Latest Posts

ECB interest rate policy: First rate cut, and then?

The European Central Bank is likely to cut its key interest rate tomorrow for the first time since the interest rate turnaround in 2022. But what comes next? Will the first cut herald a series of interest rate cuts or will the monetary guardians remain cautious? Chief economist Gerhard Winzer takes a look at the ECB’s possible future interest rate policy.

ERSTE OPPORTUNITIES MIX: the most important questions and answers

Taking advantage of short- and medium-term opportunities on the markets while at the same time focusing on long-term future trends – the new mixed fund ERSTE OPPORTUNITIES MIX makes this possible. We have summarized the most important questions and answers on the launch of the new fund.

China hopes to extend its export boom with continued investments

Thanks to booming exports, the Chinese economy started the year with surprisingly strong growth. As growth has now lost some of its momentum, the aim is to keep the export boom going with new investments. However, this could have a negative impact on the trade dispute with the US and the EU.

International Monetary Fund/World Bank Group Spring Meetings 2024

At this year’s spring meeting of the International Monetary Fund and the World Bank, the focus was on the increasingly unlikely recession in the USA as well as the future monetary policy and the political situation. Fund manager Tolgahan Memİşoğlu reports on his impressions.

Short-term opportunities or long-term trends – why not both?

Investing in the major trends of the future while taking advantage of short-term market opportunities – the new mixed fund ERSTE OPPORTUNITIES MIX makes this possible. Alexander Lechner, Head of Multi Asset Management, explains the concept behind the fund in an interview.

Investment strategy: What happened to the recession?

The topic of an impending recession has recently become quieter again – especially in the USA. A look at a few indicators helps to assess whether the spectre of recession has actually been banished (at least for the time being).

The miracle forest and why we need to protect it

The forest ecosystem is not only an important carbon store, but also a habitat for a variety of plants and creatures. In this interview, Robert Pröll, farmer, national park ranger, and speaker at this year’s sustainability conference, explains why we need to protect the “miracle of the forest” more than ever in the fight against the climate crisis.

20th Anniversary of the 2004 EU Enlargement: The Success Story Continues

The EU is celebrating a political and economic success story with the 20th anniversary of the EU’s eastward enlargement on 1 May. The countries that joined at that time and those that followed have caught up massively in economic terms. The signs continue to point to solid growth in the region.

At the pulse of opportunity – new mixed fund about to launch!

Combining long-term trend themes with short and medium-term market opportunities: The new broadly diversified mixed fund ERSTE OPPORTUNITIES MIX makes this possible with its active and flexible approach.

Investment strategy: Turning points

The good performance of equities has suffered a small setback since the end of March. Such turning points are difficult to predict on the markets – and yet there are a few approaches and indicators that can provide clues.

Sustainable finance initiatives – a jumble of letters or effective multi-stakeholder approaches?

Sustainable finance is a dynamic process that aims to make the financial system sustainable. In his guest article, Michael Schmidt, member of the Sustainable Finance Advisory Board of the German Federal Government, explains why the many different initiatives on the topic of sustainable finance are needed and which three points are necessary for the sustainable transformation of our financial system.

Socially sustainable investment – how does it work?

Investing sustainably in companies with a social impact – this is possible with the ERSTE FAIR INVEST equity fund. In this interview, fund manager Bernhard Selinger explains how he finds socially sustainable companies for the portfolio and why a sustainable strategy is also good for the company’s success.

EVs: Industry plans to drive sales with price reductions, compact models, and new batteries

Even though the car industry continues to focus on e-cars, demand has recently stalled somewhat. In addition to the major car manufacturers, more and more tech companies are entering the market. Meanwhile, a new hope for the future is emerging in the field of battery technology.

Animal Spirits – Excessively positive sentiment on the markets?

The stock markets performed consistently well in the first quarter of the current year. From the USA to Europe and Japan, many indices reached new all-time highs. In view of this positive performance, can we already speak of exaggerated euphoria on the markets?

Attack on Israel

The smouldering conflagration in the Middle East reached a new level of escalation last weekend. Iran attacked Israel directly with drones and missiles for the first time in history. There is a risk of further escalation between Iran and Israel. How is the market reacting to this?

“Back to business” after the election in India?

The parliamentary elections in India, which will last 44 days, will begin in the coming days. The economically up-and-coming country has also recently become the most populous country in the world. What can we expect from the election and how could India develop afterwards?

Favorable indicators: Soft landing on approach?

More and more indicators are pointing to good global growth. Even regions and sectors that had recently weakened are likely to return to growth. The soft landing after the sharp rise in inflation and the turnaround in interest rates could succeed. The decline in inflation is pausing at the same time, as yesterday’s US inflation data shows.

