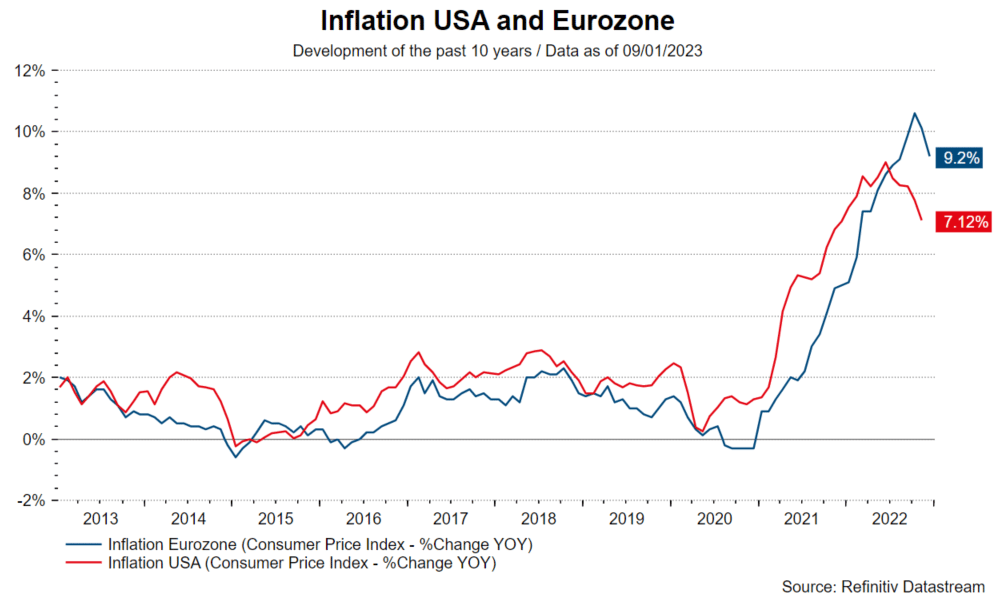

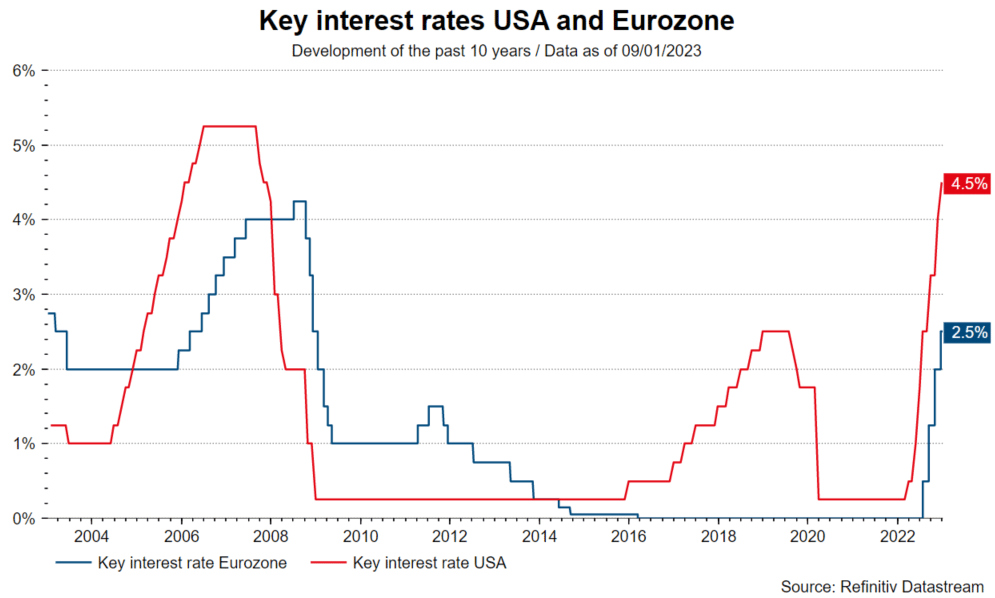

The global economy was confronted with two negative events within a short period of time. First, the Covid-19 pandemic and second, the war in Ukraine. This has led, first, to unexpectedly high inflation, second, to rapid, sharp increases in key interest rates, and third, to weak real economic growth.

