As a former winter sports enthusiast, Norway has always been an almost sacred place for me: the Mecca of Nordic skiing! Almost ten years later, however, the reasons for my visit there are different. I was visiting portfolio companies of our impact funds (ERSTE WWF STOCK ENVIRONMENT and ERSTE GREEN INVEST) in Norway and talking to the management of these companies.

Nevertheless, I couldn’t pass up the opportunity to visit Holmenkollen (probably the most traditional ski jump in the world) – but “unfortunately” without skis. For the sake of my health.

Erste AM’s sustainable investment philosophy is not limited to identifying companies that generate attractive returns for our clients and at the same time make a positive contribution to the environment and our society. It is equally important for us to maintain a culture of open dialog with the management of selected companies (note: please bear in mind that investing in securities entails risks as well as opportunities).

These dialogs not only give us, as co-owners of the companies, the opportunity to gain an even deeper insight into their activities and draw their attention to potential changes. The companies themselves also benefit from this: the management gains insights into what is important to us as investors and where we still see potential for change.

Norway: Sustainable pioneer with large oil reserves

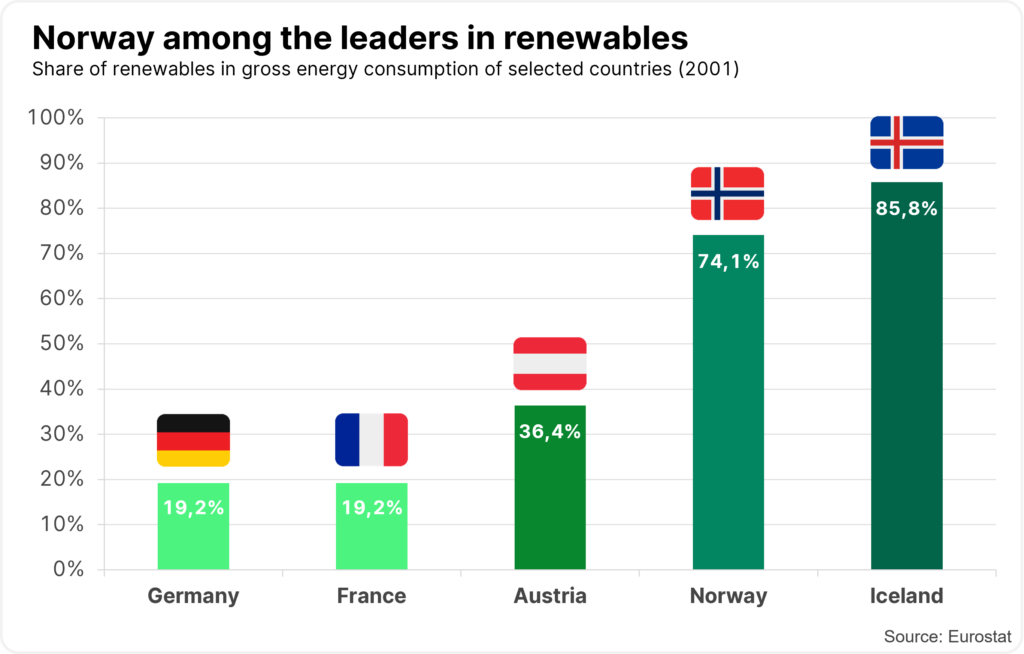

Norway has the largest oil reserves in Europe and they continue to be heavily extracted. On the one hand, this raises the question of how the country can make itself more ecologically sustainable. On the other hand, Norway is considered a pioneer in Europe when it comes to sustainability, and that on many levels. For example, they rank second in the use of energy from renewable sources (~75%-80%), behind only Iceland, which benefits from a high level of geothermal energy.

