The global economy is currently in a stagflationary period. Three scenarios emerge for the next year:

- Surprisingly strong economic growth with inflation rates continuing to fall (disinflation). Central banks may even lower key interest rates.

- Low economic growth (disinflation) with only moderately falling inflation rates. Central bank policies remain restrictive.

- Global recession if inflation rates remain surprisingly high. Central banks raise key interest rates more than is currently priced into the markets.

The underlying factor is inflation. The challenge is thus to correctly assess the inflation trend. The problem is that inflation dynamics are not sufficiently well understood.

Weak economic environment

The economic environment is weak. High inflation rates are dampening purchasing power and restrictive monetary policies are dampening economic growth with a time lag, the financial environment is also becoming increasingly restrictive (higher cost of capital) and uncertainty about another liquidity crisis like the one in the UK is a major unknown.

In addition, GDP in Europe is likely to contract in the fourth quarter of 2022 and the first quarter of 2023 due to the energy price shock. However, the extent is less pronounced than originally feared, firstly because of government supports, and secondly because of the sharp drop in wholesale prices for natural gas. In China, economic activity is being impacted by the zero tolerance policy toward new infections and the slump in the real estate market.

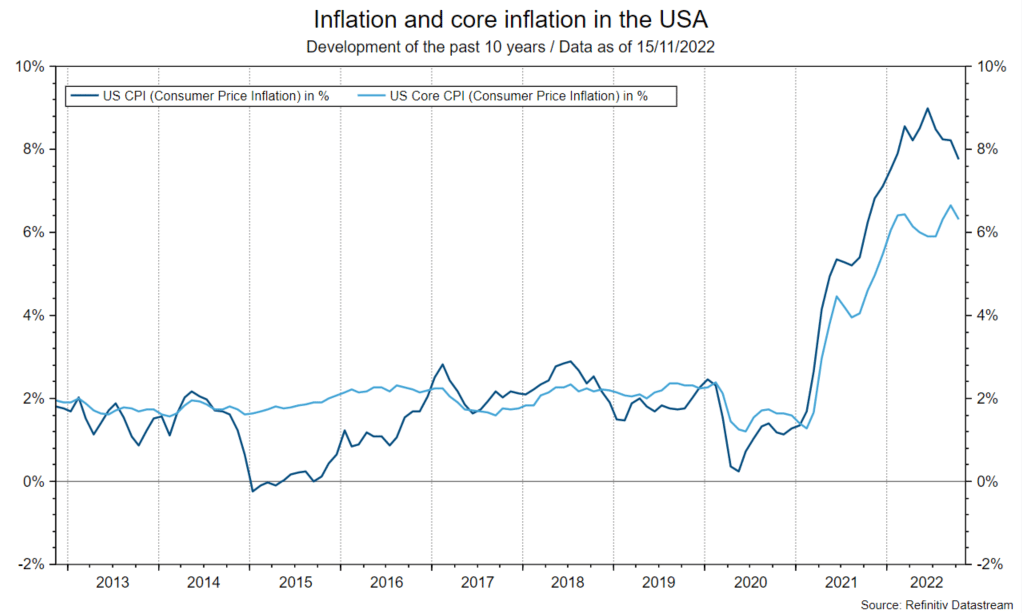

Inflation decline in the USA

Last week, the release of consumer price inflation in the US for the month of October triggered a mini-boom in the markets. The overall inflation figure rose 0.4% month-on-month to 7.7% year-on-year. Market participants focused on core inflation (overall inflation excluding food and energy). This measure firstly rose by less on a monthly basis than in the months before (0.3% after 0.6% in September) and secondly was below the estimated increase (0.5%).

Note: Past performance is not a reliable indicator for future performance.

The positive sentiment triggered by the lower-than-estimated rise in inflation was reinforced by two other weak subcomponents. First, excluding rents, core inflation actually fell by 0.1% month-on-month. Second, goods prices excluding food and energy also fell (by 0.4% month-on-month).

Less restrictive interest rate policy

The October inflation increase was not weak, and a lower-than-expected inflation report does not yet represent a trend. The positive market reaction can be explained by three points. First, the falling core inflation rate has increased the likelihood that the US Federal Reserve will actually reduce the pace of interest rate hikes. After four consecutive hikes of 0.75% percentage point each, a 0.5 percentage point rate hike to 4.5% is priced in for December. Second, the inflation report has caused the estimate for the end point of rate hikes to slide downward. Last Wednesday, a key interest rate nearly 1.25 percentage points higher was still priced in. That estimate has shrunk to one percentage point. Third, the magnitude of key rate cuts priced in has increased (to 0.85 percentage point between December 2023 and December 2024) after reaching the 5% level in the spring of 2023.

Uncertain inflation outlook

Pricing in a less restrictive interest rate policy is positive for bond and equity markets. First, because the discount rate for future cash flows (coupons, earnings) falls, thereby increasing the present value (estimated fair value of an asset class). Second, because it makes a recession less likely (favorable for profits).

However, the assessment of further inflation developments is highly uncertain. On the upside, indicators of underlying inflation have been falling for months. That from the New York Fed peaked inflation already last March at 4.9% (October value: 4.2%). There are also indications of at least a slight easing in wage growth. The Atlanta Fed’s indicator fell from 6.7% y/y in August to 6.4% in October). However, other inflation indicators that look at inflation persistence have remained high. The Atlanta Fed publishes a measure of sticky inflation. This remained high at 6.5% y/y in October.

Disappointments on the credit side

On the economy-negative side, two reports in particular stood out last week. First, in the US, the Federal Reserve Senior Officer Opinion Survey on bank lending conditions showed a further tightening. Interpretation: As long as Fed policy remains restrictive, recession risks (for the US) will remain elevated. Second, in China, total credit (Total Social Financing) increased less than expected in October (908 billion yuan vs. 1600 billion yuan). In addition, goods exports in China fell by about 2% month-on-month in October. In China, the only positive development was indications of an easing of the zero tolerance policy toward new infections.

Caution

The lower-than-expected rise in inflation in the US, the fall in natural gas prices in Europe and indications of an easing of zero-tolerance policy in China represent positive developments. However, Fed policy is only becoming less restrictive, GDP-in Europe will (probably) still contract, and in China the slump in the real estate market is a strong headwind. A favorable inflation report is not yet a trend. To bet on a sustained decline in inflation would be bold.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.