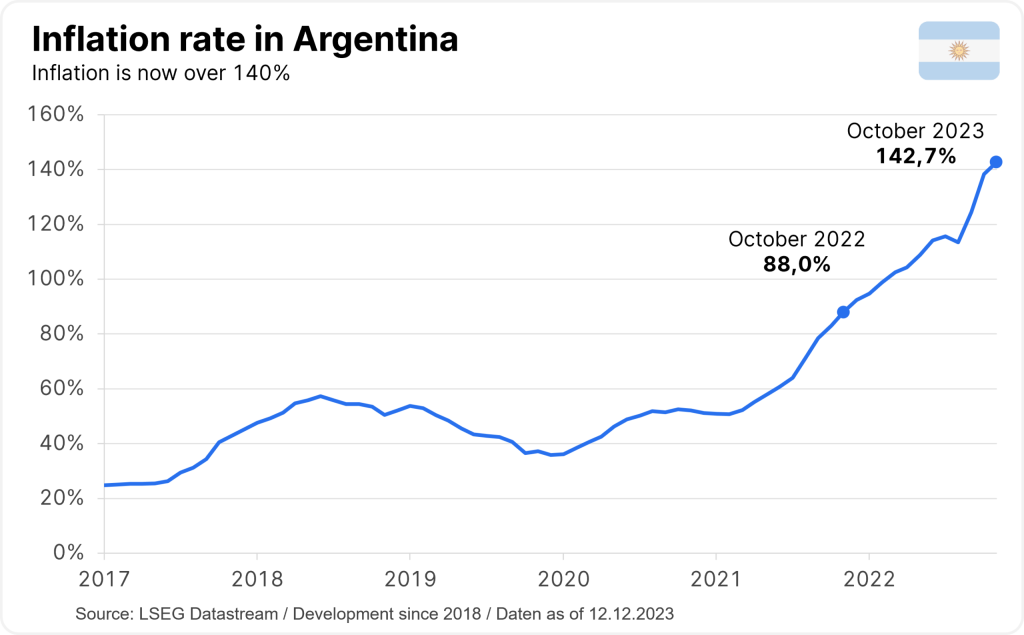

Following the resurgence of the political left in Latin America in recent years (Mexico, Chile, Brazil), Javier Milei’s election victory is a desperate cry for change from the people and a leap into the unknown. The left-wing Peronism that had ruled Argentina until then left behind an economic fiasco. For example, an annual inflation rate of over 100 percent and a unique dependence on multilateral financial organizations, above all the IMF.

Economist and “anarcho-capitalist”

The economist Milei and his “anarcho-capitalists”, libertarian and ultra-right, are obsessively pursuing a single political goal: the total and final destruction of Kirchnerism, the progressive wing of (left-wing) Peronism. Their brazen style and penchant for conspiracy theories show remarkable parallels with Donald J. Trump. Milei took office on December 10 without governors or parliamentary majorities and with broad sectors opposed to his policies. Before the election, he affirmed that he would break off relations with “communist” Brazil and China as soon as he became president. Even the Pope is a communist in his view.

China is Argentina’s most important trading partner, ahead of the USA and Brazil. In the meantime, however, the economic realities with Lula and Xi Jinping have led to a cuddly course again. The Managing Director of the IMF, Kristalina Georgieva, congratulated Milei and told him that she expected to work with his government on “a solid plan to ensure Argentina’s economic stability”. The president-elect confirmed that he had already had his first meeting with the organization and that the dialogue had been going on since August.

Milei‘s Cabinet

Economist Luis Caputo will head the Ministry of Finance and Economy. The 58-year-old, who has worked in the banking and financial sector for many years (including at Deutsche Bank), was Finance Minister for one year under Mauricio Macri (2015-2019) and briefly President of the Central Bank. Milei justified his choice with his expertise in financial reforms. Caputo is not actually considered unorthodox.

Economist Diana Mondino becomes the new foreign minister. She has already given assurances that Argentina will not join the Brics group (Brazil, Russia, India, China, South Africa). And Milei has already said in advance that he would try to leave the Southern Common Market (Mercado Común del Sur, Mercosur), which is “useless” for Argentina, and that he would act quickly to deregulate the commodity markets.

Milei’s further program

He pledged to “dissolve” the central bank and prohibit the use of bank deposits for lending. On the other hand, and to reassure all foreign creditors, he assured them that he would do everything in his power to avoid a default on government debt. He has created the illusion among voters that (adventurous) dollarization can generate high incomes and stabilize the economy. In view of the lack of foreign currency reserves, however, complete dollarization is not feasible for the time being.

His plans also include a tough budget adjustment (cutting spending by at least 13% of gross domestic product by mid-2025). Public works, the number of ministries and subsidies are to be drastically reduced, as are capital restrictions. He also promised to privatize the education and healthcare systems, liberalize the organ trade, end social programmes and reduce wages. He also opposes sex education and abortion, denies climate change and aims to solve the problem of insecurity with the free bearing of arms. He offered pardons to the military. In anticipatory honesty, Milei also prepared “his people” for the fact that Argentina would experience “stagflation” (estanflación) as a result of his fiscal and financial policy measures, with “negative effects on the economy”.

Neither traditional party nor ideological base behind Milei

With his ultra-right messages, Milei is channeling fatigue and frustration in the face of the disaster the country is facing. He is unpredictable, singular, and relies neither on a traditional party like Donald Trump, nor on an ideological-social base like Chile’s José Kast or an evangelical-military one like Brazil’s Jair Bolsonaro. He pursues an ultra-reactionary discourse and captivates his followers with public gestures (chainsaw) and verbal outbursts. And he likes to appear like a rock star in a leather jacket and with a wild mane.

Difficult government work without a coalition

As a former management consultant and tantra teacher, Milei has no experience in government (nor do his closest supporters), and his own party has just ten percent in the Chamber of Deputies and 15 percent in the Senate of the National Congress. Governing without coalitions will be awkward. And from this point of view, his radical plans are difficult, if not impossible, to implement.

However, Milei has already announced that he will “work” with referendums and by decree if there is no parliamentary support for his ideas. However, this is likely to lead to widespread protests in parliament and from social movements. So winds of change with the new President Milei? Yes, but not quite as stormy as announced and partly in a teacup.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.