After the price gains in the previous year, the Japanese stocks benchmark index Nikkei has continued to soar in 2024. In this blog post, we take a look at the Japanese economy and the Bank of Japan’s monetary policy. We also explain how investors can invest in Japanese stocks.

Please note that an investment in securities entails risks in addition to the opportunities described.

👉 What will you read in this article?

Early 2024 sees Japan’s stocks continuing to trend upwards towards record highs

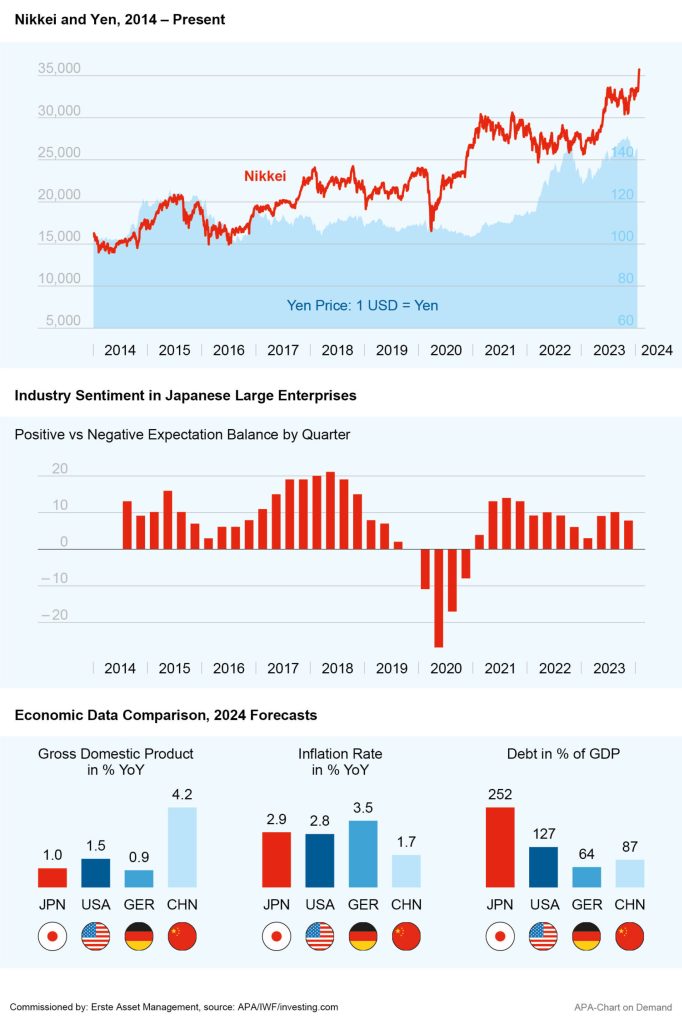

The Japanese stock market continued its recent upward trend in January. After the country’s leading index, the Nikkei, recorded its best year since 2013 in 2023. With an increase of around 28 per cent, it has so far continued to rise in the new year. Even the record high from 1989 appears to be within reach.

Japanese stocks have recently been driven by the central bank’s ongoing zero interest rate policy and the associated weakness of the yen. In the past year alone, the US dollar has gained around 8 per cent against the yen. This provides a competitive advantage for Japanese companies with a strong focus on exports. It enables large export groups such as Sony or Toyota to offer their goods more favourably in global trade.

Negative interest rates and Yen weakness support Japan’s stocks

The background to the weakness of the Yen is the widening interest rate gap between Japan and other industrialised nations in recent years. Other major economies have successively raised their key interest rates in the fight against inflation. They are now even considering cutting interest rates again. In the meantime the monetary policy in Japan is virtually upside down. In view of the low inflation rates, the Bank of Japan has left its key interest rate unchanged at minus 0.1 per cent for now. The monetary authorities are also sticking to their policy of controlling yields. They are continuing their attempt to keep the interest rate for ten-year government bonds close to zero by intervening in the bond market.

Japan’s economy continues to recover

Note: Past performance is not a reliable indicator of future performance. Representation of an index, no investment possible.

The central bank’s aim in this is to wait and see whether the country’s inflation rate settles above the desired target of 2% for a sustained period before turning around their monetary policy and raising interest rates again. However, inflation has recently fallen again. In December, consumer prices in the greater Tokyo area rose by only 2.1% year-on-year, following an inflation rate of 2.3% in November. The core consumer price index for the whole country showed an increase of 2.5% in November, the slowest increase for over a year.

Central bank may continue to adhere to ultra-loose monetary policy after earthquake

In addition, the earthquake that shook Japan’s west coast on New Year’s Day could prompt the central bank to adhere to its ultra-expansionary monetary policy for a little longer than planned. Many market participants still expect the BoJ to abandon its zero interest rate policy in the course of the year. However no such announcement is now expected for the upcoming interest rate meeting on 22 and 23 January.

According to recent statements, Japan’s central bank chief Kazuo Ueda believes that the upward trend continues. He expects that the economy has recovered somewhat from low growth and low inflation in 2023. However, he is in no hurry to end the ultra-loose monetary policy, Ueda told the television station NHK at the turn of the year. He considers the risk of a significant rise in the inflation rate to be low at present.

Sentiment has improved recently

This could also allow the weakening economy to continue its recovery. In Q3 of 2023, Japan’s GDP decreased by 2.9%, while the economy also suffered from weak consumer spending. Private consumption, which accounts for more than half of the economy, fell by 0.2% in the period from July to September. Although the loose interest rate policy and the weak Yen are supporting exports, they are also causing a loss of purchasing power and consumer restraint. Japanese real wages shrank by around 2.3%, marking the 19th consecutive month of decline. The resulting weaker demand has caused industrial activity to shrink as well in recent months.

