Artificial intelligence (AI) continues to spark great hopes on the stock markets. As the quarterly reporting season draws to a close, the results of the companies considered to be the AI boom’s main beneficiaries accordingly take center stage.

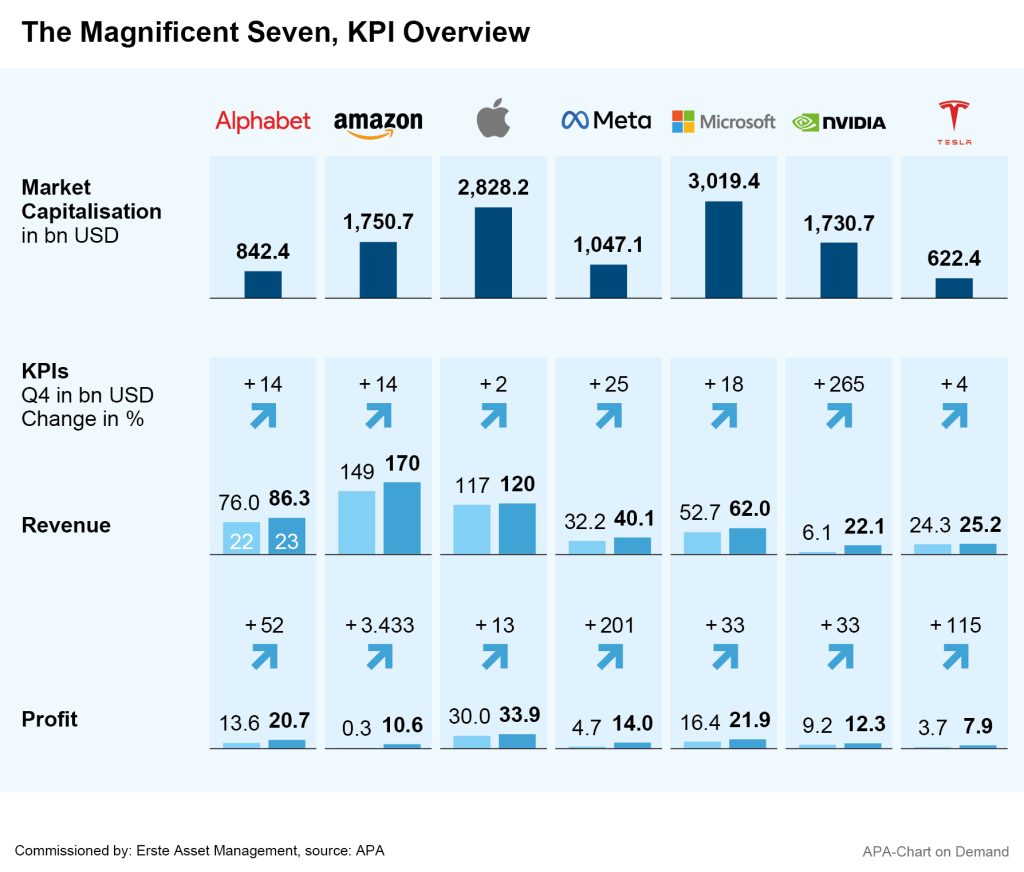

Of particular interest is the question which of the so-called “Magnificent Seven stocks” – those being Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla – can most profitably jump on the AI bandwagon. After close on Wednesday, chip manufacturer Nvidia reported its figures, exceeding even the high expectations and initially causing strong gains after close.

