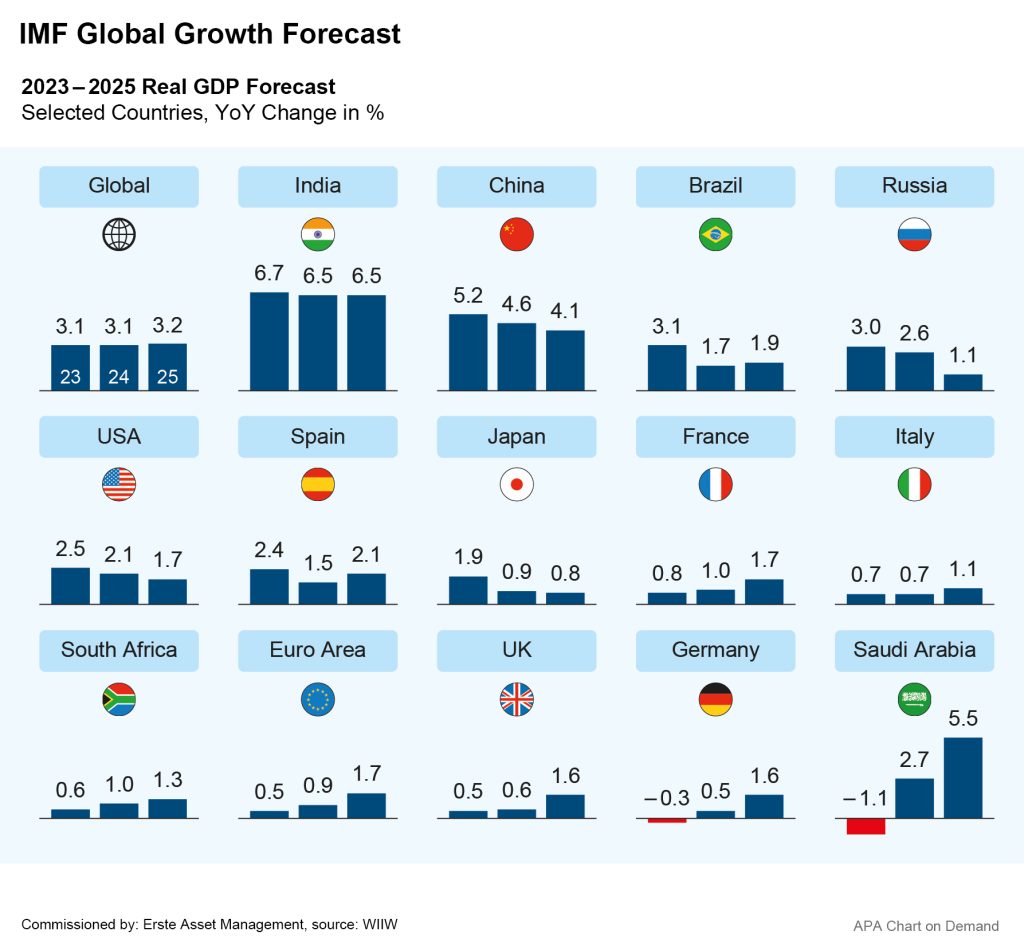

The global economy could grow more strongly than expected this year. In its latest World Economic Outlook, the International Monetary Fund (IMF) presents a more optimistic view of the current year. Global growth is expected to reach 3.1% in 2024, 0.2 points higher than expectations in October 2023. For 2025, the IMF expects growth of 3.2%.

❔ What is the IMF ❔

The International Monetary Fund (IMF) is a specialized agency of the United Nations (UN). The IMF’s main task is to promote international cooperation in matters of monetary policy in order to ensure the stability of the global economy and the international financial system. In its World Economic Outlook, the IMF regularly publishes forecasts on the development of the global economy.

👉 What will you read in this article?

