AI hype and geopolitical conflicts – although the coronavirus years are over, 2023 was another eventful year on the markets. Despite the mixed performance of many asset classes and the increased geopolitical risks, the balance for the 2023 investment year is positive. Erste Asset Management CEO Heinz Bednar and CIO (Chief Investment Officer) Gerold Permoser are correspondingly optimistic about the coming market year 2024. What will happen to inflation and which asset classes could be worth a look in 2024? These and many other key questions before the turn of the year were the subject of the recent press conference on Erste Asset Management’s “Capital Markets Outlook for 2024”. Here is an overview of the most important statements and topics:

Inflation on the retreat to the target figure

Many indicators currently suggest that the economy in the major target markets of the USA, Europe and China is cooling down. However, Permoser does not currently see a significant decline in economic activity, i.e. a recession: “We do not expect a severe recession in the USA. Nor do we currently see anything in other parts of the world that could shake the market.” At the same time, increased geopolitical tensions and conflicts pose a risk. These are also likely to be a defining issue in what is probably the most important political event of 2024 – the US election in November.

In terms of inflation, the “worst” is probably already behind the markets. The decline in inflation rates has continued in recent months. However, due to higher wage settlements, the central banks’ target of around 2% will probably not be reached next year.

This is also likely to have an impact on the central banks’ interest rate policy. In the USA, interest rate cuts in the coming year are now being priced in. At the same time, the European Central Bank (ECB) is likely to remain on the brakes for a little longer or largely maintain the current interest rate level.

Catch-up potential away from the big technology stocks

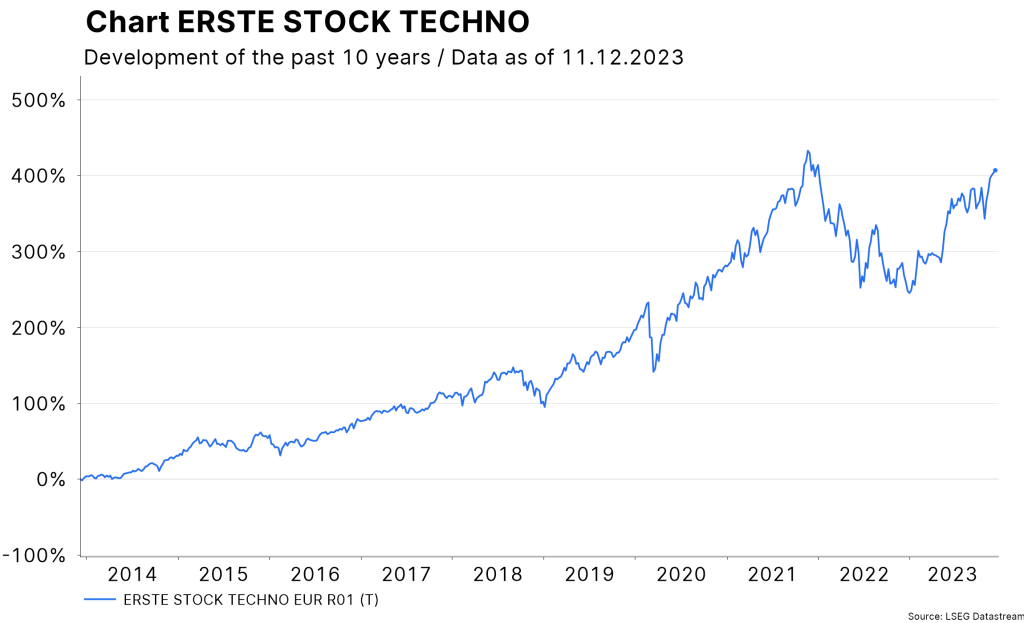

Artificial intelligence (AI) was the hot topic on the stock market in 2023. The hype surrounding the new technology was also reflected in the performance of the major technology stocks. The positive performance on the market as a whole was primarily driven by the Magnificent 7 (Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta and Tesla). Investors in the ERSTE STOCK TECHNO tech equity fund were also able to benefit from this, gaining over 50% this year alone.

Note: The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. Past performance is not a reliable indicator of the future performance of a fund.

According to Permoser, the environment for equities depends above all on the further development of the economy, inflation and key interest rates. Despite the recent price rises, equities are not expensive per se. Apart from the technology sector, other sectors have only recently begun to catch up. There could therefore also be catch-up potential for thematic funds such as ERSTE WWF STOCK ENVIRONMENT. Many small and mid-capitalized companies from the environmental and renewable energy sectors could benefit from an easing of key interest rates.