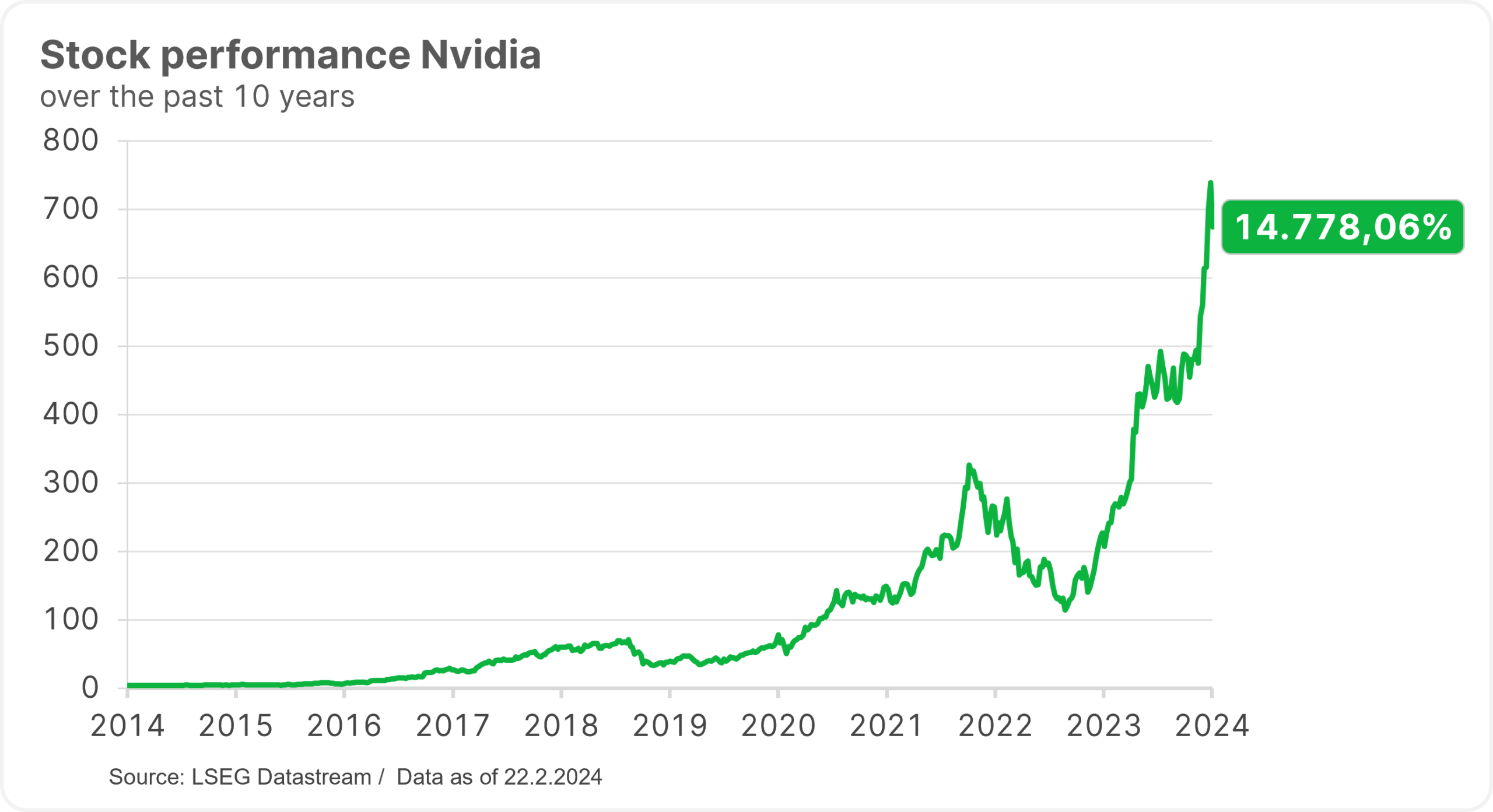

Nvidia exceeds expectations with figures

Nvidia, which specialises in AI chips, more than tripled its turnover to USD 22.1bn year-over-year in the past quarter, where analysts had expected an average turnover of USD 20.4bn. Within a year, the company’s quarterly profit multiplied from USD 1.4bn to almost USD 12.3bn, and the outlook for the current quarter is also above expectations: Nvidia is projecting a revenue of around USD 24bn, compared to the previous market expectation of a USD 22bn forecast.

Thanks to its specialisation in graphics processors (GPUs), Nvidia has become the AI boom’s shooting star among chip manufacturers. The specialised chips originally developed for graphics cards and video game applications in particular are eminently suitable for the computationally extremely demanding training of AI applications. In view of the AI boom, the demand for GPUs is enormous worldwide, with manufacturers of these chips barely able to keep up with production.

Nvidia Remains Top Dog in AI Chips, Competitors Racing to Catch Up

So far, Nvidia’s expertise and extensive investments in the GPU sector have given it an initial advantage that is difficult to catch up with. According to experts, Nvidia currently controls around 80 per cent of the market for AI chips. However, other chip manufacturers are also benefiting from the boom and are trying to catch up further.

Note: Please note that an investment in securities involves risks as well as opportunities. The companies listed here have been selected as examples and do not constitute an investment recommendation. Past performance is not a reliable indicator of future performance. Source: APA/company information, as at 22.2.2024; the key figures relate to the fourth quarter of 2023.

