India’s economy is booming and could grow even faster in the future thanks to the country’s role as a potential alternative to China. Within the next three years, India intends to become the third largest global economy in the world after the USA and China, by which time the gross domestic product (GDP) is expected to reach USD 5tn, according to a report published by the Indian government in late January.

Dependence on China is viewed critically

Particularly since the start of the Ukraine war and the resulting strengthened economic partnership between Russia and China, many countries and companies have reconsidered their heavy dependence on China as a trading partner and production location and are looking for alternatives.

This is likely to fuel India’s economic boom further: the government expects GDP growth of 7.3% for the financial year that ended in March, and forecasts see an increase of 7% for the 2024/25 fiscal year. The OECD expects India to grow by more than 6% in both financial years.

The rating agency S&P also views India as the fastest-growing country among the major economies over the next three years, its strong population growth with a high proportion of young people being a favourable factor, according to S&P. Almost 53 per cent of Indian citizens are under 30 years old. However, in order to better utilise its potential, India particularly needs to further strengthen its industrial sector.

Need to catch up in the industrial sector

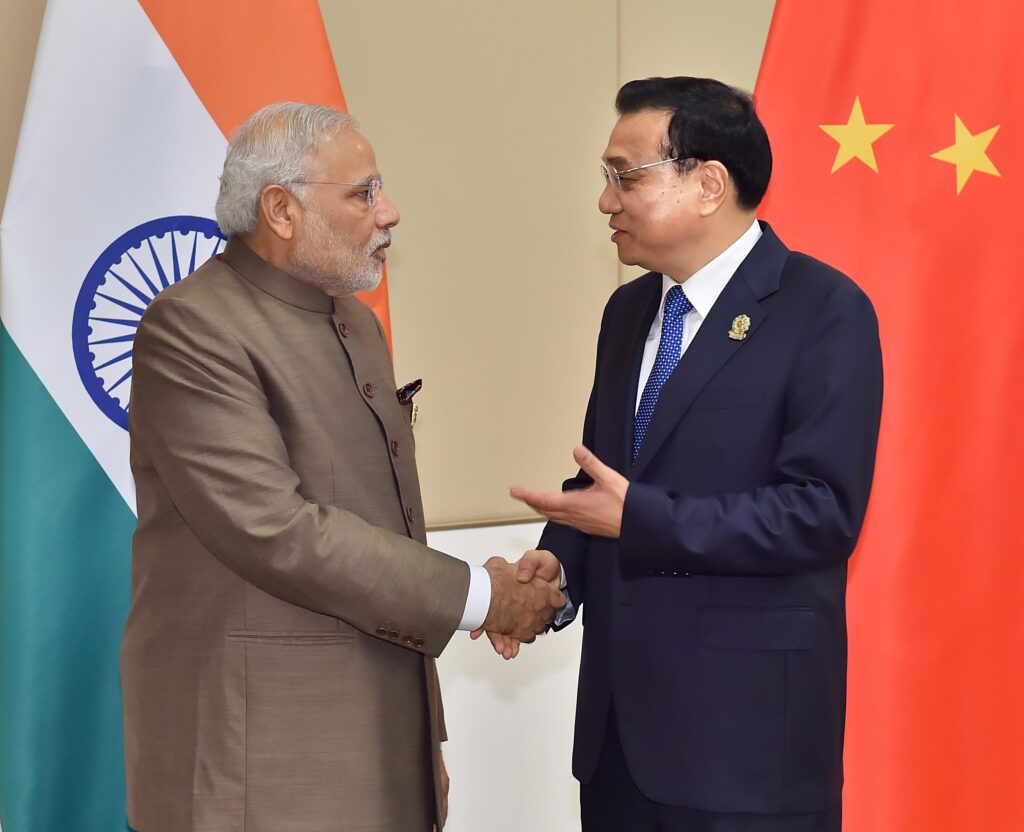

The industrial sector currently accounts for around 18% of India’s GDP, while the service sector generates more than half of economic output. Prime Minister Narendra Modi’s government wants to catch up here and strengthen the industrial sector with a “Made in India” campaign. Companies are to be encouraged to develop and manufacture products in the country. To this end, plans are in place to ease investment restrictions and fight corruption, supported by incentives for targeted investments in manufacturing.

Foreign direct investment in India is already increasing steadily. According to data from the UN Conference on Trade and Development (UNCTAD), foreign investment grew by nearly 10% to around USD 49bn in 2023. This currently puts India in eighth place worldwide, but the trend is pointing upwards. India itself expects annual investments of USD 100bn in the coming years.

