In 2020 we introduced the ESGenius® Score at Erste Asset Management, a rating that combines environmental, social, and corporate governance data with the purpose of assessing the ESG performance of companies. The rating applies a best-in-class approach and was soon successfully integrated as an input for the investability of the companies.

Three years later, in order to enhance the ESG performance analysis of companies, we launched the Climate Score last year. The Climate Score combines different environmental data in order to define the leaders and the laggards of each sector. The score arose from the need to quantitatively communicate our research findings on the most important environmental factors and their risk impact on different sectors.

The purpose of this article is to present the methodology behind this new score by analysing one of the laggard companies identified in the utilities sector: Adani Power Limited, an electricity supplier and operator of several coal-fired power plants in India. The Climate Score is evaluated combining three primary inputs for each company:

- the environmental key issues

- the carbon emissions trend, and

- the environmental score of our ESGenius Score calculation.

Environmental key Issues

The environmental key issues are relevant environmental data provided by MSCI regarding 13 risk and opportunities factors. For each company, only the factors relevant to the industry sector are taken into consideration. Adani Power limited, for example, could exploit great opportunities through the use of renewable energy but presents a very poor performance in dealing with toxic waste, carbon emissions, and the use of water, which are clear risk factors.

These factors are subsequently combined into a unique score, representing how exposed the company is to environmental factors and how well it can manage this exposure. In the case of Adani, the combination of a high exposure and low management skills results in a score significantly below the average.

Carbon emissions

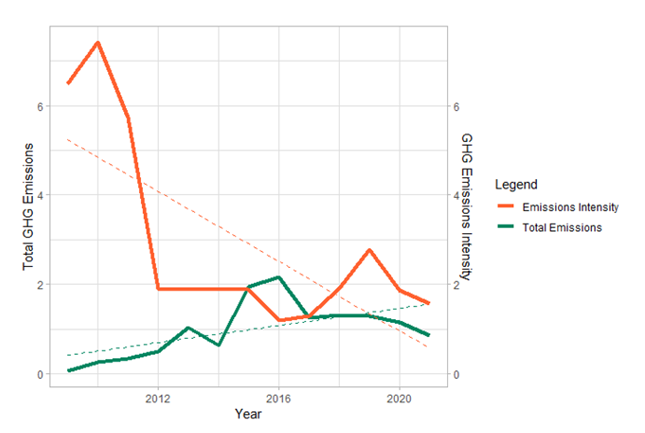

The second input used for the computation of the Climate Score is the Carbon emissions trend, which is evaluated using Scope 1 and 2 emissions. The trend is computed by considering two different aspects: the total emissions produced and the emissions intensity. The latter represents the green house gas emissions produced for USD 1mn in revenues. This dual analysis ensures that growing companies, which are likely to face increasing emissions due to a business enlargement, will not be penalised. The emissions trend is obtained by considering the average pattern of the historical total and intensity emissions.

The following chart shows the development of Adani´s total emissions and emissions intensity over the years, and the relative trend. The company represents a particular case, with a decreasing trend in the emissions intensity and, on the contrary, an increasing one in total emissions. The two trends put the company respectively among the best and the worst of those analysed. In order to smooth these extremes, we consider the mean, resulting in an average result compared to the other companies.

* Input data from MSCI, Emissions Trends are obtained through internal calculation. Note: Past performance is not a reliable indicator for future performance.

E-score

The last input is the environmental score of our ESGenius® Score, that combines MSCI and ISS environmental data. As part of the comprehensive ESGenius® analysis, an ESGenius® score from 0 to 100 is determined for each company. The overall score is made up of the components E (Environmental), S (Social) and G (Governance). As the Climate Score focuses on environmental risks and how companies deal with them, only the environmental component, i.e. the E-score of the ESGenius® rating, is included in the Climate Score. You can find more information about our analysis and the score on our website.

Once all the three inputs are evaluated, they are rescaled on a 1-10 basis and combined. Adani Power limited has one of the lowest scores resulting from the combination of the environmental key factors, as well as a low E-score. The combination of these two with the average score of the carbon trend results in a score of 2.25. The low result of the Climate Score identifies it as one of the laggards in the utilities sector.

Conclusion

Thanks to its combination of different environmental factors, which assess the relevant risks and the opportunities for each GICS sector, the Climate Score should not be seen as a company rating, but rather as a tool to identify the leaders and the laggards of each sector. This means that the effects of climate change and the associated risks for companies can be better taken into account in the sustainability analysis of companies.

Read more articles from the ESGenius Letter on the topic of “Climate Risks” here!

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.