Chip manufacturer AMD plans to challenge market leader Nvidia and has high hopes for its new MI300 processor family, which is tailored to processing information for generative AI. However, AMD’s latest outlook was met with disappointment on the stock market. Although the company nearly doubled its AI chip sales target to USD 3.5bn, investors had hoped for even more.

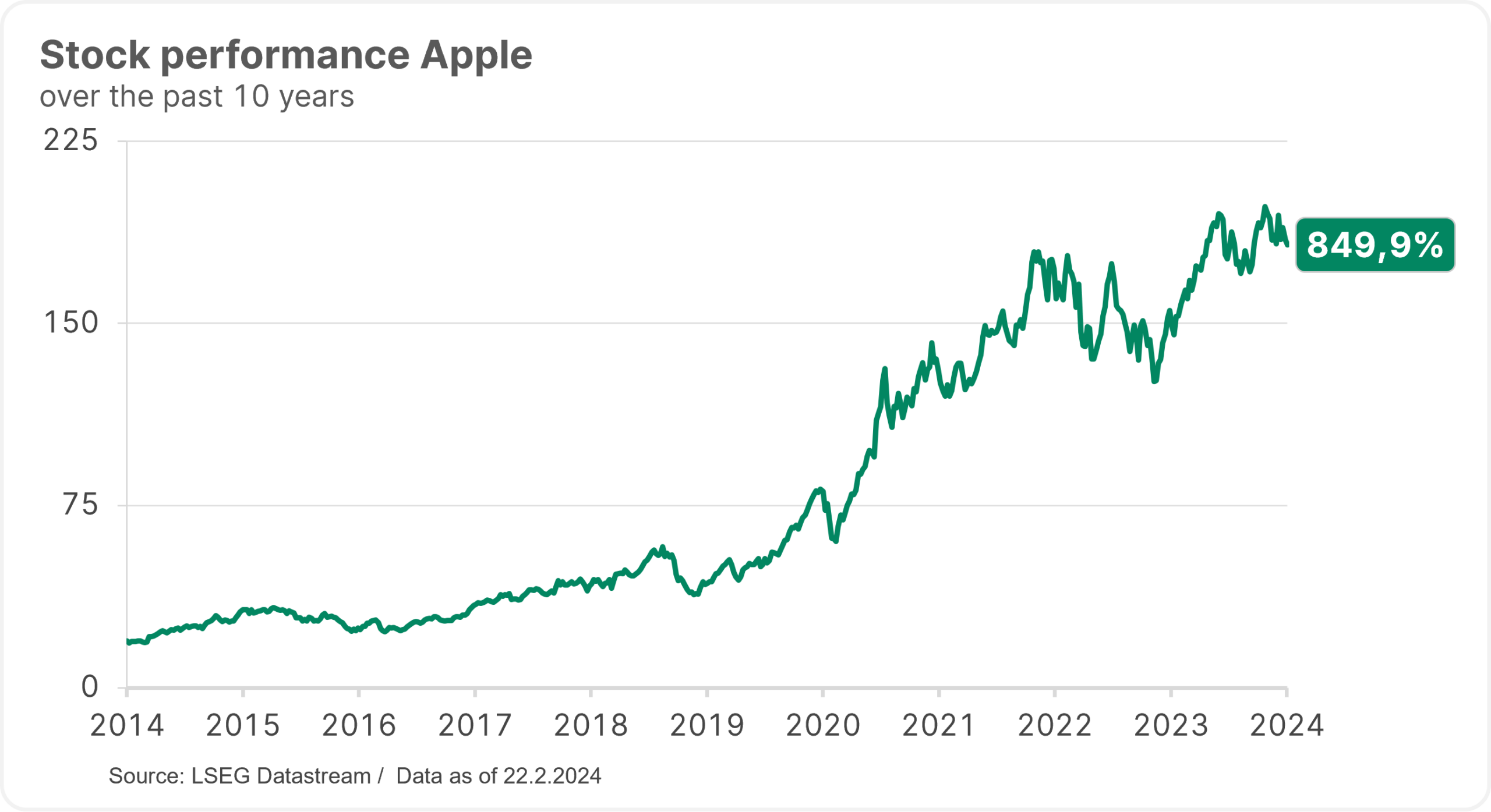

Meanwhile, ARM, the chip developer known primarily for its smartphone processors, exceeded market expectations with its quarterly figures. Apple, among others, develops the processors for its iPhones and now also for Mac computers based on the chip architectures designed by Arm. With its move into the data centre business, ARM is now also benefiting from the AI boom, expecting sales of between USD 850m and 900m against analysts’ average expectations of USD 778m.

