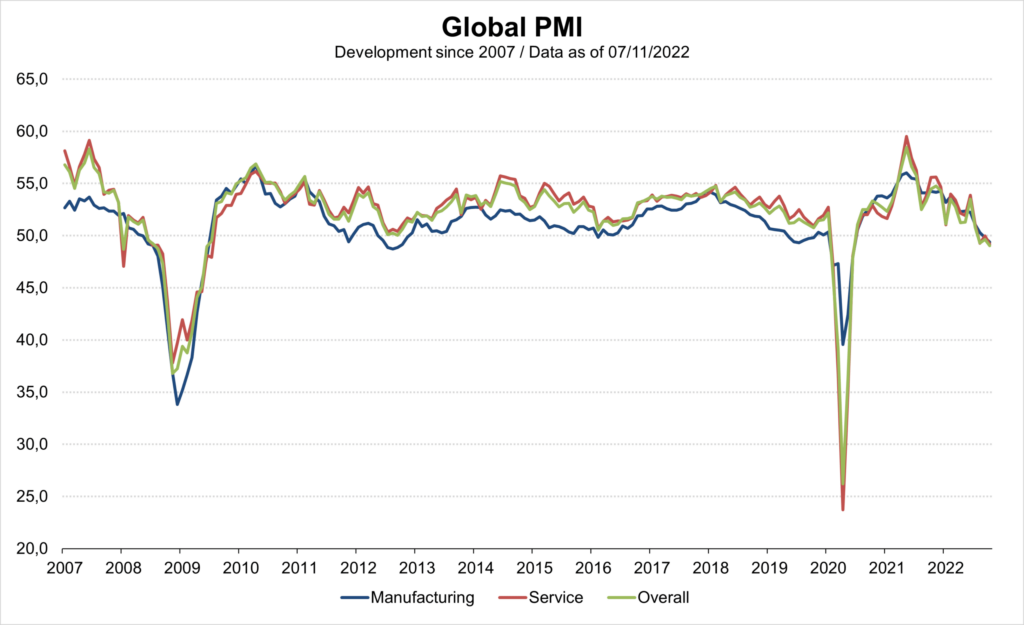

Falling economic indicators

The majority of economic indicators are in line with weak real economic growth. However, the falling trend is worrying. For example, the global purchasing managers’ index also continued its falling trend in the month of October (49.0). The low level of new orders (49.1) points to weakening demand. The employment component (at 51.0) has also lost some of its strength in recent months. Unsurprisingly, the sentiment component has fallen further. After all, sales prices are also down. It is also noteworthy that both sectors (manufacturing: 49.4; services: 49.2) are losing momentum in numerous countries. Because the rapid, strong and synchronous increases in key interest rates and the higher cost of capital are only reaching the real economy with a time lag, a further weakening of economic activity is likely. The risks of a global recession have increased.

Note: Past performance is not a reliable indicator for future performance of an investment.

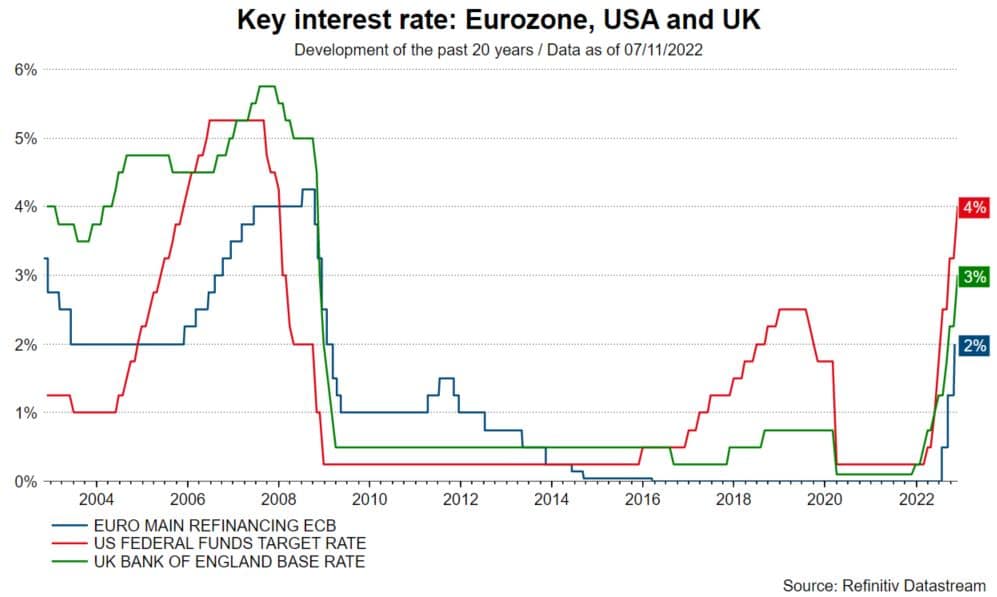

Reduction in the pace of interest rate hikes

More and more central banks are signaling a reduction in the pace at which they raise policy rates. However, this does not necessarily mean that central banks are softening their focus on fighting inflation. Even a pause in the raising cycle may represent hawkish policy when (falling) economic growth indicators would actually already call for rate cuts.

