The forecasts in January 2023 were very cautious – but still came with an optimistic component: After a disappointing 2022 in stock market terms, there was certainly room for positive surprises! December is always one of the busiest months in the industry, but now is also an opportunity to take stock.

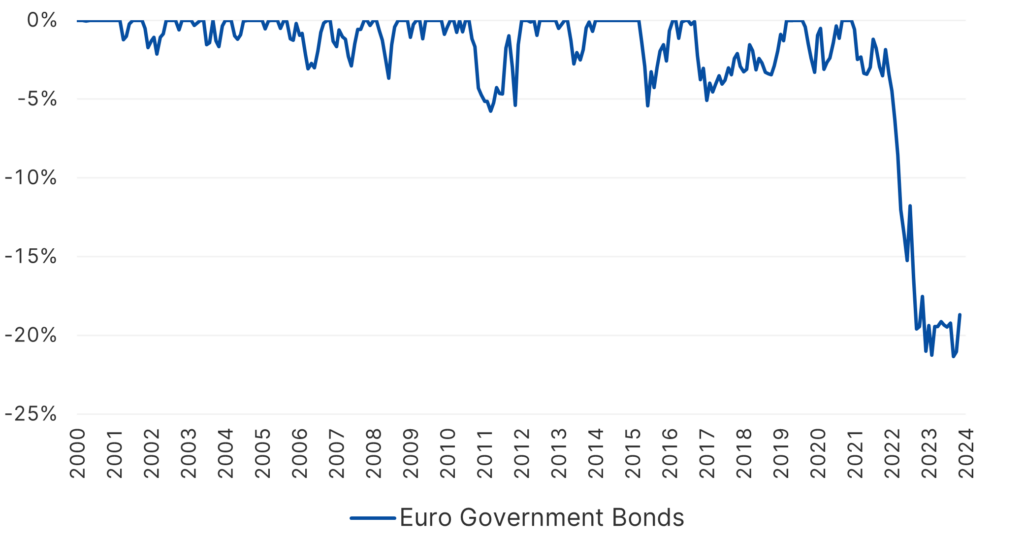

What comes and remains should be the renewed strength of bonds as a source of income. The following chart shows the loss phases for European government bonds in the past:

Loss phases for European government bonds

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023; Index: ICE BofA Euro Government Index

Until 2022, government bonds (and the associated corporate bonds) went through limited periods of losses and quickly made up for them. The development from 2022 onwards stands out completely – it is the result of the massive interest rate hikes by the central banks. The current loss phase has not even come close to being recouped – this opens up a stable earnings opportunity for the future. In the wake of this, so-called mixed investment funds and asset allocation mandates should once again become more of a focus for investors.