Microsoft & Co Benefit From AI-Driven Boom in Cloud Services

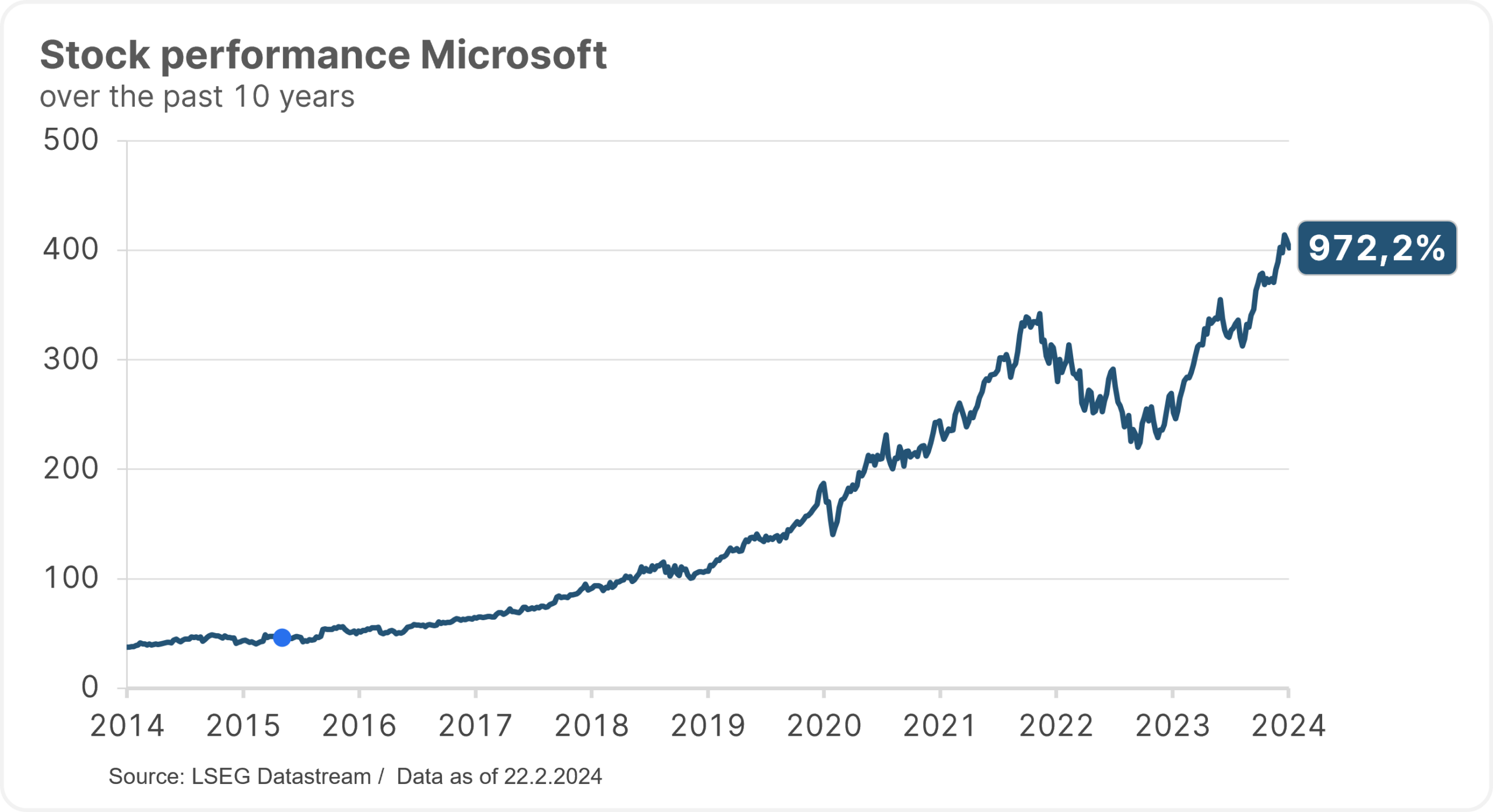

The AI boom’s second major beneficiary is software giant Microsoft, which recently exceeded analysts’ expectations with its figures for the past quarter. The company reported an 18 per cent increase in revenue to USD 62bn in Q4. Revenue from its important cloud division, which provides the computing power for AI applications, increased by 20 per cent to USD 25.9bn.