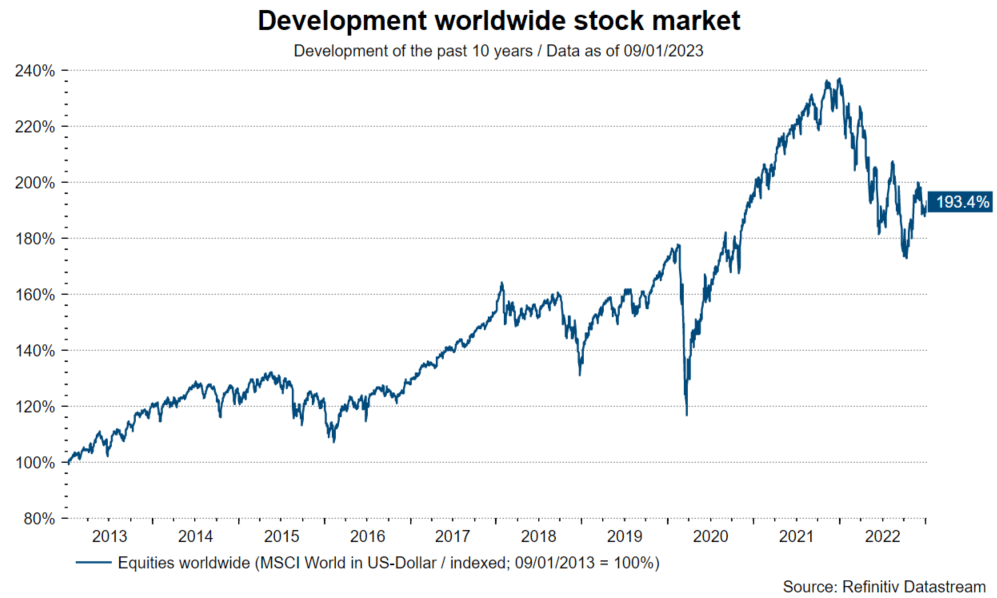

In hindsight, it is little wonder why most classes of securities have shown negative return performance over the past year. The following ten topics could be particularly relevant for the financial markets in this year 2023.

1. High macroeconomic uncertainty

The period of low macroeconomic volatility is likely over.

A) Inflation dynamics are not sufficiently well understood.

B) The dampening effects of restrictive monetary policies on the economy will not become apparent for several quarters.

C) To an increasing extent, structural factors are affecting economic dynamics (deglobalization, aging, climate change).

The three major scenarios for 2023,

A) “continued decline in inflation” (positive for economic growth),

B) “stagnation” (predicted by most institutions), and

C) “global recession” (when inflation falls only a little) could alternate as the driving factor for financial markets in the coming months.

At the beginning of 2023, optimism prevailed among investors, unlike commentators and analysts. Stock and bond prices have risen. In Europe, the rapid decline in energy prices and fiscal support measures have led to an improvement in economic indicators. The indications of “merely” stagnation are growing stronger. In the summer, there were fears of a severe recession. In China, the unexpectedly rapid departure from the zero-tolerance policy toward new infections and the selective support measures for the real estate sector argue for an economic recovery in H1. In the USA, any falling inflation indicator seems to be interpreted as an indication of a less than feared restrictive monetary policy. Most recently, lower-than-expected growth in average hourly wages for December boosted market prices. However, possible disappointments in the further course of the year are likely.

2. High geopolitical uncertainty

The war in Ukraine is called a war of attrition. The side with the greater economic resources has an advantage, perhaps a decisive one. Thus, the nature and extent of the West’s support for Ukraine remains a major factor influencing future developments. In any case, the war in Ukraine has permanently damaged the West’s relations with Russia. The effects have been stagflationary. This is most visible in the rapid shift to alternative energy sources.

Increased tensions between the US and China, manifested in export and investment restrictions by the US, among other things, are also having a stagflationary effect. The notion of “nearshoring” as a consequence of the pandemic is joined by “friendshoring.” The widely discussed possibility of an escalation around the Taiwan issue would probably have an even more negative impact than the war in Ukraine.

