The news flow on the financial markets has been negative for a while now: rising rates of new infections, falling economic indicators, rising inflation, and monetary policies that are slowly but surely tightening have been on the front pages. This situation notwithstanding, equities and other risky asset classes are on the rise. Does this add up?

The global economy is going through a cyclical recovery phase. This translates into economic growth that is significantly above the long-term trend and above potential growth until full employment has been achieved. The headwind has picked up in recent months. More and more growth indicators suggest a declining growth momentum, such as the purchasing managers’ indices, consumer and business sentiment, retail sales, industrial production, and company investments.

For recovery to continue ….

In order for the recovery phase to continue (i.e. for it not to be interrupted), the economic momentum cannot decline any further. We can see five necessary conditions that need to be met to ensure said continuation:

- In the base case scenario, the negative impact of the Delta variant is of a temporary nature and insignificant. The recovery is carried by more and more countries and by private consumption in the service sector, which in many cases is still clearly below pre-pandemic levels.

- The pandemic created shortages on the supply side (semiconductors, closed port terminals, long supply chains) as well as on the demand side (a lack of personnel in the service sector). This has resulted in limited production and high purchase prices and the inability faced by businesses to build inventories. In the base case scenario, shortages decrease, production increases, the pressure on prices falls, and the very low inventories will be restocked.

- In China, the economic indicators suggest weakening economic growth. Indeed, real GDP stagnated in Q3 on a quarter-on-quarter basis. This is due to the termination of the generally loose politico-economic stance, which has led to falling credit growth, restrictive measures aimed at containing the Delta variant, and regulatory reforms. In the base case scenario, China will take measures to support the economy.

- The phase of elevated inflation rates exceeds the forecasts from the beginning of the year both in terms of duration and extent. By definition, the inflation drivers are of a transitory nature (constraints on the supply side due to bottlenecks, strong demand growth in the sectors that are taking steps towards re-opening). Some key questions remain unanswered for the time being. How long will this phase last? To what level will inflation fall after the pandemic? Will there be a long-term inflation problem in the second half of this decade? Spill-over and second round effects are the medium-term (cyclical) risk. The prices of other goods and services that are not directly affected by the pandemic have also increased more significantly than expected. This could set off a wage-price-spiral, and we have to keep our eyes on it.

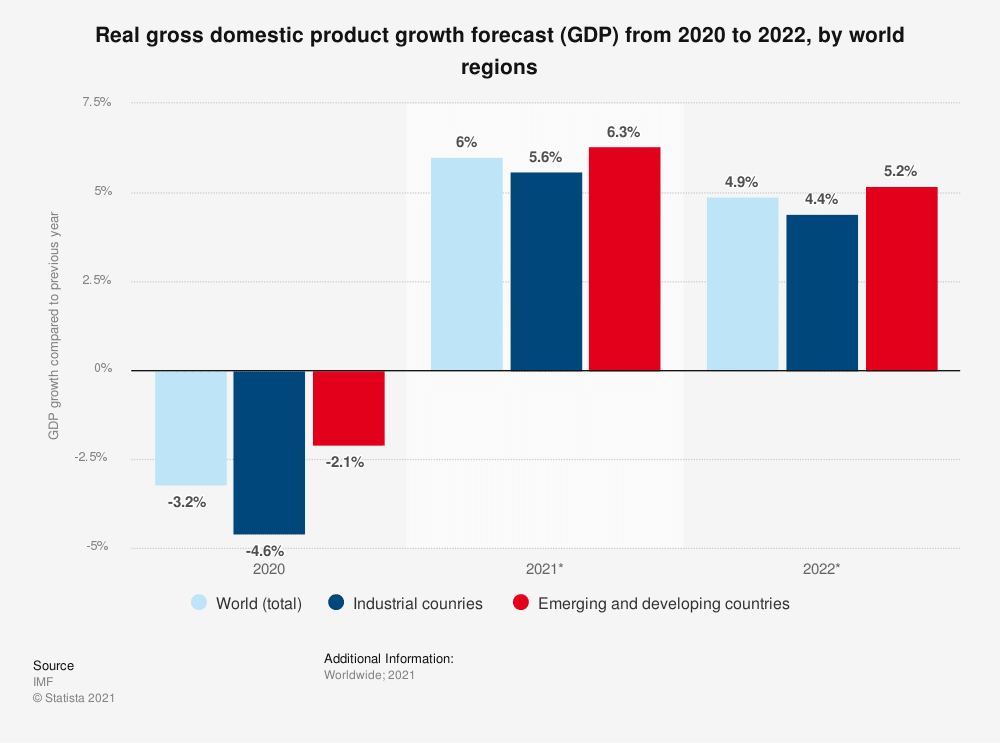

World Bank forecast: real gross domestic product (GDP) growth by country group from 2018 to 2023 (year-on-year)

For the long-term economic outlook, it is crucial whether the structural (disinflationary) forces that are dampening inflation disappear (scenario A) or, quite the opposite, reverse (scenario B).

Scenario A: the opening of China dampened inflation. That was a one-off. In the future, new technologies hold the potential of productivity growth. That, too, would contain inflation pressure.

Scenario B: the receding growth of the employable population and the rising share of people aged 65 and above could have an inflationary effect – especially if the monetary and fiscal policies remain supportive despite full employment having been achieved. In the base case scenario, the high inflation rates will subside again, but it will be important to monitor the medium- and long-term development.

- An increasing number of central banks have been tapering their ultra-expansive measures. In those emerging economies where inflation is a problem, the key-lending rates have already been raised. In the developed economies, a gradually increasing number of central banks have been hinting at a cut in bond purchases. This also applies to the most important central bank, the US Fed. However, the Fed has been operating very cautiously, trying to prevent a so-called tantrum, i.e. a negative market reaction to any restrictive measures taken by the central bank. So far, this has worked well. Although the Fed is getting closer to announcing the tapering (i.e. reduction) of its bond purchases, the markets have not reacted with losses. The Fed has been preparing the market participants for such a step for months. The same is true for rate hikes. The first hike is becoming increasingly likely to happen in Q4 2022. Here, too, we can expect the Fed members to carefully prepare the markets in numerous statements. In the base case scenario, the monetary policy of the developed world remains expansive, i.e. supportive.

CONCLUSION:

There are two reasons for the good performance of the risky asset classes. First, the negative developments are being ignored because they are probably only temporary (Delta variant, shortages, China, inflation) and the central banks have proven to be smooth operators. Second, there is an enormous savings glut, i.e. excess of savings. In the medium term, this does of course come with risks for financial stability. But in the foreseeable future, it will support the share prices.

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.