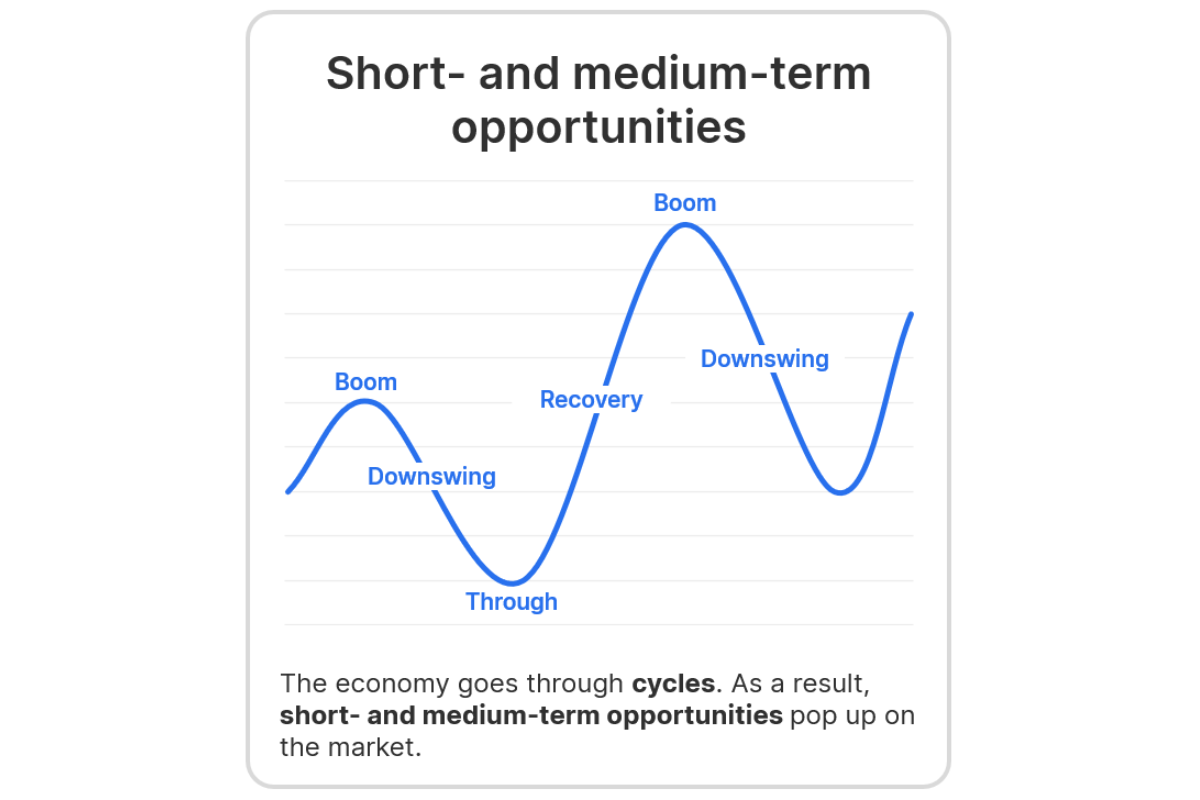

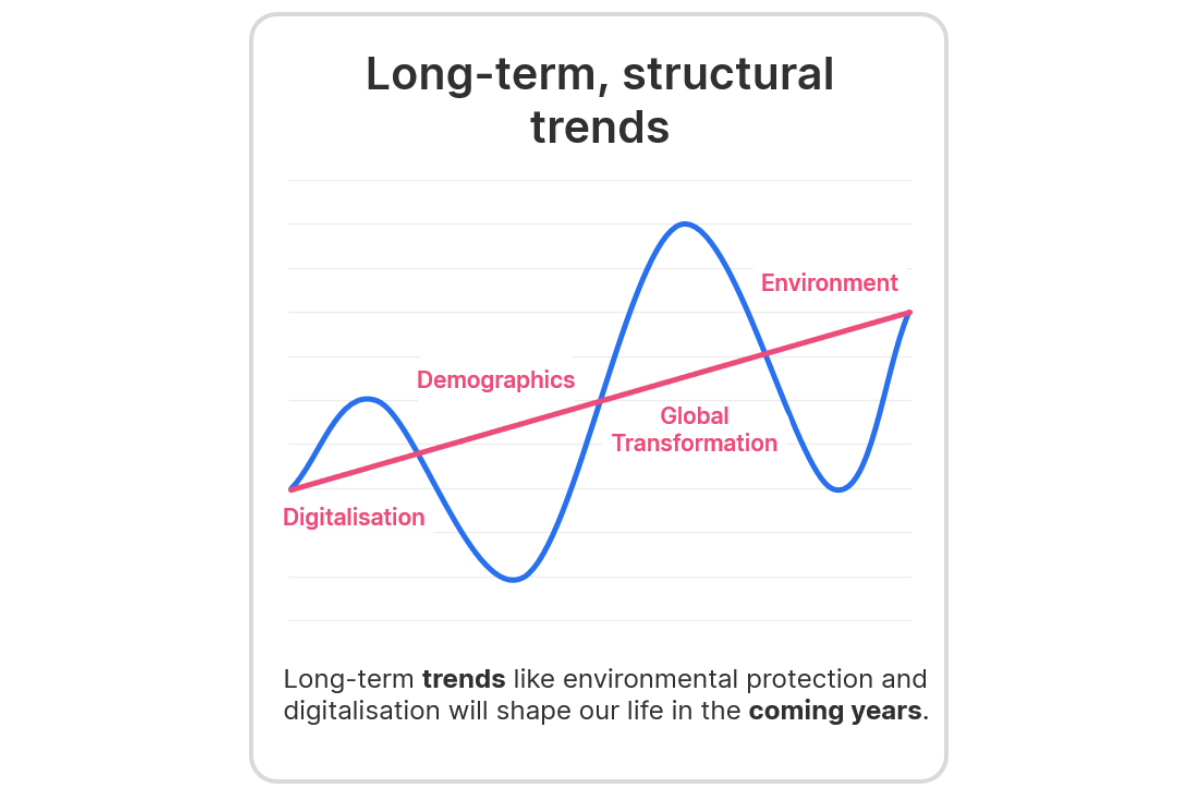

When investing, many people like to focus on the big, long-term trends of the future – digitalisation, environmental protection, artificial intelligence, etc. However, the market also offers interesting short and medium-term opportunities – but these are usually difficult for small investors to access.

So how do you combine these long-term investment themes with short-term opportunities in the market? The answer: with a broadly diversified mixed fund that invests actively and flexibly at the pulse of opportunities, or in short, with ERSTE OPPORTUNITIES MIX.

Please note: companies may not be investable for sustainability reasons. It is not yet possible to forecast which companies will benefit most from the long-term trends.

Long-term trends shape our everyday lives

On the one hand, the fund focuses on long-term developments that we are increasingly aware of in our everyday lives. Digitalisation and environmental technologies are with us every day and therefore also play a major role on the markets.

