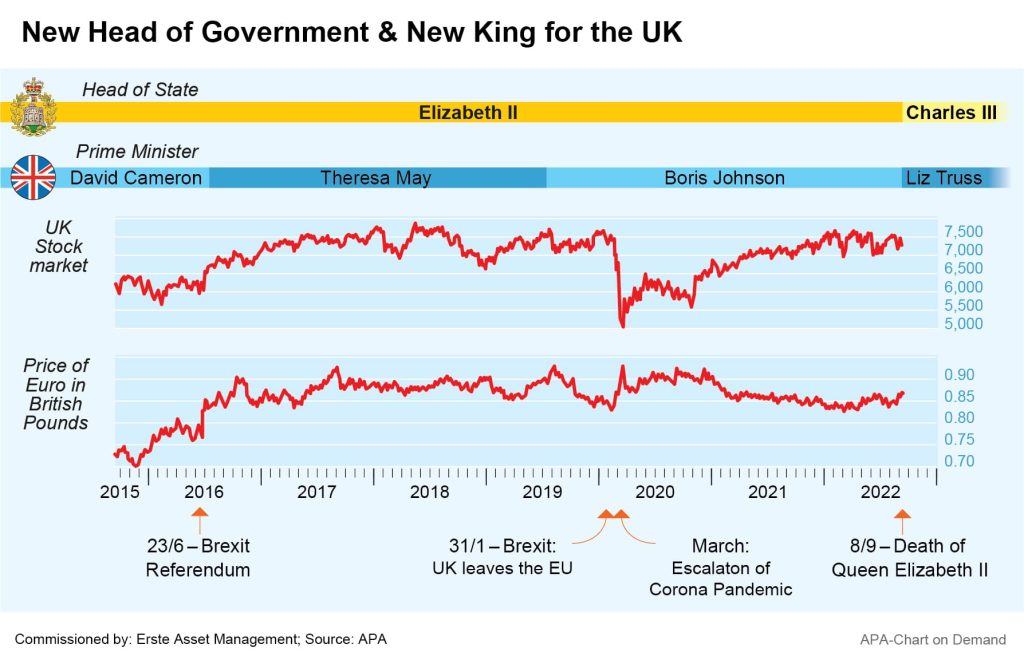

The funeral of Queen Elizabeth II held today, Monday, marks a turning point for the United Kingdom in several respects. The long-serving monarch of the kingdom is succeeded by a new king, Charles III. Only a few days before the Queen’s death, she had appointed the new UK Prime Minister. Liz Truss succeed former PM Boris Johnson. Truss takes office during a turbulent time. In addition to the succession to the throne, the country is dealing with the consequences of the Corona pandemic, supply bottlenecks, the further Brexit course and the energy crisis associated with the Ukraine war. The British pound’s exchange rate also dropped to its lowest level against the dollar since 1985 immediately after Truss took office.

The high energy prices in particular are currently posing major challenges for the British government. Immediately after her inauguration, Truss presented a package of measures to curb the skyrocketing energy prices. The new British PM wants to freeze gas and electricity prices at GBP 2,500, about EUR 2,890 per year for an average household. With this measure, the government hopes to keep millions of households from slipping into poverty.

The drastic rise in gas and electricity prices is already pushing almost half of the people in Britain to their financial limits, according to the latest survey by the Opinium polling institute. According to the survey, almost 40 per cent of people in the UK are already cutting back on food purchases in order to cope with the price increase. A study by the Resolution Foundation (RF) think tank also sees poverty in the country increasing in the face of the energy crisis. Without a change in government policy, the number of people in absolute poverty would increase by three million to 14 million by FY 2023/24, the RF predicts.

Energy Price Cap to Support Households and Businesses

The energy price cap will be in effect for two years, starting in October. A formerly promised one-time aid of GBP 400 per household will remain. Businesses are also to be shielded from the rapidly rising prices on the world market with a support package. The cost of the measure is estimated around GBP 100bn, about EUR 116bn.

