Recent geopolitical events have had a major impact on the markets in the short term. Short-term negative movements on the equity markets remain frequent and intense, while the multi-year equity performance has been stabilising. This illustrates the advantage of a long-term investment strategy. There have been phases of corrections almost every year, and 2023 was no exception.

Note: It should be noted that an investment in securities involves risks as well as opportunities.

Invest for the long term – a tried and tested truth

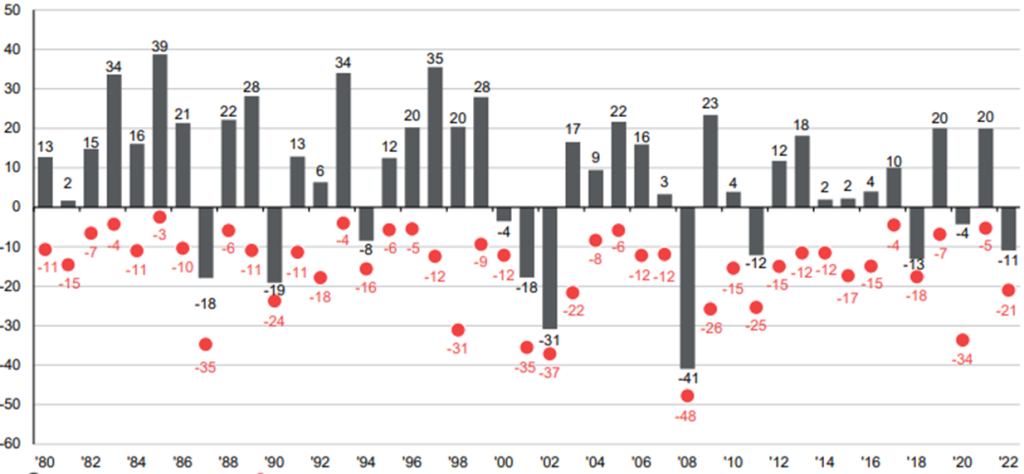

The red dots in the following chart highlight the loss during a calendar year between the highest and lowest index level based on the broadly diversified MSCI Europe share index. Most setbacks are caused by geopolitical developments or environmental phenomena that cannot be predicted. Such market declines, sometimes even in the double-digits, are a fact in most years. It is normal for the financial markets to go through phases of volatility. As an investor, you therefore have to expect such setbacks. At the same time, it is important to anticipate difficulties rather than react emotionally once they have materialised. Emotional reactions in or to a crisis can lead to major losses.

The grey bars illustrate the performance of the MSCI Europe index over the individual calendar years of the past 20 years. We can see that the markets have achieved positive annual results in most cases, despite the interim setbacks they had to incur each year.

The lesson to be learnt from this is therefore not to react emotionally in crises and sell at lows, but to take advantage of a bottoming out to make new purchases.

Set-backs of the MSCI Europe index over a year (red) relative to the performance during a calendar year (black). Source: JP Morgan Asset Management, MSCI, LSEG Datastream / Note: Past performance is not a reliable indicator for future performance.