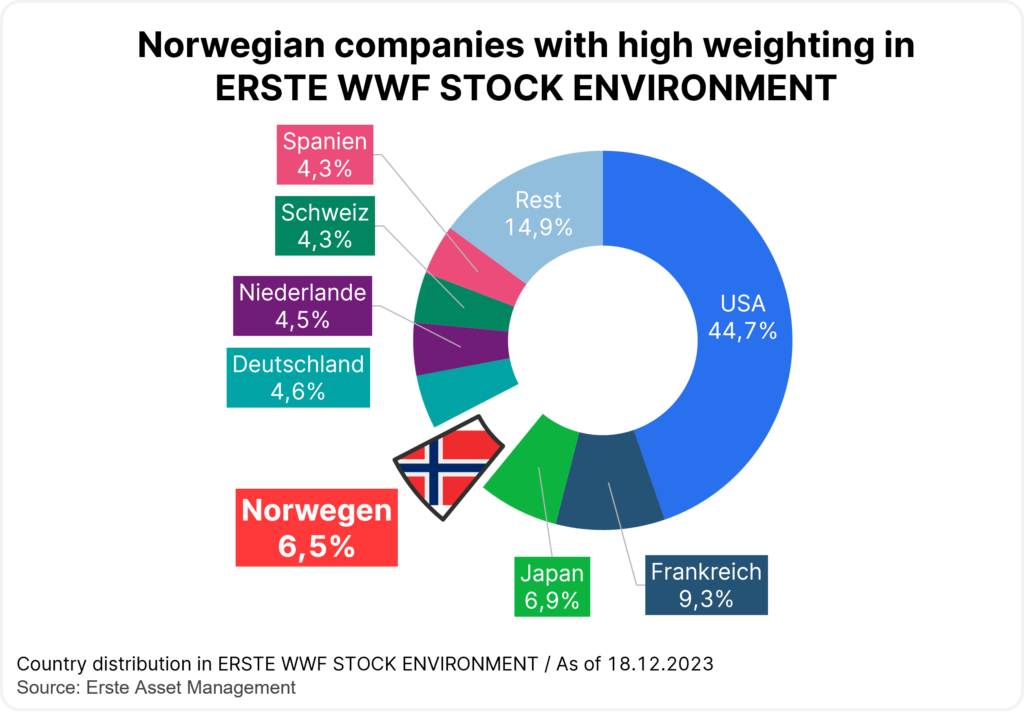

Norwegians even lead the world in the purchase of electric cars – in 2022 alone, 80% of newly purchased cars were electric. There are also many companies in the industrial sector that are working on sustainable value creation. This can also be seen in our ERSTE WWF STOCK ENVIRONMENT, an impact fund with a focus on renewable energies: Ten of the total of around 70 companies we hold in this fund are based in Norway. Although they do not have the largest weightings in the fund, they are an important component of the portfolio with a total of around 6.5%.

In the following, I would like to present a small selection of companies that I visited during my business trip.

Note: As part of active management, the portfolio positions mentioned may change at any time. The companies listed here have been selected as examples and do not constitute an investment recommendation.

Hydrogen: energy source of the future

“Green” hydrogen (water electrolysis with exclusively renewable energy) as an energy source will play a decisive role in the decarbonization of our industry in the future. For example, the production of steel and plastics, use in heavy goods transport or the production of ammonia, one of the most important fertilizers in agriculture, which is currently still produced using natural gas, would be possible and sensible applications.

The problem: the lack of (hydrogen) infrastructure, high capital costs (not least due to the sharp rise in interest rates) and a price for hydrogen that is (still) too high (currently around €6-7/kg). The following two companies offer solutions to the infrastructure problem.

Nel Hydrogen: Manufacturer of electrolyzers

Nel Hydrogen builds and sells systems that can be used to produce hydrogen, i.e. electrolysers. Put simply, water (H2O) flows into the system and is split into its two components, hydrogen (H2) and oxygen (O), by electrolysis using green electricity. The two elements then enter a storage tank via different routes.

Hexagon Purus: Hydrogen systems for the transportation sector

The second company, Hexagon Purus, offers hydrogen solutions in the mobility sector. These can play a particularly important role in the aforementioned heavy-duty transportation sector, as electric or battery-powered drives are less efficient due to their lower energy density. Heavy-duty transportation includes not only trucks, but also cargo ships, for example. Even trains can be operated relatively easily with a fuel cell and hydrogen tank. Hexagon Purus specializes in the production of these tanks. As H2 is a very light element, it has to be highly compressed for storage and transportation. The company’s tanks are filled at a pressure of around 600(!) bar.

The company already has well-known customers and even supplies two of the three largest institutions in the aerospace industry – a strong sign of quality! In addition to solutions for the mobility sector, Hexagon Purus also supplies the hydrogen infrastructure with distribution systems, i.e. the transportation of hydrogen, as well as mobile and stationary refuelling systems.