Return to “normality” on the bond market

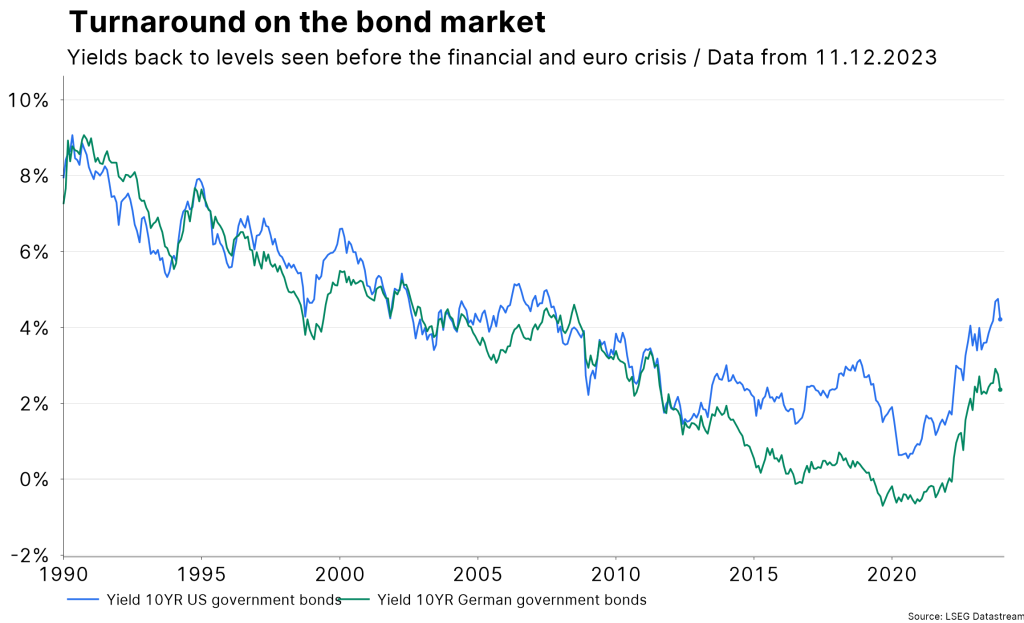

According to Permoser, we can speak of a “comeback in yields” on the bond market following the interest rate turnaround. In a long-term comparison, however, the trend reversal on the bond market is much more a return to “normality”. Following the zero interest rate phase, yields are now back at the level they were at before the financial and euro crisis. However, even with such price increases, it should be noted that an investment in securities involves risks as well as opportunities.

Note: Past performance is not a reliable indicator of the future performance of a fund. No costs or other fees are included in the indices. Representation of an index, no direct investment possible.

This also opens up new opportunities for government and corporate bonds. “The risk/reward ratio is right again if we can offer average yields of over 4% and more with funds,” emphasizes Bednar. In terms of bond funds, corporate bonds such as ERSTE RESPONSIBLE BOND EURO CORPORATE and ERSTE BOND CORPORATE BB are currently favored.

CIO Gerold Permoser also emphasizes the new opportunities in bonds: “The increased bond yields are back at attractive levels and offer a buffer, should yields rise again.” As a result, active fund management has considerably more room for manoeuvre again, especially for mixed funds. Note: In addition to opportunities and risks, an investment in securities also involves risks.

Mixed funds: broadly diversified and equipped for a wide range of scenarios

For many years, there was little alternative to investing in equities due to the zero interest rate phase. Following the turnaround in interest rates and the renewed rise in yields, this could change, which means that traditional mixed funds such as ERSTE GLOBAL INCOME or the YOU INVEST GREEN fund family are coming back into focus.

Positioning in mixed funds makes sense for diversification reasons in 2024, Bednar emphasizes: “A situation is beginning to establish itself that requires active management. Bond and mixed funds were not in focus for a long time. This is now changing at a time when every asset class can offer interesting return opportunities. In 2024, you are in good hands with a mixed fund for most scenarios.”

Volume invested increased again

CEO Heinz Bednar was satisfied with the business performance in 2023. Despite the heterogeneous development on the capital markets, Erste Asset Management was able to increase assets under management by more than 10% to EUR 75.6 billion (as at 30.11.2023). There were significant inflows of funds not only in the domestic market, but also in the Czech Republic and Hungary in particular. Investment funds in bonds with short fixed interest rates are particularly in demand there.

