There were 4,913 insolvency proceedings in Austria in 2022, almost 60% up on the previous year, according to the creditor protection association Creditreform. What sounds like a significant increase at first is actually a normalisation after a clearly below-average year in 2021. After the expiry of the Corona aid measures and a somewhat more difficult economy again with high inflation and rising interest rates, it was mainly companies that had struggled to survive even before the Corona pandemic that ended up bankrupt.

Most companies continue to do well. Low unemployment, robust balance sheets, and resilient consumer demand are absorbing higher input and energy prices. Thus, the picture in Austria reflects what is currently also seen in corporate bonds.

Higher yields provide more attractive investment entry levels

The year 2022 not only brought double-digit price drops for equity indices, but also caused bond prices to fall by almost the same degree. This historically extremely rare market condition was triggered primarily by rising inflation rates and central banks that are becoming significantly more restrictive. If bond prices fall, however, this also leads to higher yields and thus to more interesting entry levels for future investments. For corporate bonds in euro with good credit ratings (investment grade), this means a current yield of around 3.9%, and for corporate bonds with low credit ratings (high-yield) even slightly over 7%.

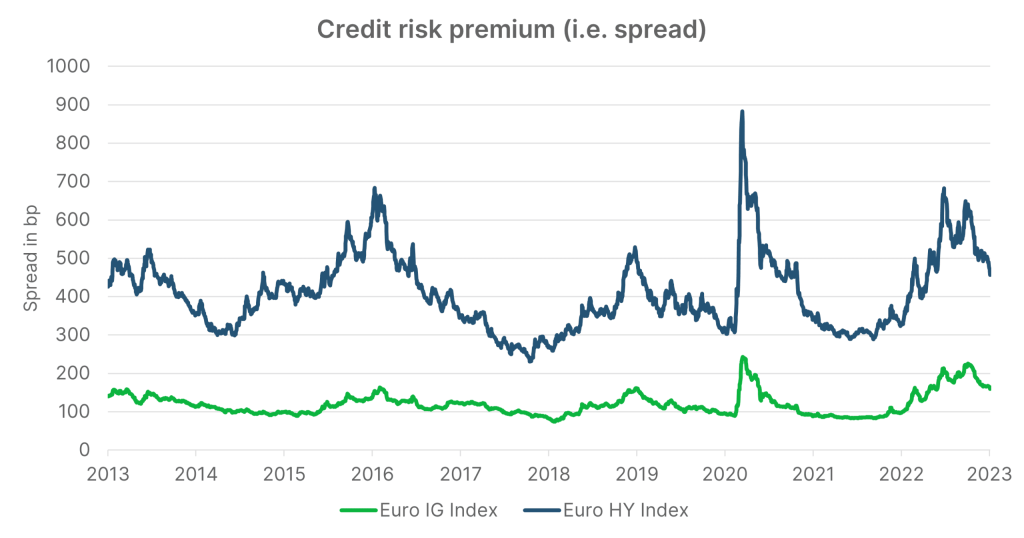

Corporate bond yields are made up of two components, the underlying “risk-free” interest rate (usually a government bond of the same currency and maturity) and the so-called credit risk premium (spread), which takes into account the higher risk of default. Both parameters increased significantly in 2022. The spread echoed share prices in their reaction to the more difficult macro environment. The higher inflation leads to cost pressure for companies, and the more restrictive central bank policy on the one hand increases interest rates and thus financing costs, but it also causes a deliberate slowdown in economic growth to counter inflation.

Please note: Past performance is not indicative of the future development of an investment.

Default rate 2022 at historical low

It is important to note that credit spreads do not reflect current default rates, but those expected in the future. In 2022, default rates remained at a historic low. According to CreditSights, they were just 1% for euro-denominated high-yield bonds. And in fact, none of the four defaults counted were actual bankruptcies, but three arrears and one bond exchange that was counted as a default.

The situation is similar in the US high-yield market. The default rate here was 1.6%. Of the 15 companies affected, only five filed for Chapter 11 proceedings and thus for judicial restructuring. The rest either reduced or adjusted their outstanding debt with the consent of creditors, or were indeed in default. That being said, the so-called distress ratio, the share of companies with a spread of more than 1,000 basis points (bps), remains high at currently just under 14% in US dollar and slightly more than 15% in euro. In addition, the lowest rating segment in particular has underperformed in recent months and only recovered somewhat last week. Nevertheless, the high credit risk premium in this segment shows that investors remain cautious and expect more companies to run into problems in 2023.

Above-average level of defaults priced in

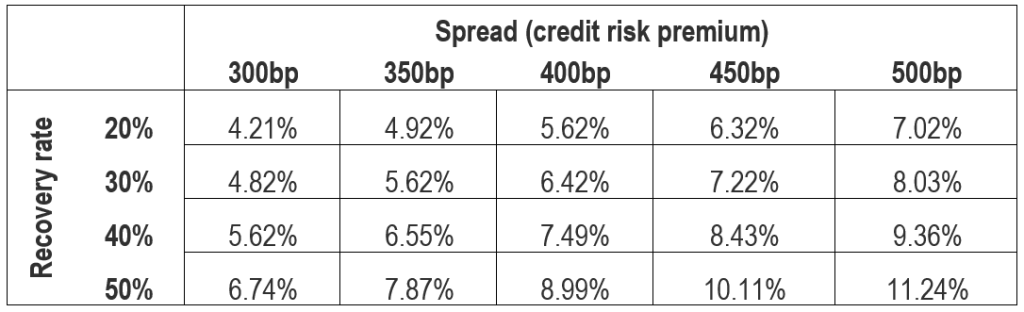

A simplified model allows us to establish an approximate priced-in default rate based on the current spread. Dividing the credit risk premium of a bond by the loss rate (i.e. 1 – recovery rate) multiplied by the purchase price roughly yields the annual expected default rate of the respective bond.