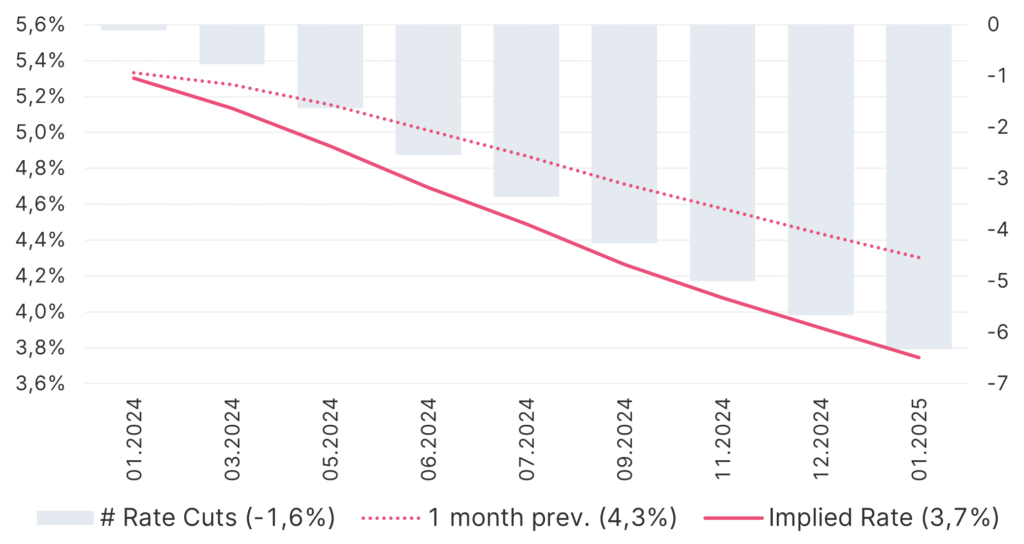

The expectation of future key interest rates can be seen on the financial markets. This assessment is, of course, a snapshot and is itself volatile, but it can nevertheless be an indicator for 2024. The following chart shows the picture for the USA:

Expectation of key interest rate development in the USA

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023

Interest rates are expected to be cut by a total of 1.6% over the course of the year, meaning that the key interest rate would be in the region of 3.7% at the end of the year. Just one month ago, this expectation was around 4.3%. In the past 1-2 years, the financial markets have predicted a trend reversal in the US Federal Reserve’s approach 7 times (so-called “Fed pivot”), but now this expectation could materialize.

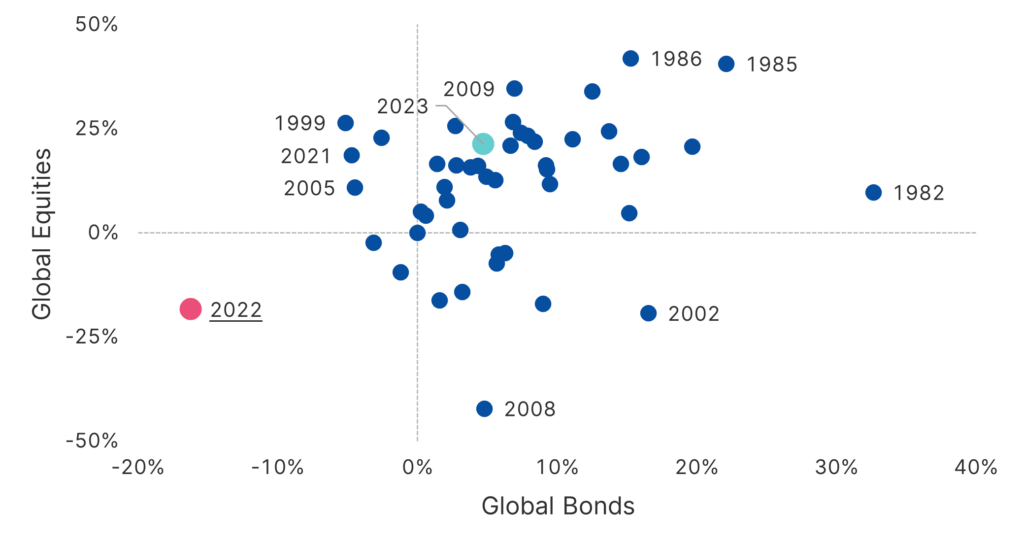

Overall, the current year is in the middle of the cloud of annual returns for equities and bonds over the past five decades, so to speak:

Historical annual returns of equities and bonds

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023; Indieces: MSCI ACWI (Global Equities), Bloomberg Global Aggregate Index (Global Bonds)

