Latest Posts

The Good, the Bad and the Hawk

Last week brought good, bad and inflation-fighting news, all from the US. At the start of the new trading week, the focus is on the turbulence surrounding Silicon Valley Bank.

EU and US Looking to Latin America as new Strategic Business Partner

The EU and the USA want to focus more on Latin America as an important economic partner. Most recently, the chances of concluding the EU’s long-planned trade agreement with the Latin American Mercosur free trade zone have also increased.

Why women should start investing

The financial reality of Austrian women still does not look rosy in 2023. However, as a recent study shows, more and more women have a desire for financial independence. Women are increasingly aware of their financial circumstances and want to actively do something about them.

Conditionally positive economic news

Last week, positive economic data brought back some confidence. The global purchasing managers’ index, one of the most important survey-based economic reports, rose for the third time in a row. On the other hand, the latest inflation reports dampen hopes of a rapid decline in inflation without additional key rate hikes.

A sustainable story of success

In July, the ERSTE RESPONSIBLE STOCK GLOBAL fund will celebrate its 20th anniversary. During its history so far, the fund has achieved a highly successful performance while the world of sustainable investments has changed fundamentally.

ChatGPT – what’s behind the revolutionary technology?

ChatGPT has made headlines in recent months and is seeing rapid user growth. What is behind this tech innovation and how are the major technology companies reacting to this new trend?

Risk inflation persistence

Inflation, which remains too high, continues to be the dominant macroeconomic issue. Hopes that inflation will fall as quickly as it has risen have been dampened, as Chief Economist Gerhard Winzer explains in his market commentary.

The Energy of the Future – OMV’s role and transformation

OMV is one of Austria’s largest listed industrial companies and a globally active energy and chemicals group. In this guest article, Florian Greger, Senior Vice President Investor Relations & Sustainability, explains the Group’s transformation strategy.

One Year Into the Ukraine War: Energy Price Shock and Inflation Still Noticeable, but Recovery on the Horizon

One year after the start of the Russian war of aggression on Ukraine, the economic impact is felt around the globe. Naturally, the economic damage in Ukraine itself is devastating.

An extraordinary year for alternative investments

The year 2022 was a challenging one on the stock markets. However, compared to the asset classes equities and bonds, alternative investments clearly outperformed. Read more in the blog post by senior fund manager Christian Süttinger.

Calibration

Central banks and markets are in a calibration phase. The question is how many key rate hikes are needed to be able to confidently expect inflation to fall in the direction of 2%. Particular attention is therefore once again being paid to the US inflation data, which will be published today, Tuesday.

Metaverse – just a dream or long-term investment opportunity?

Besides artificial intelligence, the Metaverse continues to be one of the big future topics in the tech industry. Our expert Harald Egger gives an insight into what the metaverse actually is and what possible areas of application there are.

Microfinance defies international capital markets in 2022

The microfinance market also faced a variety of challenges in 2022. Despite the difficult environment, however, the global market continued to grow dynamically. The ERSTE RESPONSIBLE MICROFINANCE also developed positively in the previous year compared with the global equity and bond markets.

Positive January on the markets

On the stock markets, the first month of the year was positive. The recent softer tones of the central banks give rise to hopes that interest rate hikes are slowly coming to an end. Read more about the current market assessment in our Investment Update.

China Aiming for Fast Economic Recovery After End Of Covid Restrictions

After the lifting of the Corona restrictions, mighty China is back on track for growth. Also the global economy is benefiting from this. In any case, the Shanghai and Hong Kong stock exchanges started the “Year of the Rabbit” on a positive note.

5 tips for building capital with investment funds

For many investors, a fund savings plan is a useful way to build up capital over the long term. To make sure this works, our expert Johann Griener has 5 useful tips for getting over difficult market times.

“Environmental themes offer potential for long-term growth phase“

Forbes Magazine ranked Clemens Klein, fund manager of ERSTE WWF STOCK ENVIRONMENT, as one of the top ten fund managers of the German-speaking region. In our interview, he talks about the investment strategy and philosophy of the fund.

