If you are interested in investing in equities, you may at first only look at the share price performance. The bigger the upside potential, the bigger your interest. In addition to rising prices, there is another factor that makes listed companies interesting: the annual dividend they pay out to their shareholders. In general, however, it should also be noted that investing in equities with dividend payouts entails risks as well as opportunities.

After all, it offers investors a welcome chance to earn a profit from shares even if the prices are not really moving. And even in the case of falling prices, shares that pay out high dividends can absorb some of the losses. So you get your share of the profit every year, similar to the lemon harvest.

👉 What will you read in this article?

❔ What is a dividend?

The purchase of a share makes the buyer a co-owner of the respective company. Therefore, shareholders also usually participate in the profit of the company; in other words, they receive a dividend.

Companies that are able to pay out dividends are often companies with a high market capitalization and a long tradition on the stock exchange. Companies that pass on part of their profits to their shareholders in the form of a dividend have a strong foundation and a certain earnings power that helps them to cushion setbacks when stock market prices fluctuate more strongly.

📊 What is the level, the amount of the dividend based on?

Upon successful conclusion of a fiscal year, the owners decide at the Annual General Meeting (AGM) whether and how much dividend will be paid out. The amount is based on the financial situation of the company and takes into account the expected business performance.

❕❗ Important: Not every company decides to pay a dividend. Depending on the company, this can also have advantages for shareholders. In particular, companies that are still growing strongly can reinvest profits in the company to generate a profit. This in turn could cause the company’s share price to rise.

On the other hand, a dividend payment can be approved at the Annual General Meeting even if the previous financial year ended in the red but there is a large capital cushion that is not needed.

What happens if the company becomes insolvent? In this case, the shareholder cannot assert any claims against the Management Board, as he or she is not treated as a creditor, i.e. debtor, of the company. As a rule, insolvency would lead to a sharp fall in the company’s share price.

🗓 How often are dividends paid out?

In Europe, dividends are usually distributed annually and benefit all shareholders. In individual cases, however, dividends are also distributed quarterly or even monthly. Such companies are mainly found in the USA.

❌ Does a company have to pay out a dividend?

No – the dividend is no foregone conclusion and there is no legal right to receive one. If it is important for the success of the business, the entire company profit can be used for investments or to form reserves. While the shareholders may fall short of receiving a payout at that point in time, there is the chance that the profits that were ploughed back by the company will lead to rising share prices in the long run.

💰 What happens to a dividend in an investment fund?

An equity fund invests in several companies, including groups that pay a dividend. With many equity funds, investors have the choice between two options:

A shares with annual payout

Investors in these units benefit from an annual distribution. The amount of the distribution is determined annually by the investment company that manages the fund. However, there is a legally regulated lower limit for the amount of the distribution.

❕❗ Important: The payout is always made from the fund assets and reduces these – and thus the calculated value of the fund – by the same amount.

T shares without payout

As soon as a company distributes a dividend, this increases the calculated value of the fund. The dividends are generally used by the fund management for further share purchases, i.e. reinvested.

➗ What is the dividend yield?

The dividend yield is a ratio by which the profitability of a share can be assessed. It is expressed as the dividend paid out divided by the share price. A dividend of EUR 10 per share and a share price of EUR 200 therefore gives you a dividend yield of 5%.

Example:

10 € (Dividend per share) x 100 = 5 % (Dividend yield in percent)

200 € (Share price)

The higher the dividend yield, the more interesting the share becomes for investors. The reason is obvious: these shares promise an attractive annual profit participation, and a high dividend yield signals a successful business. One word of caution though: a high dividend yield may also be the result of a rapid share price decline. Therefore, one should also resort to other key ratios when assessing a share, e.g. the price/earnings ratio or the equity ratio.

