The automotive industry‘s focus on EVs remains unbroken. The e-mobility transformation envisaged as part of the climate transition is continuing worldwide, but the process is likely to take longer than initially expected. In addition to price reductions, many car manufacturers are now focussing on compact models and new types of batteries to boost new sales, while tech companies are also increasingly pushing into this market.

Demand for e-cars recently declining

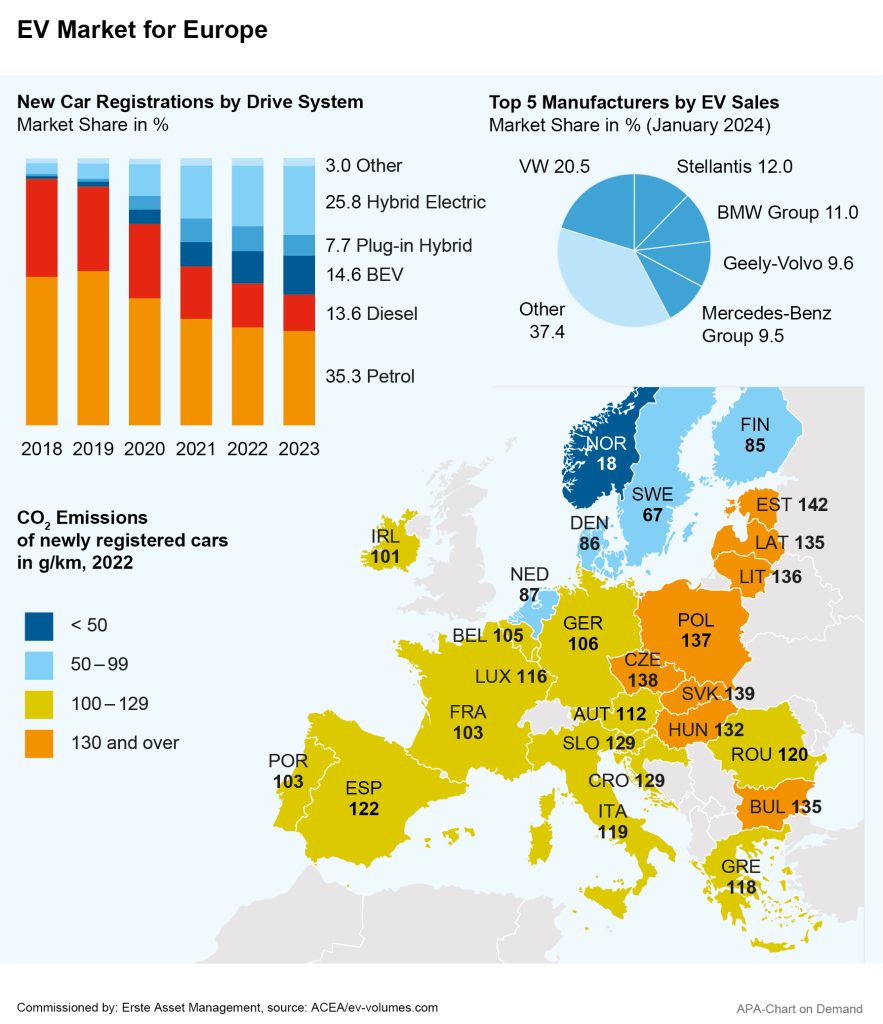

From 2035, only vehicles with zero CO2 emissions may be brought onto the market in the EU. In 2023, the number of new EVs in the EU increased by 37% to 1.54 million, reaching a market share of 14.6%. Petrol cars accounted for the largest share of 35.3%, followed by hybrid electric vehicles (25.8%), diesel vehicles (13.6%) and rechargeable plug-in hybrids (7.7%).

In some countries, however, demand for EVs has recently stalled somewhat. In Germany, the number of new EV registrations fell by 29% in March, while the total number of new car registrations fell by only 6.2%. The German Association of the Automotive Industry (VDA) attributes the decline to the fact that some of the financial incentives responsible for the run on electric cars in 2022 have been discontinued.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation.

The faltering demand was also recently reflected in major car manufacturers’ sales. Automotive giant Volkswagen reported record sales and profit for 2023, but also sluggish new business for EVs. „Incoming orders are currently still below our target for 2024,“ said VW CFO Arno Antlitz at the figures’ presentation. This chiefly applies to electric vehicles. He expects a transitional year before the Group can accelerate sales again.

Price war and increased competitive pressure in China

Demand for EVs has also recently declined somewhat in the important Chinese automotive market. Last year, sales only increased by 21 per cent, after a soaring 74 per cent increase in 2022. US electric car pioneer Tesla and its Chinese competitors responded with significant price cuts. Although this discount battle boosted sales for EVs in China overall, it puts a dent in the business figures of individual manufacturers.

Tesla reported its first decline in sales for Q1 of 2024 in four years. The effect of the price reductions initiated by Tesla is likely to slowly fade, while the company is simultaneously facing ever stronger competition from established car manufacturers as well as newcomers to the EV market. Tesla CEO Elon Musk now expects significantly slower growth this year and recently announced job cuts to the tune 10% of the workforce.

Tesla’s US rival Rivian also plans to lay off 10% of employees in the face of faltering demand, citing downtime due to factory upgrades as a reason apart from the declining customer orders. Rivian produced 13,980 vehicles in Q1, short of analysts’ expectations, although this still constitutes a year-on-year increase of 50%.

