The term “animal spirits” was coined back in the 1930s by the economist John Maynard Keynes, whose school of thought – also known as Keynesianism – fundamentally changed economics. He understood by this phrase irrational elements such as herd behaviour or overshooting that could have an excessive influence on economic activity or even the capital markets.

The rally initiated in October last year, which brought the US equity markets and even the DAX gains of 25-30% within a few months without any noticeable setbacks, may well have awakened “animal spirits” in some of us. Certainly, the first forms of overshooting can be found in some areas – but we are miles away from irrational herd behaviour, such as we experienced in the dot-com bubble at the turn of the millennium. This is mainly because the recent rally on the equity market has been fuelled primarily by fundamental drivers such as rising earnings expectations, solid economic data, and a moderating monetary policy, and is also gradually gaining in breadth.

Broadening dynamics

While at the beginning of last year it was primarily the hype surrounding artificial intelligence that fuelled share prices in the technology sector and, indirectly, the market as a whole, we have experienced a noticeable broadening of momentum since last autumn.

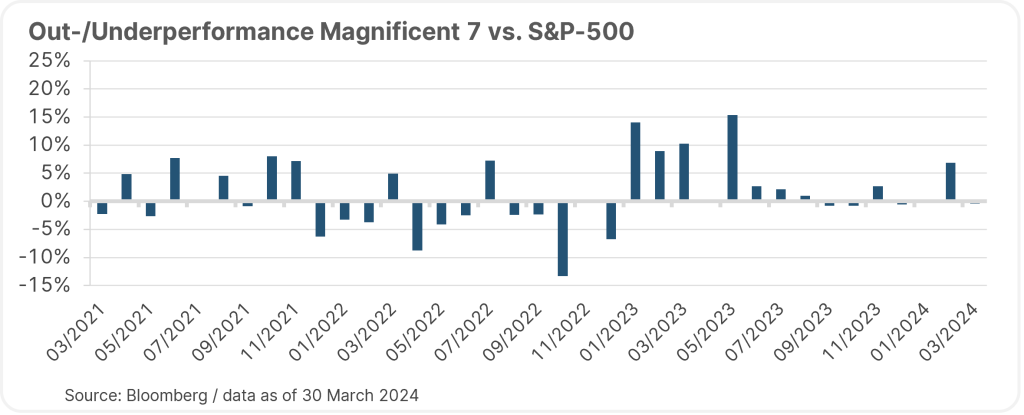

The chart below, for example, shows the monthly performance differences of the Magnificent 7 (Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla) compared to the broad S&P 500 share index. As is easy to see, the technology-heavy index heavyweights continue to perform solidly, but the massive outperformance appears to be over for the time being. In some cases, this has even reversed – Tesla, for example, has shed more than 30% since the turn of the year, while Apple has also incurred a significant loss of more than 10%. The recovery in market breadth should also be seen as positive, as share prices now reflect the overall solid economic situation.

Please note: The companies listed have been selected as examples and do not constitute an investment recommendation. Past performance is no reliable indicator of future value developments.

Solid profit growth is not only expected for Amazon and the like, but the sectors of the unflatteringly labelled “old economy” such as energy, banks, and the industrial sector are also on the upswing. In March, for example, the much-noticed purchasing managers’ index (PMI) for the manufacturing sector in the USA climbed surprisingly sharply from 47.8 to 50.3, reaching its highest level since November 2022.

A revival of the industrial sector, which has effectively been in a recession for months, would lend even more stability to the US economy, which is already performing well. Developments in Europe are similarly upbeat, with the ifo business expectations index, for example, rising by a surprisingly sharp degree month-on-month and signalling a brightening of sentiment among German companies, which have recently been hit hard.

Soft, hard, or no landing?

As we have already explained here several times in the past, the key question is and remains whether the economy will be able to avoid a recession and thus a hard landing. The favourable economic indicators suggest that an immediate recession can be averted despite the high interest rates. In addition, share prices illustrate that the capital market is already pricing in a soft landing, i.e. a controlled decline in economic growth and inflation.

However, there are increasing signs that a no-landing scenario should also be considered as a possible outcome in addition to a soft landing. In this case, the economy would continue to grow strongly while inflation would rise, which in turn would mean that the central bank would not cut or indeed even increase interest rates. This scenario is fuelled by the latest inflation figures in the USA, which have recently risen somewhat more significantly than anticipated. The labour market also makes the Fed’s first interest rate cut, originally planned for June, less likely. With more than 300,000 new jobs created in March, there is no easing in sight on the labour market.

Turnaround in interest rates yes – but when?