Party Crashers

Improved growth prospects for China and Europe and hopes of a sustained decline in inflation have supported the markets since the beginning of the year. However, sharp central bank rhetoric and weak growth indicators in the USA could prove to be spoilers.

Chatbot “Sustainable Investing”: The new expert on sustainability

With so much information and offers on sustainable investing, investors can easily lose track of what’s out there. Our new chatbot “Sustainable Investing” can help here and shed some light on the matter. In this article, we explain which questions the chatbot can answer and how to find it.

Attractive yields: Why corporate bonds are worth a look

Corporate bond yields are now back at attractive levels. In his article, senior fund manager Hannes Kusstatscher explains what this means and how the situation on the bond market could develop.

Tug of war

At present, indicators on inflation and economic activity are competing to determine which of the two categories is more important for the financial market. Read more in the current market commentary by Chief Economist Gerhard Winzer.

After a Difficult Year, the Tech Industry Returns to the CES Industry Trade Show

After a three-year pandemic break, the technology industry returned to the renowned electronics trade show CES in Las Vegas. The dominant topics were artificial intelligence and virtual reality. However, extensive staff reduction programs at major tech companies also made headlines recently.

Decision to invest taken – what happens next?

As an investor, you will come across several parties or institutions in the fund selection and securities account opening process.

Understanding fund risks – nothing ventured, nothing gained

In this blog we analyse the different types of risk that one should be aware of before investing in a fund. We show which considerations should be made regarding the time of entry and the investment period.

The topic of water in sustainable investing

Clean water is one of the most valuable and important resources on our planet. This is one of the reasons why ERSTE WWF STOCK ENVIRONMENT invests specifically in companies that help to reduce water consumption. In this article, we explain what role the topic of water plays in sustainable investment and how water risks are taken into account in the investment process.

How to invest in corporate bond funds

Yields on corporate bonds in both the investment grade and high-yield segments have risen significantly in recent months. This means that there are currently interesting entry levels again.

Our expert Johann Griener explains in his blogpost how to take advantage of this opportunity with a corporate bond fund.

Upbeat markets at the beginning of the year

Despite uncertainties, the stock and bond markets got off to a friendly start in the new year. In the USA, economic data recently surprised on the upside. Is the situation better than the mood?

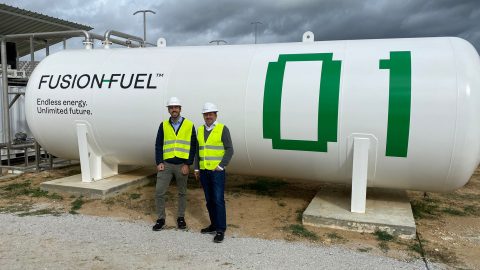

New Power – Green Hydrogen

Technological advantages and cost reductions have dramatically changed the environment for green hydrogen production. Our fund managers Clemens Klein and Alexander Weiss report on their journey to an exciting company in this industry.

What types of funds are there?

Actively managed funds and ETFs – what is the difference? Behind an actively managed fund there are always fund managers who influence the composition of the fund and actively look after the weighting of individual securities. Actively managed funds can therefore react to different market phases and are realigned by the fund managers if necessary. […]

How can I invest my money wisely?

There are many reasons to make income-oriented provisions – be it to provide for retirement or maternity leave, to save for larger investments or to finance the education of children or grandchildren.

How a bond fund “works”

Interest rates are back, which means that investing in bonds and bond funds again offers opportunities for attractive returns. Our expert Johann Griener explains how a bond fund works and what you should bear in mind when investing.

Ten topics for 2023

The previous year was marked by unexpectedly high inflation and rapid key interest rate hikes – but what will the new year bring?

In his article, Chief Economist Gerhard Winzer presents ten topics that could be particularly relevant for the financial markets in 2023.

Market commentary: What will the new year 2023 bring?

In the past year, numerous trouble spots preoccupied the markets. In his market commentary, Gerald Stadlbauer, Head of Discretionary Portfolio Management, gives an outlook on what 2023 might bring.

Interest rates are back

After many years of low interest rates, the tide has turned in recent months. This is also creating some opportunities on the bond market again, as our expert Johann Griener explains in his article.