The Chinese car manufacturer BYD recently lost its position as the world’s largest e-car company. © unsplash

The competition from China is also showing signs of slowing down. Chinese car manufacturer BYD once again lost its position as the world’s largest EV manufacturer to Tesla, which it had achieved in the final quarter of 2023. BYD sold nearly 300,000 EVs in Q1, marking a decrease of 43% compared to the record number sold in Q1 of the previous year. By 2023, BYD had surpassed Tesla thanks to its domestic sales and overtaken Volkswagen as the market leader in the world’s largest car market. This year, the Group increased its net profit by 81% to a record CNY 30.04bn, nearly EUR 4bn.

EV manufacturers and tech companies are now betting on new compact models

Several automotive groups are now focussing their efforts on further price reductions and smaller and cheaper EV models. BYD recently lowered the price of its cheapest model, the Seagull, by 5%. The compact car now costs CNY 69,800 yuan or just under EUR 9,000 in China. Tesla plans to start production of a new compact model in 2025, while Ford, Renault and VW are also planning smaller and cheaper EV models. Czech VW subsidiary Skoda wants to get involved in the affordable entry-level EV segment with a new battery-electric small car. According to industry circles, Chinese electric car manufacturer Leapmotor is planning to produce a small electric car at a Stellantis plant in Poland.

The Chinese smartphone manufacturer Xiaomi recently presented its first e-car model, the SU7. © PAU BARRENA / AFP / picturedesk.com

The established car manufacturers are facing competition from newcomers from the technology sector. Smartphone manufacturers Xiaomi and Huawei as well as Google’s Chinese counterpart Baidu are now building their own electric car models in cooperation with other companies. The launch of Xiaomi’s SU7 electric car recently resulted in strong gains for the company’s shares. According to industry expert Ferdinand Dudenhöffer, there are signs of a paradigm shift in the industry. Traditional car companies could become pure car manufacturers that only assemble vehicles, while the software crucial to the car is delivered by the tech companies, according to the expert.

Note: The companies listed here have been selected as examples and do not constitute an investment recommendation.

Trade barriers under discussion, but industry representatives caution

In this competitive environment, individual politicians and business leaders are now calling for stronger trade barriers. Chinese car manufacturers are so strong that the majority of the industry would not stand a chance against them without trade barriers, warned Tesla boss Musk recently. In the US, an import duty of 25% is currently keeping Chinese car manufacturers out of the market.

EU Commission President Ursula von der Leyen is also critical of the growing import of cheap EVs from China. She told the Redaktionsnetzwerk Deutschland (RND) in April that there is currently „a drastic overproduction of electric vehicles in China, coupled with massive state subsidies.“ The US is closing off its market, as are Brazil, Mexico and Turkey. „The EU cannot be the only market that remains open to Chinese overproduction,“ said von der Leyen. Competition is desired, „but the conditions must be fair.“

Trade barriers for Chinese e-car manufacturers are being called for in the EU – but industry experts are skeptical © unsplash

The German automotive industry, on the other hand, recently cautioned against trade barriers. EU measures currently being considered against subsidies for the sector in China could „not solve the challenges for the German car industry – on the contrary,“ association president Hildegard Müller recently told the German newspaper „Welt am Sonntag“. Countervailing duties could „quickly have a negative impact in the event of a trade conflict.“ Müller called for a „willingness to engage in dialogue on both sides“ with regard to the EU anti-subsidy investigation. After all, the current business with China secures „a large number of jobs in Germany.“

Case in point: industry giant Volkswagen recently increased its investments in China. The joint venture with JAC Motors is receiving the equivalent of almost EUR 1.8bn in additional capital from the two shareholders. VW founded the joint venture with a focus on electric cars in 2017 and increased its stake to 75 per cent in 2020. Volkswagen is also collaborating with Xpeng, SAIC and FAW in China. Going forward, Volkswagen plans to work together with Chinese EV manufacturer Xpeng on the development of electric cars. The two companies recently reached an agreement on the joint development of two B-Class battery-electric vehicles (BEVs).

Solid-state battery remains a future goal

Volkswagen and other companies are also increasingly focussing on the development of new types of batteries as part of the e-mobility transition. The battery-manufacturing VW subsidiary PowerCo is currently developing a new solid-state cell battery with its US partner QuantumScale and is building a battery cell factory in Salzgitter, Germany. The Group is also looking into a possible IPO of the battery subsidiary.

Solid-state cells are regarded in the industry as the next big step in battery development. Unlike with the lithium-ion batteries currently employed in EVs, a solid electrolyte is used instead of a liquid one. Manufacturers are hoping that this will result in a greater range, faster charging and less wear.

Other manufacturers have been working on this new type of battery technology for years as well. BMW wants to build a pilot plant in Parsdorf near Munich together with its partner Solid Power and is planning its first test vehicle with solid-state cells for this year. Nissan has announced a pilot plant in Japan for 2024, while Toyota wants to bring the technology into series production in 2027.

Notes ERSTE GREEN INVEST

Note: Please note that an investment in securities entails risks in addition to the opportunities described. Prognoses are not a reliable indicator of future performance.

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited. Please note that investing in securities also involves risks besides the opportunities described.

For further information on the sustainable focus of ERSTE GREEN INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE GREEN INVEST, consideration should be given to any characteristics or objectives of the ERSTE GREEN INVEST as described in the Fund Documents.

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.