When Russia’s Ukraine war woke us up from the illusion that peace will stay forever, Germany’s historical shift to boost military spending by targeting the budget to 2% of GDP from currently 1.5% in addition to an one-time surge of allocating 100 billion Euros won applause. Meanwhile, the European defense industry made a case for labeling themselves as sustainable for their contribution to national security and peace. However, this idea was largely rejected by the Final Report on Social Taxonomy published in Feb 2022 though leaving room for interpretation.

As a backdrop, the Social Taxonomy is proposed in the EU as a parallel to the Environmental Taxonomy to define a list of economic activities with screening criteria to achieve social objectives, which is to fill the gap in the current market of lacking consistent definition of social investments and to direct capital into these socially valuable activities. Ultimately, these sustainable activities will be awarded with lower cost of capital by the market as investors are getting more and more conscious of sustainability.

Lucrative business, ESG-beleaguered

Defense industry, in fact, has been on the blacklist of investors, asset managers and ESG labeling organizations for a long time. For example, both the Austrian ecolabel and the FNG label, a Germany-based renowned qualification for sustainable investments, require applicant funds to exclude both controversial and conventional weapons. Nevertheless, weapon producers argue that “No sustainability without a defense and security industry” with their role being to protect democracy and freedoms in a very unstable global environment, contributing to a proper implementation of the UN Sustainable Development Goals, particularly SDG 16 ‘Peace, Justice and Strong Institutions’.

No wonder that the defense industry is defending themselves on the front of sustainable finance. It is a lucrative business. Europe is home to some of the world’s largest weapon producers, with 26 companies on the SIPRI top 100 list (the Stockholm International Peace Research Institute (Sipri) Top 100 Arms-Producing and Military Services Companies). With combined arms sales of $109 billion in 2020, these 26 European companies accounted for 21 per cent of total Top 100 arms sales. France, Germany, UK, Spain, Italy, and the Netherlands are among world’s top 10 exporters of major arms. With an annual turnover of €180 billion, the industry in Europe as a whole, though lucrative, are facing challenges of declining profit margins and lack of financing as banks begin to cut ties and investors shun. As a result of lacking investments in innovation and technology, the sector is at risk of weakening and losing competitiveness.

Harmful activities

However, weapon producers will fail the “do no significant harm criteria” (DNSH) test to be included in Social Taxonomy. On the one hand, weapons of mass destruction, be it nuclear, radiological, chemical, or biological, are destructive by nature and they kill civilians indiscriminately or are specifically prohibited by international treaties. On the other hand, conventional weapons, such as cluster munitions, pose a particular hazard to civilians as they are unreliable, inaccurate, prone to indiscriminate use, and expose civilians to severe and lasting risks from blinds. Apart from this, the proliferation of small arms and light weapons and the use of these weapons in violent and illicit activities are undercutting EU’s own security, spurring political instability, fueling the drug trade worldwide, and supporting terrorism, of which EU itself had become a victim, as seen in the 2015 Paris and the 2020 Austria attacks.

Good intentions meet bad actors

Even if the “do no significant harm” criteria were not considered and assuming that weapons for defensive purposes were socially sustainable, it is not possible to ascertain where those weapons end up because of significant diversion and misuse risks due to poor arms control, illicit transfer, and loose regulation. Consequently, arms are often used to destabilize entire countries and regions instead of defending populations or to enhance local or regional security as it is claimed. Astonishingly, there is virtually no effective international regulation of arms exports despite the lucrative business fuels conflict, destruction and devastation, and untold human suffering. As a case in point, arms of prominent weapon producers are reported to land in the hands of rebels in crisis areas around the world as well as in several states that are the target of export bans, although it is unclear how it happened.

Setting the bar high

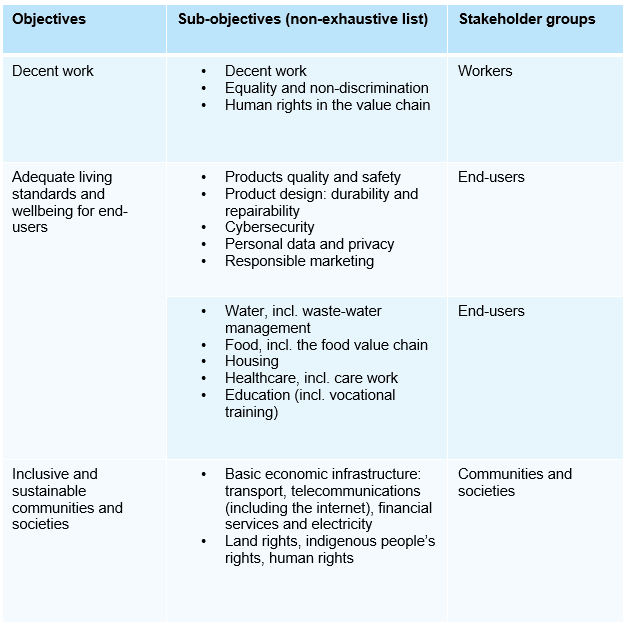

Turning to the social taxonomy, which economic activities will qualify in the Hall of Fame? Apart conducting economic activities that make substantial contribution to social objectives, fulfilling technical screening criteria, companies are assessed against “do no significant harm” DNSH criteria and minimum safeguards in order to align with social taxonomy. While the Final Report provides guidance on the selection of activities that could substantially contribute to objectives, the list of socially sustainable economic activities, and technical screening criteria, as well as minimum safeguards are still to be unveiled. Nonetheless, the Final Report on Social Taxonomy has identified three social objectives to be attained, with corresponding stakeholders being workforce, end-users/consumers, and affected communities.

These three social objectives are:

- Decent work (including for value-chain workers)

- Adequate living standards and wellbeing for end-users

- Inclusive and sustainable communities and societies.

Substantial contribution can be made in three ways:

- Avoiding and addressing negative impact

- Enhancing the inherent positive impacts of social goods and services and/or basic economic infrastructure

- Conducting activities that enable substantial risk reductions in other sectors.

Room for interpretation and pending decision

The Final Report explicitly lists a number of international treaties and conventions which prohibit or restrict the employment of controversial weapons and certain conventional weapons as a source for identifying harmful activities. Upcoming treaties for examples on autonomous weapons will be considered as well. Yet, the treaties listed do not cover all types of weapons, leaving room for interpretation on including remaining or other kind of weapons.

Noteworthily, the advice of the Final Report on Social Taxonomy is non-binding, based on which the European Commission needs to decide whether to go ahead with the Social Taxonomy by July 2022. Although in the past, the EC has chosen to align to the technical advice, market liberalists may question whether we need interventions from regulators to tell people where investments should go especially when definition of “social” is so varied from different point of views. Admittedly, unlike any science-based criteria, there are a thousand definition for “social” for a thousand people. For some, it is right to exclude weapon producers from the social taxonomy, while some others disagree. No matter how the rule is proposed, the defense industry will exist and be financed, as seen from governments’ response to the wake-up call of the Russia-Ukraine war.

Please note: Since 2012 Erste Asset Management has committed to refraining from investments in companies that are involved in controversial weapons. Among them are:

- Biological and chemical weapons

- Submunition, including possible launch and ejection systems

- Anti-personnel mines, mine-planting systems, and other mine systems

- Nuclear weapons

- Depleted uranium weapons

You can get further information here: https://www.erste-am.at/en/private-investors/sustainability/publications-and-guidelines

This article is part of the ESGenius Letter on the topic “Social – The ‘S’ in ESG”. Further information and insights from our experts on social factors in sustainable investment can be found here.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.