Thanks to the AI trend, Microsoft was the second company after Apple to break the USD 3tn market capitalisation mark this year. Because of its early investment in ChatGPT developer OpenAI, the Group is benefiting more than other tech companies from the boom in artificial intelligence and has since integrated the OpenAI chatbot into a whole range of its software.

Apart from Microsoft, other companies are also benefiting from the demand for cloud services driven by AI applications. Companies that do not have their own data centres with the necessary capacity have to rent computing power in the form of cloud services to develop their own complex AI applications.

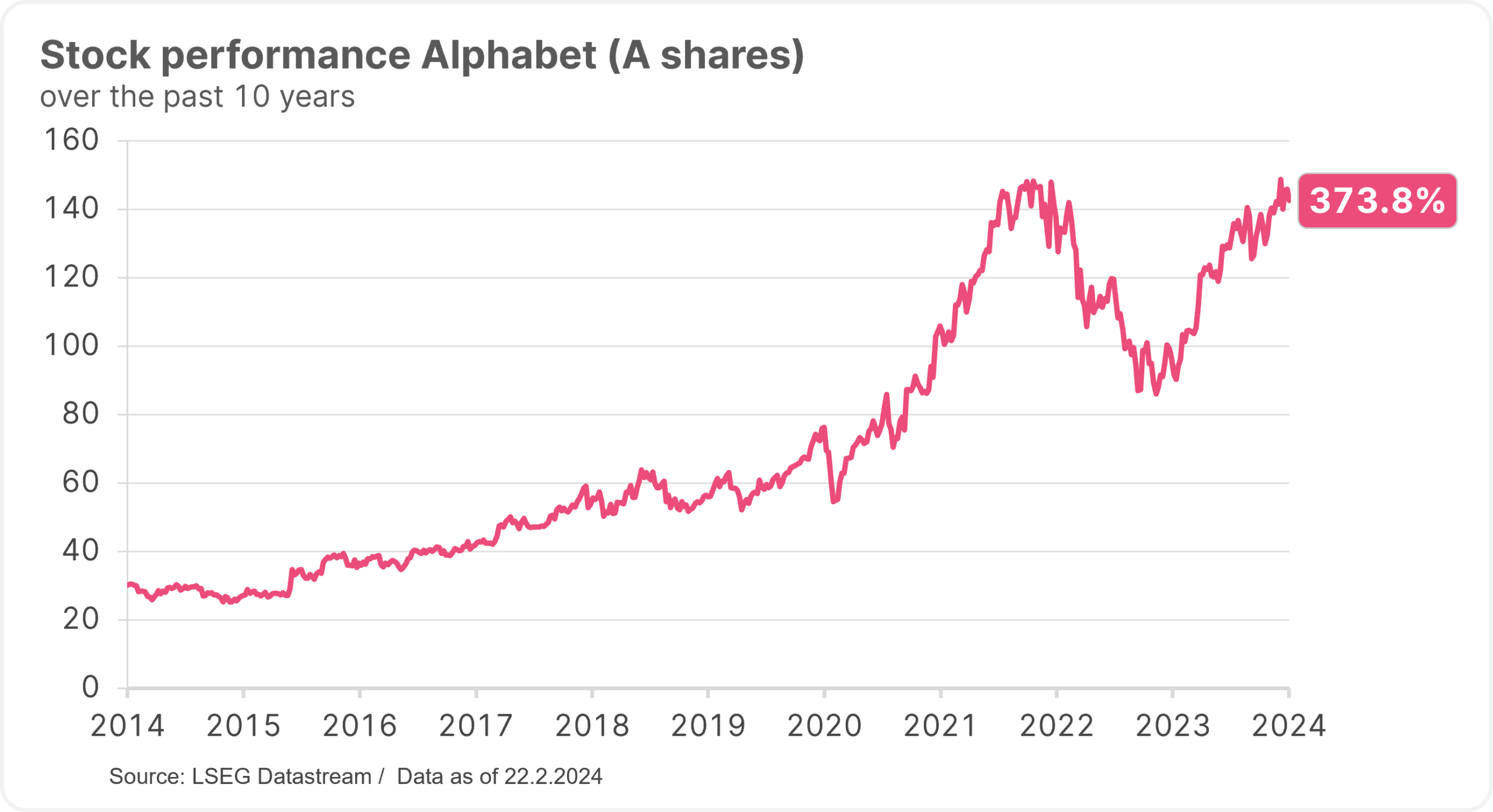

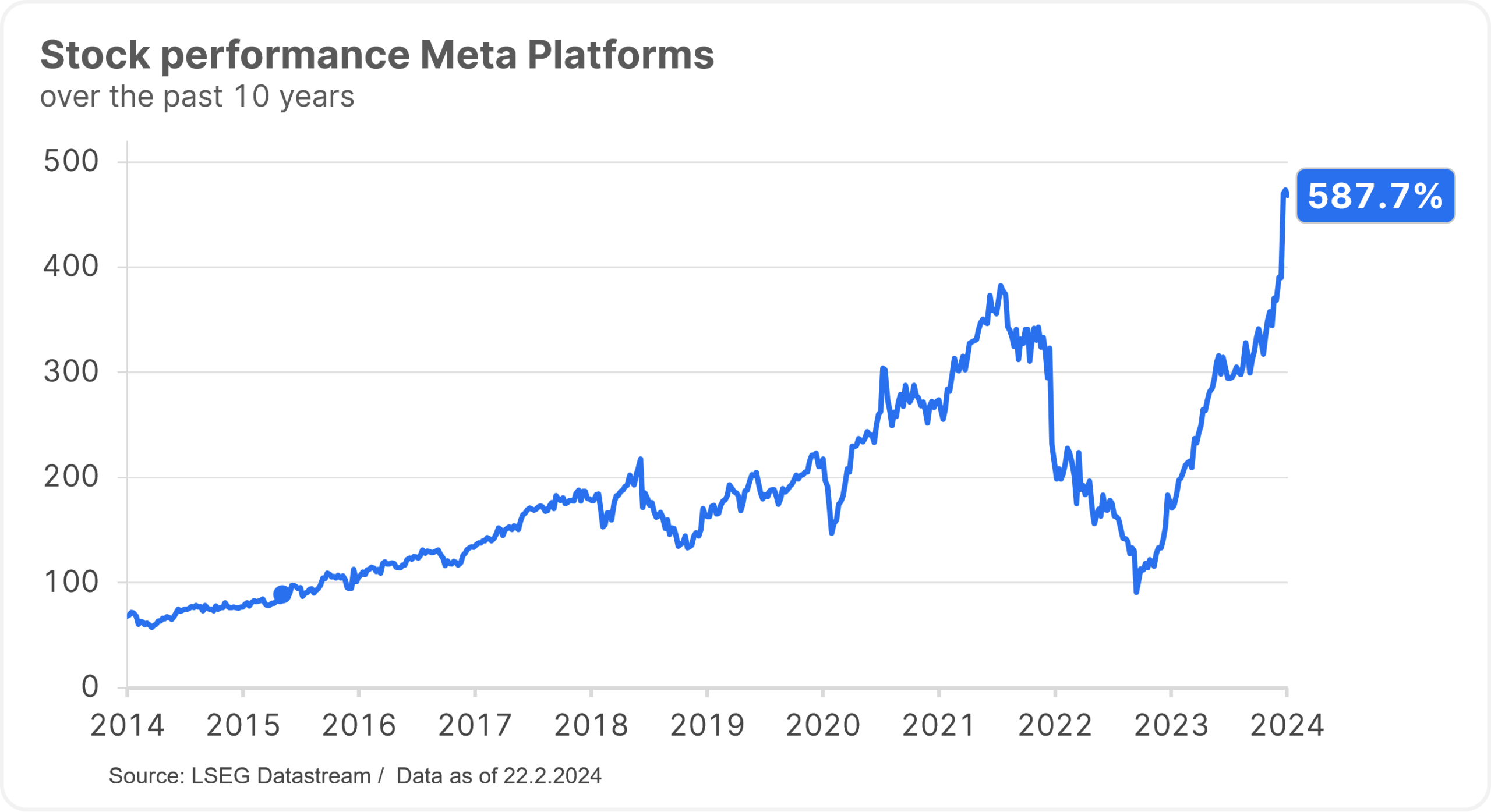

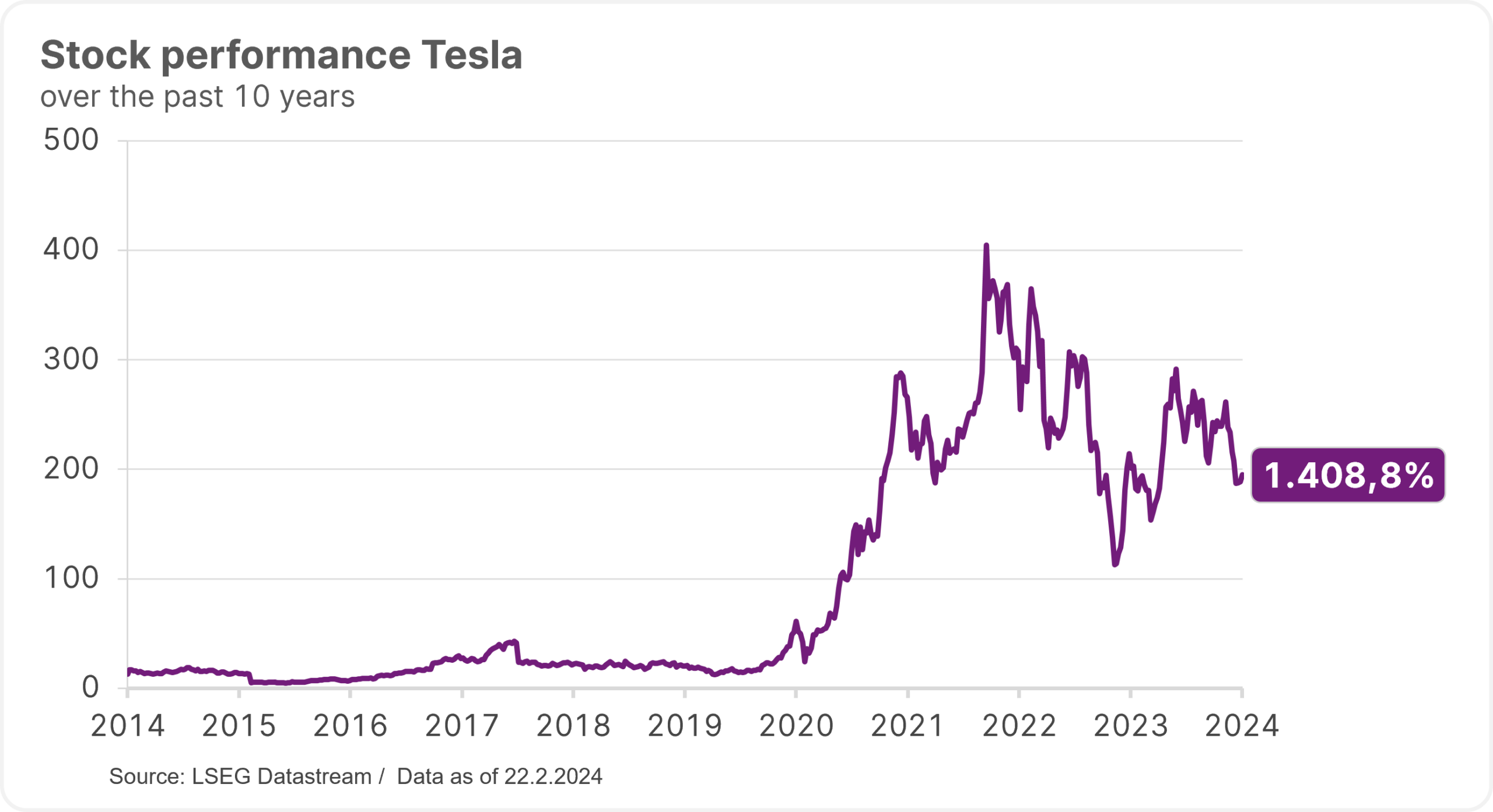

How have the stocks of the Magnificent Seven performed over the past 10 years?

Note: Past performance is not a reliable indicator of future performance.

Google Parent Company Alphabet Expands AI Services

Alphabet wants to expand its market position as a leading AI company with the cloud-based Vertex AI platform for programming multimodal AI models and has also lowered its cloud prices. In addition, the Google parent has opened up its AI technology Gemini to external developers, enabling them to write their own applications based on Gemini. Gemini can not only generate texts in a chatbot, but can also solve certain problems and make situation-dependent decisions. This is Google’s way of catching up in the AI race after the company initially fell behind following ChatGTP’s release.

The cloud boom is already apparent in Alphabet’s figures reported for Q4. While Google’s advertising business, which is important for the Group, was disappointing, the cloud business grew more strongly than expected from USD 7.3bn to USD 9.2bn. The division, which posted an operating loss of USD 186m in the same quarter of the previous year, is now in the black at USD 864m.

