Today, 22 March, marks the 21st International World Water Day. In these more than two decades, attention to the topic has also increased significantly in the world of business and finance, and for one simple reason: this valuable resource is becoming increasingly scarce.

Exceedingly often, examples of droughts and water scarcity are making us realise the relevance of the “blue gold”. Why is water such an important resource not only for life on our planet but also for our economic coexistence, and what can we do to combat its increasing scarcity? We want to address these questions in this blog post.

Droughts and dry spells are becoming more frequent

February 2024: in the middle of winter in Europe, nobody would think that water scarcity and drought could be a problem. But in Catalonia, the regional government was forced to adopt an emergency package a month ago for precisely this reason, which is intended to drastically limit water consumption.

The measures not only affect private households, but also agriculture and industry, which shows that droughts are increasingly affecting the economy. In Catalonia, for example, irrigation in agriculture is to be reduced by 80% and in the industrial sector by 25%.

The drought in Catalonia has forced the regional government into taking emergency measures. The picture above shows a water reservoir in Sau in the Catalan province of Girona, which is one of the main reservoirs supplying the metropolis of Barcelona with water. © PAU BARRENA / AFP / picturedesk.com

Sustained droughts and acute water shortages may therefore also come with serious consequences for the corporate sector: from strict regulatory measures on water consumption (as is currently the case in Catalonia, for example) to rising costs and production delays. Walter Hatak, Head of Responsible Investments, agrees: “Many examples from the recent past show that water scarcity has dramatic effects that exceed agriculture: when water levels in rivers are too low, shipping has to be suspended and it is impossible to utilise hydropower or cool nuclear reactors.”

This has recently become apparent not only in Catalonia, but also in other parts of the world, for example in Chile, where copper mines had to be scaled back due to the lack of water; or in China, where energy from hydropower has recently fallen due to drought.

The problem here is not the volume of water as such, since the amount of water available basically remains the same. What is changing, however, is the local and temporal distribution and the water quality. Due to rising temperatures, more and more water is being stored in the air through increased humidity. Rainfall is becoming less frequent but heavier, and the dried-out soil cannot absorb the water. The result is flooding of massive proportions.

Water – the underestimated economic factor

People are rightly talking about the responsible use of scarce resources that are needed for the production of many everyday goods, for example, lithium and rare earths for battery production, among other things.

This is not yet so clearly the case with water: “Water is (still) one of the most heavily subsidised raw materials and is therefore not sufficiently important for some companies,” emphasises Walter Hatak.

Yet the raw material is found in pretty much every product that is produced, bought, or sold worldwide. One example: according to a study by the environmental organisation “Friends of the Earth”, it takes 3.9 m³ of water to produce one cotton t-shirt.

Source: „Friends of the Earth” – The land and water footprints of everyday products

This is referred to as “virtual water”, as these water resources are not consumed directly, for example in the form of drinking water, but are nevertheless contained in all food, services, and goods. Water consumption is likely to continue to rise, especially in the economy, as a study by scientists at the University of Maryland in the USA shows. According to the study, the market for virtual water could grow fivefold by the year 2100. With water becoming increasingly scarce, how can this sharp rise in consumption be countered in financial investments?