3. Restrictive monetary policies

The past year has been characterized by rapid, broad-based key rate hikes. Major central banks are currently signaling their intention to raise policy rates to restrictive levels and to maintain these levels for some time. However, the higher the key interest rates are raised, the more likely a pause in the rate hike cycle becomes. Central banks are aware of the time-lagged and uncertain effect of monetary policy on economic growth and, even more uncertainly, inflation. Whether this pause is actually just a pause (further rate hikes), an end (with interest rates remaining restrictive) or a reversal (rate cuts) will be decisive for market price developments. In any case, relying on interest rate cuts contradicts the central banks’ forward guidance (guidance of market expectations).

4. More unstable financial market

Last year, key interest rate increases led to a higher discount factor for future cash flows (profits, coupon payments). Significant price declines were the result. Unexpected, further key rate hikes would prolong this process. The risk of liquidity crises similar to the one in the United Kingdom last September could increase once again.

5. High debt

During the phase of zero and negative interest rate policies coupled with extensive bond purchase programs by central banks, high (government) debt did not pose an immediate problem. However, the key interest rate hikes and the central bank balance sheet reduction programs that have started increase the risk of countries (as well as companies and individuals) with high debt. This increases (in theory) the required spreads for risky debtors compared to an environment of excessive liquidity.

6. Higher Risk Premiums

The new regime of fallen stability at the macroeconomic, geopolitical and financial market levels, together with lower central bank liquidity, requires higher risk premia in equilibrium, in theory. In other words, the higher expected risk increases the required risk premiums. The immediate potential for price increases is therefore lower. This does not sound so bad, were it not for the price adjustment process towards this theoretical equilibrium. If one takes a look at the market development since the beginning of the year (price increases in equities and bonds, fallen priced-in volatilities), market prices may soon have priced in too much of an optimistic scenario (continued decline in inflation), but neither a realistic one (stagnation), nor a pessimistic one (global recession).

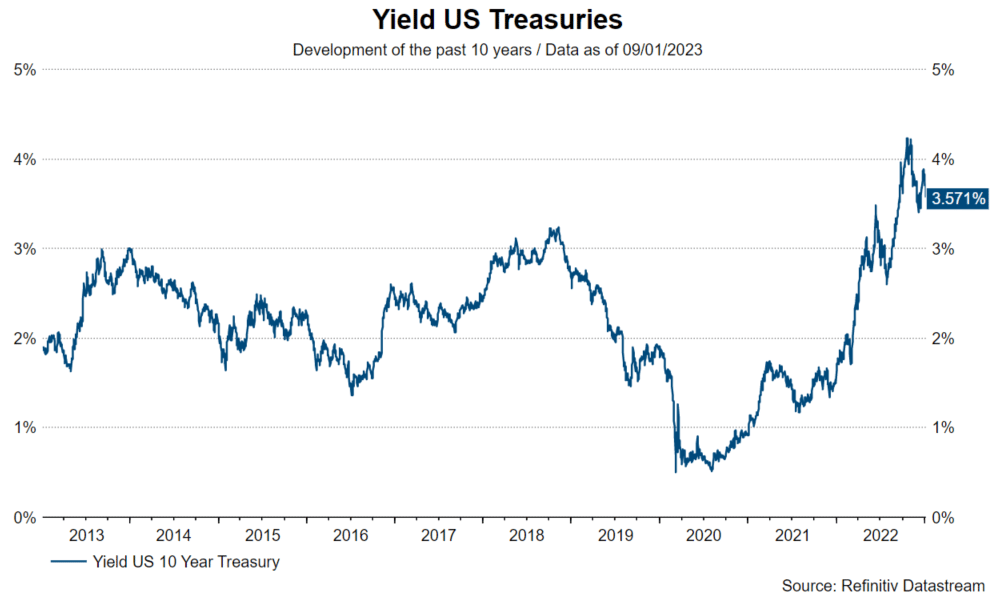

7. Price increases in bonds – not a one-way street

Falling inflation is generally positive for bonds. Currently, the decline in inflation is mainly driven by falling goods and energy prices. However, the labor market remains very tight (low unemployment rates) and inflation persistence may have risen permanently. Central banks are signaling that, in order to ease monetary policy, they need to be highly confident that inflation will fall toward the central bank target and stay there.