There was also an upward trend in the volume of sustainable investments in 2023, which currently stands at EUR 15.7 billion (as at 30.10.2023). CEO Bednar also emphasized the importance of sustainable investments at the press conference: “Sustainable investments have experienced remarkable momentum in recent years and are now in demand across all age groups.” The number of Erste AM funds bearing the Austrian Ecolabel now stands at 19. 17 funds were also awarded the FNG seal and the highest rating of three stars this year. You can read more about the purpose of these sustainability seals in this blog post.

Conclusion

After a difficult market year in 2022, many asset classes performed much better this year. The outlook for 2024 is also positive – the central banks’ turnaround in interest rates has brought about a return to normality on the bond market and, with the rise in yields, is also opening up new opportunities for investors. At the same time, the ongoing geopolitical tensions in particular pose a challenge. With the improved yield opportunities for bonds, mixed funds are also coming back into focus.

The main drivers on the equity market this year were the major technology stocks. Outside of this, other sectors such as environmental stocks have catch-up potential. The further development of interest rates will be the decisive factor here. The decline in inflation and market expectations suggest that the US Federal Reserve will make its first interest rate cuts in 2024.

Risk information ERSTE GLOBAL INCOME

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the management company’s discretionary powers are not restricted.

Risk information YOU INVEST GREEN solid

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the management company’s discretion is not restricted.

Further information on the sustainable orientation of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD and on the disclosures pursuant to the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852) can be found in the current prospectus, point 12 and Annex “Sustainability principles”. When deciding to invest in ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD, all characteristics or objectives of ERSTE RESPONSIBLE BOND GLOBAL HIGH YIELD as described in the fund documents should be taken into account.

Risk information YOU INVEST GREEN balanced

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the management company’s discretionary powers are not restricted.

Further information on the sustainable orientation of YOU INVEST GREEN balanced and the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852) can be found in the current prospectus, point 12 and the annex “Sustainability principles”. When deciding to invest in YOU INVEST GREEN balanced, all characteristics or objectives of YOU INVEST GREEN balanced as described in the fund documents should be taken into account.

Risk information YOU INVEST GREEN advanced

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the management company’s discretionary powers are not restricted.

Further information on the sustainable orientation of YOU INVEST GREEN advanced and the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852) can be found in the current prospectus, point 12 and the annex “Sustainability principles”. When deciding to invest in YOU INVEST GREEN advanced, all characteristics or objectives of YOU INVEST GREEN advanced as described in the fund documents should be taken into account.

Risk information YOU INVEST GREEN progressive

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the management company’s discretionary powers are not restricted.

Further information on the sustainable orientation of YOU INVEST GREEN progressive and the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852) can be found in the current prospectus, point 12 and the annex “Sustainability principles”. When deciding to invest in YOU INVEST GREEN progressive, all characteristics or objectives of YOU INVEST GREEN progressive as described in the fund documents should be taken into account.

Risk information YOU INVEST GREEN active

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the management company’s discretionary powers are not restricted.

Further information on the sustainable orientation of YOU INVEST GREEN active and the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852) can be found in the current prospectus, point 12 and the annex “Sustainability principles”. When deciding to invest in YOU INVEST GREEN active, all characteristics or objectives of YOU INVEST GREEN active as described in the fund documents should be taken into account.

Risk information ERSTE WWF STOCK ENVIRONMENT

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the management company’s discretionary powers are not restricted.

Further information on the sustainable orientation of ERSTE WWF STOCK ENVIRONMENT and on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852) can be found in the current prospectus, point 12 and the annex “Sustainability principles”. When deciding to invest in ERSTE WWF STOCK ENVIRONMENT, all characteristics or objectives of ERSTE WWF STOCK ENVIRONMENT as described in the fund documents should be taken into account.

Risk information ERSTE RESPONSIBLE BOND EURO CORPORATE

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the management company’s discretionary powers are not restricted.

Further information on the sustainable orientation of ERSTE RESPONSIBLE BOND EURO CORPORATE and on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852) can be found in the current prospectus, point 12 and the annex “Sustainability principles”. When deciding to invest in ERSTE RESPONSIBLE BOND EURO CORPORATE, all characteristics or objectives of ERSTE RESPONSIBLE BOND EURO CORPORATE as described in the fund documents should be taken into account.

Risk information ERSTE BOND CORPORATE BB

The fund pursues an active investment policy and is not based on a benchmark index. The assets are selected on a discretionary basis and the discretion of the management company is not restricted.

Further information on the sustainable orientation of ERSTE BOND CORPORATE BB and the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852) can be found in the current prospectus, point 12 and the annex “Sustainability principles”. When deciding to invest in ERSTE BOND CORPORATE BB, all characteristics or objectives of ERSTE BOND CORPORATE BB as described in the fund documents should be taken into account.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.