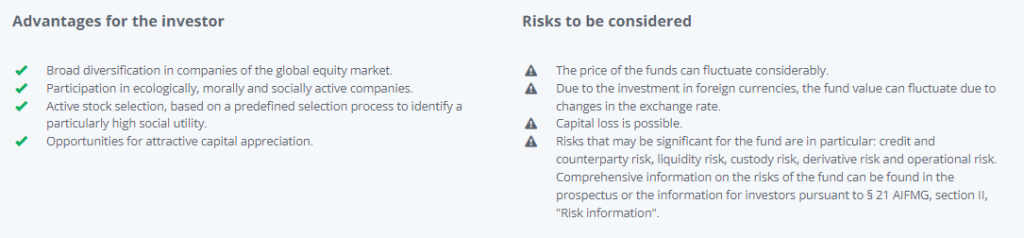

Please note that an investment in securities also entails risks in addition to the opportunities described.

About a year ago, we launched the social impact fund ERSTE FAIR INVEST – a good reason for us to take a closer look at the fund that puts the S in ESG. In addition, the fund manager Bernhard Selinger explains the term “fair” in an interview and illustrates how companies can assume social responsibility on the basis of two examples.

Impact investments with significant gains

Sustainable investments remain popular with Austrian investors. In 2021, the volume of sustainable and responsible investments reached all-time highs in Austria, as the market report of the Sustainable Investment Forum (Forum für nachhaltige Geldanlage, FNG) illustrates.

So-called impact investments recorded particularly substantial profits. The goal of impact investments is to achieve a positive social and ecological impact in addition to financial return. According to FNG, this area posted a clear increase of more than 200% in 2021 relative to the previous year.

Social factors play an important role

Sustainability and sustainable investments are often only seen in connection with environmental criteria and ecological aspects, when, really, social factors play an important role as well. Here, capital is invested in a socially responsible way. ERSTE FAIR INVEST therefore focuses on these social aspects and invests globally in companies that create social utility.

The United Nations also attach great importance to social aspects in their Agenda 2030 for Sustainable Development. The UN sustainable development goals (SDGs) include a number of aspects that ERSTE FAIR INVEST is structured to actively support:

Labour, society, health & well-being

ERSTE FAIR INVEST contains a broad array of topics that are of great importance to society. The three focal themes of the fund can be broken down into three strands. One of them is labour. It includes issues like fair working conditions, remuneration, diversity, and inclusion. Another strand is health & well-being. The third strand is society. This includes topics such as access to education, financial inclusion, and social infrastructure in cities.

How are the securities selected for ERSTE FAIR INVEST?

The composition of the fund is based on active selection, i.e. it does not follow a benchmark index. Criteria of exclusion that apply generally for Erste Asset Management of course also apply for ERSTE FAIR INVEST. Among them are, for example, child labour, banned weapons, and coal mining.

At the next step, the companies fulfilling these minimum criteria are screened for all three ESG factors (i.e. environmental, social, and governance). Only those companies are admitted to the ERSTE FAIR INVEST investment universe that score 50 or higher in the ESGenius rating. This universe is subject to ongoing scrutiny and updates in order to take into account the latest developments.

Finally, we select solid and well-managed companies that have a measurably positive impact on society with their goods and services from this defined universe for investment. It is crucial to actively monitor and select companies in order to achieve this goal.

Interview with fund manager Bernhard Selinger

In the interview, fund manager Bernhard Selinger discusses the term “fair”. He also explains why assuming social responsibility does not have to be at odds with the business goals of companies. Two exemplary companies illustrate particularly well how to a create positive social impact.

- What does the term “fair” actually mean?

The term “fair” has multiple layers, generating a variety of different associations. For this fund, we have deliberately chosen a holistic approach and take into account all aspects of well-being.

This may be on a personal level, where we all need different things to be well: sports, a healthy diet, pets may all contribute to a balanced being. For this fund, we invest in companies that enrich our lives sustainably.

The work area is important as well. We believe that companies with a diverse group of satisfied employees and a balanced ratio of female to male managers are more successful in the long run.

In terms of social parameters, we focus on fair opportunities, broad access to education, financial inclusion and financial literacy, and social infrastructure as building blocks for a fair society with a high standard of living.

- The focus has shifted to social topics not the least as a result of the Covid pandemic. Do you think that this trend will last?

Absolutely. Whereas in previous years we were focusing mainly on environmental topics, we can now see that more and more people are paying attention to social topics, i.e. the S in ESG.

The timing is no coincidence: the pandemic highlighted many social problems, e.g. with respect to the working conditions in global supply chains. However, the pandemic also effected a newly found solidarity in society and illustrated how important social topics were also in investment.

Politics are supportive as well. For example, Germany passed a law in autumn 2021 (“supply chain law”) which obliges companies to assume responsibility in their supply chains and to ensure that no human rights violations occur. The Social Taxonomy of the EU is currently pursuing a much more far-reaching standard unified across the EU.

Climate protection has shown us that stronger awareness can fuel support from consumers, politicians, and the capital market – and now the focus has moved to social issues.

“Whereas in previous years we were focusing mainly on environmental topics, we can now see that more and more people are paying attention to social topics, i.e. the S in ESG.”

Bernhard Selinger,

Fondsmanager ERSTE FAIR INVEST

- Can you give us examples of companies with positive impact in which ERSTE FAIR INVEST is invested?

Impact means for the fund that we want to contribute positively to society, i.e. we want to achieve a positive change. This could be in the health(care) sector, where the pharmaceutical company Gilead Sciences distributes e.g. HIV drugs in emerging countries at cost and thus facilitates access to therapy for millions of people.

In the social segment (i.e. society), I can think of financial inclusion and of credit institutes that give people access to essential banking services regardless of their income and promote financial literacy in society. A positive example in this context is Bank Rakyat Indonesia, which is a pioneer in microloans.

- Are the companies your fund is invested in profitable as well, and do they have a sustainable business model?

Absolutely – we invest in solid and successful companies that take on social responsibility. These companies not only do the right thing, they also benefit from it at the bottom line.

This makes intuitively sense: we are talking about a competitive advantage due to well-trained and satisfied employees as key to long-term corporate success. For example, many sectors depend crucially on highly skilled labour.

The awareness of social topics among consumers is also on the rise, which in turn means higher demand for companies that can prove that no human rights violations are being perpetrated across their global supply chains.

And lastly, responsible action prevents corporate scandals (which not only cost money but also entail significant reputational damage) and thus creates a basis for sustainable corporate success.

This article is part of the ESGenius Letter on the topic “Social – The ‘S’ in ESG”. Further information and insights from our experts on social factors in sustainable investment can be found here.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.