Food and fuel price increases as manifestation of an extraordinary bout of inflation are burdening the Austrian consumers noticeably. Heating energy will be subject to extreme price hikes in the coming winter at the latest. And if the Ukraine crisis does not ease off, the situation can get even worse.

Financial burden and dependencies

There are probably few charts that illustrate the cost pressure that has been building better than the following one. It illustrates the German balance of trade: after decades of exports exceeding imports, this year’s balance of trade is negative for the first time since 1991. In other words, imports now exceed exports. The unsolicited growth in imports is due to the energy prices.

Chart: Balance of trade Germany

Note: Past performance is not a reliable indicator for the future performance of an investment.

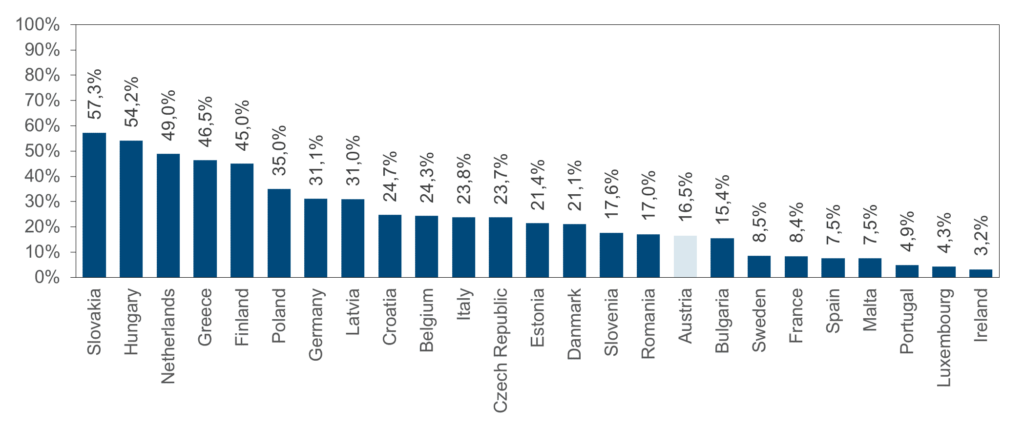

Europe derives an average of 24.4% (based on EU numbers) of energy imports from Russia (in terms of volume used). Values vary significantly between countries. For Austria, Russian imports account for 16.5%:

Chart: Energy imports Russian share

While 16.5% does not seem that dramatic, the shortfall of this volume would trigger a massive recession in Austria. One also has to take into account the energy mix: in Austria, natural gas accounts for 58.6%; the situation is particularly serious in the East of Austria and Vienna, where the dependency on natural gas is critical.

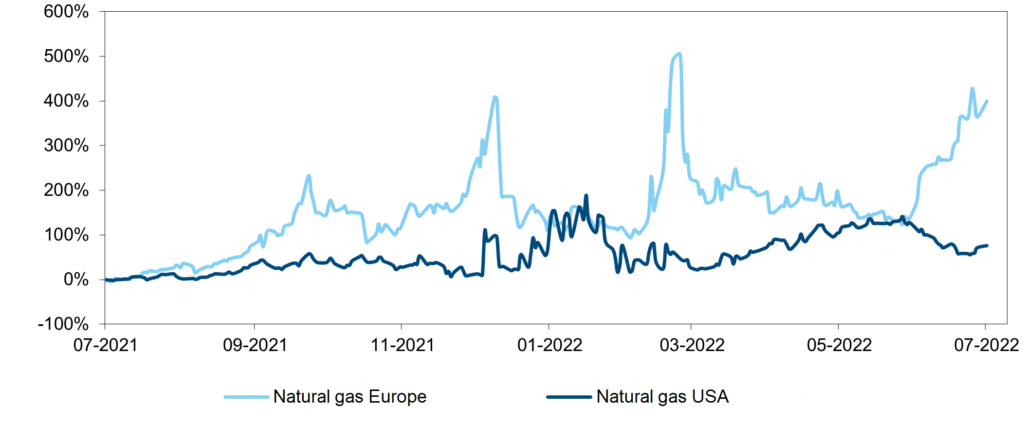

The global differences in natural gas prices is a crucial aspect with far-reaching consequences. Whereas oil is relatively mobile (via tankers), natural gas can only be transported through pipelines or shipped in liquid form (LNG). A change of suppliers therefore takes a long time. This has led to massive price fluctuations of several hundred percent for natural gas on the exchange in Europe over the past year, whereas natural gas on the US market has been relatively stable, as the chart below illustrates. Whenever the supply situation from Russia becomes uncertain, the price pretty much explodes:

Chart: Natural gas prices in Europe and USA

Note: Past performance is not a reliable indicator for the future performance of an investment.

