Even though inflation rates have been falling significantly at monthly intervals since July, the inflation problem is not yet over. Central banks are showing a strong commitment to maintaining the basic monetary policy stance hawkish (rapid and synchronous key rate hikes) and restrictive (dampening the economy) until inflation rates have convincingly embarked on a downward trend.

Falling energy prices

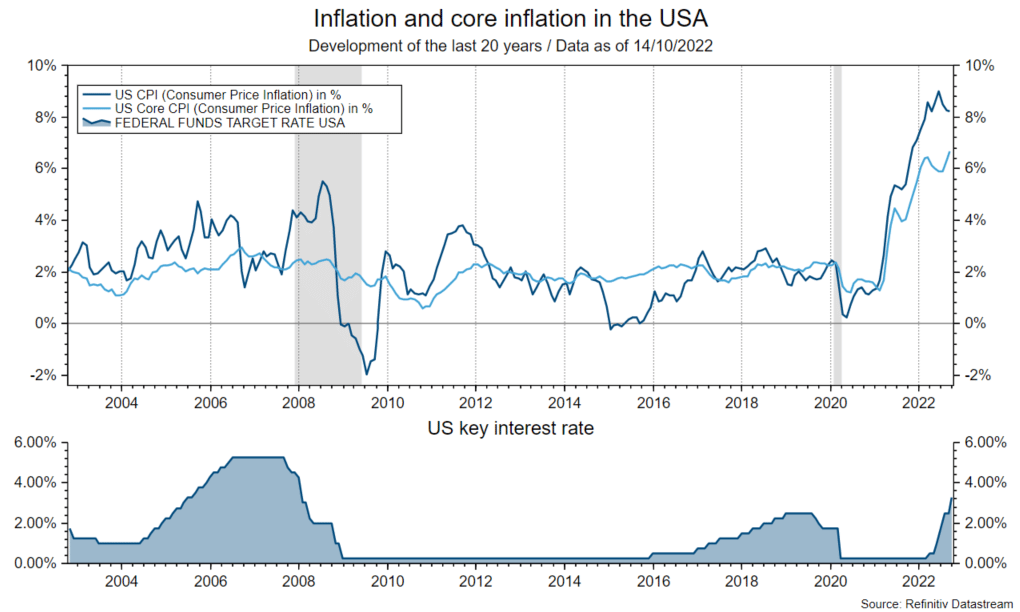

The underlying driving factor for the markets is inflation. In the OECD area, consumer price inflation rose by 0.4% in July and by 0.3% in August after very high increases in H1 (by 1.1% on average at monthly intervals). This can mainly be attributed to falling energy prices outside Europe (July: -2% p.m., August: -3.2% p.m.).

High house price inflation

In the U.S., consumer price inflation increased by 0.4% month-on-month to 8.2% year-on-year in the month of September. The inflation dynamics have four main characteristics: falling energy prices (-2.1%), rising food prices (0.8%), low goods price inflation (core rate: 0%), high service price inflation (core rate: 0.8%). Thereby, the high house price inflation is remarkable: 0.7% p.m. To summarize: Excluding food and house prices, inflation has risen by only 0.1%. The problem here is that, unlike food, persistence in the service sector could remain high. That is, once inflation reaches a high level, it will remain high even if economic growth cools. Inflation is a lagging indicator of economic momentum.

Fed could stabilize brake pressure

Excluding food and energy (core rate), inflation has risen 0.6% month-on-month to 6.6% year-on-year. These levels are far too high for the U.S. Federal Reserve. The Fed’s core message is that the cost of sustained high inflation is greater than the cost of a recession. At the same time, it is likely that the central bank will act more cautiously, perhaps even pause, if the targeted level for the key interest rate of 4.5% is reached by the end of the year. If so, the fed funds rate would have been raised by 4.25 percentage points between March and December.

Note: Past performance is not a reliable indicator for future performance.

The Fed is also aware that rapid monetary policy tightening affects the economy with a time lag of up to one year. Moreover, the negative feedback from the deteriorating market environment to the economy has intensified. Of course, the assumption that the Fed will at least not increase the braking pressure further next year only applies if the inflation dynamics change. Since 2021, inflation rates have been surprisingly high.

Inflation dynamics not well discernible

The theoretical question of whether a sharp weakening of demand (=recession) is necessary, or whether a mild weakening of growth will be sufficient (=soft landing) to weaken inflation is hotly debated, but a consensus has not (yet) been reached. However, because even the central banks are not in a good position to assess this, global recession risks remain elevated, as the basic stance is geared toward fighting inflation. The basic formula of “high inflation plus restrictive monetary policies plus deterioration of the financial environment plus uncertainty about further liquidity crises like in the UK equals global recession risks” still applies.

Hard or soft landing?

Corollary: Surprisingly falling inflation would only be positive for (most) markets in the case of a “soft landing” of the economy. Falling inflation combined with a recession would “only” be a positive environment for bonds (with low credit risk). Even if, in the short term, technical factors such as the particularly negative sentiment point to a recovery, the environment for the markets remains, shall we say: challenging.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.