With a weighted average bond price of EUR 89 in the Euro High Yield index (ICE BofA HEAF index) and an assumed recovery rate in the range of 30%-40% (roughly in line with the historical average), this corresponds to a default expectation of around 8% with a spread in the high-yield segment of just under 450bps. Historically, this is high and, since the early 1990s, has only been reached or exceeded in the major market crises of 1990/1991, 2001/2002 and 2009. According to Moody’s, the long-term average for global high-yield bonds is around 4.1%.

Sample calculation: expected annual default rate

Fundamentally, most companies are well off

The majority of companies have so far shown resilience to the weaker economic environment. Although higher costs have already led to a slight decline in profit margins, many companies have been able to pass on the price increases to their customers without suffering a decrease in sales. The consumption of goods is supported by extraordinarily high employment rates and relief measures against the high energy costs, as we have also seen in Austria, for example.

Despite the fact that corporate debt has risen marginally in recent quarters, interest coverage has increased significantly, with many companies having already announced that they were preparing for more difficult times. This positive picture is also reflected in the ratings. In both euro and US dollar, rating upgrades and downgrades were roughly on balanced terms in 2022, according to CreditSights, and a similar picture is emerging for 2023 according to the outlook provided by the rating agencies. For 2023, fewer rising stars are expected (i.e. companies that move from the speculative rating segment into the investment grade range), but overall the number of positive outlooks exceeds that of negative outlooks.

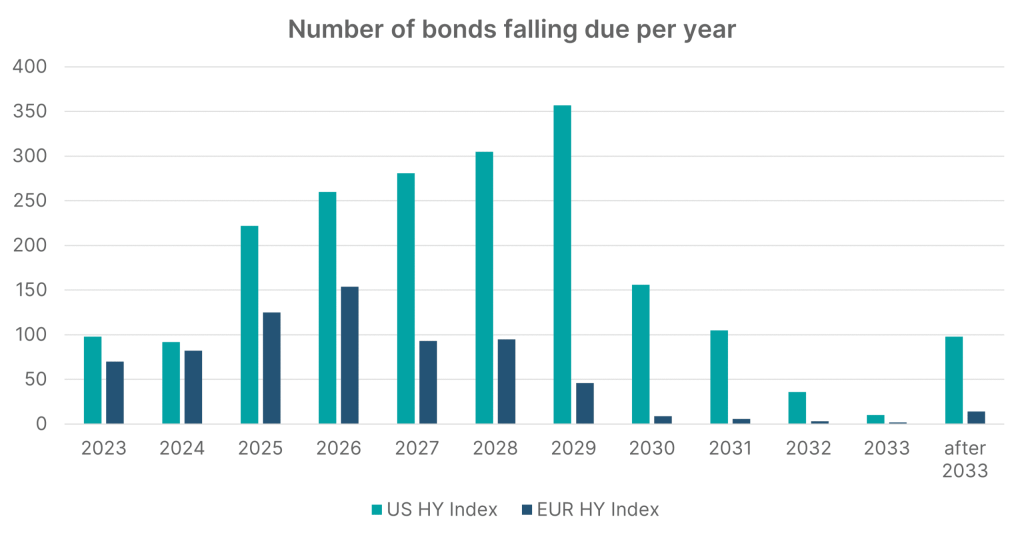

Still, some companies with poor ratings may face challenges in 2023 when having to refinance outstanding bonds amid higher interest rates. The average index coupon in EUR high-yield (ICE BofA HEAF index) is currently only 3.6% and in US high-yield (ICE BofA HUC0 Index) 5.8%. Especially in the high-yield segment, higher yields translate more quickly into higher interest costs, as many companies have floating-rate loans in addition to bonds, and bond maturities are generally shorter. But only few bonds are scheduled to expire in 2023, as many companies have already taken precautions in previous years and extended their maturities. After a particularly weak 2022 for new issues in the high-yield segment, a rather subdued year is therefore also expected for 2023.

Please note: Past performance is not indicative of the future development of an investment.

Outlook

Inflation and how it develops will be the most important factor for the coming months, as well as how restrictive the central banks have to remain to bring it under control. The higher interest rates cause financing costs to gradually rise, as a result of which especially highly leveraged companies have problems refinancing themselves. Higher interest rates then also lead to less investment and cost-cutting by companies, which in turn can lead to higher unemployment. This dampens consumption and leads to weakening economic growth.

At the moment, however, most analysts do not expect a drastic slump in the economy. So far, the economic environment has held up well and inflation rates are already declining somewhat, even though they remain well above the central bank’s target of 2%. Still, we can expect higher default rates in the coming year than in 2022. The higher interest rates and credit spreads are already pricing in a very negative development, which is reflected in high yields.

ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD: Exploiting the Potential of High Yield Corporate Bonds

For investors who on the one hand want to exploit the potential on the bond market and on the other hand want to invest their money sustainably, the bond fund ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD could be an interesting alternative. The actively managed fund invests primarily in the major high-yield markets in the USA and Europe and the portfolio currently comprises 165 securities. In addition, sustainability aspects are taken into account in the selection of securities in accordance with the proven responsible approach of Erste AM.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Advantages for the investor

- Investments in selected bonds of sustainable (ethical) issuers.

- An ethics advisory board regularly reviews sustainability.

- Foreign currenciy risks are mostly hedged against the euro.

- Broad diversification in the area of global high-yield bonds.

Risks to be considered

- Deteriorations in credit ratings can lead to price declines.

- Increased risk due to average and below average credit rating of participating companies.

- The net asset value of the fund can be subject to considerable volatility.

- Fluctuations in foreign currencies may affect the net asset value.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For further information on the sustainable focus of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.