Economy surprisingly resilient

The global economy’s recovery from the coronavirus pandemic, the consequences of the war in Ukraine and high inflation proves to be surprisingly resilient, the IMF experts write. Inflation has had less of an impact on the labour market and productivity than feared and is also pulling back from its record highs faster than expected. As a result, the pressure on many countries caused by interest rate hikes is abating, and central banks are regaining the flexibility to gradually loosen their monetary policy.

The IMF is still expecting a global inflation rate of 5.8% for 2024, dropping to 4.4% in 2025. The forecast for industrialised countries is 2.6% and 2.0%, respectively, compared to 4.6% in 2023. However, with the decline in inflation, many economies must also return to greater discipline in their budgets in order to be prepared for any future crises, the IMF says.

Note: Forecasts are not a reliable indicator of future performance. Please note that investing in securities involves risks as well as opportunities.

IMF sees robust economy in China and the US

The IMF sees the economies of the two largest national economies, the USA and China, as particularly robust, and has upgraded its forecasts for both countries accordingly. The growth forecast for the USA for 2024 has been raised significantly by 0.6 points to 2.1%, with 1.7% expected for 2025.

For China, a growth of 4.6% is projected for this year, 0.4 points up from previous expectations and dropping slightly to 4.1% in 2025, marking a recovery of the second-largest national economy following the end of the strict zero-corona policy. According to the IMF, the upturn was driven by strong domestic demand, a loose monetary policy and tax relief.

However, the IMF is expecting weaker growth for China in the following years. For 2028, the fund sees a growth of just 3.4% due to weak productivity and the ageing population. Inflation is also expected to rise according to the forecast. In addition, the IMF experts cite the crisis in the Chinese property sector as a potential risk factor.

Strong growth in India

At 6.5%, India shows the strongest growth of the major economies in the 2024 forecast. According to the IMF, the country’s surprisingly resilient domestic demand is a key factor. India’s government plans to make the country’s economy the third largest in the world within three years by incentivising investment and promoting the industrial sector. India could also benefit from the fact that many companies are currently re-evaluating their commitment to China.

Moderate growth forecast for Euro Area

The IMF expects growth of 0.9% for the euro area in 2024. The economic area has particularly suffered from the war in Ukraine but should now recover. According to the IMF outlook, increased consumption after falling energy prices and the general easing of price pressure should be a major driver for the euro area’s recovery.

For the UK, The IMF predicts only moderate growth of 0.6% in 2024. With the expected decline in inflation and its positive impact on real incomes, growth in the UK should then accelerate to 1.6% in 2025. Japan is also expected to see only modest economic growth of 0.9% in 2024, followed by 0.8% in 2025.

Forecasts for Germany Lowered

Germany’s economy is likely to grow this year and the next, but less strongly than previously expected. The IMF believes that Germany won’t manage to achieve more than 0.5% growth this year, with 1.6% projected for 2025. This is a reduction of 0.4 points, respectively, from the October estimates. The silver lining is that a hard landing is unlikely, according to the global economic outlook. Last year, the German economy actually shrank by 0.3%, partly due to weak exports and weak consumption. This situation is likely to persist in 2024, as Germany, an export nation, will probably continue to suffer from high energy prices and weakening global trade.

Forecast below long-term average

According to the IMF, geopolitical tensions such as the war in Ukraine and the re-ignited conflict in the Middle East will continue to slow down international trade. Growth rates of 3.3 and then 3.6% are expected for 2024 and 2025 respectively, which is below the long-term trade growth average of 4.9%.

Despite the slight improvement, the outlook for the global economy is weak in a long-term comparison according to the IMF forecasts. The average growth rate for 2000 to 2019 was 3.8%. The higher interest rates used to combat inflation come at the expense of investment. In addition, many countries accrued massive debt during the coronavirus pandemic, and later to cushion high energy prices. Government support is now gradually being cut back, which is also dampening growth.

How to invest in the global economy?