Green technologies: US elections as showstopper?

The Inflation Reduction Act has triggered billions of dollars of investment in green technologies in the USA. Are the subsidies and tax breaks for renewable energies at risk in view of the upcoming US election? Clemens Klein, fund manager of ERSTE GREEN INVEST, provides some answers.

India: The new counterweight to China?

The Indian economy is booming as more and more companies see the country as a potential alternative to China. In the coming years, India wants to become the third largest economy in the world. What is behind these ambitious plans? Is India really the market of the future?

World Water Day: the (scarce) blue gold

Droughts and water shortages are also increasing in Europe – what can be done about them? When investing, it certainly makes sense to take a close look at the water risks of companies. If you want to go one step further, you can also specifically integrate the topic of water into your portfolio.

Best of Charts: Warm-up for the US election

The US presidential election in November is already casting its shadow. What impact could the outcome of the election have on share prices and how is the US economy performing in general.

Pharma industry continues to profit from booming weight loss drugs

The boom in weight loss products has long since spread to the stock markets. While the shares of pharmaceutical companies Novo Nordisk and Eli Lilly are benefiting from the high demand, other industry giants are also looking to follow. However, experts are also warning of possible side effects of the drugs, which were originally developed to treat diabetes.

Interest rate cuts and economic growth – a favourable environment for the markets

Even though the ECB recently left its key interest rate unchanged, central banks are increasingly signaling an inclination to cut interest rates for the first time. At the same time, the indicators point to good economic growth at a global level. These are positive signals for the stock markets.

Is this time different?

The risk premiums on corporate bonds are close to their lows. What are the reasons? Is a correction imminent or is everything perhaps completely different on the bond market this time?

What is the key interest rate?

Ahead of the ECB’s upcoming interest rate decision, there is much discussion about the central banks’ interest rate policy and the key interest rate – will it be lowered or not? Its development has a significant influence on the economy and the financial markets. In this article, we discuss the role of the key interest rate and which interest rates are relevant.

Swimming against the tide with alternative investments

Alternative investment strategies are not comparable with traditional asset classes such as equities or bonds – this is precisely their charm. But how do these strategies work and how can investors invest in them?

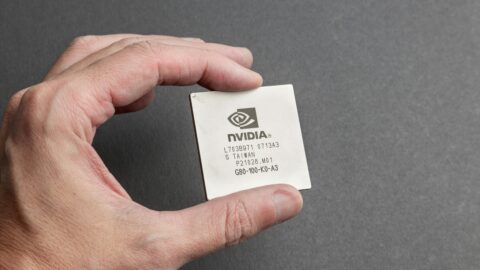

AI Boom Yields Strong Quarterly Gains for US Tech Giants

The topic of artificial intelligence continues to flourish on the stock market. The US chip company Nvidia recently attracted attention with another strong set of quarterly figures. How did the rest of the “Magnificent Seven” fare in the reporting season and what are the plans of the tech giants in the AI sector?

Money tip: Are biotechnology stocks at the outset of a new upswing?

Biotechnology stocks have been back in the spotlight since the beginning of the year. Successes in research and market approvals for new drugs could provide fresh impetus. Is the sector worth a look now?

Corporate bonds – Why emerging markets are worth a look

Fund manager Thomas Oposich explains in an interview what makes investments in emerging market bonds interesting and which sectors and companies he considers promising.

Stock market at all-time high: What are the reasons?

Several important stock indices have recently reached new record highs. What are the reasons for the positive sentiment, what could move the markets this year and what about the much-cited Magnificent 7?

Global Economy: IMF with more positive outlook

According to the IMF, the global economy could grow more strongly than expected this year. In the US and China, the economy is likely to remain robust, although growth in the People’s Republic is likely to weaken. The experts are less optimistic about the German economy.

🍋 Dividend basics for shareholders

An increasing number of investors, when selecting shares, do not only focus on share price performance, but also on a stable, high dividend – for good reason.

US interest rates: What are we to expect in the coming months?

As the latest data shows, the US economy continues to grow strongly – despite the significant interest rate hikes in the past two years. What impact will this have on the Federal Reserve’s future interest rate policy and when could the first rate cuts follow?

Davos 2024: Climate Crisis, AI, geopolitics and interest rates were key topics

Last week, many high-ranking representatives from politics and business once again gathered in Davos, Switzerland, for the annual World Economic Forum. The most pressing topics were the use of AI, the climate crisis and geopolitical tensions. Meanwhile, central bankers made interesting statements on future interest rate policy.