Water consumption – the “where” is crucial

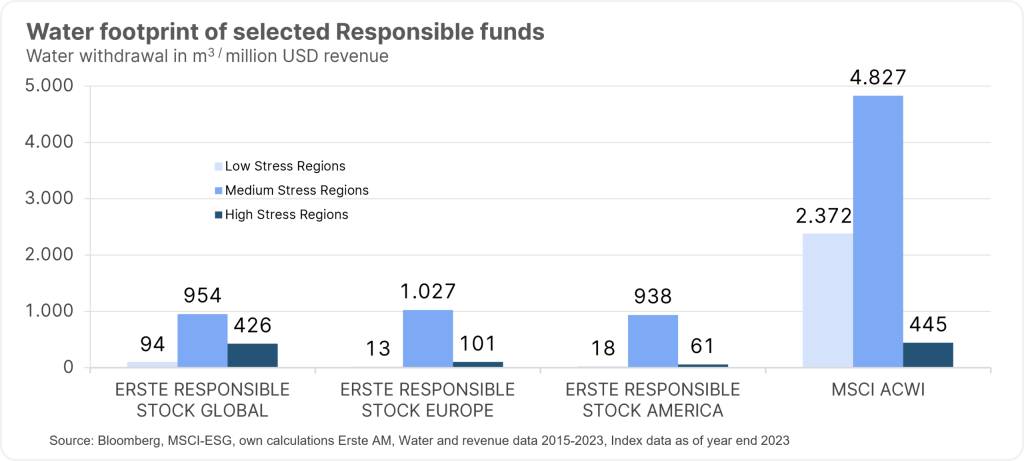

One way is by analysing one’s own investments in terms of water consumption. This is where the so-called water footprint is being brought to bear. It measures the water consumption of all companies and countries whose shares or bonds are included in the respective fund. To measure the water footprint, the published data of the companies is collected and set in relation to the respective sales figures.

Since we at Erste Asset Management first published the water footprint of our sustainable Responsible product range in 2017, a lot has happened. At that time, not even half of the companies analysed had disclosed their water consumption. Today, seven years on, data availability is already at around 74%. Companies are therefore taking a more conscious look at their water consumption.

The decisive factor here is not just pure consumption, but also the regional context. After all, high consumption in water-scarce regions such as Spain has more serious consequences than high consumption in regions that, like Austria, have a higher volume of water resources. We follow the risk categorisation of the World Resources Institute and distinguish between low- (e.g. Austria in the Alps), medium- (e.g. Germany), and high- (e.g. Spain) stress regions.

The evaluation of our responsible investment funds shows that sustainable investments outperform the market as a whole in terms of water consumption. For example, the sustainable global equity fund ERSTE RESPONSIBLE STOCK GLOBAL has a considerably lower water footprint than the global equity index MSCI All Countries World in low-stress, medium-stress, and high-stress regions.

Please note: The index mentioned is only used for comparison. Representation of an index; no direct investment possible. The benchmark index does not affect the discretionary powers of the asset management company when selecting the assets of ERSTE RESPONSIBLE STOCK GLOBAL, ERSTE RESPONSIBLE STOCK EUROPE, and ERSTE RESPONSIBLE STOCK AMERICA. When determining the average water intensity of the companies held in the funds, we use the water withdrawal published by the companies as key indicator. Water intensity measures the water consumption in cubic metres per USD mn in sales.

The chart shows the water footprint of selected funds. For a complete overview of all responsible equity and bond funds, please visit https://www.erste-am.at/de/private-anleger/nachhaltigkeit/responsible#wasserfussabdruck.

Targeted investment in companies in the water management sector

In addition, targeted investment in pioneers in the areas of water treatment and water management can also promote the sustainable use of global water resources. This is possible via so-called impact funds, for example. Their goal is to exert a positive and measurable impact on the environment or society.

In the ERSTE WWF STOCK ENVIRONMENT impact fund, for example, water is one of the three main themes, alongside environment and waste & recycling. Among other things, the fund makes targeted investments in companies that help to reduce water consumption.

One company from this fund that is currently one of the top holdings in the portfolio is Xylem. This US company helps water supply companies to quickly localise and rectify leaks and burst pipes with a real-time monitoring system. In addition, the company’s systems and analyses allow for the identification of potential weak points in the supply networks at an early stage.

“Xylem makes a very decisive contribution when it comes to reducing high water losses from damaged infrastructure,” says Clemens Klein, fund manager of ERSTE WWF STOCK ENVIRONMENT. This is a major problem in the United States in particular: “In the USA, 23 billion litres of drinking water are lost every day because some of the pipes are more than 100 years old. This is equal to more than 15% of daily water consumption in the USA.”

Please note: where portfolio positioning of funds is disclosed in this document, it is based on market developments at the time of writing. In the context of active management, the stated portfolio positions may change at any time. The companies listed here have been selected as examples and do not constitute an investment recommendation.

Conclusion

Drought and aridity are on the increase, and with them the water risks for the economy. It therefore makes sense for companies to pay close attention to water consumption and its regional distribution in order to identify and react to risks as quickly as possible. Many companies already publish their water data, but there is still potential for improvement. After all, one thing is certain: with climate change, recurring water shortages have also arrived in Europe – just look at Catalonia for proof.

If you also want to pay close attention to the water risks in your own portfolio, sustainably managed funds are a good option. These tend to have a smaller water footprint than the broad market, especially in high-stress regions that are particularly at risk of water scarcity. Impact funds, which invest specifically in companies with a sustainable impact, go one step further. Among them is the ERSTE WWF STOCK ENVIRONMENT equity fund, where water is one of the five central investment themes.