Even if the IMF experts’ forecasts are below the long-term average, the growth outlook remains positive. The good news for investors: The “soft landing” of the economy following the sharp interest rate hikes in the US and Europe is possible. But how can investors benefit from economic growth as a whole or in individual regions? Here are a few examples 👇

Global Equities

American Equities

European Equities

Emerging Markets Equities

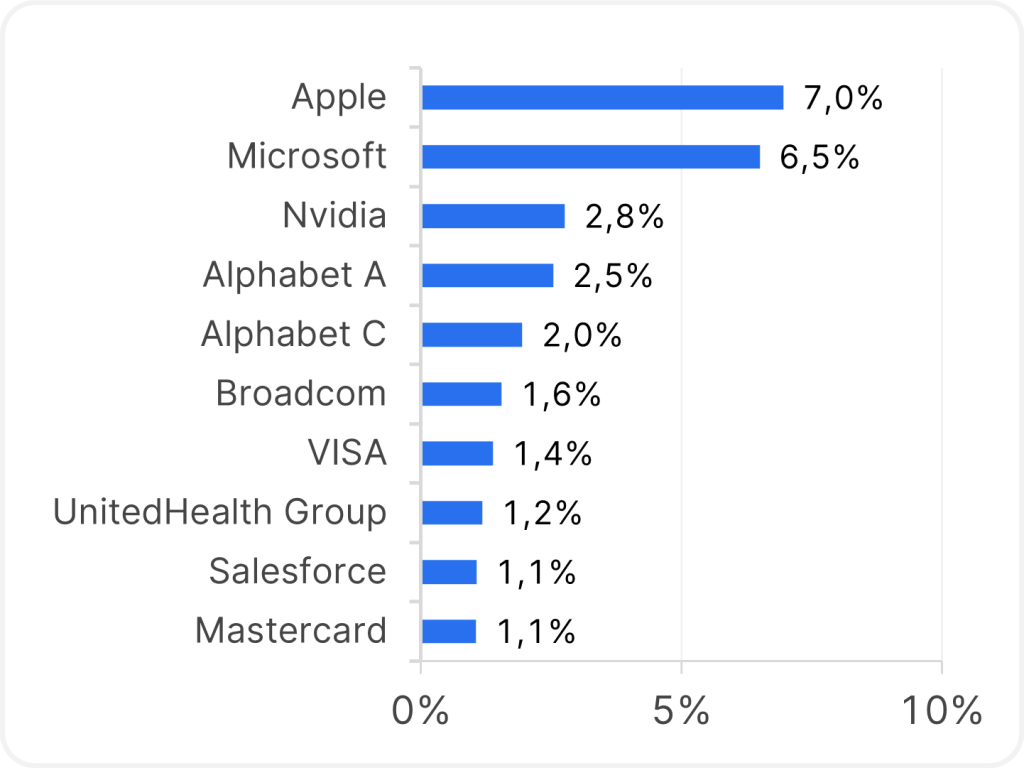

ERSTE RESPONSIBLE STOCK GLOBAL enables investors to invest in a globally diversified manner in shares of large and well-known companies from developed markets (so-called “developed countries”) – including the USA, France, Japan and Germany, for example.

Sustainability criteria are also taken into account when selecting the shares in the fund’s portfolio. The aim is to invest primarily in companies that are pioneers in terms of sustainability. You can find out more about the criteria in our sustainable funds here.

Note: Past performance does not allow any reliable conclusions to be drawn about the future performance of a fund.

How has the fund performed?

Development over the past 10 years

What is in it?

Top 10 Positions in the fund

Note: Chart is indexed (3.2.2014 = 100). The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. The following information is provided by the manufacturer (Erste Asset Management GmbH), information of the respective sales partners may differ.

Opportunities and risks at a glance

Advantages for the investor

- Broadly diversified investment in equities in developed markets.