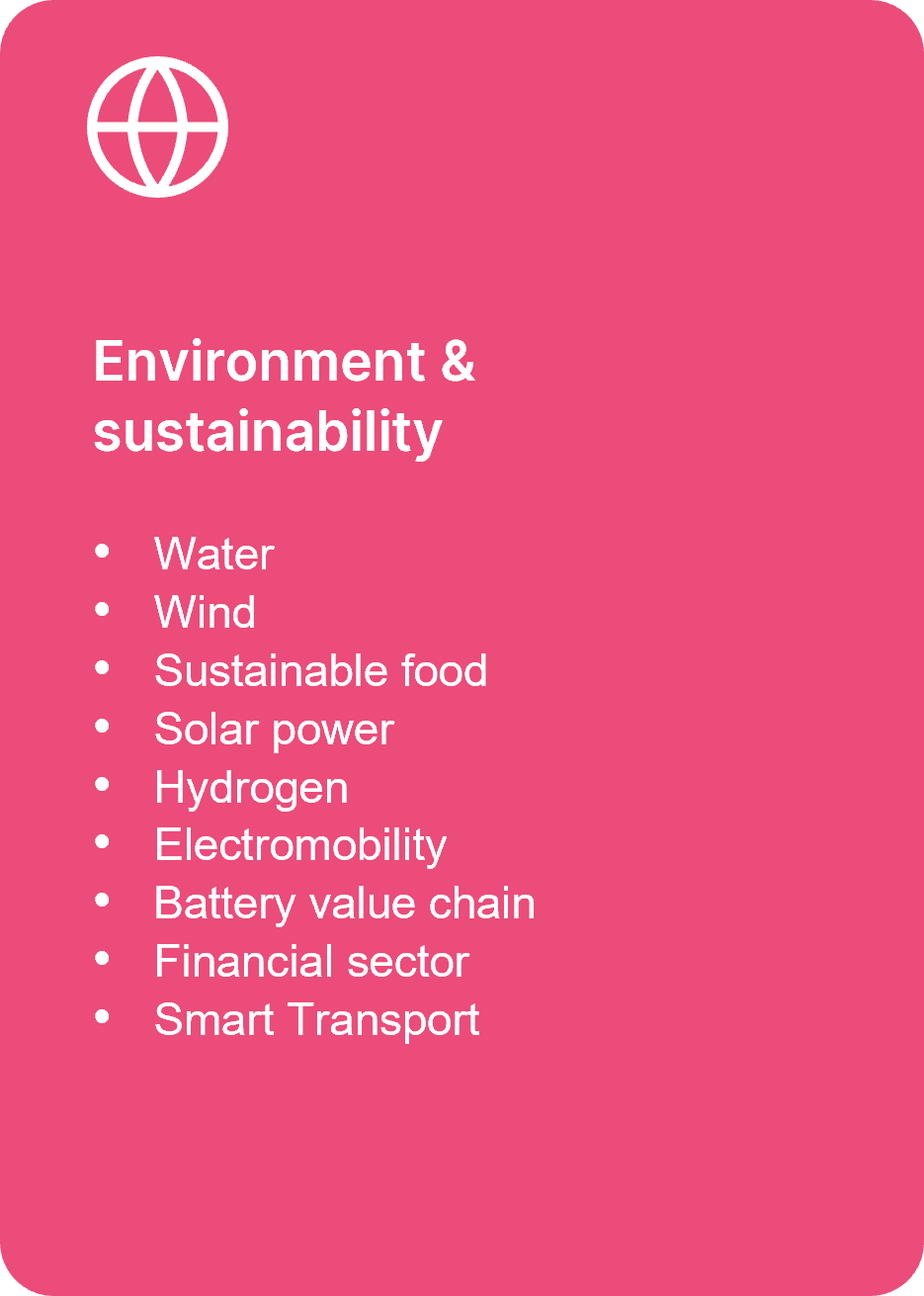

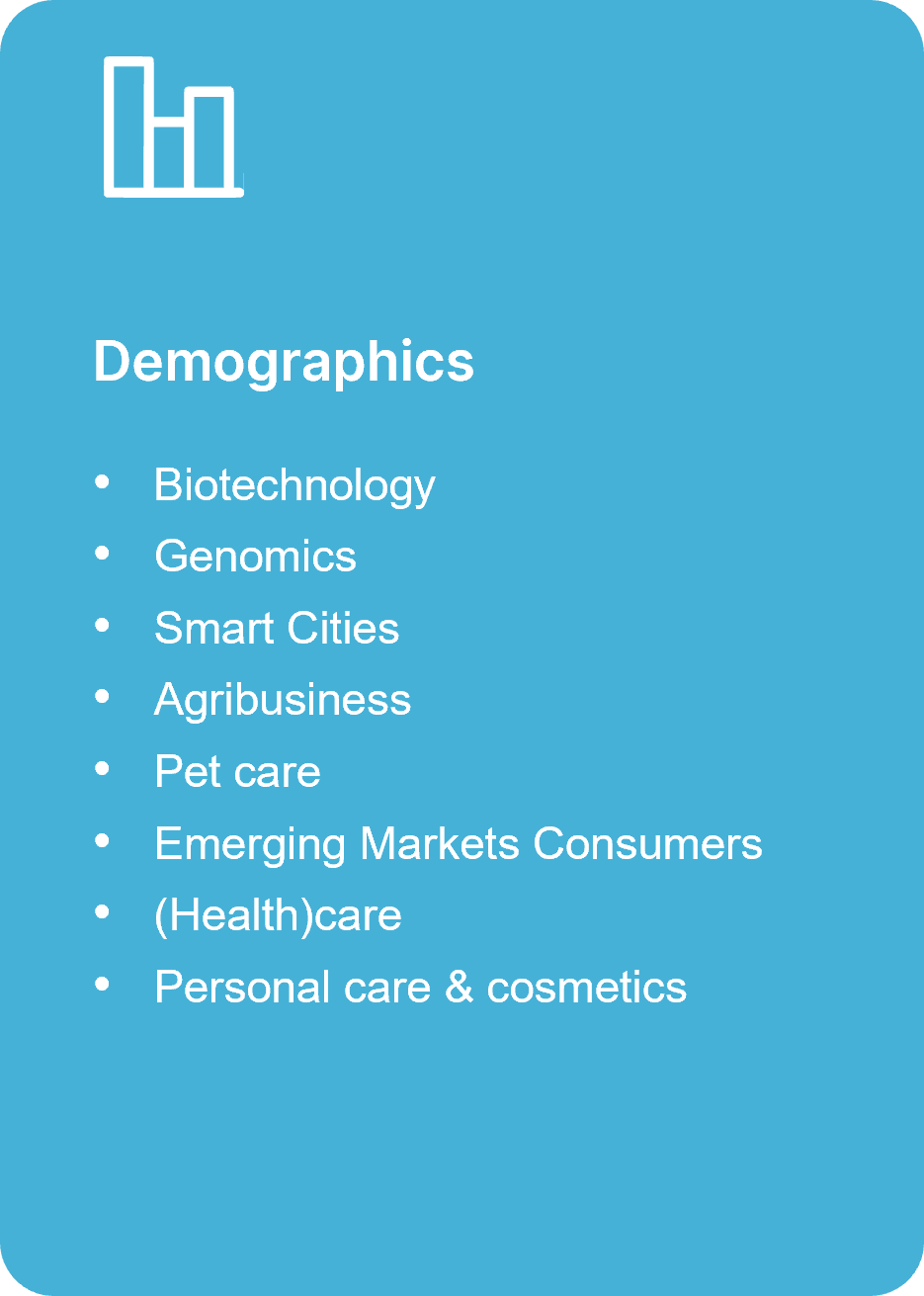

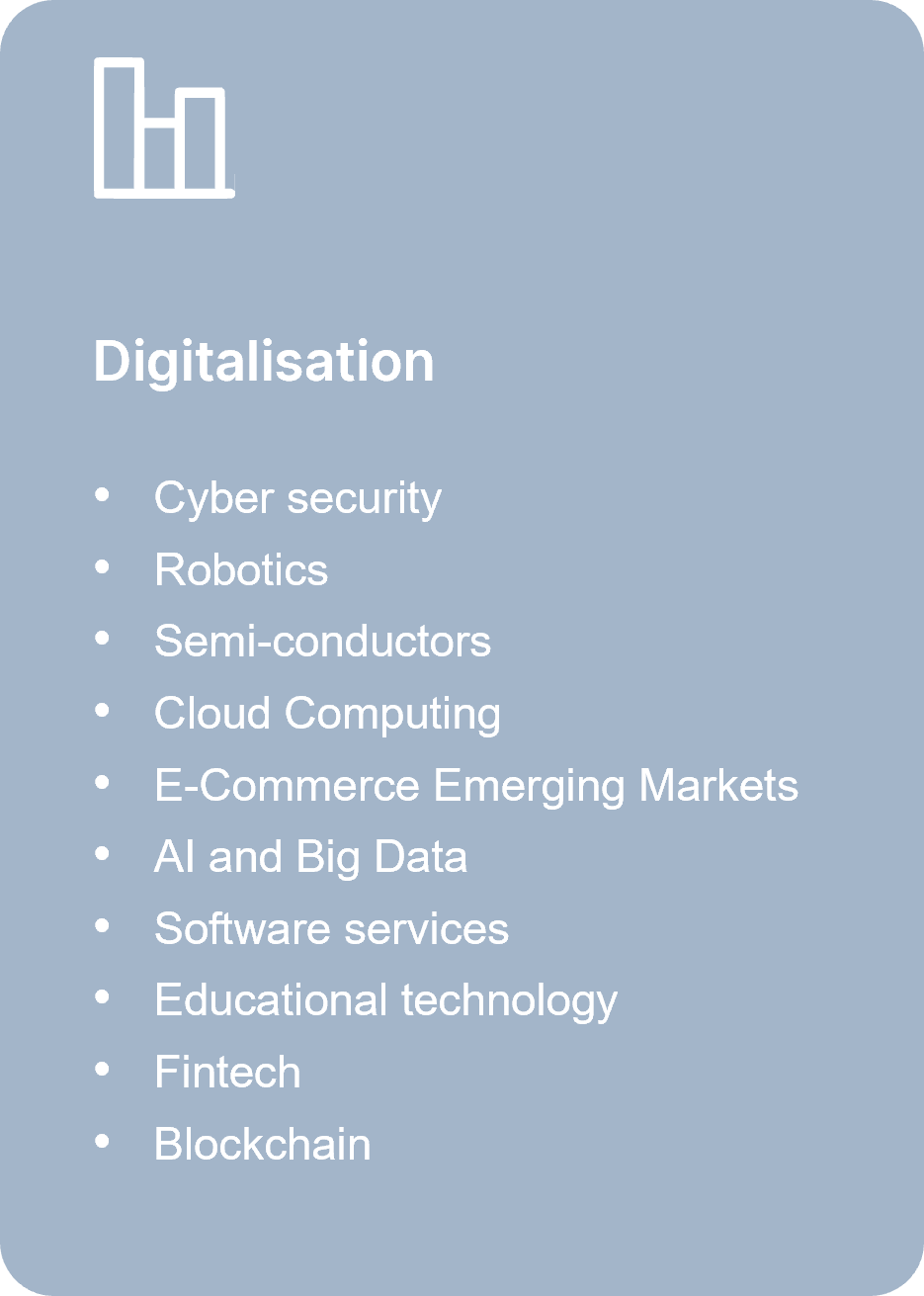

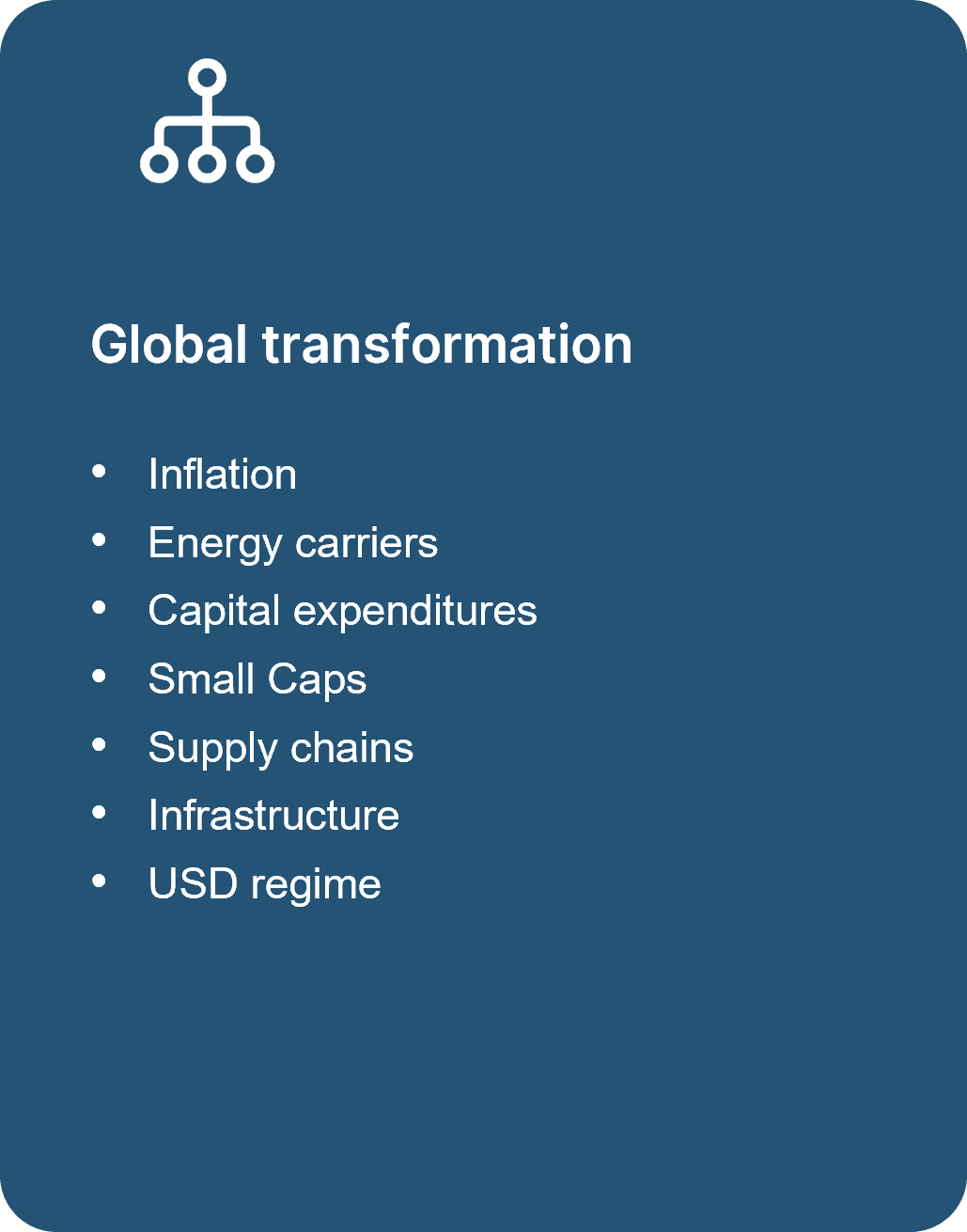

In summary, the fund focuses on four overarching trends (environment & sustainability, demographics, digitalization and global transformation), which in turn give rise to individual themes.

AI, for example, is one of the key topics in the area of digitalization. The Environment & Sustainability trend is about new forms of energy such as hydrogen or the topics of water and electromobility, among others. Here is an overview of the topics:

And what could such a trend look like in the fund? Let’s take the example of digitalisation and the currently much-discussed topic of AI:

Example: Artificial Intelligence (AI)

There is no way around AI in everyday life or on the markets. ChatGPT reached the magic mark of 100 million users at record speed. And that was just the starting pistol for the development of this new technology. There is a multitude of potential applications: be it in medicine, the entertainment industry, or advertising – AI could completely transform many sectors of the economy.

