Share prices are rising, while yields on credit-safe bonds, credit risk premiums and the countercyclical US dollar are falling. The markets are supported by increasing hopes for a “soft” landing of the economy.

In this scenario, inflation would fall towards the central bank target of around 2%, while the unemployment rate would rise only moderately. Falling inflation would allow central banks to lower key interest rates earlier than expected. A departure from the central banks’ restrictive stance would in turn reduce the risks to growth.

Declining inclination to raise key interest rates

In speeches over the past few weeks, numerous central bankers have pointed to a weakening bias for further interest rate hikes. However, the signals for a continued restrictive key interest rate level remain unchanged. US Federal Reserve Chairman Jerome Powell also said in a speech last Friday that the central bank would proceed with caution and that the risks of too few or too many interest rate hikes were increasingly balanced.

Signals for interest rate cuts

Fed Governor Christopher Waller stole the show from the other central bankers last week: “If we see that disinflation continues for a few more months – I don’t know how long that might be, three months, four months, five months…., then we might start to lower the federal funds rate just because inflation is lower.” This statement contradicts the central banks’ previous strategy of cutting rates later rather than sooner because there are still risks of inflation remaining too high.

This raises the key question of whether the central banks will turn away from their restrictive interest rate policy in the near future. The markets have already answered this question with a “yes”. For both the USA and the eurozone, key interest rate cuts are priced in for March 2024 with a probability of over 50%.

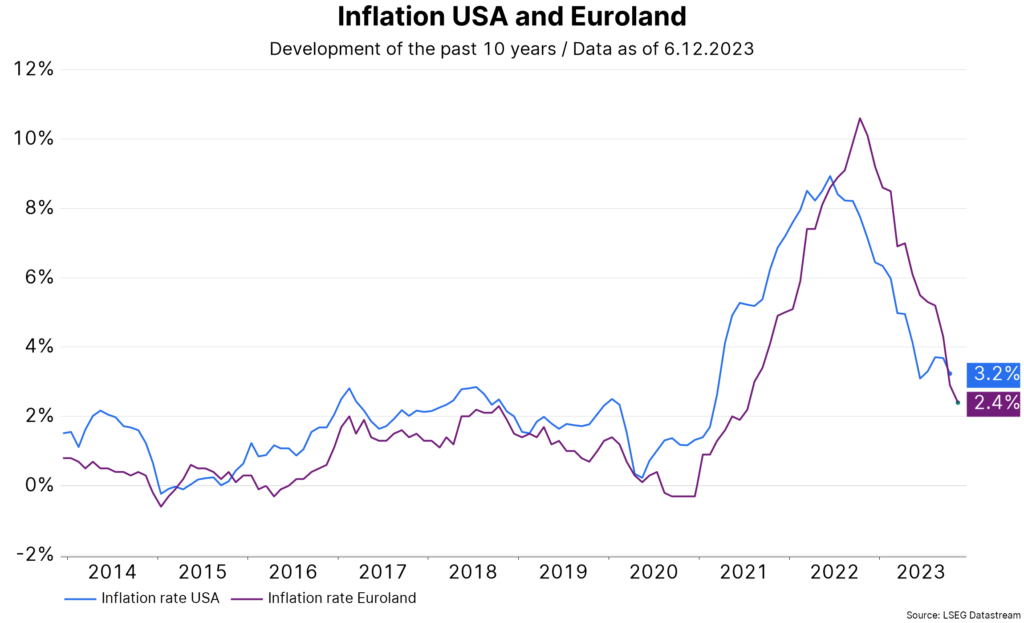

Falling inflation

Inflation reports in both the eurozone and the US point to a continuation of the downward trend (disinflation). In the USA, the deflator for personal consumption expenditure remained unchanged in October compared to the previous month. Year-on-year inflation fell from 3.7% to 3.2%. The decline in the core rate (total excluding energy and food) is particularly encouraging – the three-month average (annualized) fell to 2.2%.

In the eurozone, the flash estimate of consumer price inflation for November showed a fall from 2.9% to 2.4%. The core rate also fell significantly from 4.2% to 3.6%. The markets are pricing in a continuation of disinflation. In the services sector, however, there are still signs that inflation is remaining at too high a level.