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Notes ERSTE RESPONSIBLE STOCK GLOBAL

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK GLOBAL as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK GLOBAL, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK GLOBAL as described in the Fund Documents.

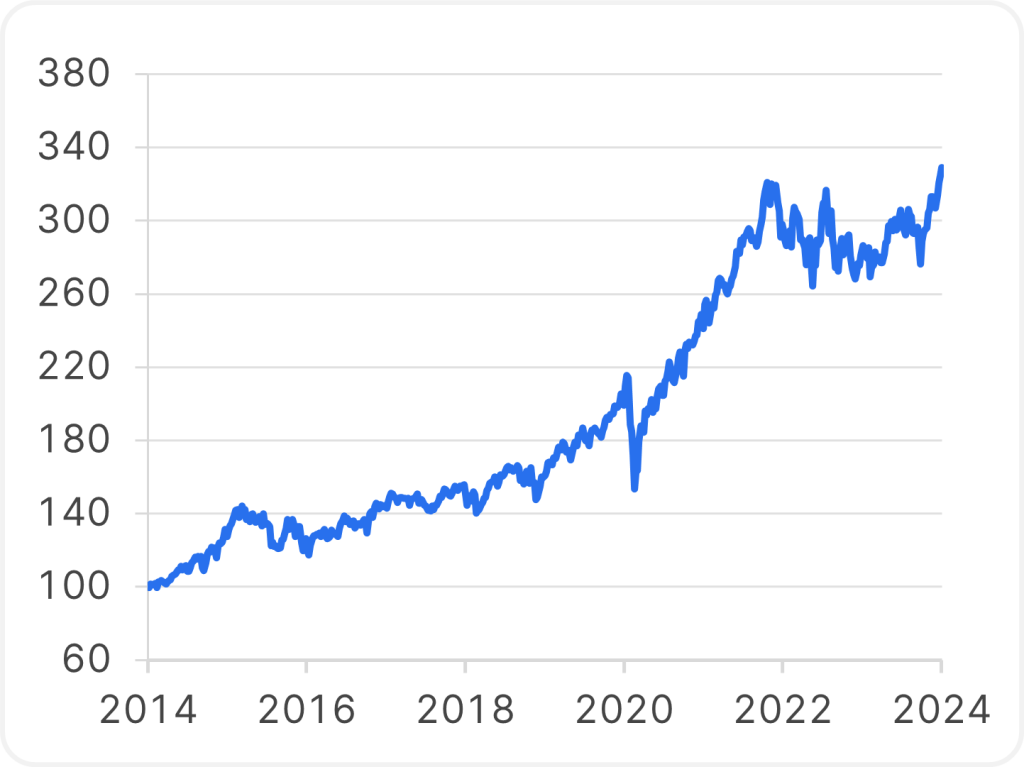

ERSTE RESPONSIBLE STOCK AMERICA invests in numerous companies based in North America. The companies in the fund are mainly from the United States and are largely at home in the IT sector. The portfolio also includes large companies from the healthcare, industrial and financial sectors.

Sustainability criteria are also taken into account when selecting the shares in the fund’s portfolio. The aim is to invest primarily in companies that are pioneers in terms of sustainability. You can find out more about the criteria in our sustainable funds here.

Note: Past performance does not allow any reliable conclusions to be drawn about the future performance of a fund.

How has the fund performed?

Development over the past 10 years

What is in it?

Top 10 Positions in the fund

Note: Chart is indexed (3.2.2014 = 100). The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. The following information is provided by the manufacturer (Erste Asset Management GmbH), information of the respective sales partners may differ.

Opportunities and risks at a glance

Advantages for the investor

- Broadly diversified investment in North American stocks (US and Canada).

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for attractive capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Notes ERSTE RESPONSIBLE STOCK AMERICA

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK AMERICA as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK AMERICA, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK AMERICA as described in the Fund Documents.