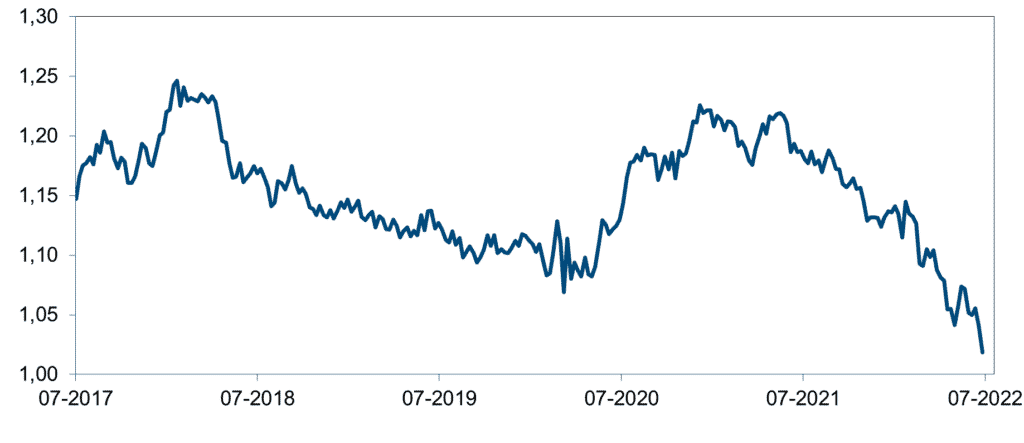

The financial markets see a distinct chance of a recession in Europe (especially in Germany, the economic engine), triggered by the forced ramp-down of entire sectors that depend on natural gas. This assessment is reflected in the EUR/USD exchange rate. While the USA is also subject to a certain risk of recession – for other reasons though, i.e. the slow-down of the economy facilitated by the central bank in order to contain inflation – Europe is being seen in a slightly more negative light in the medium term. As a result, the euro has been going through a phase of weakness:

Chart: EUR/USD

Note: Past performance is not a reliable indicator for the future performance of an investment.

The depreciation of an exchange rate has various different consequences. On the one hand, the competitive situation improves as exports become cheaper for buyers. At the same time, however, imports become more expensive, and this is currently the dominant effect, given the share of energy imports. In addition, commodities are traditionally traded in USD. A potentially improving competitive situation is thus coupled with even more imported inflation.

The so-called interest rate differential is also relevant for the exchange rate – in this case, the difference between the interest rates in the Eurozone and the USA. Here, the US Fed has recently implemented a number of significant rate hikes, whereas the ECB has much less room to manoeuvre, for two reasons: first, it does not want to burden the economy in Europe any further; and second, it does not want to fuel a fragmentation within Europe. Fragmentation in this context refers to the (higher) spreads that have to paid by the issuers of government bonds in countries like Italy, which then could rise to an extent where such debt could not be financed any longer by the budgets of the respective countries.