The market leader in this sector, Amazon, also reported strong growth in its cloud business. However, Amazon’s results for Q4 were primarily driven by strong Christmas business in the shipping service. While the cloud division AWS benefited from the AI-related offerings with an increase of 13 per cent to USD 24.2bn, AWS revenue thus remained in line with expectations but did not exceed them.

Investors also had high hopes for Adobe’s AI business. The software company has been trying to capitalise on the AI hype early on with generative AI functions in its products such as automatically generated image and media content. In its financial year ending on 1 December, Adobe increased its turnover by 10 per cent to USD 19.4bn. At the bottom line, the company increased its profit by 14 per cent to USD 5.4bn.

Money tip: Investing in future technologies

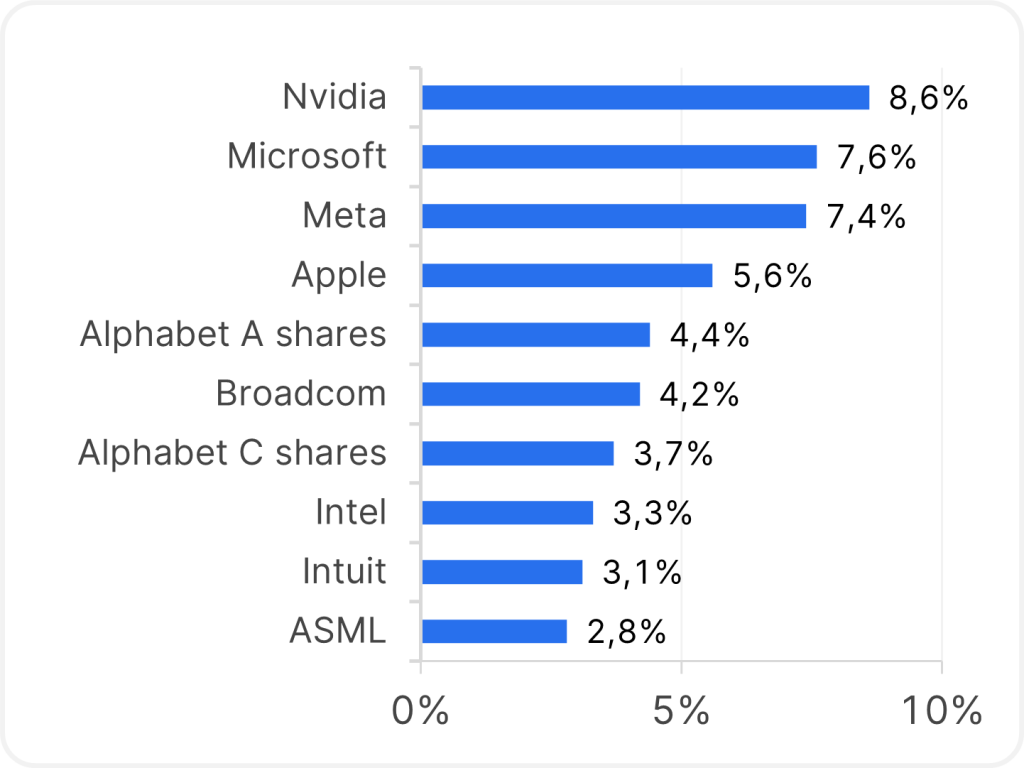

You can invest in promising future technologies such as AI and cybersecurity with ERSTE STOCK TECHNO. The equity fund’s portfolio includes well-known tech stocks such as Nvidia, Microsoft, Meta and Apple.

Note: Please note that an investment in securities involves risks as well as opportunities. The companies listed here have been selected as examples and do not constitute an investment recommendation. The portfolio positions listed may change at any time as part of active management. There is no guarantee that securities will be permanently included in the portfolio. Past performance is not a reliable indicator of future performance.

How has the fund performed?

Development over the past 10 years

What’s inside?

Top 10 Positions of the funds

Note: Chart is indexed (17.2.2014 = 100). The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. The following information is provided by the manufacturer (Erste Asset Management GmbH), information of the respective sales partners may differ.

Risks and opportunities at a glance

Advantages for the investor

- Broad diversification in technology companies with little capital investment.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Notes ERSTE STOCK TECHNO

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE STOCK TECHNO as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE STOCK TECHNO, consideration should be given to any characteristics or objectives of the ERSTE STOCK TECHNO as described in the Fund Documents.

More articles on the topic of equities 👇

No Posts Found

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.