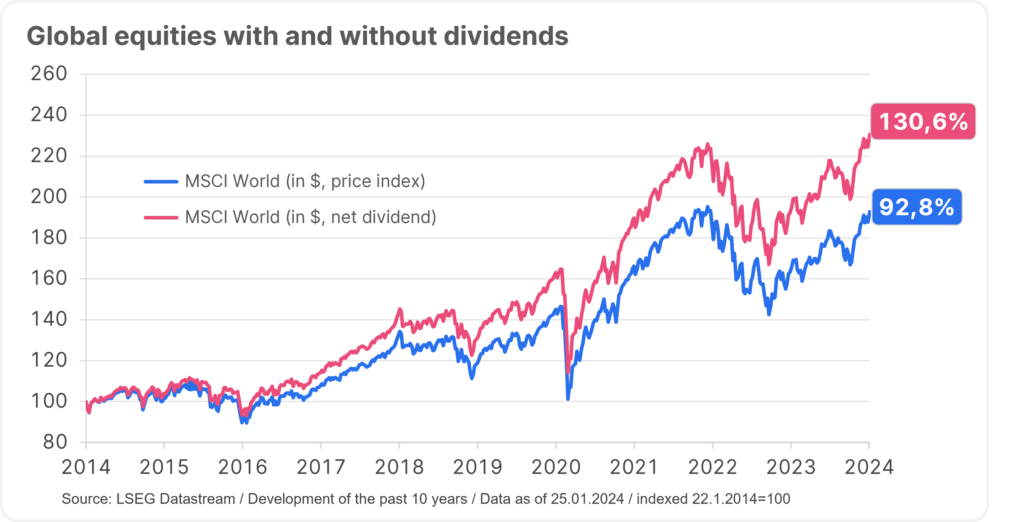

📈 Dividends make up a large part of the performance of a stock market

A look at the MSCI World, one of the most important share indices in the world, shows that dividend payments account for a significant proportion of the overall performance (“total return”). The performance difference between the share index that includes dividend payments (MSCI World net return Index) and the share index that does not include dividends (MSCI World Price Index) is almost 40% over the past ten years!

Note: Past performance is not a reliable indicator of future performance.

💶 Share buy-back vs. dividend payout – what is the difference?

In addition to divided payments, companies have another way of returning capital to their investors: the share buy-back. This is how it works: by buying its own shares, the company reduces the number of shares traded on the stock exchange. The reduction leads, all other things being equal, to a rise in share prices, from which the shareholders benefit.

Also, the dividend part of the group profit can be split among fewer shares; this is where shareholders benefit again, this time from higher dividends. The companies benefit as well: the share buy-back usually increases the earnings per share.

Don’t want to miss any more of our blog posts? Click here to subscribe 👇

💡 Equites with strong dividends under one umbrella

Investors who would rather delegate the informed selection of shares with high dividend yield should leave it to experts in the field and invest in a dividend fund – such as the ERSTE RESPONSIBLE STOCK DIVIDEND fund.

This equity fund invests globally in the shares of selected companies in the developed markets that are subjected to a fundamental analysis. The following characteristics are taken into account when selecting companies:

- high to medium market capitalization,

- attractive dividend yield,

- comparatively low price fluctuations in the past.

The level of the dividend yield is only one criterion of whether a share should be admitted into the fund or not. It is also crucial to see whether the dividends can be paid from profits or whether the company has to eat into its own assets. A high dividend yield could also be the sign of an imminent crisis of a company. The more regular the dividend pay-outs, the lower the volatility – which is also the goal of ERSTE RESPONSIBLE STOCK DIVIDEND.

ERSTE RESPONSIBLE STOCK DIVIDEND – opportunities and risks at a glance:

Benefits for investors

- Broad diversification across equities from developed markets

- Participation in companies that act in line with high environmental, moral, and social standards

- Active stock picking on the basis of fundamental criteria

- Chance of attractive ongoing return and value increase

Risks to be aware of

- The price of the fund may be subject to strong fluctuations (high volatility)

- Due to the investment in foreign currencies, the fund value may be affected by foreign exchange fluctuations

- Capital loss is possible

- Relevant risks for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk, and operational risks. For comprehensive information about the risks associated with the fund, please refer to the prospectus and the key investment information pursuant to sec. 21, part II, chapter “Risk Notifications” of the Austrian Alternative Investment Fund Managers Act

🌱 Focus on sustainability – not only in terms of dividend

The managers of the ERSTE RESPONSIBLE STOCK DIVIDEND fund target the shares of companies that are ESG (environmental social, and governance) pioneers. As part of our holistic ESG approach, we also take into account ethical aspects.

🔍 Investing in dividends with a plan and a goal

Investors who want to make use of the perspectives offered by high-dividend shares can invest a lump sum in ERSTE RESPONSIBLE STOCK DIVIDEND or build capital on the basis of a fund savings plan (s Fond Plan) with as little as EUR 50 a month.

❕❗ Note on the s Fund Plan: The average cost effect decreases as the term of the savings plan increases, as the assets saved behave more and more as if the total amount had been invested once. Depending on market developments, a one-off investment can also prove to be more favorable. Investing in securities involves risks as well as opportunities.

Want more information on the topic of dividends?

You can find more articles here 👇

Dividend strategy: falling prices may still come with opportunities

Corrections on the markets are often painful, as previous price gains are reduced or the investment even slips into the…

The “Squirrel Principle” – get through winter on dividends

Dividend shares provide regular profit distributions even in difficult times on the stock market. This makes them particularly…

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK DIVIDEND as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK DIVIDEND, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK DIVIDEND as described in the Fund Documents.