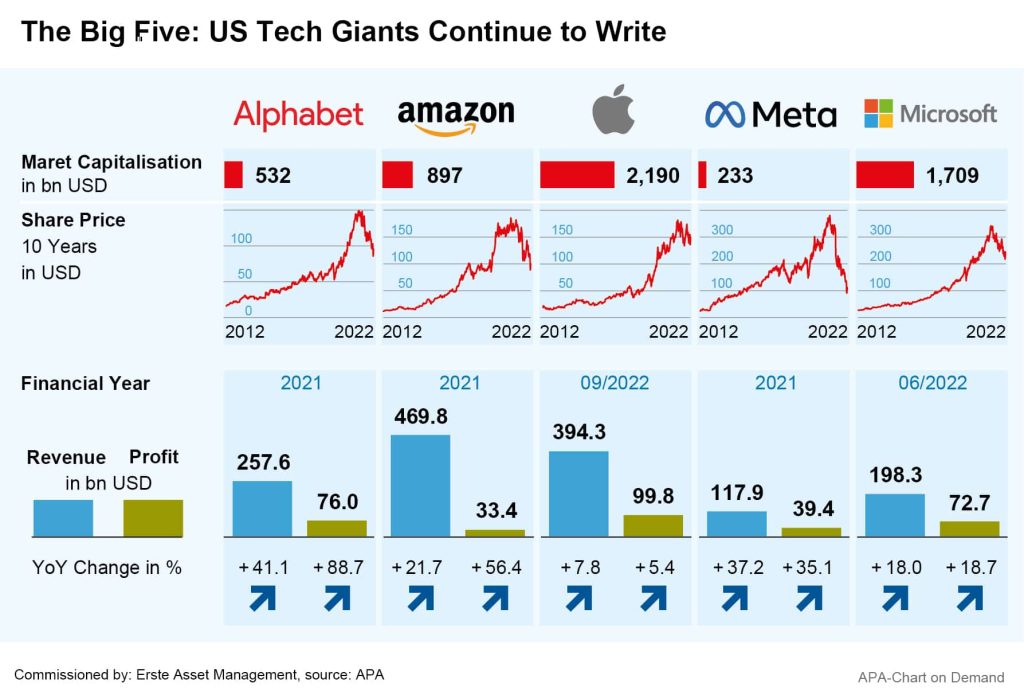

The five major US technology companies’ current quarterly results turned out fair to middling. Among the so-called “Big Five”, i.e. Google’s parent company Alphabet, Amazon, Apple, Facebook group Meta and Microsoft, Apple’s figures impressed the most. The other big tech companies such as Google and Microsoft continue to post profits in the billions, but are experiencing the effects of economic worries, restraint by consumers as well as advertisers and a sluggish cloud business.

Apple defied consumer reticence, mainly thanks to iPhone sales. In the last quarter, the company increased its revenue by 8 per cent year-on-year to USD 90.1bn. At the bottom line, profits rose from USD 20.55bn to 20.72bn.

Apple Continues to Profit From the iPhone’s Popularity

The iPhone was a central driver of Apple’s business, with an increase in revenue from USD 38.9bn to 42.6bn. The company itself does not reveal the number of sold units, but according to calculations by analysis firm Canalys, Apple was the only major manufacturer to increase sales – by 8 per cent to 53 million iPhones. Samsung retained the top position in the market with a market share of 22 per cent, but with 18 per cent, Apple is not far behind.

Recently, however, the Cupertino-based firm had to struggle with considerable delivery bottlenecks for its new iPhone 14 Pro. Production in China is currently affected by covid restrictions, Apple announced. China ordered a seven-day lockdown of the industrial park housing the factory of iPhone contract manufacturer Foxconn due to a coronavirus outbreak. According to insiders, the Apple supplier now plans to significantly expand its iPhone capacities in India to compensate for the manufacturing issues in China.

Apple’s Mac computer business also grew from around USD 9.2bn to a record USD 11.5bn amid a rapid contraction in the PC market. In contrast, iPad sales fell from USD 8.25bn to just under 7.2bn. Here Apple cited comparative effects – in the previous year’s same quarter, the then-new models boosted sales. The semiconductor supply bottlenecks, which had partly slowed down business in the past years, no longer play a significant role, said Apple CEO Tim Cook. In the services business, the revenue increased by 5 per cent to USD 19.2bn, growing more slowly than before. Among other things, the business with advertising and games in the App Store slowed down.

Apple’s figures were positively received on stock exchanges and by analysts, and the iPhone manufacturer’s share price rose by 7.6 per cent on the day after the results were published. Compared to the start of the year, Apple shares are still down more than 15 per cent, but have held up much better than those of other tech giants.

Amazon’s quarterly results, presented at the same time as the Apple figures, were punished with a drop on the stock market. Amazon shares lost 12 per cent on the day after publication, and have fallen by almost 40 per cent since the beginning of the year.

Amazon Disappointed With Outlook

The world’s largest online retailer expects a surprisingly weak holiday business in the face of increased inflation and recession worries. The company expects revenues between USD 140bn and 148bn for Q4, while analysts had expected considerably more. The profit forecast caused disappointment: Amazon expects earnings for the year’s last quarter to lie in a very broad range between zero and 4.0 billion dollars.

