“If it passes, the US Inflation Reduction Act would be a landmark legislative achievement.”

Joseph Stiglitz

“The good news is that if this legislation is signed into law it would provide far more funding for energy efficiency and sustainable energy than has ever been invested before.”

Bernie Sanders

“If passed, it would be the most important climate bill in history by a huge margin.”

The Wilderness Society

These are just a few of the voices of economists, politicians and NGOs on the “Inflation Reduction Act 2022”, which was passed uniformly by the Democrats in the US Senate on August 7 and now only needs to be signed by President Joe Biden.

Admittedly, the bill does not have such a resonant name as the originally planned “Build Back Better”, which could not be implemented due to internal party resistance. Nevertheless, the “Inflation Reduction Act 2022” retains virtually all of the originally planned subsidies, especially in the area of climate protection, and in some cases even more. John Berger, CEO of the American solar company Sunnova, put it in a nutshell in the earnings call: “If you had to write a perfect law for private solar companies, this would be it”.

A climate bill at its core

It is no coincidence that the Inflation Reduction Act has just been passed: the polls for Joe Biden and the Democrats are at an all-time low, and the proposed bill fulfills one of the key election promises before the mid-term elections in the USA in November. In addition to a minimum tax of 15% on companies and changes in the healthcare system, it is above all the promotion of renewable energies that can be seen as the core issue of the bill.

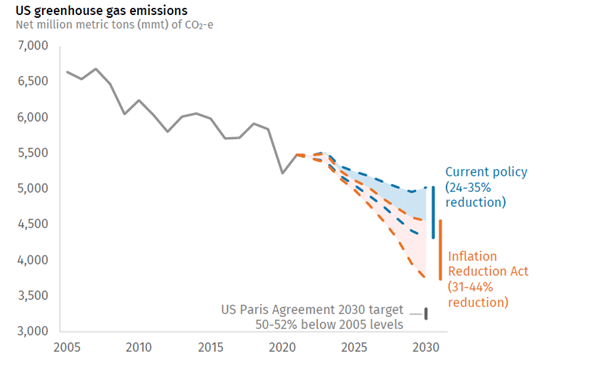

369 billion US-dollar are to be invested in renewable energies through various channels by 2030 and are intended to bring the USA closer to the goal set in the Paris Agreement of reducing CO2 emissions by 50% by 2030 compared to 2005.

As you can see in the following chart, the Inflation Reduction Act alone will not achieve this goal, but it does put the US back on track and re-establishes the United States as a leading force in the fight against climate change.

Strong tailwind for shares from the environmental sector

The subsidies are very broad and affect virtually every part of the renewable energy value chain – examples?

- 30 billion USD to build local manufacturing capacity for wind and solar

- 10-year extension for subsidies for wind and solar projects, depending on the share of domestic products, subsidies can be up to 50% (!)

- 30 billion USD in loan and subsidy programs to accelerate the energy transition

- Up to USD 7,500 subsidy for the purchase of electric cars

- 27 billion USD to promote technologies that reduce CO2 emissions

Admittedly, some of these examples are woolly and we will see how they are actually implemented. The bill has over 700 pages and has changed several times. The fact is that the Inflation Reduction Act will have a positive effect on topics such as solar, wind, hydropower, hydrogen, batteries, electromobility, energy efficiency, etc. The stock market has already responded: Sunnova, the solar company mentioned above, has made almost +50% since the announcement of the bill and is also one of the largest positions in our funds.

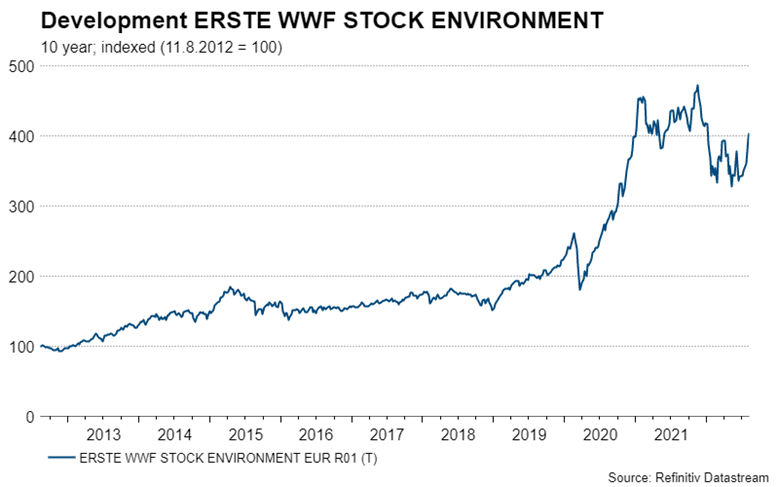

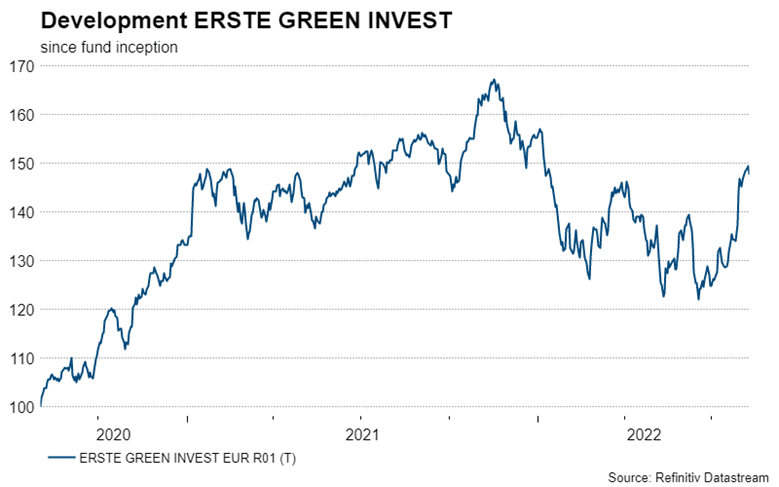

The ERSTE WWF STOCK ENVIRONMENT has gained more than 13% since the announcement on July, 27 – the ERSTE GREEN INVEST about 10%. In both funds we deliberately have an increased quota in the energy sector, which we have already built up after the outbreak of the Russia-Ukraine war. In the EU in May of this year € 600 billion were allocated for the promotion of renewable energies (REPower EU) – quasi for the same topics.

Almost ¾ of the fund is currently invested in stocks that will benefit from the Inflation Reduction Act and REPower EU. We therefore have a higher concentration in this segment than ever before – and we deliberately want to keep it high.

In a difficult market environment, it makes sense to focus on topics that have a structural advantage. For ERSTE WWF STOCK ENVIRONMENT and ERSTE GREEN INVEST, the global political tailwind, which has now also been cast into law in the USA, speaks for itself.

Having started with a quote from Joseph Stiglitz, I’d also like to end with one: “Development is about changing people’s lives, not just the economy.” The Inflation Reduction Act has the potential to accomplish both – we are confident!

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Thanks a lot for the great article