Stock Exchanges Carefully Optimistic for 2023 After Year of Losses

The turn of the year marked the end of a difficult and lossy year on the stock markets. After two years of Corona pandemic, 2022 was dominated by Russia’s invasion of Ukraine, with many stock exchanges suffering double-digit losses.

The forthcoming steepening of the term structure of interest rates: An investment case

How the yield curve of a bond looks depends on several factors. In his article, fund manager Tolgahan Memişoğlu explains what this means and why yield curves could become steeper again in the future.

Hawkish holidays from the Bank of Japan

Last week, the Japanese central bank made the last major monetary policy decision of 2022, bringing an eventful year to an end – also from a central bank perspective.

Ukraine war: Exclusive interview with ORF correspondent Christian Wehrschütz

Hardly any journalist like Christian Wehrschütz has been dealing so intensively with the background of the Ukraine war for years. In an exclusive interview, the ORF correspondent gave us insights into daily life in the midst of a war. He does not currently see a solution to the conflict in the near future.

Energy of the Future

There is no perfect solution to solve our energy problems in the long term, explains Walter Hatak, Head of Responsible Investments. But instead of burying our heads in the sand, we should be able to choose the best possible alternative, take the future into account in our planning, and learn from past mistakes.

Inflation Reduction Act: what’s next?

The Inflation Reduction Act is designed to get the US back on track in terms of climate protection. What will the law achieve and who could benefit from it? Senior Research Analyst Stefanie Schock addresses these questions in her article.

ERSTE GREEN INVEST – with a tailwind towards energy transition

With the energy transition and the necessary ecologisation of the economy, “green technologies” are likely to remain one of the megatrends of the coming years. The ERSTE GREEN INVEST impact fund invests in precisely those companies whose business models could benefit from this megatrend.

Hydrogen – a colour theory

Hydrogen has great potential as a carbon-free fuel, electricity storage or energy carrier and could play an important role in the energy transition. But not all hydrogen is the same, as Senior ESG Researcher Alexander Osojnik explains. There are certain differences depending on how it is produced, which makes the topic of hydrogen almost a color theory.

Getting out of crisis mode

The use of energy has driven human development. However, the unchecked burning of fossil fuels produces massive amounts of CO2, which has disastrous consequences for the climate and the environment. More efficient energy use and more nature-friendly, renewable energies are therefore needed.

Thrilling decisions before Christmas

This week, the financial markets are once again in for an exciting ride: The European Central Bank and the US Federal Reserve will decide to what extent interest rates will be raised again.

Best of Charts

Consumer prices, interest rates, purchasing managers’ sentiment, bond yields, stock market prices, corporate profits, commodities – all these influence the financial markets. We provide an overview of the most important charts that fund managers pay attention to.

Successful launch of private equity fund of funds in difficult market environment

In June, Erste Asset Management announced the first closing of its private equity fund of funds, “Erste Diversified Private Equity I” at EUR 80mn. In an interview, Thomas Bobek, Head of Private Equity Management, is very satisfied with the successful start of the fund.

High uncertainty reduces potential for asset price increases

The environment for the financial markets remains highly uncertain. The further development of inflation and economic growth is not sufficiently foreseeable. This points to continued high fluctuations in asset prices.

Ceteris Paribus

The indications that the inflation peak will be exceeded are growing. If the relationship between inflation surprises (upside) and asset prices (downside) were to hold, that would be, all other things being equal, good news for the financial market.

Retailers hopeful for Black Friday and Cyber Week

On Black Friday and Cyber Monday, many retailers traditionally draw shoppers with discounts and special offers. In view of high inflation and rising interest rates and their potential impact, the financial markets are looking particularly eagerly to the two big holiday shopping days this year.

Sustainable and ethical line of Erste Asset Management funds awarded top marks

The sustainability and ethical fund family of Erste Asset Management received several awards from the Forum für Nachhaltige Geldanlagen e.V. (FNG) this year. All 16 funds submitted by Erste AM received the FNG seal, the quality standard for sustainable investment funds in German-speaking countries.