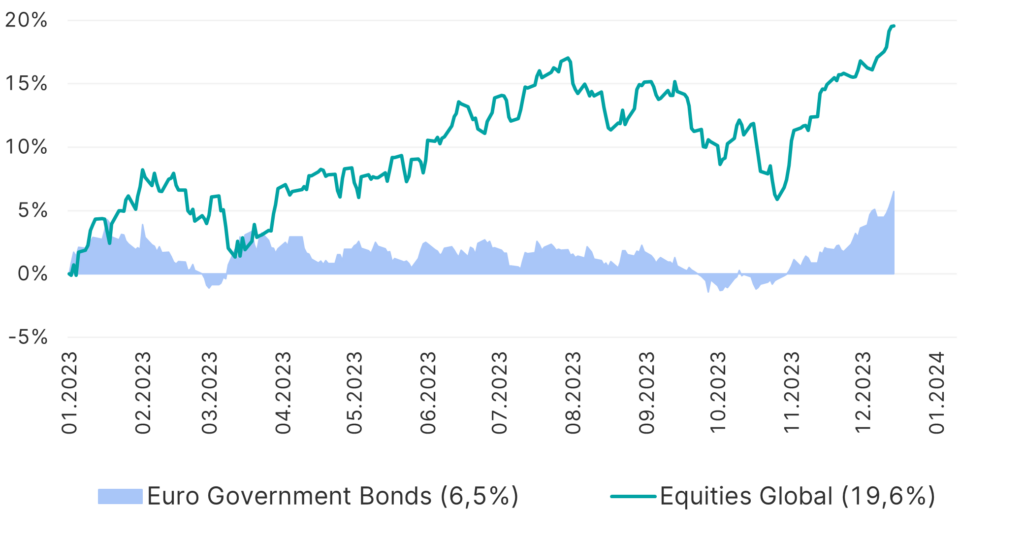

The performance of global equities and European government bonds over the course of this year is as follows

2023 Performance of European government bonds and global equities

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023; Indieces: ICE BofA Euro Government Index (Euro Government Bonds), MSCI World (Equities Global)

Three phases become visible: January to the end of July, when the recession worries (USA) were gradually priced out – then until around the end of October, when the financial markets came to the conclusion that the key interest rate policy would no longer have a supportive effect in the foreseeable future – and finally until today, when the view that this supportive effect would still materialize prevailed.

Private equity investments in Europe (with the exception of the UK) are often viewed with a certain degree of skepticism. It is worth taking a look across the “big pond”:

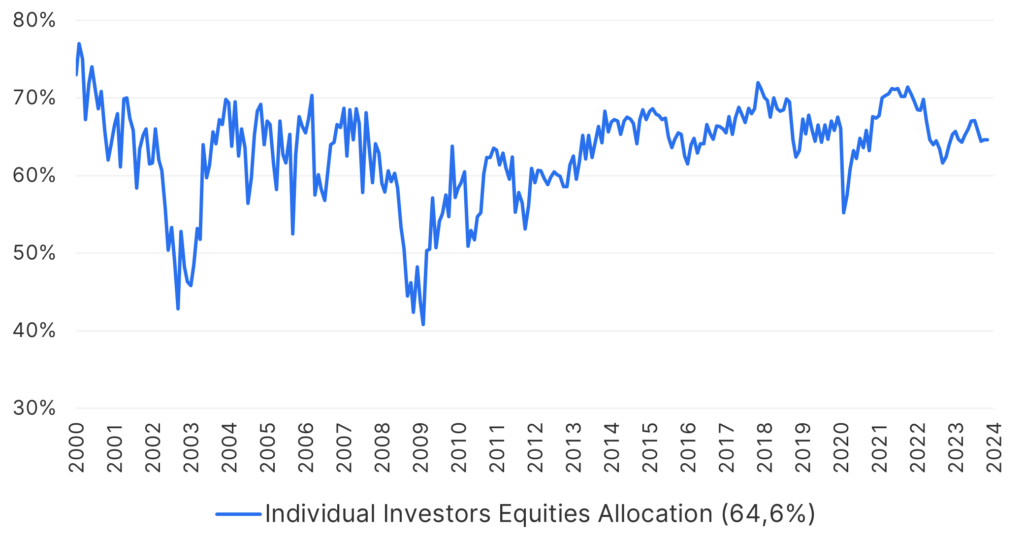

Portfolio share equities of private investors in the USA

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023

The proportion of equities in the investments of savers in the USA fluctuates in the range of around 60%-70%, regardless of occasional crises on the stock markets. Even in 2002 and 2009, the share did not fall below 40%. The values in this chart are survey-based.