Truss ruled out a stronger skimming of large energy companies’ excess profits despite demands to that effect by the opposition, arguing that it was more important to allow the companies to invest in the development of new gas and oil deposits in the North Sea as well as renewable energies. According to insiders, the UK government wants to grant dozens of new licences for oil and gas exploration in the North Sea to boost domestic production. Truss also hinted at building new nuclear power stations.

The Bank of England’s chief economist, Huw Pill, recently expressed optimism that the government’s plans to ease the gas crisis would help to curb inflation. The measures were urgently needed, because the soaring energy prices were noticeably reflected in the inflation rates.

Inflation Recently Rose Above 10 Per Cent

In July, inflation in the UK had already risen to 10.1 per cent. This is the highest rate since records began 25 years ago. In August, the dropped fell back to 9.9 per cent. The reason was a slight easing of energy prices, but the coast is far from clear. Analysts at major investment banks believe that further increases are possible if gas prices remain high.

The high inflation rates are also likely to have an impact on economic performance. To compensate for the surge in inflation, many consumers have started to reduce their spending. Gross domestic product (GDP) fell by 0.1 per cent between April and June compared to the previous quarter, according to the Office for National Statistics (ONS). The Bank of England expects the country could slip into recession at the end of the year. This could last well into the next year.

In the fight against inflation, the Bank of England tightened its interest rate reins further in August. It raised its key interest rate by half a percentage point to 1.75 per cent. This is more than at any time since the central bank gained its independence from politics in 1997. Markets are now closely following the upcoming interest rate meeting. The meeting has been postponed until 22 September due to the mourning period following the death of the Queen. The futures markets currently consider it likely that the central bank will leave it at a 0.5 percentage point increase. Previously, there had been increased speculation of a larger move of 0.75 percentage points.

Northern Ireland Protocol Causes Political Tension

Truss also faces the challenge of unresolved Brexit issues, in particular the Northern Ireland issue. The Northern Ireland Protocol negotiated by the British government as part of the EU exit currently provides for special customs rules for Northern Ireland. The sensitive border between the British province and the EU member country Ireland are kept open. It also prevents a flaring-up of the Northern Ireland conflict. However, the agreement has de facto created a customs border in the Irish Sea, separating Northern Ireland from the rest of the United Kingdom. Among other things, this led to delivery problems and also to great resentment in Great Britain overall.

In her former position as Foreign Secretary, Truss had pushed a bill to undermine the Northern Ireland Protocol. The Northern Ireland Protocol Amendment Bill cleared its first parliamentary hurdle in late June with a vote in the House of Commons. They decided tax changes and a labelling system for goods. The European Court of Justice will no longer be responsible for disputes regarding the implementation of Brexit.

The EU sharply criticises the plan and threatens to take the matter to the European Court of Justice. The US had also recently warned Truss against unilateral changes to the Brexit deal. Any attempt to undermine the Northern Ireland Agreement would have a negative impact on talks on a trade deal between the UK and the US, a US government spokeswoman said.

Queen’s Death Fuels Scotland’s Independence Drive After Brexit

The death of Queen Elizabeth II is also likely to give a further boost to aspirations of independence in Scotland, which were already fuelled by the Brexit. “Some Scots will see the end of this era as a natural time for a fresh start,” said Scottish journalist Alex Massie in a commentary for The Times.

The independence movement in Scotland has been growing for years. The SNP has been in power since 2007. In a referendum in 2014, however, 55 per cent of Scots voted to remain in the United Kingdom. Scottish leader Nicola Sturgeon announced at the end of June that she wants to hold a new referendum on independence in autumn 2023. A decision that the UK Supreme Court will consider in October.

However, a possible secession from Britain would not have to be synonymous with a farewell to the royal house. The new King Charles III has a special relationship with Scotland. Some regional newspapers, such as the Daily Record, see Charles’ commitment to environmental protection as an opportunity for Scotland. They hope that the King will support the move away from coal mining to a pioneer in renewable energy.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.