To bet on a sustained decline in inflation would be bold. After all, service price inflation could remain uncomfortably high. Then there are the very difficult-to-assess effects of central banks reducing their bond portfolios (quantitative tightening). At least the bond environment this year is not as predominantly negative as it was last year. However, the environment is likely to be characterized more by high volatility than by an upward trend in prices.

8. Equities – recession risk not adequately priced

As a rule of thumb, stock prices (especially) fall during a recession. Does this mean that the fall in share prices last year already reflects a recession? Probably not. After all, the main reason for the price declines was the rise in interest rates. The two scenarios “disinflation” (very positive), and “stagnation” (cautiously positive) represent a favorable equity environment. However, the risk scenario of a global recession does not seem to be adequately priced. Two negative stock market years in a row are very rare. That would require two shocks, such as interest rate hikes and a recession.

9. US dollar – not so clearly negative

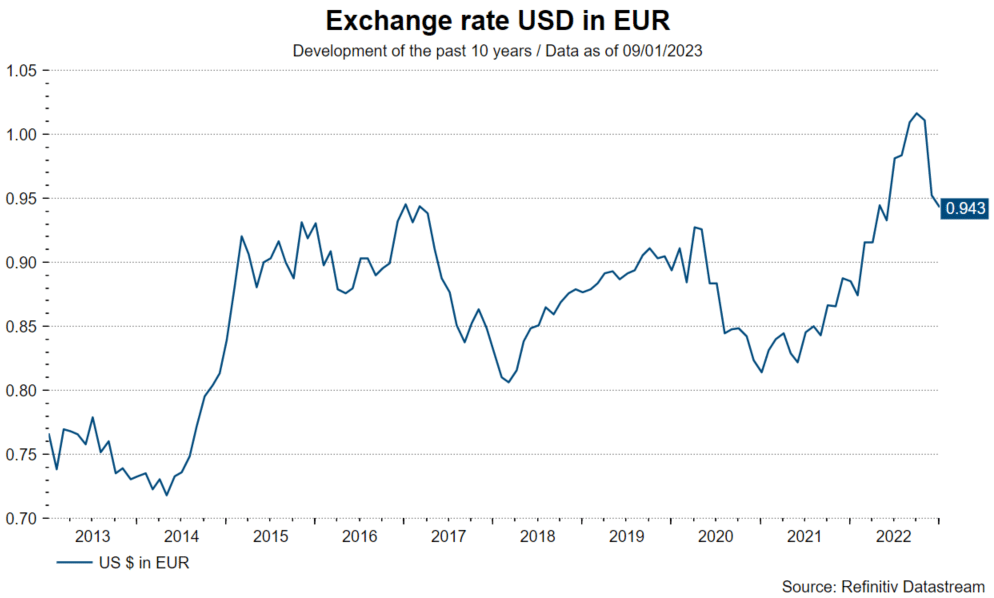

Since the priced-in real government bond yields in the USA have stopped rising (index currently at 1.8%) or expectations for future key interest rates have not risen further, the US dollar has tended to weaken against the other currencies. However, the traditional indicators still point to an overvaluation. Further weakening is suggested by many commentators, but it is not so clear. This could occur mainly if the optimistic scenario (disinflation) becomes more likely. The other two scenarios, however, tend to argue for a sideways movement (stagnation), and for renewed firming (recession), respectively. Traditionally, the US dollar is a countercyclical currency, and the US central bank has shown a strong willingness to get inflation under control.

10. Commodities – positive

Low global economic growth suggests subdued demand for commodities. However, the rapid shift to non-Russian energy sources as well as sustainable energy sources could structurally support commodities. In addition, there are the geopolitical risks “China” and “Iran”. At least as a hedge against further geopolitical escalation, commodities remain interesting.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.