One aspect that could (again) cause increased volatility in equities in 2024 is a recession in the USA. This was already expected in 2023, but the economy proved to be extremely resilient. The reason for a recession remains unchanged: To dampen interest rate hikes with the purpose of slowing down the economy. Although 2024 is in the past, the effect of this has often been felt with a delay of 1-2 years: Primarily via the increase in the cost of financing/credit for companies.

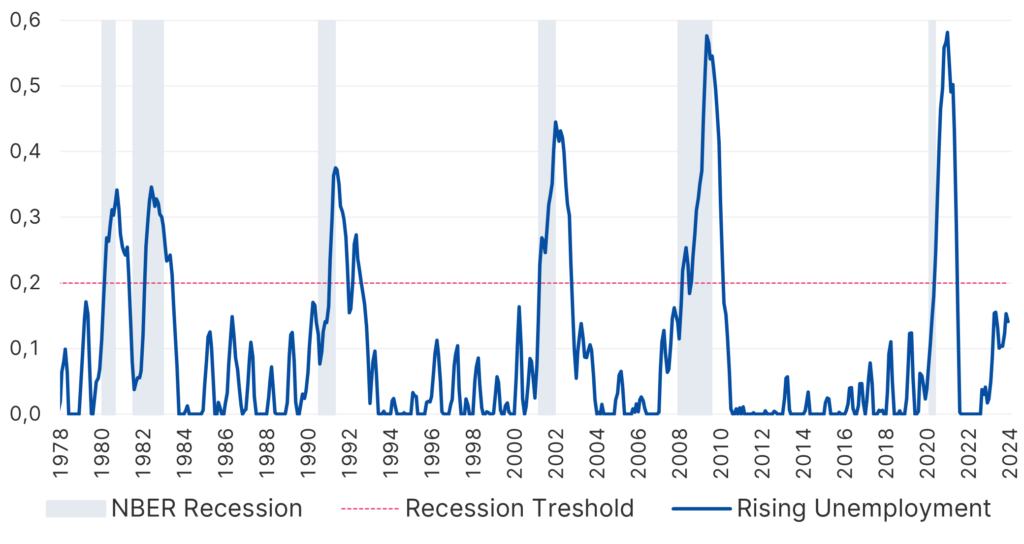

Recessions are, one might almost say, notoriously difficult to forecast or recognize in a timely manner. If recessions could be predicted with a good lead time, they would not exist at all because there would still be time to counteract them. In the past, a sudden, sharp rise in unemployment was an indicator, a signal for a recession. This is shown in the following chart:

Correlation between unemployment and recessions in the US

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023

The value in the chart is based on a moving average of new unemployment. You can see that the line often rises and then falls back again – only to then “break out” sharply. The cause is an interaction between unemployment and the economy: layoffs occur (only) when the profit situation of companies has deteriorated. The number of unemployed subsequently has a negative effect on consumption, as consumption is only stable if there is no concern about jobs.

Recessions will therefore remain a concern for the time being, and the aforementioned analysis will play a role in this.

