Global equity markets have been under pressure for several months. The leading US indices, Dow Jones Industrial Average, S&P 500, and NASDAQ Composite have lost 18.5%, 24.8%, and 34.0%, respectively, in the year to date (as of 14 October 2022). The brief recovery in summer was followed by a September during which the three aforementioned indices shed more than 5% again. What are the reasons for the current bear market? And how can a retail investor know when it is the right time to invest in equities?

Various reasons for bad sentiment

The main drivers of current developments are diverse and partly stem from regional differences. The central banks have to manage their interest rate policy in such a way as to reduce the pressure on the upward spiral of consumer prices. In the United States, the Federal Reserve Bank (FED) is at the forefront with its aggressively restrictive interest rate policy (manifested by Fed funds rate hikes). The European Central Bank (ECB), while acting somewhat more cautiously, has ultimately also raised the key-lending rate significantly. You can read why higher interest rates cause falling stock prices in the recent blog article of my colleague, Harald Egger.

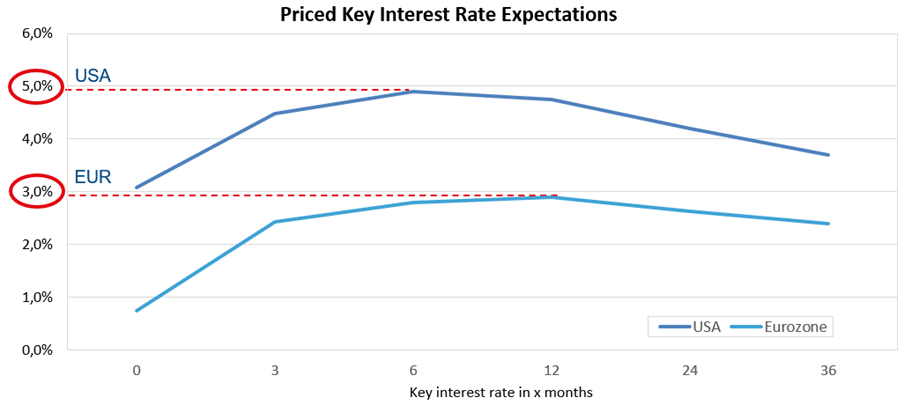

The forward guidance provided by central banks is another important parameter taken into account by the market participants. The FED has already signalled that it will maintain higher interest rates for an “extended period”. At the moment, key-lending rates are expected to peak in the coming six to twelve months (USA: ~4.9%, Eurozone: ~3.0%). Current market prices already reflect these key interest rate expectations.

Note: Prognoses are not a reliable indicator of future performance.

News flow as driver of uncertainty

The points mentioned do not only sound negative – they are. However, one should not forget that none of them are news that can surprise the market. So, would now be a good time to invest in equities, since everything negative is already priced in? – Unfortunately, it is not as simple as that…

By definition, news comes unexpectedly, often surprisingly. Risks that may not yet have been priced into the markets – such as even higher key interest rates than mentioned above, larger than expected declines in company earnings, or a prolonged recession in 2023 – could, among other factors, further hurt the equity markets. It is impossible to predict when, if at all, we will see a surprising negative news flow and how strong or weak an impact it will have on market prices.

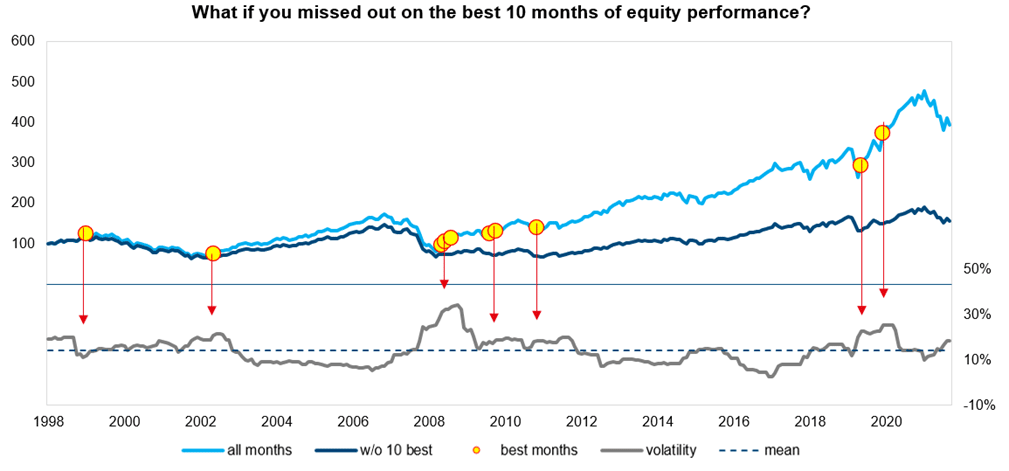

In times like these, the question is often asked whether it would not make sense to simply hold cash or money market instruments and wait. The following chart shows that this approach could come at a a high price.

Note: Past performance is not a reliable indicator of future performance of an investment.

The light blue line in the chart shows the performance of the global equity market since the introduction of the euro. The dark blue line illustrates what the performance would have been if one had not been invested in equities for the ten months with the highest return (marked by yellow dots). The resulting difference in return is obvious. The grey line in the lower part of the chart shows the annualised standard deviation on a rolling basis. Almost all of the best months occur during periods of above-average volatility.

Conclusion: long-term holding strategy often outperforms market-timing

What does all this mean, then? Volatility rises because of the uncertainty in the market. Having to ride out fluctuations does not feel good. As a result, investors may refrain from investing their money in equities. However, as seen above, this could result in missing out on capital gains. The well-known quote “Time in the market beats timing the market”, i.e. that being invested for the long term is usually better than trying to guess the right entry and exit times, seems apt here.

Historically, holding cash and “waiting for better times” has been a costly mistake – especially during times when being invested in equities didn’t feel good. Is it the same this time?

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.