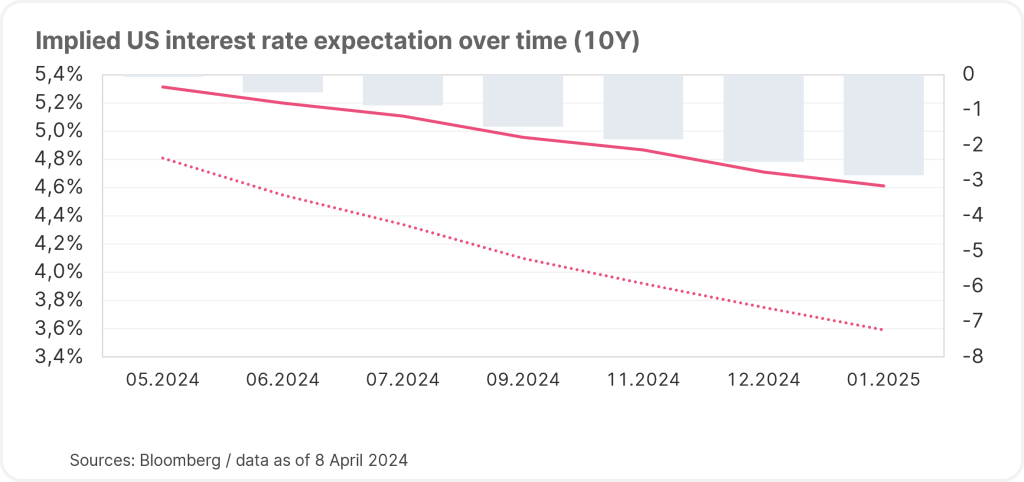

US Federal Reserve Chairman Jerome Powell, whose mandate essentially comprises price stability and maximising employment in the USA, will probably have to continue to exercise patience. The course is still set for a reversal of interest rates, although the interest rate markets have already reacted in recent months. While seven interest rate cuts were expected over the course of 2024 at the turn of the year, only two to three interest rate cuts are currently being priced in, as shown below.

Please note: Past performance is no reliable indicator of future value developments. The implicit key interest rates are derived interest rate expectations, which are derived from the FED Funds Futures priced on the market.

The situation is different in Europe, where an interest rate cut in June is regarded as certain and the ECB is unlikely to lag behind the Fed for a change. Regardless of the current interest rate path in Europe or the USA, the extent of the upcoming interest rate reversal has weakened considerably. In this context, the resilience of the equity markets is once again remarkable. In addition to artificial intelligence, interest rate cut fantasies were a key driver of the rally in 2023. This driver has increasingly lost steam in recent weeks, which surprisingly has not stopped the bull market.

Interest rate expectations are gradually being replaced by economic and earnings expectations as the catalyst for pricing. This “normalisation” should be regarded as positive and could continue to support the current upswing on the markets. The reporting season has only just begun, but the first results once again point to solid results and mostly double-digit growth rates.

Gold is shining again!

It was not only equities that soared in the first quarter; the precious metal gold also reached a new all-time high, currently trading at over USD 2,300. As with equities, it was also interesting to see that the price of gold was rising sharply despite the dwindling interest rate cut fantasy. Gold generally benefits from low interest rates, as the precious metal itself does not generate any income. In fact, the continuing strength of the US dollar would also argue against the recent gold rally. The precious metal is traded in USD and the weaker the US currency, the more gold can be bought.

Since the rise is not attributable to the classic drivers, the recent increase is therefore likely to be partly due to the sharp rise in central bank purchases. Emerging countries in particular have increased their purchases significantly in recent months, which is presumably also due to the ongoing fragile geopolitical environment. In this context, the gold price may also be the first harbinger of a potential re-election of Donald Trump, which would almost certainly result in more volatility.

“As long as the music is playing, you’ve got to get up and dance.”

This statement was made by former Citigroup CEO Chuck Prince just before the global financial crisis in 2007. What happened afterwards needs no further explanation and reminds us that crises may often come out of the blue.

Even now, it would be presumptuous to believe that the developments of recent months can be extrapolated one-to-one. The geopolitical risks in particular remain, as the recent Iranian attack on Israel has shown. Regardless of this, we continue to see a certain potential on the markets.

The economy is performing well overall, inflation remains at a higher but tolerable level, and interest rates are likely to fall rather than rise in the medium term. The environment therefore appears favourable, and, from our point of view, the music should not stop playing any time soon. We therefore think that it is not yet time to leave the dance floor, i.e. significantly reduce risky investments.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.