Fed remains hawkish

The US Federal Reserve provides a good example of this. Last week, the key interest rate (upper band) was raised from 3.25% to 4.0% in the USA, as generally expected. The statement on the interest rate decision talks about the fact that future decisions will also take into account the interest rate hikes that have been made so far and the time-lagged effect of monetary policy on the real economy. This provides a hint for a December rate hike from 4.0% to 4.5%. However, in the press conference, Chairman Powell opined that data suggest a higher end point for rate hikes than originally thought (in September). This points to a key interest rate level of at least 5% in the first quarter.

Note: Past performance is not a reliable indicator for future performance of an investment.

For a pause a change in inflation dynamics is necessary

A necessary condition for a pause in the rate hike cycle is a change in inflation dynamics. Until September, inflation data surprised to the upside in many countries. When this process breaks, it becomes easier for a central bank to argue a pause without losing credibility. After all, the case for falling inflationary pressures is growing: commodity prices for energy have fallen, goods price inflation is falling, delivery times are getting shorter, and evidence of falling price pressures due to falling demand is also growing. Both the magnitude of first-round effects (from energy to the other sectors) and that of second-round effects (wage developments) remain a major uncertainty. Since the beginning of 2021, inflation dynamics are not sufficiently understood.

ECB signals further interest rate hikes

This can also explain the rather hawkish statements made by numerous members of the ECB Governing Council. After all, the flash estimate for consumer price inflation in October was (once again) above expectations at 1.5% on a monthly basis and 10.7% on an annual basis. A further interest rate hike in December by at least 0.5 percentage points to 2% (discount rate) is likely. All the more so as the unemployment rate in the euro zone reached a new low of 6.6% in September.

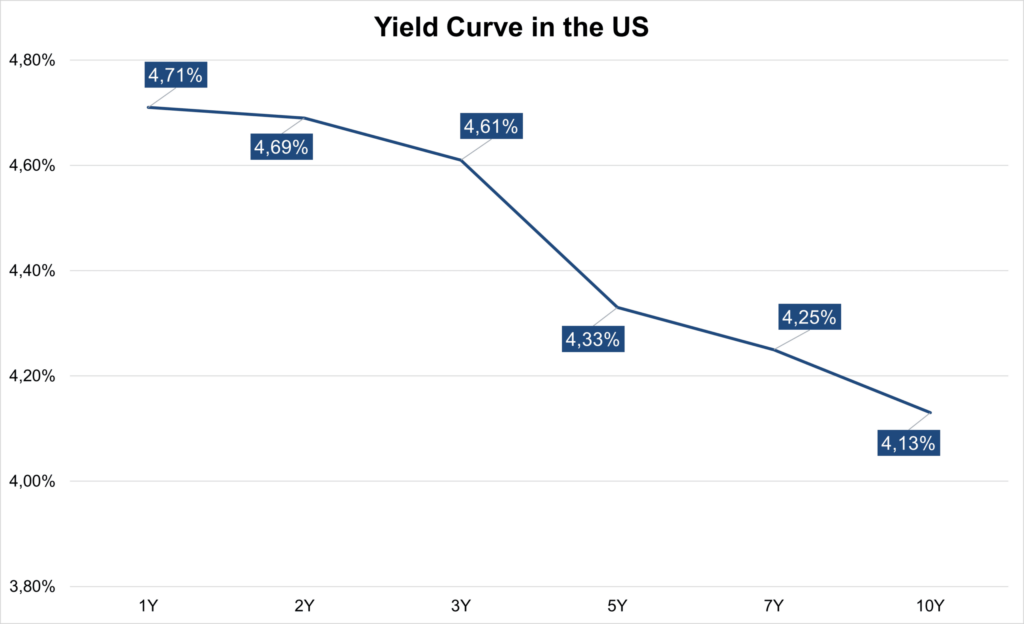

Inverted yield curve in the USA

In the USA, the two-year yield on government bonds has now been above the ten-year yield since July (currently: 0.5 percentage points). Statistically, this provides a strong indication of an impending recession. This environment of an inverted yield curve is likely to persist. This is because the Fed is signaling that it will keep key interest rates at a restrictive level for some time, even if this means pain.

Bank of England becomes dovish

What happens when you change the rhetoric too soon from hawkish (geared toward fighting inflation) to dovish (geared toward weak growth) can be seen in the policy of the central bank in the United Kingdom (Bank of England). Last week, the key interest rate was raised further and sharply by 0.75 percentage points to 3.0%. However, the statement said that the key interest rates priced into the market (then at over 5%) were too high because they would trigger a severe recession. With inflation rates in September at 0.5% on a monthly basis and 10.1% on an annual basis, the signal effect was unfavorable. Interest rate hike expectations (the two-year yield) fell, while the ten-year yield rose (higher inflation risks).

In the current environment, where inflation rates are high and the inflation dynamic is not well understood, the biggest risk for monetary policy is that it is not hawkish enough (too few rate hikes, rate cuts too early). This is because if inflation persistence remains high, it could be difficult to reduce it. At least the U.S. Federal Reserve is following this policy. A reduction in the pace does not mean a departure a hawkish policy stance. However, a reduction of the interest rate hike expectation priced into the market by mild statements (with regard to the fight against inflation) does.

In the current environment, where inflation rates are high and momentum is not well understood, the biggest risk for monetary policy is that it is not sharp enough (too few rate hikes, rate cuts too early). This is because if inflation persistence remains high, it could be difficult to contain. At least the U.S. Federal Reserve is following this policy. A reduction in the pace does not mean a departure from a hawkish monetary policy stance. However, a reduction of the interest rate hike expectation priced into the market caused by dovish statements (with regard to the fight against inflation) does.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.