In the past third quarter, the company earned USD 2.9bn, nearly 9 per cent less than a year ago. Revenue increased by 15 per cent to USD 127.1bn, but also remained below market expectations. Even Amazon’s lucrative cloud division, which offers storage space and online services for other companies, saw its growth slow. Meanwhile, Amazon has announced a hiring pause for the coming months in light of the uncertain economic situation.

Microsoft With Profit in the Billions, but Disappointing Forecast

The quarterly figures of Alphabet and Microsoft were also received with disappointment on the stock market. Microsoft managed to increase its revenue in the summer quarter by 11 per cent to USD 50.1bn, slightly exceeding market expectations. However, an increase of 6 per cent was offset by a 14 per cent decline in net income due to higher expenditure. The revenue forecast of USD 52.4bn to 53.4bn for the current quarter, presented with the figures, fell short market expectations. Microsoft is likely to suffer from the stronger dollar, and the company is also expecting a slump in PC sales and thus also in its business with Windows installations.

Google and Meta Suffer From Declining Advertising Revenues

Google parent company Alphabet has reported a 6 per cent increase in revenue for its past quarter to around USD 69bn. At the bottom line, profits dropped from USD 18.9bn to around 13.9bn. Alphabet also suffered from the decline in advertising revenue: YouTube’s advertising revenue fell from USD 7.2bn to 7.0bn, the first decline since the publication of YouTube’s advertising revenue.

Facebook company Meta experienced a decline in advertising revenue as well. Meta’s revenue fell 4 per cent to USD 27.7bn in the past quarter. Bottom-line profits dropped 52 per cent to USD 4.4bn. In Q2, Meta had reported its first-ever revenue decline.

Meta sees itself a victim of its advertising customers’ thriftiness due to high inflation and worries about the economy. Meta also had to contend with competitors such as the ByteDance subsidiary TikTok and Apple’s new data protection rules. In an initial reaction on the stock exchange, the reaction to Meta’s figures was a price drop.

Zuckerberg Betting on Metaverse

Many investors also feel rubbed the wrong way by Meta founder Mark Zuckerberg’s focus on his vision of the future of the Metaverse. For the time being, the development of the virtual world costs a lot of money, with no profits in sight. In the past quarter alone, the corresponding Reality Labs division posted a loss of almost USD 3.7bn, and Meta foresees further losses for the time being. Zuckerberg, however, continues to adhere to his vision of a virtual world. The Meta CEO recently announced a massive cut of 11,000 jobs, but wants to continue to invest heavily in the Metaverse.

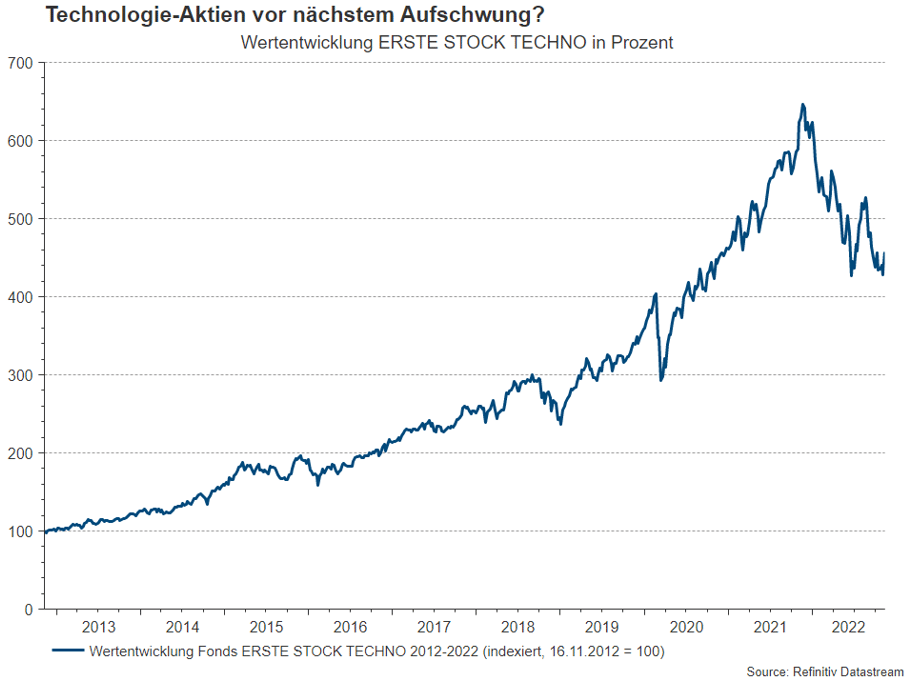

Bet on a comeback of US technology stocks with ERSTE STOCK TECHNO

Stocks of the US tech giants have seen significant price declines this year. In the years before, there were above-average price gains. With the prospect of lower inflation rates in the future, as indicated by recently published data in the USA and Europe, the situation could now ease. ERSTE STOCK TECHNO is an equity fund that invests primarily in technology companies from the USA, including some of the companies mentioned in the blog. This actively managed, broadly diversified fund is a good investment for investors with a corresponding willingness to take risks who would like to use the price reductions to build up positions.

Note: Past performance is not a reliable indicator for future performance of an investment.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.