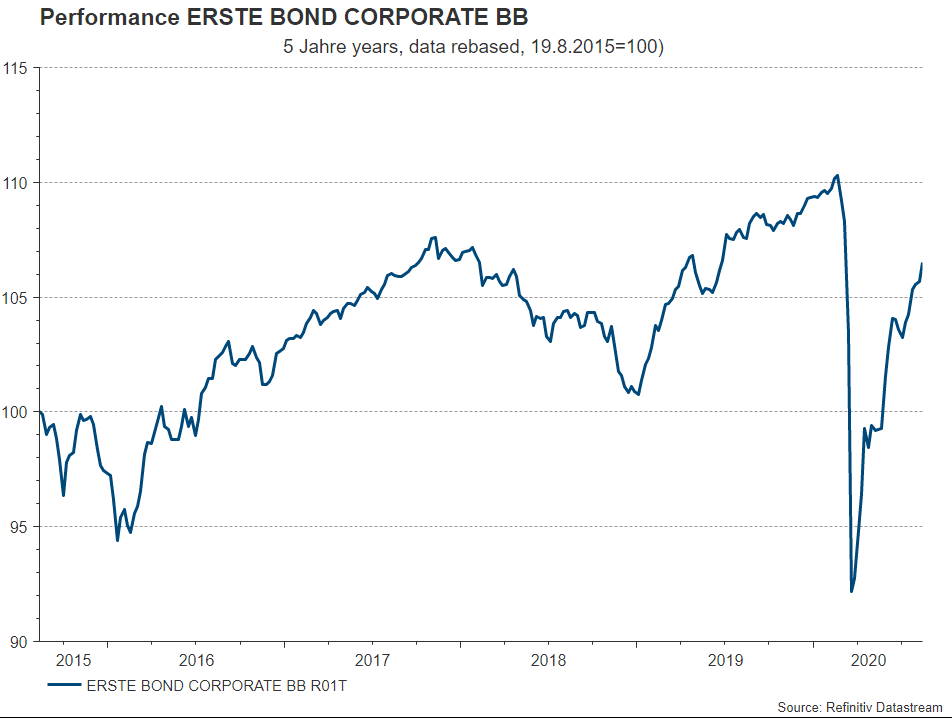

Popular fund: ERSTE BOND CORPORATE BB

ERSTE BOND CORPORATE BB invests mainly in corporate bonds from international issuers with BB rating, i.e. those companies that are at the threshold from high-yield to investment grade. BBB or B bonds may also be acquired. Foreign exchange risks, if any, are mostly hedged. The fund’s mission is to achieve an ongoing return in euro. Environmental, social, and governance factors are taken into account in the investment process. The average yield of the bonds held in the portfolio is currently 3.17% (as of 13 August 2020; source: Erste AM). Preferred sectors are communication, cyclical and non-cyclical consumer goods, financials, and industrial companies.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.