It therefore makes sense to focus on this long-term trend and make targeted investments in pioneers of this technology. Companies such as the chip company Nvidia and the software giant Microsoft are already investing heavily in the development of their AI infrastructure. At the same time, it is important to note that it is not yet possible to say conclusively which companies will benefit most from the opportunities offered by AI in the long term.

Please note: the companies listed here have been selected as examples and do not constitute an investment recommendation.

Know-how opens up potential opportunities for investors

At the same time, short- to medium-term opportunities pop up on the markets constantly. For investors, such opportunities are often difficult to access. Hardly anyone has the time or the necessary expertise to keep a constant eye on the markets and recognise opportunities in specific market niches. As a mixed fund, ERSTE OPPORTUNITIES MIX can also draw on various asset classes. This makes it possible to take advantage of opportunities that may arise outside the equity markets. But what might such short and medium-term opportunities look like?

Example: “Fallen Angels”

On the bond market, investments in bonds issued by so-called “fallen angels” repeatedly offer short-term yield opportunities. This term refers to companies whose rating has been downgraded to the high-yield segment. On the market, a fundamental distinction is made between bonds from the investment grade and the high-yield segment. Although high-yield bonds generally offer higher yields, they also come with a higher default risk. Please note: investing in securities involves risks as well as opportunities.

Why are these downgraded companies of particular interest? Companies that have been downgraded to high-yield have a strong incentive to move back up to investment grade because an upgrade offers better access to the capital market and more favourable financing costs, as many institutional investors are only likely to invest in investment-grade bonds. Investors can benefit from lower risk premiums (i.e. spreads) and the associated increase in prices in the event of an upgrading. Fallen angels are therefore among the potential opportunities that ERSTE OPPORTUNITIES MIX would like to capitalise on. It should be noted that a possible downgrade of the companies could also lead to losses.

How does the fund implement these topics?

This is therefore about long-term trends and short- to medium-term opportunities – ERSTE OPPORTUNITIES MIX combines the best of both worlds, so to speak. The special aspect about this is the fact that the fund focuses primarily on themes and opportunities and selects the best securities and asset classes based on these. There is therefore no set quota of equities or bonds, but rather a wide bandwidth. The focus is on trends and opportunities. 👇

Please note that investing in securities involves risks as well as opportunities. Forecasts are no reliable indicator of future performance.

For whom could the fund potentially be an interesting investment?

- Investors who are aware not only of the opportunities but also of the risks associated with investing in securities

- Investors who focus on the major trends and but who at the same time want to keep their finger on the pulse of current market opportunities

- Investors who invest outside of a predetermined asset allocation and therefore want maximum flexibility

- Investors who want to focus on several different asset classes

- Investors who want access to alternative asset classes such as listed private equity

Fund profile:

| Fund name | ERSTE OPPORTUNITIES MIX |

| Subscription period | 6 May – 30 May 2024 |

| Fund launch date | 3 June 2024 |

| ISIN dividend fund | AT0000A3BMH2 |

| ISIN accumulating fund | AT0000A3BMJ8 |

| Risik indicator according to KIID | 3 |

| Management fee | up to 1.2% p.a. |

Notes ERSTE OPPORTUNITIES MIX

Warning notice according to the Austrian Investment Fund Act of 2011

ERSTE OPPORTUNITIES MIX may invest a significant portion of its assets under management in shares of investment funds (UCITS, UCI) as defined by sec 71 of the Austrian Investment Fund Act of 2011.

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the investment company’s part. Please note that investing in securities also harbours risks in addition to the opportunities described above.

For further details on the sustainable strategy of ERSTE OPPORTUNITIES MIX and on the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852) please refer to the current prospectus, section 12 and the appendix, “Sustainability principles”. When deciding to invest in ERSTE OPPORTUNITIES MIX, please take into account all features and goals of ERSTE OPPORTUNITIES MIX as described in the fund documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.