Companies focusing more on India

More and more companies are moving production to India. The country is also benefiting from the fact that companies are reconsidering their business with China and want to reduce their dependence on the country. This is driven by economic interests, such as the diversification of supply chains, but also geopolitical considerations.

In July 2023, the German government presented a strategy for dealing with China, with the intention to avoid becoming too dependent on the People’s Republic in view of geopolitical risks in critical areas. German companies are being asked to reduce their risks in business with China in view of China’s threats to Taiwan and its close partnership with Russia, particularly with regard to the war in Ukraine. The de-risking strategy benefits emerging markets that are more favourable towards the West, such as India.

Tech Companies increasingly shift smartphone production and cloud services to India

India is currently making a name for itself primarily as a location for the global market production of electronic goods. Apple, for example, is currently diversifying its iPhone production and shifting more of its production to other countries such as India, Thailand and Malaysia. The Indian conglomerate Tata wants to build one of the largest iPhone factories in its home country. The factory is expected to have around 20 production lines and employ 50,000 people within two years, reported the news agency Bloomberg, citing informed sources. The Taiwanese company Foxconn, which produces iPhones for Apple and devices for many other companies, has already bought a piece of land outside India’s technology stronghold of Bangalore.

Other mobile phone manufacturers are also increasing their production in India. South Korean tech giant Samsung operates the world’s largest factory for mobile phones outside India’s capital New Delhi. Google also wants to have more of its smartphones manufactured in India going forward.

In addition to Apple and Google, other US technology giants are also increasingly focussing on India. US network equipment supplier Cisco Systems, announced in early May that it would begin production in India in order to diversify its global supply chain. The world’s largest online retailer Amazon plans to invest around USD 13bn in the expansion of its cloud computing division in India by 2030, while Microsoft and Google have already increased their cloud investments in the country. According to market research company IDC, the Indian market for cloud services is expected to reach a volume of USD 13bn by 2026. An annual growth rate of 23.1 per cent is expected until 2026.

The transport industry is also increasingly focussing on India. German airline Lufthansa is expanding its services in India, withdrawing flight capacity from other countries. “India is growing faster than all our other destinations. We are taking our capacities from other markets and deploying them in India,” Lufthansa’s Head of Sales Heiko Reitz told the news agency Reuters in January.

EU and UK Negotiate Free Trade Agreement With India

Trade relations between Western countries and India are also being expanded. While the country is not yet as important a sales market for the West as China, this is set to change significantly in view of the political endeavours to decouple economies from China, and this includes new free trade agreements with India.

The EU Commission is currently negotiating a free trade agreement with India. According to observers, the country’s negotiations with the UK on a corresponding agreement are also in an advanced stage. The European Free Trade Association (EFTA) already signed a free trade agreement with India in March, which includes investments of around USD 100bn in India by the EFTA member states Iceland, Liechtenstein, Norway and Switzerland. In recent years, India has already signed free trade agreements with Australia and the United Arab Emirates.

India also wants to compete with China in terms of trade routes, planning an alternative to the Chinese New Silk Road project. In February, India and the United Arab Emirates signed an agreement on a trade corridor that is intended to connect Europe with India in the long term. The corridor was announced in September on the margins of the G20 summit in New Delhi and is supported by the EU and the USA. It is planned to run by rail and sea from India across the Arabian Sea to the UAE and through Saudi Arabia before connecting to Europe via Jordan and Israel.

India also a partner for climate change

The EU and the US also want to win India over as an important partner for climate transition. The US is planning to develop an investment platform with India that will accelerate private investment in India’s energy transition. The German Minister for Economic Affairs and Climate Protection, Robert Habeck, is also campaigning for closer cooperation between Germany and India. “Closer cooperation, especially in renewable energies and green hydrogen, has great potential for both sides and can increase our resilience and economic security.” The German industrial group Siemens sees great potential in the expansion of solar energy and the required grids in India.

Investment in India and other emerging markets

With the equity fund ERSTE STOCK EM GLOBAL investors can make broadly diversified investments in equities from emerging markets, including India. Fundamental analysis is used to identify and invest in high-quality, high-growth companies.

Companies from India currently hold the largest position in the fund after China and Taiwan. In terms of individual sectors, companies from the IT sector currently have the heaviest weighting, followed by the financials and consumer goods sectors.

👉 Find out more about ERSTE STOCK EM GLOBAL here 👈

Note: Please note that an investment in securities entails risks in addition to the opportunities.

Notes ERSTE STOCK EM GLOBAL

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited. Please note that investing in securities also involves risks besides the opportunities described.