Supply chain disruption and labor shortages in the past two years have brought social issues to the spotlight. Companies may find themselves struggling to source the key parts for production or have difficulties in attracting talented employees. The list of social issues can go on: Issues of layoffs and furlough, health and safety during the pandemic drew growing attention to the protection of labor rights; recent cyber-attacks on critical infrastructure highlighted the Achilles’ heel of modern society.

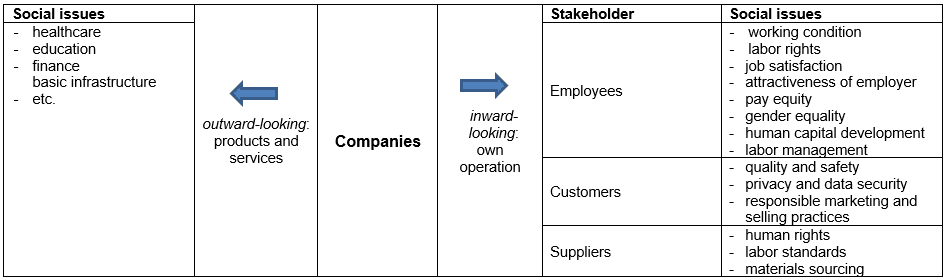

No company exists in isolation. They deal with both internal and external stakeholders of employees, customers, and suppliers. In addition, some companies directly provide goods and services with a social focus. Compared with “E”-factors (environmental) and “G”-factors (governance) of ESG rating, the “S”-factors (social) covers wide-ranging topics of which the investment industry lacks consensus. Despite the complexity, we assess social factors from two perspectives:

- How do companies interact with their stakeholders via operations?

- How do companies impact society via its product and services?

Putting ourselves in employees/customers’ shoes

Employees are vital to almost all companies. Motivated employees are more productive; by contrast, high employee turnover rates have cost implications – time, efforts and resources are needed to fill in positions and train new staff. The importance of human capital is more pronounced in the industries such as asset management, advertising, technology, pharmaceuticals as well as professional services.

While the lack of data and consistency of “S” factors continues to pose challenges in incorporating them into ESG analysis, we make qualitative assessment of companies using alternative sources on the internet. By thinking as an employee or a customer and directly looking into employee reviews and product reviews, we can gain insights of the management quality and popularity of products. Long and recent comments usually reveal some information about strength and weakness that one is not able to find in corporate reporting. We ask questions like: Would I like to work for the company if I were a job seeker? Will I buy the products after checking the reviews? By comparing with the reviews of similar companies or products, one can get an impression of how the company stands in terms of its overall management, talent development and product marketability. Third-party platforms such as Indeed, Glassdoor, Amazon, Trustpilot or discussions on Facebook and YouTube as well as specialized product review websites are places that we check. One limitation is that one must take into consideration of fake reviews, which requires some experience in identifying them.

Scrutinizing financial reports

Social issues can be material for companies. One notable example is product safety and quality. Faulty or defective products are subjected to recalls, shattering consumer confidence, tarnishing company’s reputation, and leading to losses. The Takata Air Bag Recall, which started quietly in 2008 and has since ballooned into one of the biggest recalls in history is a case of point. Total cost is estimated to exceed $24 billion, and nearly 100 million vehicles with faulty air-bag inflators made by now-bankrupt Takata were affected globally. The expenses related to product warranties are represented in provisions on the balance sheet. We can examine the assumptions made and assess whether the provisions are adequate for settlement of liability in the future.

Supply chain management and due diligence

A primary supply chain risk is the unavailability of products that are essential for a business to operate. Companies with effective, efficient, resilient, and flexible supply chains set them apart in the period of disruption. Near-shoring, diverse-sourcing, multi-sourcing and dual-sourcing strategies can be used to enhance supply chain resilience. By contrast, relying on one supplier for key parts is a warning sign.

What comes hands in hands with supply chain management is due diligence and supply chain audit. Both aim to identify any legislative and governance issues to ethical and environmental concerns risks associated with potential or existing suppliers to ensure that they uphold ethical standards and social norms. A famous case is the fast fashion retailer Boohoo, which was mired in the supply chain controversy in 2020. Companies with good supplier due diligence and regular supplier audits can mitigate such risks.

Social impact via provision of services and goods

Affordable housing, education, health, and inclusive finance are identified as four social themes in impact investing according to the PRI Impact Investing Market Map. In specific, relevant activities include managing, building or selling social housing, educational services, health facilities such as clinics or laboratories. Other examples are microcredits, SME finance and microfinance.

By conforming to criteria like the accessibility and affordability of financial services, business involved in the activities mentioned above can contribute to the UN Sustainable Development Goals, including “no poverty”, “good health and well-being”, “quality education”, “decent work and economic growth”, and “sustainable city and communities”.

In conclusion, investors are paying increasingly attention to social factors, for its wide-ranging topics and far-reaching implications. While the disclosure gap is to be fulfilled, alternative information sources and existing financial disclosure can be used to gain a glimpse of social performance of companies which investors can take advantage of.

This article is part of the ESGenius Letter on the topic “Social – The ‘S’ in ESG”. Further information and insights from our experts on social factors in sustainable investment can be found here.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.