However, some leading indicators are pointing upwards again. For example, the sentiment in Japanese large-scale industry has recently improved further. According to the quarterly survey (“Tankan”) published by the Japanese central bank in October, the sentiment index for large manufacturing companies rose more sharply than expected to plus 9 points. A positive value indicates a majority of optimists among the managers surveyed. Some economists have also recently raised their outlook for economic development again.

Automotive groups are more confident about the current year

Several major Japanese companies are also looking to the coming year with confidence. In November, car manufacturers Nissan, Honda and Toyota raised their profit forecasts for 2024 by 13, 20 and 50 per cent respectively. The companies are suffering from falling sales figures in China. However they continue to benefit from the weakness of the Yen, good demand in other regions and smoother running of supply chains.

The economy may also find support through government subsidies in some key sectors. Japan plans to boost its own chip industry with a cash injection of JPY 2tn or around EUR 12bn. The subsidies are part of the more than JPY 13tn that Japan’s Prime Minister Fumio Kishida promised in the 2023/24 extra budget.

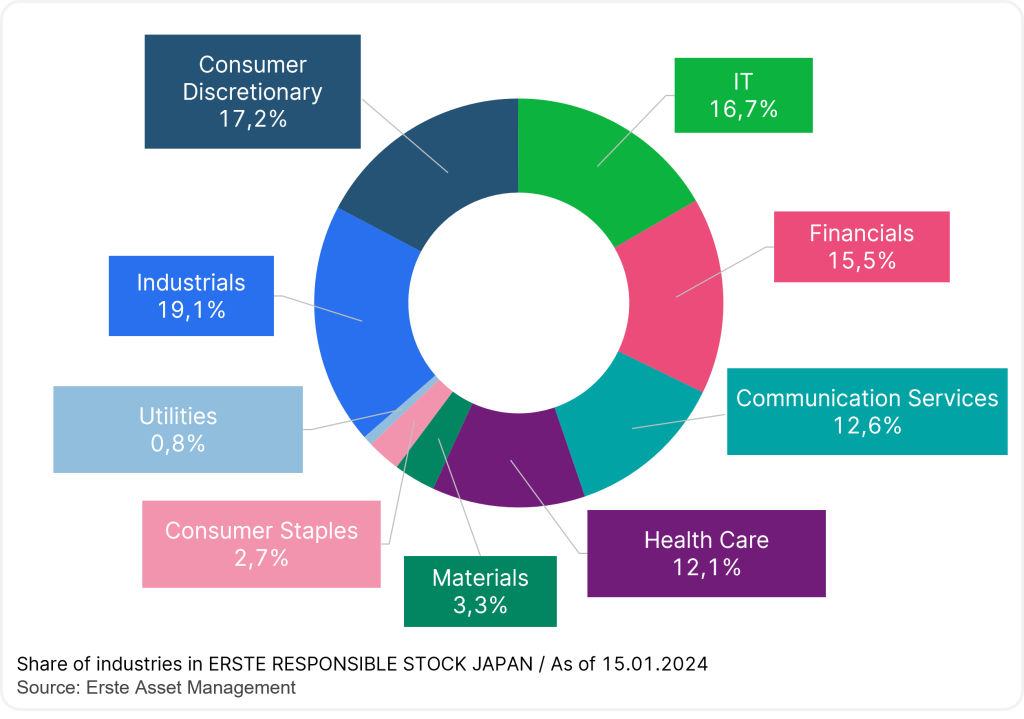

Broadly diversified investment in Japanese stocks

The outlook for the Japanese economy appears to be brightening further and the stock market is also close to previous record highs. For investors who are aware of the opportunities and risks, the ERSTE RESPONSIBLE STOCK JAPAN Japan equity fund could therefore be worth a look.

Performance ERSTE RESPONSIBLE STOCK JAPAN

Note: Past performance is not a reliable indicator of future performance. The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation.

The fund invests in shares of selected companies domiciled or listed in Japan, including some globally active and well-known companies such as:

- Tokyo Electron (semiconductor company)

- Honda Motor (automobiles, motorcycles, engines)

- Sony Group (electronics group)

- Nintendo (manufacturer of video games and game consoles)

The portfolio focuses on quality companies with medium to high market capitalization and a high dividend yield. In addition, Erste AM’s responsible sustainability criteria are taken into account when selecting stocks.

Investors can therefore invest in various sectors of the Japanese market – and with a sustainable approach to boot. The fund is therefore also suitable as an addition to an existing equity portfolio, either as a one-off investment or by means of a regular investment via a fund savings plan.

❕❗ Please note: The average cost effect decreases as the term of the savings plan increases, as the assets saved behave more and more as if the total amount had been invested once. Depending on market developments, a one-off investment can also prove to be more favorable. Investing in securities involves risks as well as opportunities.

ERSTE RESPONSIBLE STOCK JAPAN – Opportunities and risks at a glance

Advantages for the investor

- Broad diversification in selected Japanese companies with little capital investment.

- Opportunities for attractive capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the fund can fluctuate considerably (high volatility).

- Due to investments denominated in foreign currencies, especially in Japanese Yen, the net asset value of the fund can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK JAPAN as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK JAPAN, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK JAPAN as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.