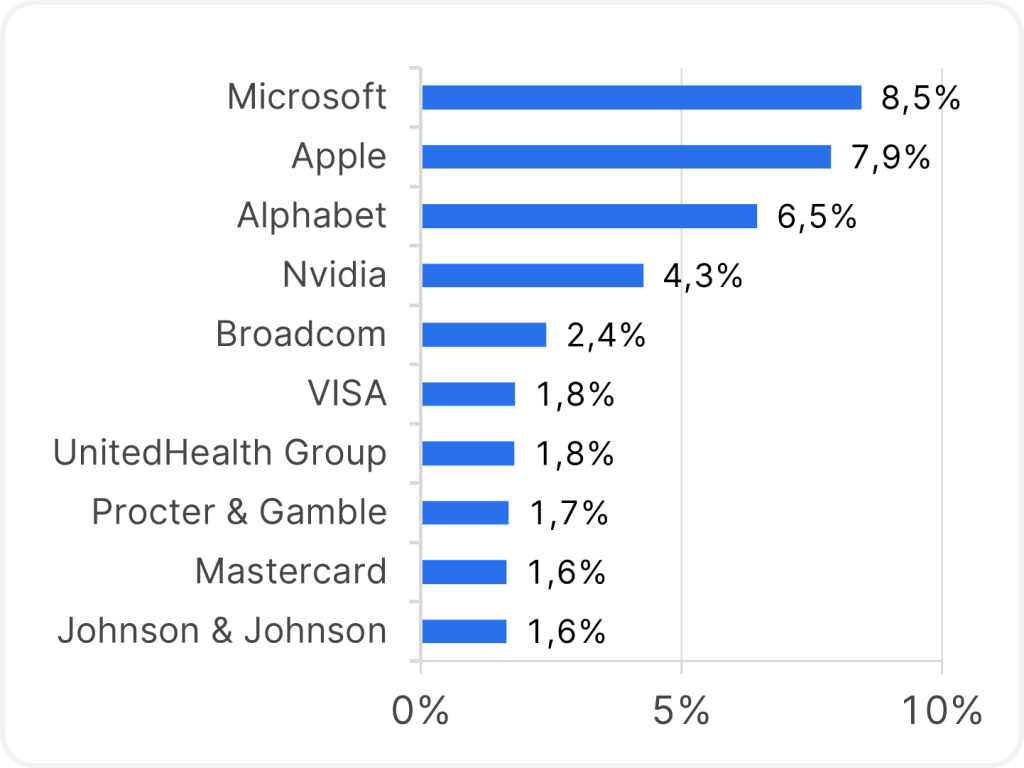

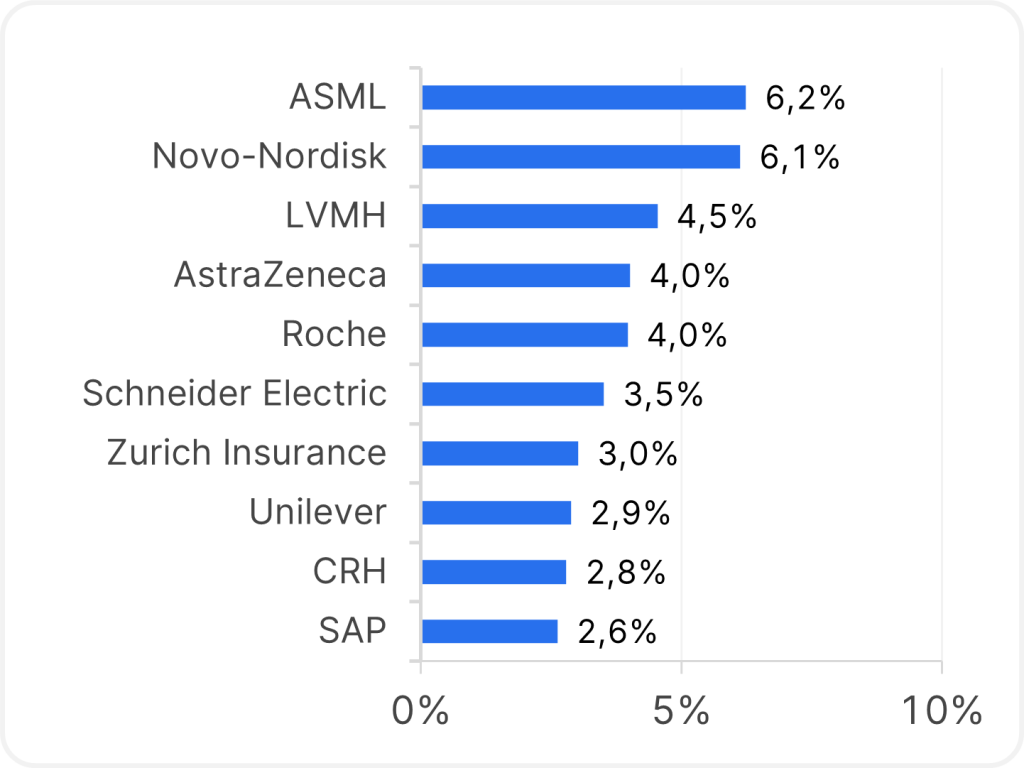

ERSTE RESPONSIBLE STOCK EUROPE invests in shares of selected European companies. The portfolio includes companies from a wide range of sectors such as finance, healthcare, industry and IT. France currently has the largest country weighting, followed by the UK and Germany.

Sustainability criteria are also taken into account when selecting the shares in the fund’s portfolio. The aim is to invest primarily in companies that are pioneers in terms of sustainability. You can find out more about the criteria in our sustainable funds here.

Note: Past performance does not allow any reliable conclusions to be drawn about the future performance of a fund.

How has the fund performed?

Development over the past 10 years

What is in it?

Top 10 Positions in the fund

Note: Chart is indexed (3.2.2014 = 100). The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. The following information is provided by the manufacturer (Erste Asset Management GmbH), information of the respective sales partners may differ.

Opportunities and risks at a glance

Advantages for the investor

- Broadly diversified investment in European stocks.

- Participation in ecologically, morally and socially operating companies.

- Active stock selection based on fundamental criteria.

- Opportunities for an attractive increase in value.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- Due to the investment in foreign currencies, the fund value can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Notes ERSTE RESPONSIBLE STOCK EUROPE

The fund employs an active investment policy and is not oriented towards a benchmark. The assets are selected on a discretionary basis and the scope of discretion of the management company is not limited.

For further information on the sustainable focus of ERSTE RESPONSIBLE STOCK EUROPE as well as on the disclosures in accordance with the Disclosure Regulation (Regulation (EU) 2019/2088) and the Taxonomy Regulation (Regulation (EU) 2020/852), please refer to the current Prospectus, section 12 and the Annex “Sustainability Principles”. In deciding to invest in ERSTE RESPONSIBLE STOCK EUROPE, consideration should be given to any characteristics or objectives of the ERSTE RESPONSIBLE STOCK EUROPE as described in the Fund Documents.