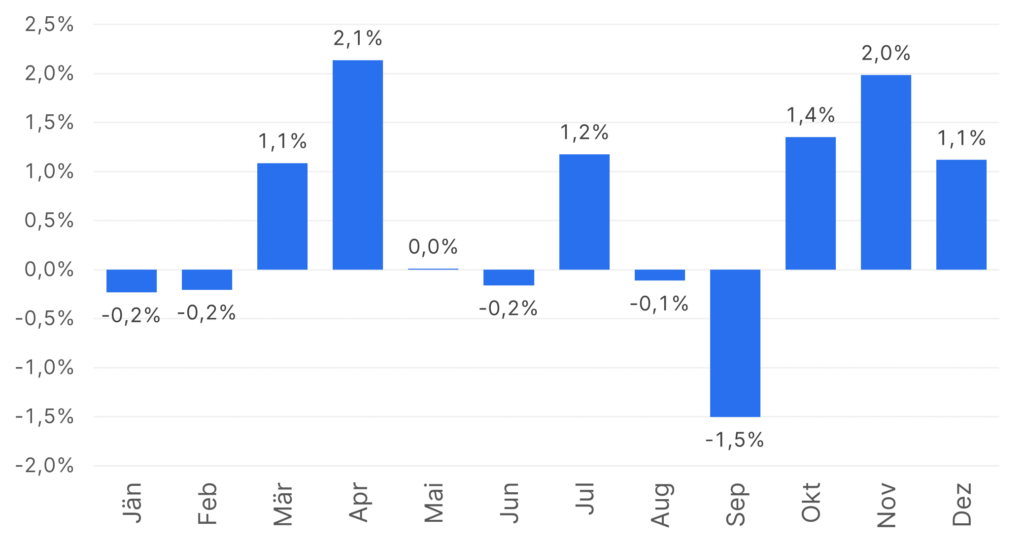

There has always been a “calendar effect” with shares. It must be remembered that this effect never occurs every year and with certainty, but on average over a long period of time (in the chart since 1999):

“Calendar effect” in global equities

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023

This shows that the 4th quarter was a good one (“end-of-year rally”), and the summer is difficult (“Sell in May…”), especially September.

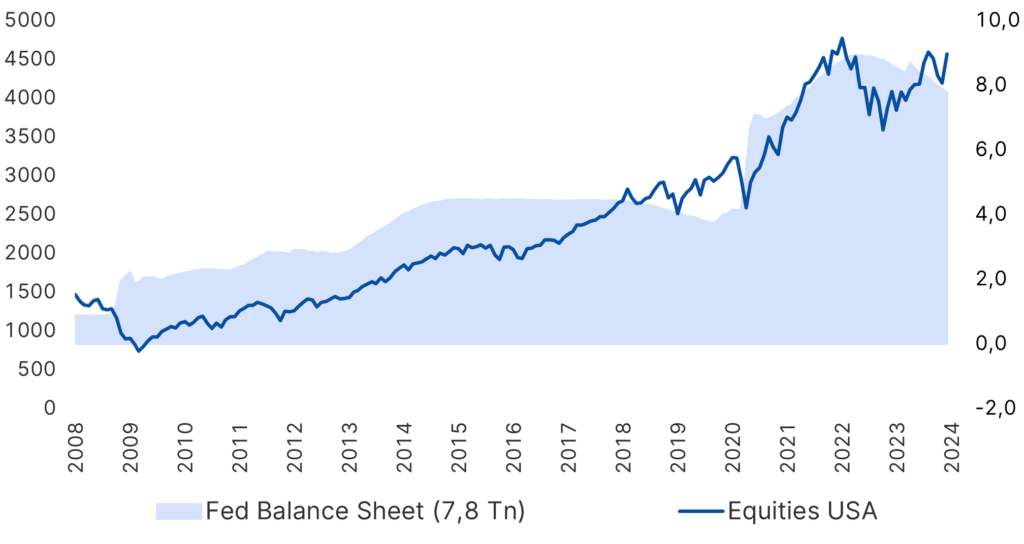

The fear that the rise in share prices in the US was and is (only) due to the support of the central bank could be dispelled. The chart shows that the strength of this correlation appears to be diminishing. A falling balance sheet total of the US Federal Reserve (as the sum of the support) meets further rising share prices:

Federal Reserve balance sheet total and US equity performance

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023; Index: MSCI USA (Equities USA)