More interesting topics 👇

No Posts Found

Legal notice: forecasts are no reliable indicator of future performance. Please note that investing in securities involves risks as well as opportunities.

Warning notices ERSTE RESPONSIBLE STOCK GLOBAL

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the asset management company’s part. Please note that investing in securities also harbours risks in addition to the opportunities described above.

For further information on the sustainable structuring of ERSTE RESPONSIBLE STOCK GLOBAL and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus.

Benefits for the investor:

- Broadly diversified investment in developed market equities

- Participation in ecologically, morally, and socially responsible companies

- Active stock selection on the basis of fundamental criteria

- Opportunities for attractive capital appreciation

Risks to bear in mind:

- The price of the fund may be subject to significant fluctuations (high volatility)

- Due to investment in foreign currency, the value of the fund may be affected by foreign exchange fluctuations

- Capital loss is possible

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act

Warning notices ERSTE RESPONSIBLE STOCK EUROPE

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the asset management company’s part. Please note that investing in securities also harbours risks in addition to the opportunities described above.

For further information on the sustainable structuring of ERSTE RESPONSIBLE STOCK EUROPE and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus.

Benefits for the investor:

- Broadly diversified investment in developed market equities

- Participation in ecologically, morally, and socially responsible companies

- Active stock selection on the basis of fundamental criteria

- Opportunities for attractive capital appreciation

Risks to bear in mind:

- The price of the fund may be subject to significant fluctuations (high volatility)

- Due to investment in foreign currency, the value of the fund may be affected by foreign exchange fluctuations

- Capital loss is possible

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act

Warning notices ERSTE RESPONSIBLE STOCK AMERICA

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the asset management company’s part. Please note that investing in securities also harbours risks in addition to the opportunities described above.

For further information on the sustainable structuring of ERSTE RESPONSIBLE STOCK AMERICA and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus. When deciding to invest in ERSTE RESPONSIBLE STOCK AMERICA, all characteristics or objectives of ERSTE RESPONSIBLE STOCK AMERICA as described in the fund documents should be taken into account.

Benefits for the investor:

- Broadly diversified investment in developed market equities

- Participation in ecologically, morally, and socially responsible companies

- Active stock selection on the basis of fundamental criteria

- Opportunities for attractive capital appreciation

Risks to bear in mind:

- The price of the fund may be subject to significant fluctuations (high volatility)

- Due to investment in foreign currency, the value of the fund may be affected by foreign exchange fluctuations

- Capital loss is possible

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act

Warning notices ERSTE WWF STOCK ENVIRONMENT

The fund pursues an active investment policy and does not follow a benchmark. The assets are selected at our discretion, without any constraints to the latitude of judgement on the asset management company’s part. Please note that investing in securities also harbours risks in addition to the opportunities described above.

For further information on the sustainable structuring of ERSTE WWF STOCK ENVIRONMENT and information in line with the Regulation (EU) 2019/2088 of the European Parliament and of the Council of 27 November 2019 on sustainability‐related disclosures in the financial services sector and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to section 12 and the Appendix, “Sustainability Principles”, of the current prospectus <bitte englischen Link einfügen>. When deciding to invest in ERSTE WWF STOCK ENVIRONMENT, all characteristics or objectives of ERSTE WWF STOCK ENVIRONMENT as described in the fund documents should be taken into account.

Benefits for the investor:

- Broadly diversified investment in equities from the environmental sector with small capital contribution

- Support of the environmental protection programmes of WWF by Erste AM

- Chances of attractive gains

- The fund is suitable as complement to an existing equity portfolio. Its goal is the long-term building of capital

Risks to bear in mind:

- The price of the fund may be subject to significant fluctuations (high volatility)

- Due to investment in foreign currency, the value of the fund may be affected by foreign exchange fluctuations

- Capital loss is possible

- The following risks may be of particular relevance to the fund: credit risk, counterparty risk, liquidity risk, deposit risk, derivative risk, and operational risks. For comprehensive information on the risks of the fund, please refer to the prospectus and to the information for investors according to sec. 21, part II, chapter “Risk notices” of the Austrian Alternative Investment Fund Managers Act

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.