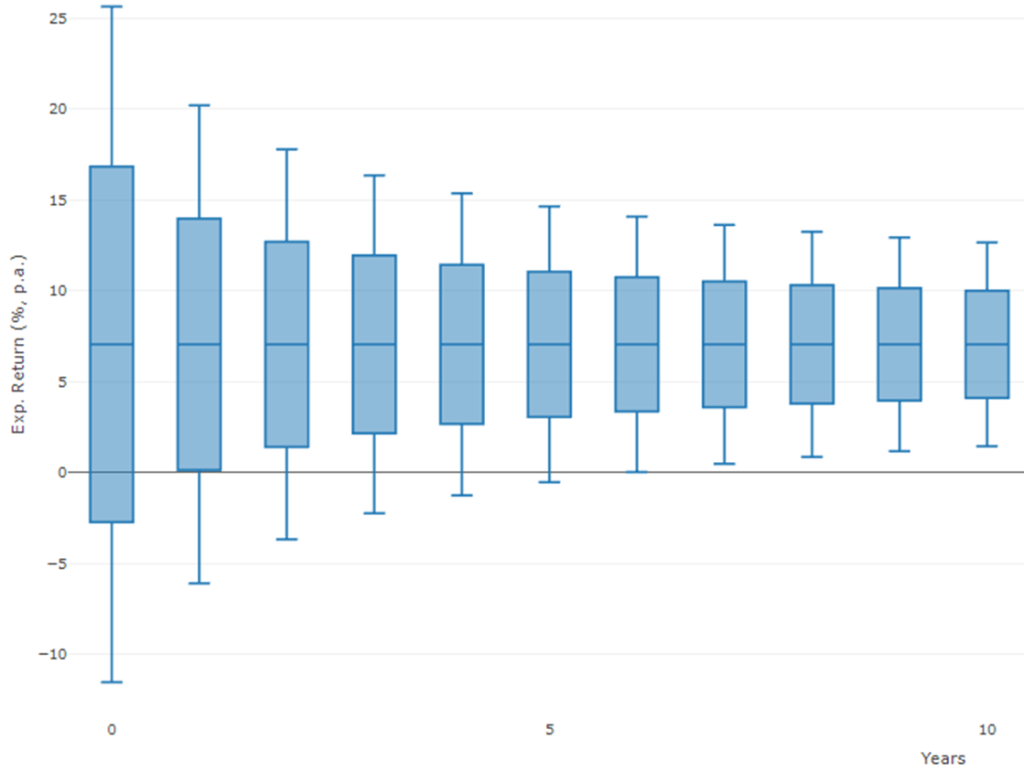

Another strategy is to ride out the short-term volatility and focus on long-term returns. A long-term investment horizon increases the chance of positive returns. Statistically, as shown in the chart below, the annual equity market performance will fall within a range of -12% to +26% with an 80% probability. Over a period of six years, there is even an 80% probability of closing the year with at least a positive return.

Expected performance per year of the MSCI World index over different periods of time (80% probability). Source: JP Morgan Asset Management, MSCI, LSEG Datastream / Note: Past performance is not a reliable indicator for future performance.

Given the level of resilience over the short periods of volatility we can scrutinise global market trends.

A long-term investment makes it possible for the investor to benefit from structural changes.

One of the main reasons to consider a long-term investment horizon is the probability of the analysable structural changes in share prices and thus in an investment becoming realisable. But what structural changes can we currently observe that might be of interest to investors?

Artificial intelligence is more than just ChatGPT

The short-term enthusiasm for the new applications of artificial intelligence (AI) has led to an upswing on the equity markets, particularly among IT companies. While semiconductor manufacturers and technology giants were the main beneficiaries of the enthusiasm for AI in the winter of 2022/23, we now expect a reorientation towards companies that will benefit from this technology. The reason for this is the chance to increase productivity across all areas, such as administration and production processes.

ESG is not just “political correctness”

The cost of adapting to sustainability criteria has put many companies under pressure this year. When it comes to environmental issues (ESG factor “environment”), profit-focused companies often find it hard to maintain, let alone increase their margins in the short term as they are exposed to increased investment activity. As a result, the performance of funds investing sustainably has often been disappointing this year.

However, we expect social decisions and proper governance to ensure the quality of a company in the long term and thus reduce the volatility of a portfolio. A company can achieve a positive working environment and thus better productivity in the medium term with social corporate governance alone.

The demographic development is more discreet, but present

Demographic change is having a continuous and less spectacular impact on the economy, but it is not to be disregarded. The increase in the world’s population highlights how important it is to use basic resources such as water, wood, and energy efficiently. As a result, companies that deal with these issues (e.g. seawater desalination) are also coming into focus and are becoming increasingly attractive to investors.

The inverted population pyramid in industrialised countries, which restricts the labour market, requires an increase in productivity, investment in healthcare and education, and a reform of the pension system. This will benefit the pharmaceutical and biotechnology industries and the financial sector. In addition, the demographic dividend increases the attractiveness of some emerging economies, such as India, Indonesia, and Mexico.

The end of globalisation as opportunity

While the deglobalisation of the global economy could have a negative impact on potential growth worldwide, particularly in emerging economies, as the International Monetary Fund (IMF) has warned, certain emerging countries in the ASEAN region (N.B. Association of Southeast Asian Nations) and Latin America would benefit from nearshoring and friendshoring1.

This is mainly due to the availability of natural resources or existing supply chains. In addition, increasing global tensions are leading to a race to secure land and cyber infrastructure, which in turn is a driver for the development of new technologies.

Conclusion

In a world where annual returns and short-term goals still take centre stage, investors should focus on structural changes to improve their long-term rate of return. Megatrends offer quantifiable opportunities and risks, whose analysis allows us to select regions, sectors, and companies with a high probability of generating higher profits in the long term and thus a positive performance.

An investment decision should be made taking into account one’s situation in life and liquidity requirements. Long-term investments can absorb higher levels of risk, for example when starting a savings plan at 20 years. However, if an investor is close to retirement, the investment should be more defensive. The shorter the investment horizon, the more defensive the investment should be. You should therefore always be aware of what sort of risk profile suits your own investment horizon.

Products that invest in companies involved in megatrends and benefiting from structural changes are particularly suitable for long-term investments such as the ERSTE FUTURE INVEST equity fund. The fund focuses on global megatrends, which means that it covers a broad range of important future topics. These include health, technology, the environment, lifestyle and economic forces in transition.

- Friendshoring is when company processes are outsourced to countries with which they share common values. Nearshoring means that a company relocates a process to a nearby country where labor is cheaper but transport and communication channels are well developed. ↩︎

Risk notes ERSTE FUTURE INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE FUTURE INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE FUTURE INVEST, consideration should be given to any characteristics or objectives of the ERSTE FUTURE INVEST as described in the Fund Documents.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.