At its virtual meeting last Thursday, the oil production organisation OPEC+ was unable to agree on official production cuts. In a joint statement after the meeting, the more than twenty OPEC+ states merely announced that Brazil would join the production alliance at the beginning of next year. The oil organization is also planning further production cuts; however, these are likely to be of a voluntary nature. No official statement from OPEC on the cuts was made, and only individual member states or unofficial meeting participants have announced plans for cuts.

Saudi Arabia for one intends to continue its current cut of one million barrels per day into next year, the news agency Bloomberg reported citing OPEC delegates. Other member states also want to reduce their supply. According to the information provided by Bloomberg, the additional production cuts will amount to one million barrels (159 litres each) per day.

In Q1 of 2024, production cuts will be even higher, with Russia participating in the initiative and cutting 200,000 barrels from their daily production, Moscow announced – raising the figure to 2.2 million barrels less per day. “The decisions that have been taken are primarily aimed at eliminating risks in times of low demand,” Alexander Novak, the head of the Russian government responsible for the energy sector, told Russian state television last Thursday.

According to Novak, demand is declining due to seasonal factors. The OPEC+ organisation had to react to this in order to keep prices stable. However, the participating countries will continue to monitor market developments closely, Nowak said.

Oil Price Drops Significantly After OPEC Meeting

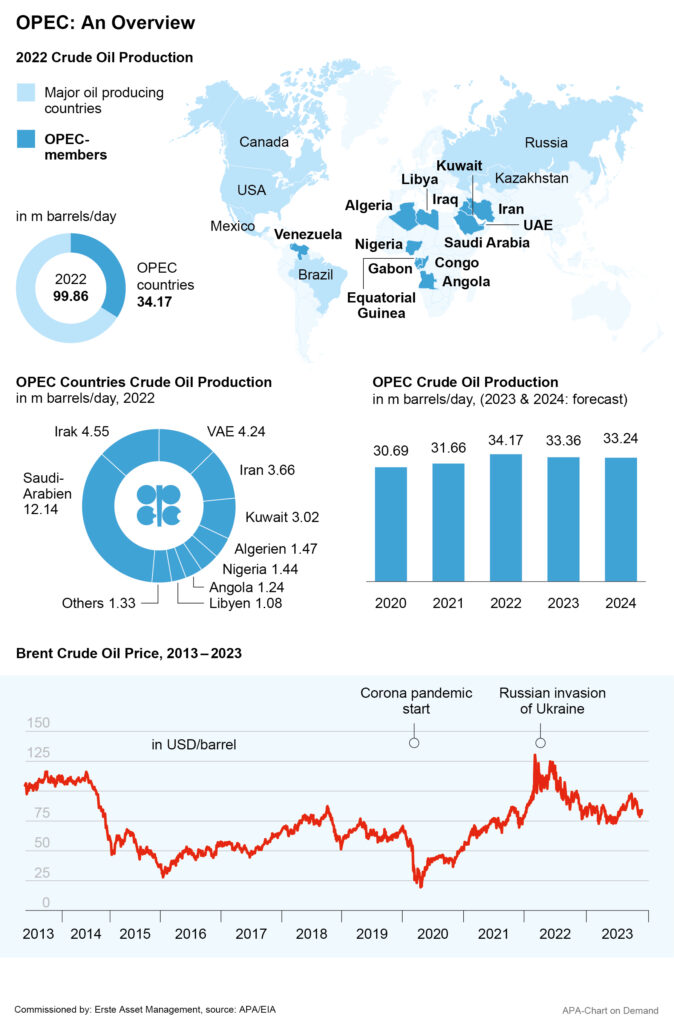

The OPEC meeting was received poorly on the commodity markets. The Brent crude oil benchmark’s price fell from over USD 84 to around USD 80 per barrel on the day of the meeting and then again over the following days, temporarily bottoming out at just under USD 78 per barrel. This means that the oil price has fallen sharply from levels of over USD 130 at the beginning of the Ukraine war. Uncertainty was caused by the fact that the cutback plans were not announced by the association, but by individual member states, which the markets interpreted as a sign of lacking cohesion within OPEC+.

Note: Past performance is not a reliable indicator for future performance.

The postponement of the originally planned date due to internal conflicts already caused uncertainty and falling oil prices earlier, where a disagreement regarding the planned production volumes is said to have caused a dispute.

The voluntary nature of the measures also raised doubts on the commodity markets about their effectiveness. One member state, Angola, has already rejected its quota, according to circles. In recent months, the existing production cuts have been repeatedly undermined by individual OPEC+ member states, which counteracts the oil price support the oil association is aiming for.

Brazil Signals Plans to Move Away From Oil

The inclusion of Brazil was seen in the media as an attempt by OPEC+ to protect its market share and thus its power over pricing. However, this could turn out to be another source of conflicts of interest. Unlike other OPEC states, Brazil is likely to want to sell as much oil as possible. In recent years, the country has continuously expanded its oil production.

On the other hand, Brazil’s President Luiz Inácio Lula da Silva recently signalled a potential change of course. As a designated member of OPEC+, the country wants to advocate a move away from oil and other fossil fuels. “I think it’s important for us to take part in OPEC+, because we need to convince the countries that produce oil that they need to prepare for the end of fossil fuels,” the Brazilian president told activists at the World Climate Change Conference (COP28) in Dubai.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.