Slowdown in growth, but no recession

Economic reports currently point to a slowdown in global growth, but no recession. Global manufacturing has been stagnating for around a year. The indications of an improvement remain weak to date. In October, the decline in the global purchasing managers’ index for the manufacturing sector (to 48.8, below the theoretical level of 50, which signifies stagnation) pointed to downside risks. Nevertheless, the rise in the index in November (49.3) has reduced these risks.

On the negative side, the low ratio of new orders to inventories continues to stand out, indicating a contraction in production. On the positive side, the sales price level of 51 indicates low goods price inflation.

The growth driver this year was the service sector. Although the purchasing managers’ indices for the services sector have shown a downward trend since the beginning of the year, the latest update on Tuesday of this week was negative. However, the latest update on Tuesday of this week was better than expected and showed an increase.

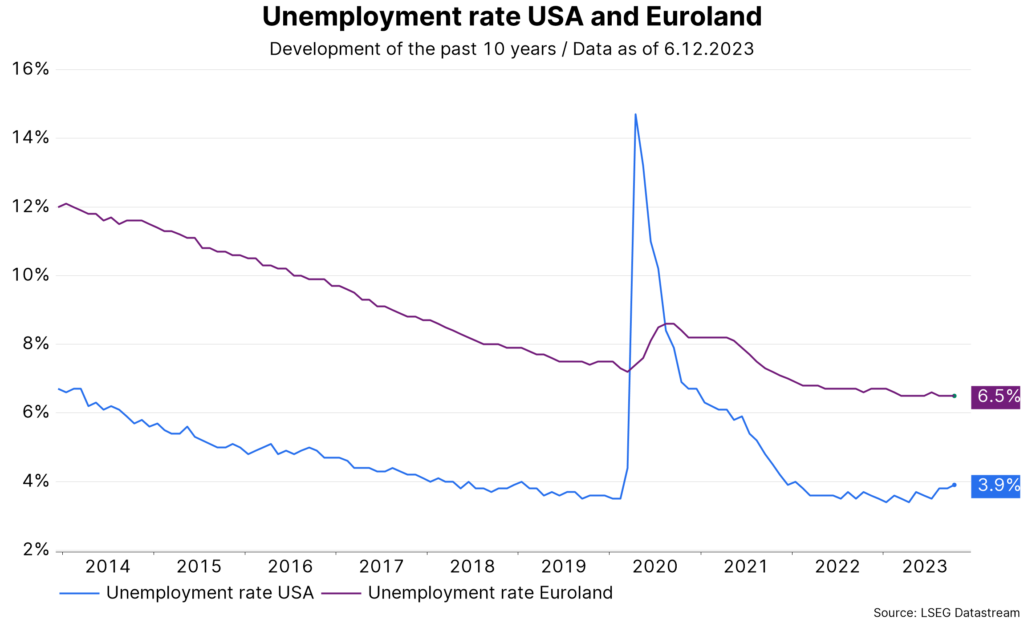

Moderate slowdown on the labor market

There are signs of a slowdown on the labor market, but so far it has only been moderate. The unemployment rate in the eurozone remained low at 6.5% in October. However, the trend in Germany stands out with a further increase in the unemployment rate. This is hardly surprising, as gross domestic product shrank in the third quarter.

This week’s focus is therefore on the US labor market reports for November, which will be published today. The unemployment rate has risen slightly this year: 3.4% in January and 3.9% in October. As long as the unemployment rate only rises slightly, the “soft” landing scenario is supported. The well-known Sahm Rule, which indicates a recession as soon as the three-month average rises by at least 0.5 percentage points, could soon kick in, but the pandemic has distorted many historical relationships and weakened the signal quality.

Early rate cuts not a foregone conclusion

It is not so clear that key interest rate cuts will begin in the spring without a recession. This is because the central banks do not want to repeat the mistakes made in the 1970s. Back then, too, key interest rates were cut in the middle of the decade when inflation was falling. In hindsight, this turned out to be a mistake. As long as the economic reports do not contradict the “soft landing” scenario, the positive sentiment on the markets could continue. However, the markets are susceptible to a correction because early interest rate cuts are already priced in.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.