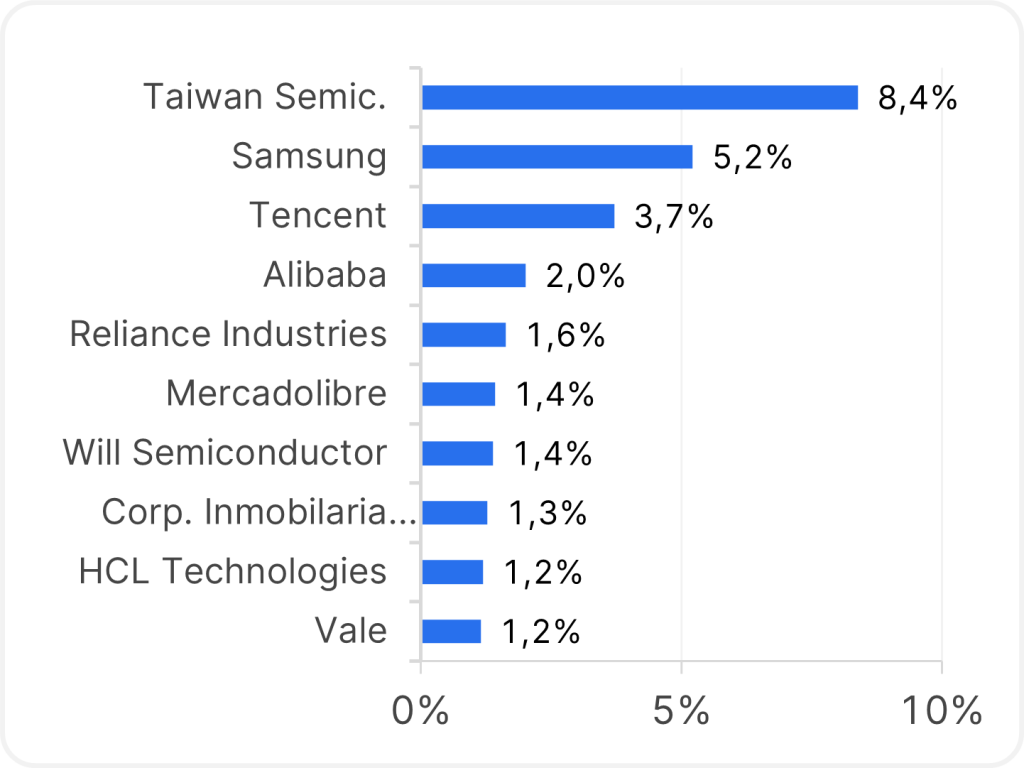

ERSTE STOCK EM GLOBAL invests in selected companies from the global emerging markets. These include China and India – both countries also have a strong weighting in the fund. The fund’s portfolio also includes equities from Taiwan, South Korea, Brazil and Mexico, for example. Almost a third of the companies in the fund are active in the IT sector.

Note: Past performance does not allow any reliable conclusions to be drawn about the future performance of a fund.

How has the fund performed?

Development over the past 10 years

What is in it?

Top 10 Positions in the fund

Note: Chart is indexed (3.2.2014 = 100). The performance is calculated in accordance with the OeKB method. The management fee as well as any performance-related remuneration is already included. The issue premium which might be applicable on purchase and as well as any individual transaction specific costs or ongoing costs that reduce earnings (e.g. account- and deposit fees) have not been taken into account in this presentation. The following information is provided by the manufacturer (Erste Asset Management GmbH), information of the respective sales partners may differ.

Opportunities and risks at a glance

Advantages for the investor

- Broadly diversified investment in companies in emerging markets with little capital investment.

- Active stock selection based on fundamental criteria.

- Participation in global emerging market growth opportunities.

- Opportunities for capital appreciation.

- The fund is suitable as an addition to an existing equity portfolio and is intended for long-term capital appreciation.

Risks to be considered

- The price of the funds can fluctuate considerably (high volatility).

- An investment in emerging markets has a higher risk potential than an investment in developed markets.

- Due to the investment in foreign currencies, the net asset value in Euro can fluctuate due to changes in the exchange rate.

- Capital loss is possible.

- Risks that may be significant for the fund are in particular: credit and counterparty risk, liquidity risk, custody risk, derivative risk and operational risk. Comprehensive information on the risks of the fund can be found in the prospectus or the information for investors pursuant to § 21 AIFMG, section II, “Risk information”.

Notes ERSTE STOCK EM GLOBAL

The fund employs an active investment policy. The assets are selected on a discretionary basis. The fund is oriented towards a benchmark (for licensing reasons, the specific naming of the index used is made in the prospectus (12.) or KID “Ziele”). The composition and performance of the fund can deviate substantially or entirely in a positive or negative direction from that of the benchmark over the short term or long term. The discretionary power of the Management Company is not limited.