Inflation, interest rates, markets: 10 topics for 2024

After the price rally at the end of last year, the markets started 2024 with price losses. The ongoing positive correlation between bonds and equities is striking. Both asset classes have fallen equally recently, which makes diversification in a portfolio more difficult. But the year has only just begun. We therefore take a look at 10 key topics for 2024 that could be helpful when putting together a portfolio.

Money tip: Invest in Japanese stocks

Following the recent gains in the Japanese benchmark index, the stock market of the world’s third-largest economy could be worth a look. What is the state of the economy and monetary policy in the “Land of the Rising Sun” and how can investors invest in Japanese stocks?

Market outlook: What investors can expect in 2024

2023 brought many surprises – including positive ones, such as the unexpectedly good performance across all asset classes. What can investors expect in the new year and which topics could come into focus? Gerald Stadlbauer, Head of Discretionary Portfolio Management, provides an outlook.

Climate Score: How we can identify sustainable leaders and laggards

In order to further improve sustainable company analysis, the Responsible Investments team at Erste Asset Management developed the Climate Score last year. The score combines various environmental data to identify the sustainable leaders and laggards in each economic sector. Read the blog post to find out how the score works and what it can be used for.

US elections 2024: The United States and its debt

In 2024, all eyes on the financial markets are also focused on the US elections in November. After years of expansionary fiscal policy, the debt situation in the United States is also coming back into focus in the run-up to the elections. What are the political and economic implications of the growing budget deficit?

Stock markets review: Hopes for interest rate cuts fuelled significant gains in 2023

The international stock markets closed out 2023 with significant gains. Hopes of abating inflationary pressure and declining interest rates were the main market drivers in Q4, resulting in a strong year for stock exchanges.

Best of Charts: What’s coming, what’s going, what’s staying?

After a weak market year in 2022, 2023 is shaping up to be a pleasing conclusion for investors. Senior Fund Manager Christian Süttinger explains what remains of this year and what could be of particular interest on the markets in 2024 with the help of a few currently important charts.

Norway: Visiting sustainable portfolio companies

Norway has the largest oil reserves in Europe. Nevertheless, the Scandinavian country is considered a pioneer in the use of renewable energies. There are also many companies in the industrial sector that are working on sustainable value creation. Fund manager Markus Gruber visited some sustainable companies from the portfolios of the impact funds ERSTE WWF STOCK ENVIRONMENT and ERSTE GREEN INVEST.

How can I as an investor benefit optimally from structural changes?

Megatrends are long-term developments that not only change the financial markets, but also global economic and social life. As an investor, you can benefit from these trends, especially with a long-term investment horizon, provided you are aware of the risks and opportunities of such a strategy. Find out which structural changes could shape the markets in the future and thus offer opportunities for investors in the blog post.

Argentina: Javier Milei Presidente! Wind of Change?

Following his surprising election victory, the controversial economist and self-proclaimed “anarcho-capitalist” Javier Milei was sworn in as Argentina’s new president. He takes over a country in economic crisis with an annual inflation rate of over 100 percent and a high debt burden.

Capital markets outlook 2024: good opportunities in the US election year

After a difficult market year in 2022, many asset classes performed much better this year. The outlook for the coming year 2024 is also positive – the central banks’ turnaround in interest rates has brought about a return to normality on the bond market and, with the rise in yields, is also opening up new opportunities for investors. At the same time, the ongoing geopolitical tensions in particular pose a challenge. With the improved yield opportunities for bonds, mixed funds are also coming back into focus.

Members of OPEC+ plan to further cut oil production

The OPEC+ oil association was unable to agree on official production cuts at its meeting last Thursday. However, individual member states announced plans for cuts. In a joint statement after the meeting, the more than twenty OPEC+ states also announced that Brazil would join the production alliance at the beginning of next year.

Increasing optimism for a “soft” economic landing

While equities have recently risen, yields on the bond market have weakened. The markets are being supported by increasing hopes of a “soft” landing for the economy. What are the chances of this scenario?

Turkish economy on the road to normalization

After years of numerous hardships, the political and economic signs are changing in Turkey. Growth, which has returned this year despite high inflation and interest rates, is expected to continue in the coming years according to forecasts. International investors have also rediscovered the Turkish stock market.

Surprise result in the Dutch elections

After around a year, the Dutch government under Prime Minister Rutte collapsed in the summer of 2023 due to disagreement over migration policy. It came as a surprise that long-serving Prime Minister Rutte decided not to stand again in the next elections. After more than thirteen years in office, making him the longest-serving prime minister […]

Can China’s economy still be revived after the slowdown?

According to Covid, growth in the Chinese economy is lower than expected and the willingness to invest and consume is declining. The real estate market is also adjusting after the boom years. What short- and long-term measures does the central government intend to take to revive the economy?