Recycling: solutions for the recovery of resources

There is a social consensus that recycling is right and important. Unfortunately, the reality lags behind these beliefs – less than 20% of global waste ends up in the recycling process. The rest either ends up in landfill or is incinerated. This status quo is clearly not fit for the future. Two Norwegian companies are tackling this issue and have solutions that focus on recovering resources that have already been used.

Most of the plastics we use are mechanically recycled, i.e. the materials are separated and washed before being reformulated and reassembled. Mechanical recycling is currently the most economical way of recycling; however, this process never produces high-quality components that are required for end products in the medical sector, for example. In addition, the quality of the compounds deteriorates with each recycling process.

Agilyx: Molecular and chemical recycling

Agilyx (currently not included in our portfolios) specializes in molecular and chemical recycling. Molecular recycling – plastic waste is converted directly into a high-quality product/monomer – enables a fast recycling process with fewer emissions. The problem here is the source material – it is crucial to obtain the same type of plastic (not all plastics are the same!). This requires more upstream sorting, which is both more time-consuming and more expensive. Chemical recycling solves the raw material problem, but involves a longer refining and production process. Here, mixed waste is refined through pyrolysis and gasification before being used to produce polymers. Agilyx has made a strategic investment in Cyclyx, which focuses on the collection and sorting of plastic waste. The aim is to procure the right raw material for the recycling processes more efficiently.

Tomra: The world’s leading manufacturer of deposit bottle return systems

We all know it and have almost certainly used it a few times: the machines for returning drinks bottles/crates in supermarkets. Tomra is the world’s leading manufacturer of these machines. These are now very technologically advanced, as I was able to see for myself at their main site in Asker, Norway. The first step was to empty a large bag filled with around 100 different bottles and cans into the machine drum. This was followed by the recognition of the containers – an extremely fast and efficient process, as the fun was over after around 30 seconds. A look behind the scenes also showed how the returnable packaging is sorted. As previously mentioned, this separate collection is an extremely important process for further processing and therefore also for the recovery of materials.

On January 1, 2025, a deposit system for disposable bottles and cans will be introduced in Austria. Some may find this development annoying, but from a sustainability perspective it is a very important and long overdue step.

Tomra also offers sorting solutions for agriculture that make the harvesting process and downstream packaging of the harvest much more efficient. Just think of a rotten/mouldy piece of fruit that is then packed in a net with other good pieces of the same variety – by sorting it in advance, the loss of food can be avoided or reduced.

The “Austria model”: the aim is to use the space of higher rooms more efficiently. From 2025, it will also be possible to use this system in this country.

Key topics for achieving the climate targets

The two priorities mentioned, i.e. (green) hydrogen and recycling, are anchored in the European Green Deal. In both areas, political support is an important part of achieving future climate targets. Both areas are also supported in the USA: on the one hand through the Inflation Reduction Act (here there is to be a subsidy of €3/kg hydrogen) and on the other hand there are also efforts towards a circular economy, in which recycling will play a key role. Even in China, there is a development plan for the circular economy as part of the five-year plan.

Conclusion

The political ambitions towards sustainability are great, but action must also follow. Norway, and in particular the companies we visited, are already leading the way and confirming to us at Erste AM that we are well positioned and well equipped for the future with our impact funds. Like real Vikings.

Risk notes ERSTE WWF STOCK ENVIRONMENT

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE WWF STOCK ENVIRONMENT as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE WWF STOCK ENVIRONMENT, consideration should be given to any characteristics or objectives of the ERSTE WWF STOCK ENVIRONMENT as described in the Fund Documents.

Advantages for the investor

- Broad diversification in companies of the environmental sector with little capital investment.

- Support for WWF’s environmental protection programs by Erste AM.

- Opportunities for attractive capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the fund can fluctuate strongly (high volatility).

- Due to the investment in foreign currencies, the net asset value in Euro can be negatively impacted by currency fluctuations.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Risk notes ERSTE GREEN INVEST

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE GREEN INVEST as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE GREEN INVEST, consideration should be given to any characteristics or objectives of the ERSTE GREEN INVEST as described in the Fund Documents.

Advantages for the investor

- Broad diversification in companies of the global equity market.

- Investment into companies with above average ESG characteristics.

- Active stock selection, based on a predefined selection process with a strong environmental focus.

- Opportunities for attractive capital appreciation.

Risks to be considered

- The net asset value of the fund can fluctuate considerably.

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Legal note:

Prognoses are no reliable indicator for future performance.