For a glossary of technical terms, please visit this link: Fund Glossary | Erste Asset Management

Related articles on this topic

No Posts Found

Legal disclaimer

This document is an advertisement. Unless indicated otherwise, source: Erste Asset Management GmbH. The language of communication of the sales offices is German and the languages of communication of the Management Company also include English.

The prospectus for UCITS funds (including any amendments) is prepared and published in accordance with the provisions of the InvFG 2011 as amended. Information for Investors pursuant to § 21 AIFMG is prepared for the alternative investment funds (AIF) administered by Erste Asset Management GmbH pursuant to the provisions of the AIFMG in conjunction with the InvFG 2011.

The currently valid versions of the prospectus, the Information for Investors pursuant to § 21 AIFMG, and the key information document can be found on the website www.erste-am.com under “Mandatory publications” and can be obtained free of charge by interested investors at the offices of the Management Company and at the offices of the depositary bank. The exact date of the most recent publication of the prospectus, the languages in which the key information document is available, and any other locations where the documents can be obtained are indicated on the website www.erste-am.com. A summary of the investor rights is available in German and English on the website www.erste-am.com/investor-rights and can also be obtained from the Management Company.

The Management Company can decide to suspend the provisions it has taken for the sale of unit certificates in other countries in accordance with the regulatory requirements.

Note: You are about to purchase a product that may be difficult to understand. We recommend that you read the indicated fund documents before making an investment decision. In addition to the locations listed above, you can obtain these documents free of charge at the offices of the referring Sparkassen bank and the offices of Erste Bank der oesterreichischen Sparkassen AG. You can also access these documents electronically at www.erste-am.com.

N.B.: The performance scenarios listed in the key information document are based on a calculation method that is specified in an EU regulation. The future market development cannot be accurately predicted. The depicted performance scenarios merely present potential earnings, but are based on the earnings in the recent past. The actual earnings may be lower than indicated. Our analyses and conclusions are general in nature and do not take into account the individual characteristics of our investors in terms of earnings, taxation, experience and knowledge, investment objective, financial position, capacity for loss, and risk tolerance.

Please note: Past performance is not a reliable indicator of the future performance of a fund. Investments in securities entail risks in addition to the opportunities presented here. The value of units and their earnings can rise and fall. Changes in exchange rates can also have a positive or negative effect on the value of an investment. For this reason, you may receive less than your originally invested amount when you redeem your units. Persons who are interested in purchasing units in investment funds are advised to read the current fund prospectus(es) and the Information for Investors pursuant to § 21 AIFMG, especially the risk notices they contain, before making an investment decision. If the fund currency is different than the investor’s home currency, changes in the relevant exchange rate can positively or negatively influence the value of the investment and the amount of the costs associated with the fund in the home currency.

We are not permitted to directly or indirectly offer, sell, transfer, or deliver this financial product to natural or legal persons whose place of residence or domicile is located in a country where this is legally prohibited. In this case, we may not provide any product information, either.

Please consult the corresponding information in the fund prospectus and the Information for Investors pursuant to § 21 AIFMG for restrictions on the sale of the fund to American or Russian citizens.

It is expressly noted that this communication does not provide any investment recommendations, but only expresses our current market assessment. Thus, this communication is not a substitute for investment advice, does not take into account the legal regulations aimed at promoting the independence of financial analyses, and is not subject to a prohibition on trading following the distribution of financial analyses.

This document does not represent a sales activity of the Management Company and therefore may not be construed as an offer for the purchase or sale of financial or investment instruments.

Erste Asset Management GmbH is affiliated with the referring Sparkassen banks and Erste Bank.

Please also read the “Information about us and our securities services” published by your bank.

Subject to misprints and errors.