The relationship of energy commodities and food prices

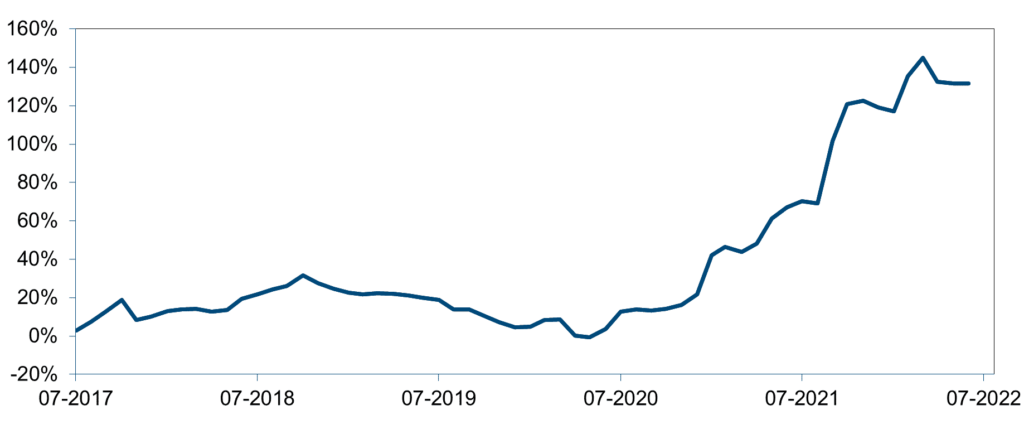

Food and energy commodity prices are linked via fertilisers, whose use is unavoidable. Nitrogen fertilisers, which are produced from air on the basis of a process that involves natural gas and nitrogen, are the most popular choice. As a result, the price of fertiliser has followed the rise in energy prices:

Chart: Price of fertiliser

Note: Past performance is not a reliable indicator for the future performance of an investment.

Russia is an important producer and exporter of fertiliser; and Ukraine was and is a global breadbasket. The harvesting, shipping, and sowing of the new crop especially of wheat and vegetable oil has been made difficult or often impossible by the war.

Is there a light at the end of the tunnel, as far as prices are concerned?

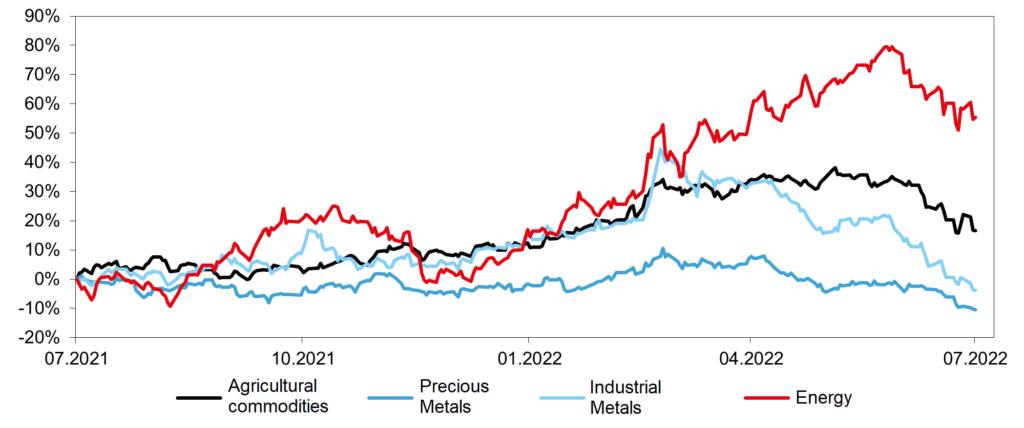

After an enormous price increase in the first five months of the year, commodities (subclassified into energy, industrial metals, and agricultural commodities) have recorded a slight decrease in prices since June due to the fact that recessions have become a plausible scenario in several parts of the world: in the USA, because of the slow-down of the economy effected by the central bank; in Europe, if the Russian gas deliveries fall through; and in China, if the real estate sector, which has grown at a disproportionate rate, turns out to be unsustainable. Recessions, even small ones, cause a decline in the demand for commodities which react very sensitively by adjusting their prices.

For commodities, supply and demand will balance in the medium term, which will dampen price increases resulting from a demand overhang.

Chart: Commodity prices

Note: Past performance is not a reliable indicator for the future performance of an investment.

This should result in the easing off of inflation, i.e. the change of prices over time – albeit not of the absolute price levels.

Conclusion

From a European perspective, we may not have been past the worst yet in case the energy supply cannot be maintained in the winter of 2022/23 (especially natural gas) and this effect cannot be offset by austerity measures. Overall, commodity prices have increased in the past twelve months by such a degree that a forced decline in demand could now dampen the inflationary pressure.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.