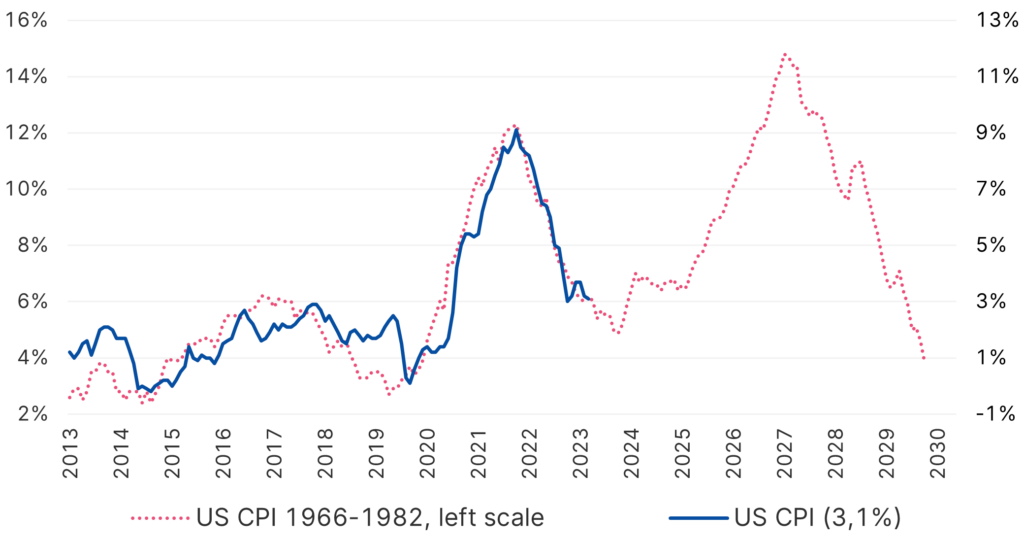

Inflation then and now

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023

A “comeback” of inflation, as would be the case from 1977 onwards, with an even stronger rise than before, would be fatal in every respect. This shows the central banks’ balancing act between the necessary fight against inflation and a premature conclusion of the measures.

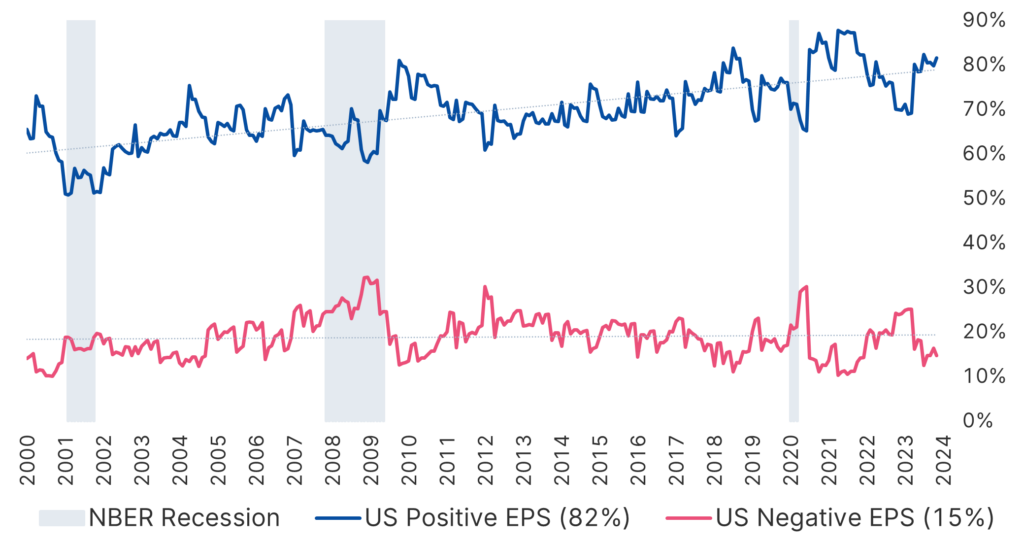

Ultimately, positive earnings surprises – in this case for US equities – are almost a fixed point:

Positive and negative earnings surprises for US equities

Note: Past performance is not a reliable indicator of future performance.

Source: Bloomberg; as at 20.12.2023

The lines are measured by the difference between the expectations of share analysts and the actual results of listed companies. This shows the innovative strength of stock corporations in their technological development and increase in productivity. This is and always will be good news for private investors.

Conclusion

2023 is shaping up to be a pleasing year for investors. It remains the case that patience is always required on the stock markets, but this patience has finally paid off. The extraordinarily high inflation of the last two years or so is over for the time being and hopefully permanently. New possibilities and opportunities will arise in 2024.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Please not, that an investment in securities entails risks in addition to the opportunities described.